Giza's Week: New Agents, New Yields

Fast-growing DeFAI (DeFi + AI) platform Giza made waves this week with back-to-back launches that showcase exactly where this intersection is headed.

On Monday, they introduced Swarms, their incentive verification layer. Then on Wednesday came Pulse, an autonomous agent built with Pendle Finance that sold out its $3M cap in just three hours.

The rapid fill-up tells you everything about the demand for what Giza's building: agents that turn your idle capital into active hunters, constantly searching for the best yields across DeFi.

Agents make DeFi so simple, even your grandma could use it.

— Giza (@gizatechxyz) September 11, 2025

That's how we reach mass adoption.

That's $GIZA ✦ https://t.co/JCUiEdeZkc

How Giza Works

At its core, Giza is a decentralized network that deploys autonomous agents to generate standout yields. A common analogy they use is shifting passive deposits to "Active Capital" — your funds move from sitting in vaults hoping for returns to being managed by AI agents constantly hunting for the best returns available.

The results speak for themselves. Giza's flagship agent ARMA delivers 15% on USDC (partially boosted by $GIZA incentives), well above standard DeFi yields. With $20M in Assets Under Agents (AUA) and a 20% reload rate — meaning one in five users reinvest their earnings rather than withdraw — users are clearly satisfied with the returns.

✦ 𝐆𝐢𝐳𝐚 𝐣𝐮𝐬𝐭 𝐡𝐢𝐭 $𝟐𝟎,𝟎𝟎𝟎,𝟎𝟎𝟎 𝐢𝐧 𝐀𝐬𝐬𝐞𝐭𝐬 𝐔𝐧𝐝𝐞𝐫 𝐀𝐠𝐞𝐧𝐭 ✦

— Giza (@gizatechxyz) September 12, 2025

From ARMA's stablecoin optimization to Pulse's automated PT strategies, our agents maximize your returns while you focus on what matters.

Onwards and upwards ⤴️ pic.twitter.com/7FUHh0bDlj

At its base, the network operates through three core layers that work in concert:

- The Semantic Layer translating DeFi protocol operations into agent-readable data, letting them evaluate opportunities across chains and protocols.

- The Smart Authorization Layer acting as the self-custodial headquarters where you’ll deposit, interact, and authorize token usage.

- The Decentralized Execution Layer which carries out your instructions, letting agents implement your preferred strategy onchain.

This week added a fourth piece: Swarms, an incentive verification layer designed to validate advertised yields through real-time testing. It's Giza's answer to ensuring agents deliver what they promise — trust through verification.

