Gold or Digital Gold?

View in Browser

gm Bankless Nation,

Gold’s 2025 surge may seem to be testing Bitcoin’s narrative, but history suggests this might just be the calm before BTC's next move.

Today's Issue ⬇️

- ☀️ Need to Know: DraftKings' Prediction Play

Predictions markets remain white-hot. - 🗣️ Analysis: Gold vs. Digital Gold

For BTC holders, 2025 has been tough. - 🎧 Premium Feed: The Real-Time Blockchain

Get this Citizen-only lowdown on MegaETH.

Sponsor: Bit Digital — ETH treasury that combines the two greatest assets of our time: ETH & AI.

- 💰 DraftKings Enters Prediction Market Arena with Polymarket Partnership. Polymarket will serve as DraftKings' designated clearinghouse.

- 📆 Andreessen Horowitz Publishes Annual State of Crypto Report. The story of crypto in 2025 is one of industry maturation, according to a16z's latest report. [Listen to our pod episode unpacking the report!]

- 🐇 MegaETH Publishes Specifics for Upcoming Public Token Sale. The MEGA ICO will commence on October 27.

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $3.60T | ↘ 3.7% | ↘ 3.8% |

|

BTC $107,144 | ↘ 3.5% | ↘ 3.5% |

|

ETH $3,744 | ↘ 5.3% | ↘ 5.4% |

For Bitcoin holders, 2025 has been a tough pill to swallow.

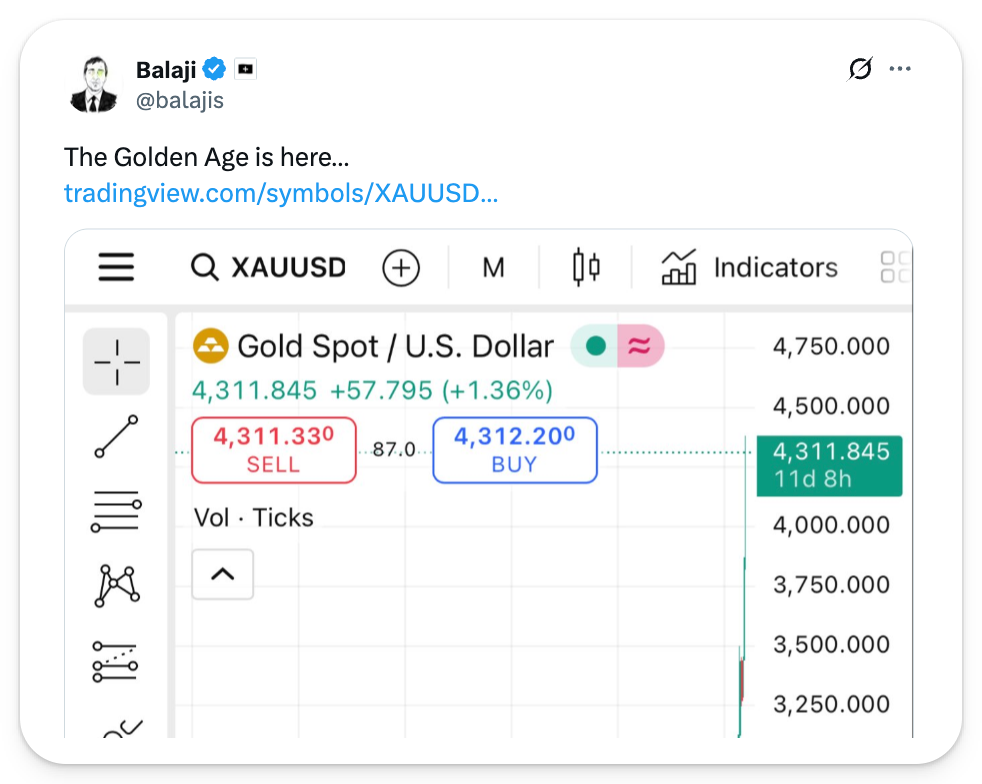

While gold ripped to $4.4K per ounce, a 60% gain at peak year-to-date (YTD), all while hitting new all-time highs on dozens of occasions, Bitcoin has comparatively limped along with just 15% YTD gains. For an asset marketed as "digital gold," watching the original outperform by more than 3x can sting.

If Bitcoin is supposed to be a superior store of value, why is it getting left in the dust during what looks like a classic safe-haven rally?

Many believe gold can be used as a leading indicator for Bitcoin's moves, with a historical lag of 70 to 100 days. In other words, gold's current surge might not signal dysfunction for Bitcoin's narrative. It could be a precursor to what comes next. Others believe this surge actually signals the end of an asset cycle overall, marking a clear stop for risk asset appreciation.

The question, of course, is which one this latest rally represents. To figure that out, we need to understand what's driving gold right now, what similar rallies have meant historically, and how these two assets actually function in a portfolio. 👇

What's Going on with Gold?

Gold's relentless 2025 performance can be attributed to unprecedented, and equally relentless, central bank buying, driven by a cocktail of inflation concerns, geopolitical tension, and a fundamental shift in how central banks think about reserves.

Gold purchased by central banks had its second-largest Q1 on record this year. Poland added 67 tonnes amid the Ukraine conflict. Turkey picked up 19.5 tonnes as its currency weakens. China continues to quietly accumulate amid its tensions with the U.S., swapping out its stash of U.S. Treasuries, while, in Shanghai, gold futures volumes have tripled since early 2024, as investors pile in, alongside the central bank, amid economic uncertainty.

