Getting to Know Your Options

Dear Bankless nation,

It’s a risky world out there and crypto investors often turn to options when they have a strong perspective on which way they think the wind is blowing.

Today, we’re delivering an intro to options trading, laying out a few of the risks involved and showing you a handful of our favorite on-chain protocols where you can further explore them.

- Bankless team

With a minefield of potential volatility ahead for crypto investors — with inflation numbers, aliens and regulators all drumming up their own concerns — it’s important to remember… you have options.

Today, we’re talking derivatives, and not of the calculus variety! This intro to options trading is separated into three parts:

- The 101 basics of DeFi options

- Options use-cases

- Our five favorite on-chain option protocols

If you’re dabbling with options, you’re likely either a degen trying to access a high-leverage returns profile without becoming a market maker’s lunch, or you’re concerned about volatility and want to hedge your downside exposure.

Options trading could be* the solution for you

🤓 The 101 basics of DeFi Options

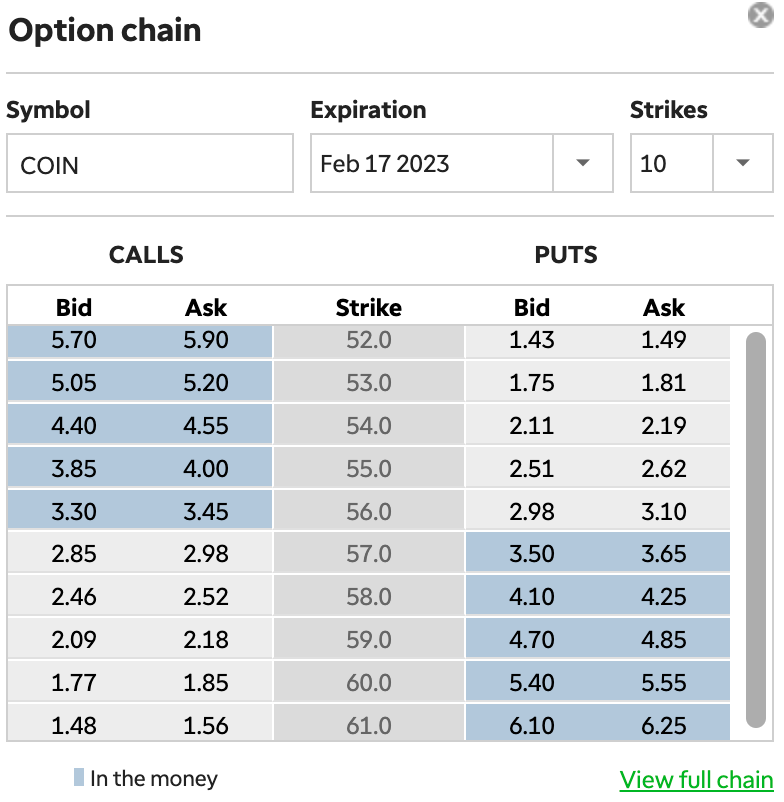

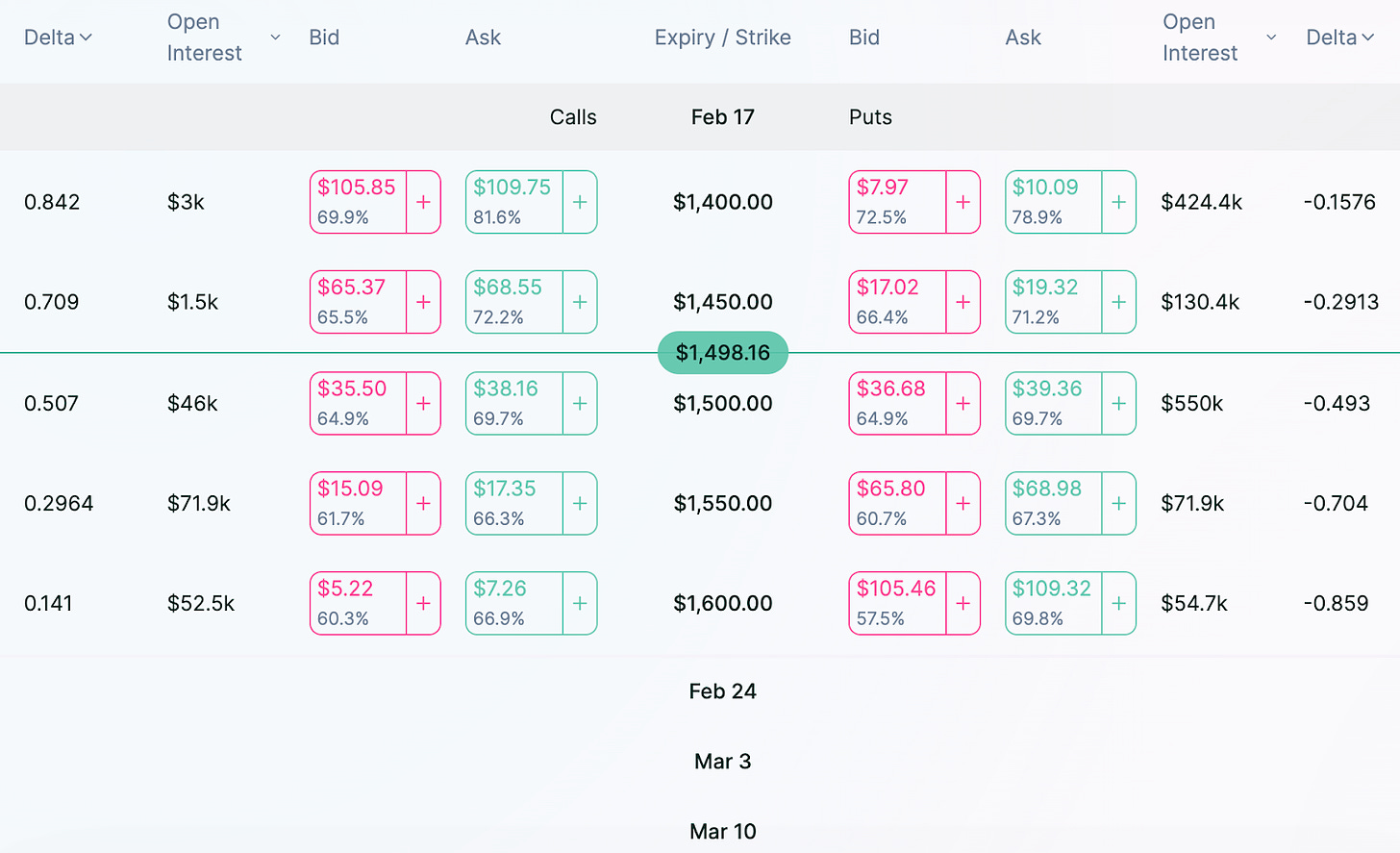

Does the below graphic induce anxiety? Absolutely zero idea what an option chain is?

Well this section is for you, fren!

Above is an option chain for Coinbase (COIN).

Option chains list various calls (left side) and puts (right side) for a given expiration date (February 17, 2023) across a variety of strikes (middle).

Purchasers of options receive the right to buy or sell the underlying asset at a predetermined strike price.

- 🐂 Calls: ability to buy COIN at the strike

- 🧸 Puts: ability to sell COIN at the strike

Scenario: Your normie friend believes that Coinbase regulatory drama is total FUD, exclaiming, “$COIN will go hyperbolic by Friday! I must ape now and want to use options to increase my payoff, but I’ve got zero clue what to buy.”

Your Response (Not Financial Advice!!!): “Really? Ok, if you insist... Given your strong bullish convictions, I would suggest a call expiring Friday, February 17th. Might I suggest the $60 strike?”

