Front-running The Regen Opportunity 🌱

Dear Bankless Nation,

Ah, the sweet scent of a green market.

Yes, anon. Number go up, but that’s not what we’re talking about here.

There’s a new wave of projects and models in Web3 that are marrying profit speculation with positive impact for people and planet.

It’s called Regen Web3, and it’s a game-changer.

No one is more on top of this movement than Gitcoin founder and Green Pill host Kevin Owocki.

He joins us on today’s newsletter for a deep dive into the ways we can rewire our business models to prioritize Web3 regeneration, while still satisfying the crypto degen within us all.

— Bankless team

There’s a lot of noise in web3. But there’s also an emerging ecosystem with a strong value proposition creating real-world impact and an ROI.

These “Regen web3” projects — many of them still early — are scalable, built for transparent governance, and could easily 10x-100x in the next decade.

Here is why you should care about regen web3, and why regen web3 is worth your scarce time.

A Regen Web Capital Rotation

As the ecosystem matures, there will be an opportunity for capital to flow into projects that create the most humanitarian value for the world — not just projects that capture economic value.

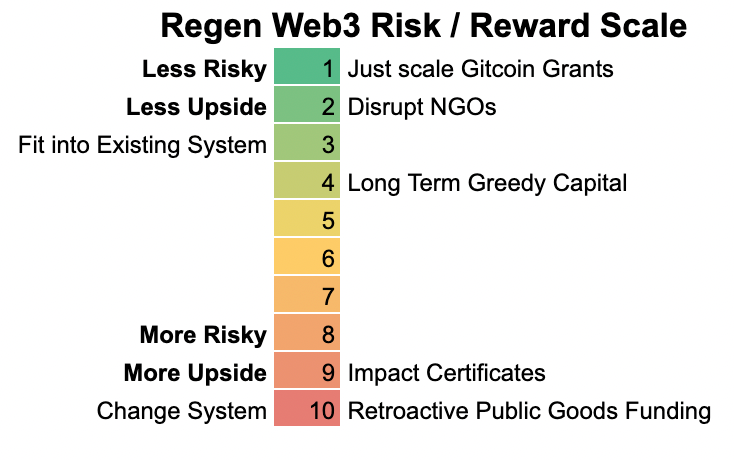

In this article, we evaluate emerging models according to a Regen Web3 Risk/Reward Scale. Projects at the top of this scale are already working today, while those at the bottom are more theoretical with upside potential.