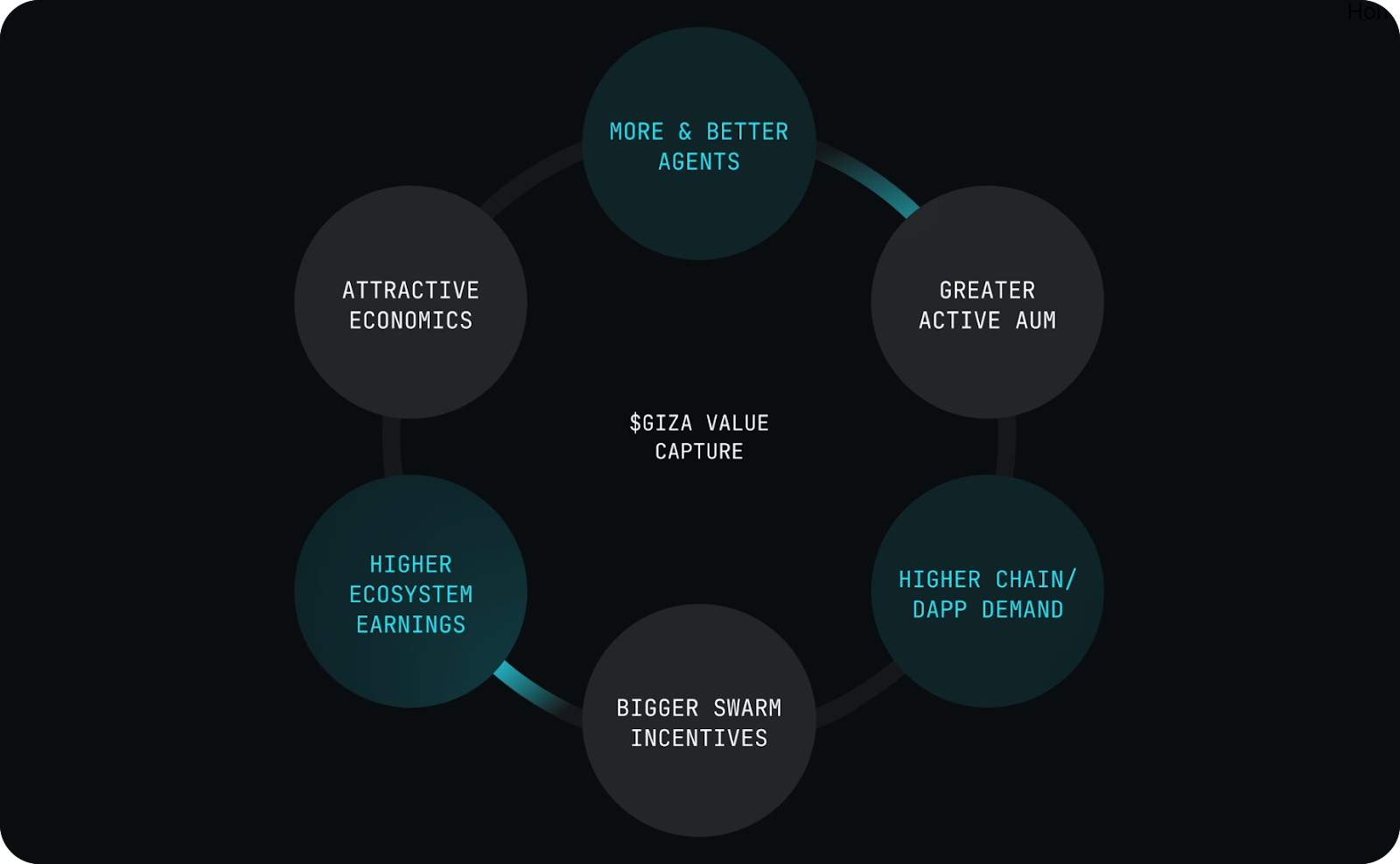

The $GIZA token ties it all together, capturing value through protocol fees from agent activities. These fees fund token buybacks, grow protocol-owned liquidity, and build Giza’s treasury for future initiatives like partnerships or protocol development. And since the network is open to developers and protocol partners, anyone can launch an agent on Giza.

Enter Pulse: Fixed Yields Made Simple

Wednesday's launch of Pulse marks Giza's expansion beyond stablecoin optimization into fixed-yield strategies. Built in partnership with Pendle Finance, Pulse specifically targets Principal Token (PT) portfolios — essentially tokenized fixed-yield positions.

For context, Pendle lets users split yield-bearing assets into two parts: Principal Tokens (PT) that guarantee your initial deposit back at maturity, and Yield Tokens (YT) that capture all the yield. It's lucrative but complex, requiring tracking expiries, manually rebalancing, and constantly optimizing allocations.

✦ 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐢𝐧𝐠 𝐏𝐮𝐥𝐬𝐞 ✦

— Giza (@gizatechxyz) September 10, 2025

Built in partnership with Pendle, Pulse is the first agent that autonomously optimizes your PT portfolio.

We're starting with ~13% APR on ETH-PT markets. More assets coming soon.

This is what intelligent fixed yield looks like ↓ pic.twitter.com/QZ7HsvgSep

Pulse looks to eliminate that complexity. The agent handles everything: tracking position expiry dates, rebalancing them, and setting up the best allocations across different PT markets. Users who've never touched Pendle before are now earning what Giza's cofounder Renç Korzay calls "institutional-grade fixed yields with zero manual intervention."

The initial results validate the approach. Launching with ETH-PT markets on Arbitrum at around 13% APR, Pulse filled its $3M cap in, fittingly, three hours. Giza's already expanded partnerships to include assets like PT-rsETH through KelpDAO, with plans to increase capacity limits and expand to more chains.

What makes this significant isn't just the yields — it's the model. As Korzay notes, the same friction points Pulse solves (user churn, accessibility barriers, suboptimal capital allocation) exist across all of DeFi. Running with this train of thoughts, each sophisticated or “complex” protocol could be greatly simplified by agents such as Pulse, increasing their overall use and expanding DeFi immensely in the meantime.

Just recorded a 5-minute demo of Pulse, our new autonomous agent built for Pendle.

— Renç Korzay (@renckorzay) September 11, 2025

Watch as I deposit ETH, then Pulse handles the rest: intelligent allocation, slippage protection, maturity rollovers, everything

True 24/7 set-and-forget yield optimization for Pendle PT markets. pic.twitter.com/0U9STXsRb2

Swarms: Keeping Agents Honest

While Pulse grabbed headlines, Monday's Swarms launch adds equally important, critical infrastructure.

The problem Swarms solves is straightforward: DeFi protocols advertise yields that agents can't verify. One protocol claims 20% APR, another says 15%, but there's no standardized way to confirm these numbers or understand what's included. This makes it impossible for agents to make optimal decisions with confidence.

Swarms intends to fix this by creating standardized APR (sAPR) — yield metrics generated through actual agent testing rather than protocol marketing. Through Swarms, protocols will now post basic incentive offers — (for example, "5% bonus on ETH deposits, applies to first $1M deposited") — then Giza agents test these protocols to extract real performance data. If agents find the base yield is 8%, they calculate a verified sAPR of 13%.

This creates a feedback loop that benefits everyone. Protocols get measurable results — they see exactly how much capital arrived and how long it stayed. Users get higher yields as protocols compete to attract intelligent capital. And capital flows to the strongest opportunities within seconds of rate changes.

For Giza, Swarms opens a second revenue stream beyond user management fees. Protocols now pay to access Giza's network of intelligent agents, with fees flowing to $GIZA holders through token buybacks and treasury growth.

Think of Swarms as quality control for DeFi’s incentive layer, supplementing capital with verifiable performance rather than just “promise.”

Swarm Finance solves one of DeFi's biggest problems:

— Renç Korzay (@renckorzay) September 8, 2025

Protocols burning through incentive budgets without knowing if their spending actually worked.

Now with Swarm, protocols get verified ROI and compete for intelligent Active Capital, creating a self-reinforcing cycle where:… https://t.co/7J7t6J1cvA

Overall, the endgame, which we’ve forecasted for some time, is increasingly becoming a reality: your portfolio becomes a swarm of intelligent agents, each optimizing their specific domain.

For us, this week's launches mean more options and better yields with less work. For DeFi broadly, it's a glimpse of what happens when AI agents start doing the heavy lifting. The rapid sellout of Pulse suggests users are ready for that future.

As Giza increases Pulse's capacity in the coming days, one thing's clear: DeFAI is growing, and growing fast — showcasing Ethereum’s edge as a nonstop, autonomous arena for capital to maximize its potential.