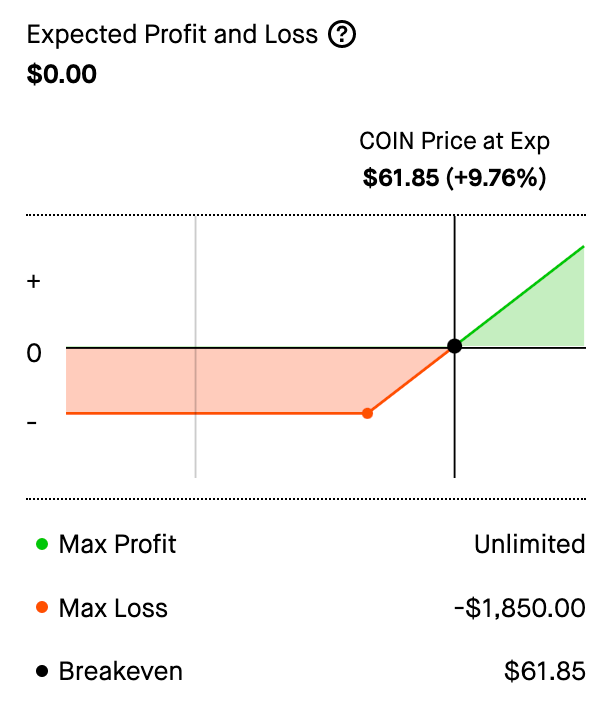

Your friend then exchanges $1,850 for the RIGHT, not obligation, to buy 1,000 shares of COIN on or before February 17 at $60 per share.

Options can be thought of as insurance-like contracts: you pay a premium upfront ($1,850) to access the insurance. When “disaster strikes” (i.e.; COIN trades above $60 in this example) you begin to profit.

Your friend does not profit until COIN trades above $61.85 ($60 strike + $1.85 premium), but has no exposure beyond the initial $1,850 investment, with every cent COIN moves beyond $61.85 being bona fide profit.

Capped losses with ~unlimited upside~ make options highly attractive for many market participants across a variety of use cases.

🛠 Options Use-Cases

Now that we’re on the same page about what an option is, how can you leverage them in your portfolio, given your unique risk appetite? There are perhaps two kinds of options traders: risk avertoors and degen speculatoors.

🦺 Risk Avertoor

“Sophisticated risk management system, party of Mx. Slow-n-Steady?” the option writer inquires from the reception.

Your crypto investing role model stands up.

You know, that one who only DCAs and is primarily in blue chips?

They’re here learning how to reduce their portfolio’s risk profile. 🤯

Degens be damned: a real individual actually using options to hedge!

Mx. Slow-n-Steady operates 100 validators. But fearing an alien invasion will bring superior blockchain tech to Earth, he is now fundamentally bearish on ETH! With 3,200 in locked ETH and no alien, our dear friend would be in quite the pickle if they didn’t have access to on-chain derivatives markets.

Selling their remaining BTC (knowing it’s going to zero regardless of alien tech) for liquidity, Mx. Slow-n-Steady remembers that Lyra Finance just launched on Arbitrum! After feverishly bridging, they then purchase 3,200 put contracts on ETH with a strike of $1,200 for $18.35 per contract, expiring March 10.

For the low price of $58,720 (1.22% of the portfolio value), they have successfully insured $4.8M in ETH against a drawdown greater than 20% within the next month using decentralized options markets!

Risk = Managed⚡

The significant leverage unlocked by OTM (out of the money), relatively short expiration put options on ETH provides a highly capital efficient method of insuring one’s portfolio.

🤑 Degen Speculatoor

Tried the whole DCA approach and number didn’t go up fast enough? Subsequently turned to gTrade on Arbitrum for leverage only to get wicked out immediately? Do you now occupy one of the bottom rungs of the trading contest leaderboard?

Well this strategy is for you! Risk averse frens of Bankless may want to turn away: we’re about to get heinously degen.

You’re still reading??

Before I let you into the world of same-day expiration (0DTE) options and 300%+ OTM calls, I would be remiss in my duties to not remind you: LEVERAGE IS RISKY.

Employing the highly speculative methods contemplated within this subsection entails a high degree of risk, up to and including the total loss of your initial investment within minutes (seconds if the market moves against you fast enough).

Options give you leverage.

Your friend enjoys over 30x levered upside ($60/$1.85 = 32.4x) on COIN past a share price of $61.85 until February 17. As a dopamine-deprived degen, this simply will not do. After all, you had access to 150x leverage on crypto and 1,000x leverage on forex with gTrade! Who the hell reads about 💤traditional financial instruments💤 if it’s not a step toward even more leverage?

How? Chase cheaper premiums. Cheaper premiums mean that $1 of equity can buy a greater number of options.