1. Scale Gitcoin Grants (Low risk, high upside)

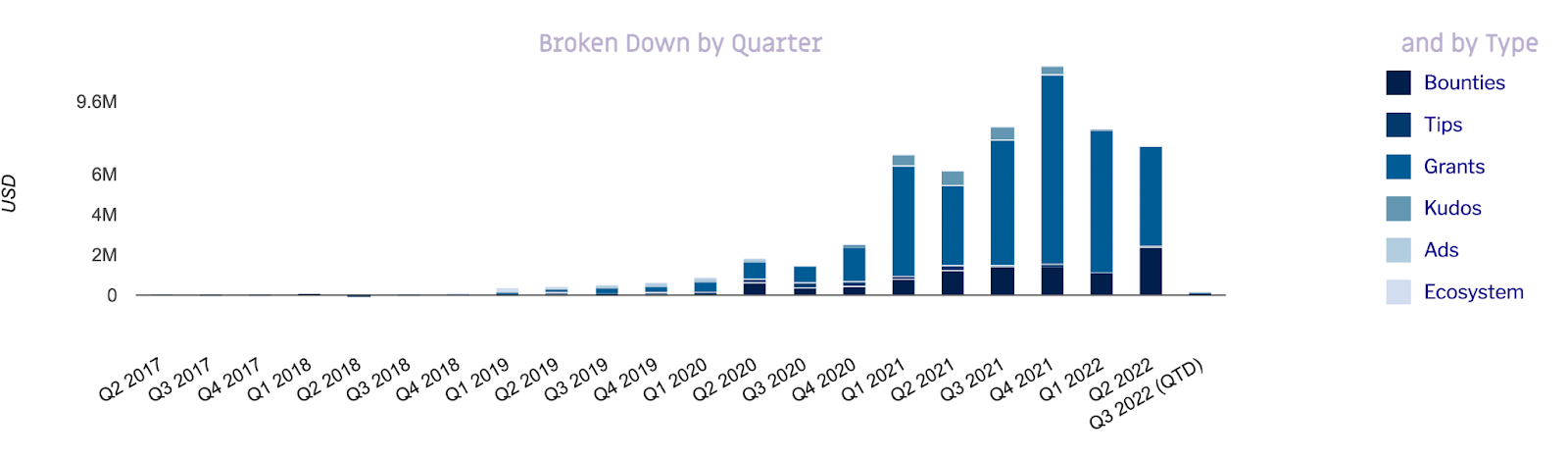

Gitcoin Grants is a capital allocation mechanism that has generated $64mm worth of funding for web3 public goods, primarily via Quadratic Funding.

Every quarter, the Gitcoin community allocates $3m worth of funding to a matching pool that is distributed according to the results of a crowdfunding campaign.

In Q2 2022, Gitcoin facilitated $7.4m in value transfer. That's about $3413/hour, for every hour during Q2 ($15374/business-hour).

But that merely scratches the surface of how much value public goods in our ecosystem create. There are billions of dollars worth of public goods created by open source software and by Ethereum. To get to that scale Gitcoin would have to grow 1000x.

To do that, Gitcoin has launched Aqueduct, a way of allocating funding to any DAO ecosystem that wants to have its public goods funded by Gitcoin Grants.

When an Aqueduct is set up, Gitcoin will automatically run a side round on top of its quarterly Gitcoin Grants round to fund that ecosystem’s public goods.

What's exciting to me is how this scales. Each quadratic funding round added is an opportunity for any given project to serve projects in other ecosystems. It’s a windmill of positive externalities.

For example: If Project X₁ is in QF Matching Round Y₁, the matching multiple of that is Z₁. And if you add Project X₁ to Y₂Y₃…Yₙ, then the matching multiple of it becomes Z₁Z₂Z₃*…Zₙ.

Essentially: if each QF round for each public is a fan, then all-together they stack to be a jet engine.

2. Disrupt NGOs - The $25 trillion Regen Opportunity (Risk Medium, Upside High)

There are $25 trillion dollars per year allocated to public goods by governments and NGOs.

With the benefits of transparency, immutability, global scale, and programmability that comes with web3, how do regen DAOs change the way these public goods are administered?

Regen web3 projects disrupt the legacy nonprofit sector, which is totally stagnant. There is a lot of red tape, opacity, and administrative overhead that decreases the dollar for dollar impact between the donated dollar and how much is left after all the working through the wasteful bloat of NGOs to actually support the work of the public good.

To give one prominent example, Africa has seen trillions of dollars in foreign aid over the past 60 years, yet per-capita income today is lower than it was in the 1970s, while the mass majority of its population remains in poverty.

Government agencies aren’t maximizing the public good per dollar spent.

Regen web3 vs legacy non-profits is not an “either/or” argument, but an important “and” argument. Because web3 projects are by design more transparent, accountable, and less bureaucratic, they are better positioned to scale and provide dollar for dollar impacts in ways that legacy non-profits cannot.

3. Incentivize for Long Term Greed (Risk High, Upside High)

One of the shortcomings of our current system is that it incentivizes short-term and quarterly results, growth, and profits at the expense of long-term returns and impact.

Many investments that need to be made for which the returns would not come to fruition for years are never made because there is no short-term benefit or bump for the person making the investment. It’s the marshmallow test for adults, investors, and humanity.

With Regen web3, we can create a class of capital that can be returned over a longer time horizon (>10 years) to incentivize for the investments that need to be made for both the short and long term.