Gold is increasingly replacing U.S. Treasuries as the "riskless" asset in global portfolios. With mounting U.S. debt and political dysfunction, central banks are diversifying. Some reports suggest gold has even flipped Treasuries to become the number one central bank reserve asset globally, though this remains disputed.

Why? Gold doesn't carry counterparty risk and can't be printed or devalued by central bank decisions. In an era where trust in institutions is eroding, that matters.

Still, gold is showing signs of being clearly overbought, especially given the volatility of the past few days. Parabolic moves like this rarely end smoothly. Which raises the question: what does a gold rally of this magnitude actually signal?

What Have Gold Rallies Meant in the Past?

To understand what gold's current surge might mean for Bitcoin, it helps to look at what similar rallies have signaled historically. The answer isn't simple. Sometimes gold's parabolic moves have preceded major crises. Other times, they've set the stage for broader risk-on rallies, with Bitcoin following months later.

The Bear Case: Late-Cycle Behavior

Gold surges often coincide with late-cycle uncertainty. From 2007 to 2008, gold spiked as the subprime crisis unraveled. That rally started before the crash, as investors positioned for what was coming. Similarly, in 1999 and 2000, gold shot up ~34% as the dot-com bubble burst and recession followed.

While, in many respects, today is different from these past periods, there certainly is a parallel level of unease in the market against the backdrop of geopolitical tension and economic uncertainty. Further, as we well know in crypto, steep climbs tend to end in sharp corrections. Gold has experienced this in the past, for example in 2010 and 2011 when the asset surged 70% before collapsing 45%.

But is this really a late-cycle warning? Maybe. Gold similarly rallied during 2020's COVID crisis, but the 2020 surge led to recovery, not prolonged downturn. This time, central banks are accumulating over 1K tonnes per year amid a structural shift away from dollar reserves. That should not be ignored.

The Bull Case: Gold as a Leading Indicator for Bitcoin

Evidence suggests that, when gold breaks out, Bitcoin has followed, usually with a lag of 70-100 days.

The clearest example is 2020. Gold surged to $2,075 amid pandemic uncertainty. About 85 days later, Bitcoin began its climb from $5K to $10K, then exploded 590% to hit $64K by early 2021. Gold moved first as a safe-haven play, then capital rotated into Bitcoin as risk appetite returned. A similar situation happened last August, with gold ripping to new all time highs while Bitcoin lagged. This was chronicled in an article published then by Coin Market Cap titled “Gold Hits All-time Highs, Why Is Bitcoin Lagging?” In its wake, as we know, Bitcoin lagged for about two months before surging come November.

If the historical pattern holds, gold's rally could be setting up Bitcoin's next leg higher. Once gold peaks or shows exhaustion, capital could flow into Bitcoin as investors shift from defensive positioning to offensive plays.

Gold doesn't need to stop rising for Bitcoin to run. These assets often diverge during transitions. The key is recognizing that gold moves first in debasement trades, and Bitcoin follows once the narrative crystallizes. So, while past performance doesn't dictate future results, know that gold’s run is not a death sentence for Bitcoin.

Things to Consider

Whether you believe gold's rally signals late-cycle risk or sets up Bitcoin's next move, it's worth understanding what these assets actually do in a portfolio.

Ray Dalio has long argued that gold is a preservation tool, pointing out that it maintains purchasing power in a world where 80% of currencies have disappeared or been severely devalued since 1750. Gold can't be printed or manipulated by central banks. It's the ultimate hedge against currency collapse.

Thus, he recommends allocating to gold, not because it outperforms, but because it provides an anchor when other assets fail.

Bitcoin, on the other hand, is functioning as a growth store of value. The DeFi Report's Bitcoin versus Gold analysis makes this explicit:

- A portfolio with 5% gold and 95% S&P 500 returned 152% since 2018

- A portfolio with 5% Bitcoin and 95% S&P 500 returned 199%

- At 10% allocations, gold delivered 155% while Bitcoin hit 253%

Another way of explaining it is that gold has had millennia to realize its value, as an asset that provides stability during periods of uncertainty. Bitcoin, still growing into this, behaves with more volatility but significantly outperforms. If your goal is wealth preservation in uncertain times, gold makes sense. If you're willing to stomach volatility (though recently it's been a bit more boring) for outsized returns, Bitcoin still remains the better bet.

So, while Bitcoin holders might feel frustrated for now watching gold gains, if history repeats itself, that frustration could be short-lived.

Bit Digital: The premier ETH treasury that combines the two greatest assets of our time—ETH & AI compute. Harness massive Ethereum holdings with institutional-grade staking for optimized rewards, while powering cutting-edge AI infrastructure for unparalleled innovation. Unlock the future of digital assets where blockchain meets intelligent computing.

*We’re being compensated by Bit Digital (NASDAQ: BTBT) for this ad promoting their company and BTBT. The compensation is paid in cash as a one-time payment. You can find additional information about Bit Digital and BTBT on their Investor page at bit-digital.com/investors. Not investment advice.

MegaETH aims to be the first real-time blockchain, achieving millisecond block times and Web2-level performance on Ethereum.

Namik Muduroglu and Shuyao Kong join to discuss how real-time execution unlocks new classes of applications, the philosophy behind their MegaMafia incubator, and why decentralization on Ethereum remains the foundation for scalable, high-performance crypto infrastructure.

The conversation also covers MegaETH’s upcoming token auction, its long-term strategy for app ecosystem growth, and how it fits into Ethereum’s endgame.Listen to the full episode 👇