- Shorten the expiration! OTM options with sooner expiration dates are less likely to be profitable than OTM options with the same strike at a later date, resulting in cheaper premiums.

- Go further OTM! Further OTM options are less likely to be profitable, resulting in cheaper premiums. Cheaper premiums mean that $1 of equity can buy a greater number of options.

It’s really that simple!

As you can see, it is very easy to assume massive amounts of risk in financial markets: just find the riskiest toys to play with. Massive amounts of risk, however, do not correlate to guaranteed returns.

When you purchase OTM, short expiration options, your odds of hitting a payout become infinitesimally small.

However, this riskiest approach to options is an excellent way to provide highly leveraged, directional market exposure to the underlying that may prove highly profitable, while limiting losses to the initial payment and not carrying liquidation risks!

📝 Our 5 Favorite On-Chain Option Protocols

Degen or risk avertoor, we all use the same on-chain options protocols. 🤝

Good luck trading ETH options on Schwab!

Forget about the exchanges when it comes to crypto options, because the best markets are being built natively on-chain.

Let’s explore our top five favorites:

1. Lyra Finance

Lyra is the option protocol your girlfriend tells you not to worry about.

Lyra Finance has over $29M in TVL, spread evenly between its Optimism and Arbitrum deployments. Its TVL doubled after launching on Arbitrum in January.

With a simplistic UI, wide variety of strikes and expirations, and tight bid-ask spreads, Lyra Finance offers more liquidity in ETH and BTC options to aspiring options traders than any other protocol on the block.

We recommend Lyra for: experienced traders looking to replicate the trad brokerage experience.