4. Retro Public Goods Funding (Risk Very High, Upside Very High)

Economies, systems, and people act according to incentives. The outcomes that we earn depend on the design of our incentive structures. If different outcomes are needed, then the rules of the game need to change.

At present, regen web3 projects also operate in a non-optimal incentive system that rewards founders for private value capture over value creation for the public.

Retroactive Public Goods Funding could change all that.

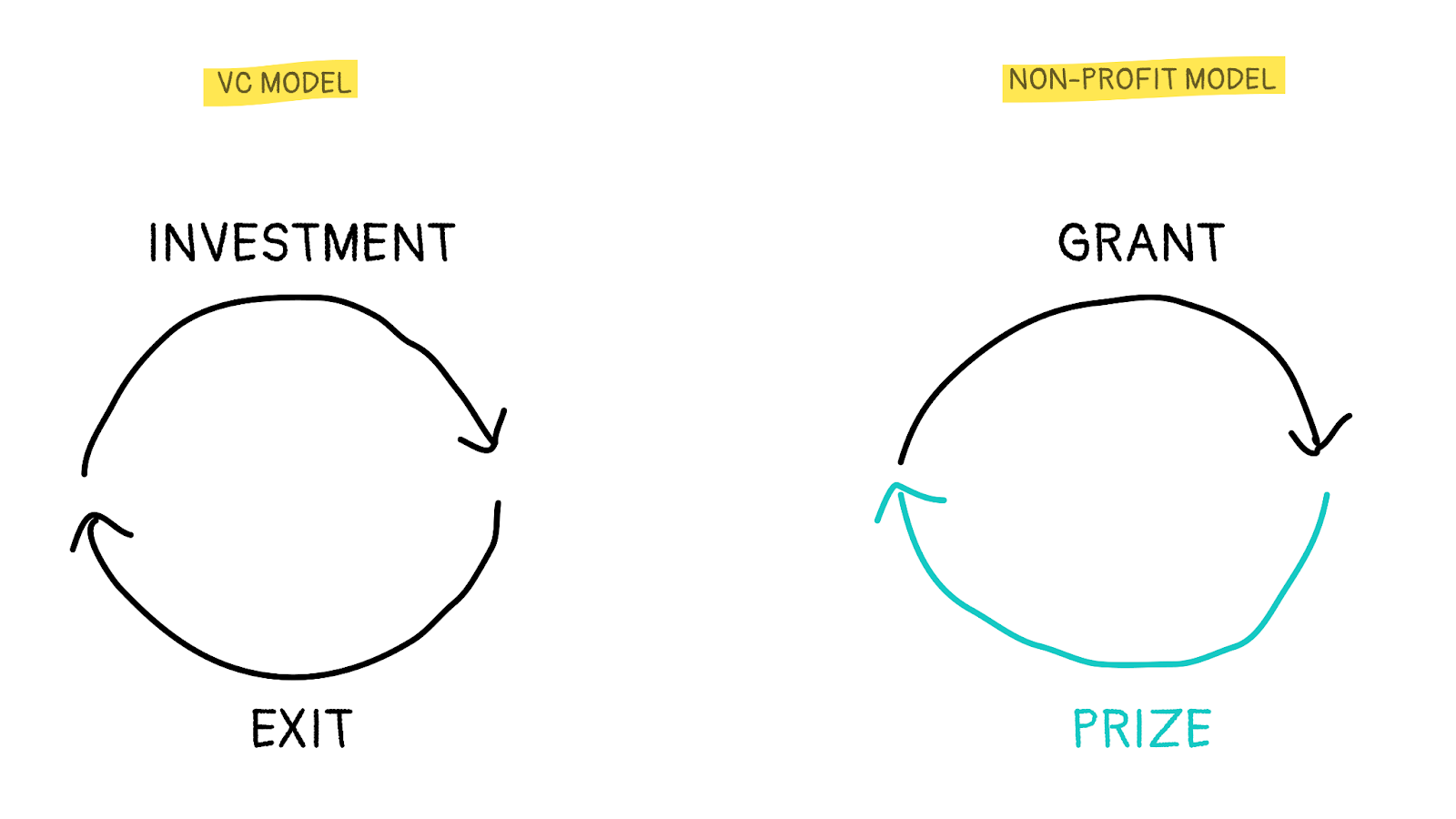

With retroactive public goods funding, an incentive structure for public goods can be created to provide exit incentives for impact founders similar to those that exist for founders in the for-profit world.