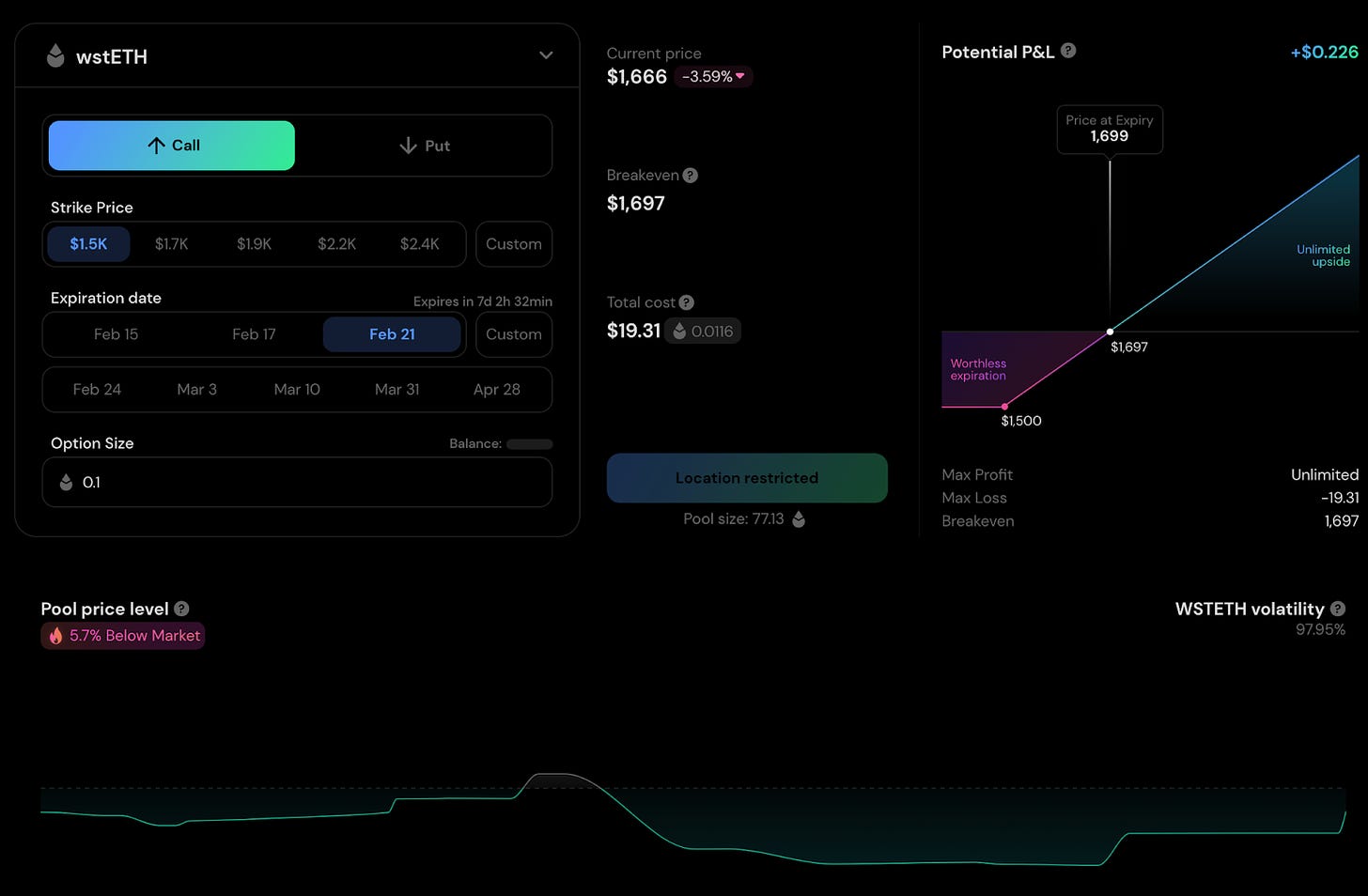

2. Hegic

If you feel constrained by Lyra’s pre-defined expiration date, maybe you are interested in implementing complex, multi-leg options strategies.

Need some assistance in setting up your trade? Hegic is the solution to your problems.

With custom-dated options and a range of one-click strategies offered at multiple strikes, Hegic makes options easy.

Users can select from a variety of bullish, bearish, high volatility, or low volatility biases, tailoring payoff outcomes to their unique risk tolerance and market sentiment. The dApp overlays your resulting payoff onto an interactive chart, providing users with an intuitive understanding of what they stand to gain (or lose) at any expected value of the underlying.

We recommend Hegic for: degens looking for flexible expirations and one-click, complex option strategies.

3. Whiteheart

Are you finance bro-ed out? Have you been seeking a no-frills method to simply lock-in today’s ETH or BTC prices for a fee?

Whiteheart is your answer! The dApp delivers an extremely simplistic user interface with two decisions:

- ETH or BTC

- Number of days you want to hedge

Complete the transaction and boom: you’ve locked in today’s ETH or BTC prices for the duration of your contract! Whiteheart’s “hedge contract” provides users with deep options liquidity minus the protocol’s complicated interface and complex options strategies, which may be daunting to new DeFi frens.

We recommend Whiteheart for: novice option traders looking for an easy-to-understand way to lock in today’s current ETH or BTC prices and eliminate downside risk for a fixed period of time.

4. Premia

- Website | Twitter

- Chains: Ethereum, Arbitrum, Optimism, Fantom

- Options for: ETH, BTC, YFI, LINK, ALCX, alETH, OP, FTM

Who said options were only for ETH and BTC?

Premia offers options for smaller market cap assets you may be interested in hedging the tail risk of or speculating on. Similar to Hegic, the protocol offers custom expiry dates across a variety of strikes to traders.

Unique to Premia is an option pricing dashboard, which provides insight to traders if an option is over or under priced. The model employed is similar to the Black-Scholes model underlying trad option pricing but has been tweaked to optimize for crypto assets.

We recommend Premia for: traders looking for flexible expirations and who want option pricing insights on a wide variety of underlying assets.

5. Siren

An options protocol on Polygon? Here I was thinking it was a Starbucks’ collectible enterprise chain solution the whole time…

Siren provides a TradFi-inspired options interface, with a more striking color scheme than Lyra. Both protocols utilize traditional option chains to display prices to users, and Siren is Lyra’s most direct competitor in terms of user experience listed within this guide. Siren offers options on a wider range of underlying collaterals at more strikes than Lyra.

We recommend Siren for: experienced traders looking to replicate the trad brokerage experience with a wider variety of underlying collaterals and further OTM options than Lyra.

Action steps

- 📖 Read and understand the key inputs for the Black-Scholes pricing model, known as “the Greeks” and their impact on options pricing.

- 📖 Check out A Guide to Options on Lyra