Vitalik Buterin wrote that “the core principle behind the concept of retroactive public goods funding is… it’s easier to agree on what was useful than what will be useful.”

Since it is easier to measure and reward what was instead of what will be, retroactive public goods funding is a mechanism for investing in regen web3 projects that are worthy of funding based on their verifiable impact.

Optimism is the most prominent example of Retroactive Public Goods Funding.

Using millions of dollars in revenue from Sequencer fees, Optimism funds its ecosystem’s top public goods according to the fairness ratio — basically 1 unit of impact = $1.

As sequencer fees grow, so too does the funding for public goods projects. From there, public goods projects can have an “exit.” This in turn incentivizes investors to allocate towards projects that create humanitarian impact, not just those that capture private value.

Here is a great visual of this that I borrowed from Nick Barr:

Here’s a fun bit of Optimism Lore: Karl Floersch, founder of Optimism, proliferated the idea of Ether’s Phoenix, An angel who rewards you for funding public goods.

It is an algorithm that rewards the early cooperators who coordinated to help fund public goods. Because followers of Ether’s Phoenix expect that it will reward future contributions to public goods, they change their behavior today to fund public goods today, making it more likely that Ethers Phoenix will manifest itself in the future.

Learn more about Ethers Phoenix here.

5. Verifiable Impact >>> Impact Certificates (Risk Very High, Upside Very High)

How do we verify the impact of different projects?

The solution: Impact Certificates.

Certificates of Impact can be issued to projects that verifiably meet measurable impact targets.

Here’s how it works: On what’s called an impact marketplace, those who own impact certificates can sell them to those who believe in projects that are creating impact. This would create a speculative market around projects that have value-creation, unlike a luxury good (think PFP NFTs). Profit can be created while the impact of the positive action is attributed to a new owner.

This would systemically change the incentives of web3 projects by tying together revenue creation and impact creation. I took a deep dive into Impact Certificates with Evan Miyazono, Head of Research at Protocol Labs, on the Green Pill podcast.

Bonus: VEV — Vibes Extractable Value

How would you change your behavior if you knew that you would be rewarded for positive impact?

The world in the future will reward those who create impact, so how will you create impact to front-run that?

How to front run the opportunity (for regens):

- Look for a mission-oriented project, show up & start adding value. Do it early because you love the mission.

- Don’t show up late once the project is inevitable. You’ll miss the VEV — vibes extractable value🖖

- Each project will find its own virtuous cycle if the right people choose to coordinate and make it successful. By front-running the opportunity, you are creating the opportunity.

Here’s to everyone who joined DAOs with cultures of a shared sense of purpose and civic pride — and who joined because these things are ends in themselves.

Vibes Extractable Value is the reality that DAOs tend to out-coordinate everything else. They do so because positive vibes focused through a shared purpose and mission lead to positive value and outcomes.

This cycle can become reflexive, repeating in a virtuous cycle of growth and impact.

Summary

If you are looking for a regen project, we can help. To learn more about the projects in this space and where impact is already happening, check out the ImpactDAO book I wrote with Ale Borda and the GitcoinDAO Public Goods Funding Workstream.

Join us! Dive into the world of Regen web3. Join a DAO. Invest. Contribute to a Gitcoin Grant. Join one of these projects that is measuring and creating impact and creating the future of technology, finance, and well-being that we can’t even imagine yet.

Action steps

- 🪙 Git the book IMPACTDAOs: Web3 projects with positive impact on the world (Coupon Code: BE_LONG_TERM_GREEDY for 100% off the books - 100 uses only)

- 📖 Read Kevin’s previous article: How Crypto Is Regenerating the World