Getting Started with Spark Protocol ⚡️

Dear Bankless Nation,

It's been a slower year for DeFi action, but plenty of builders are still shipping! Today, we're sharing a tactic on how to experiment with Maker's latest release: Spark Protocol.

- Bankless team

Bankless Writer: William Peaster

DeFi pioneer and DAI stablecoin creator Maker is now powering Spark Protocol. Spark is the first DAI-centric lending market and a direct competitor to Aave. Today, we’ll walk you through the basics of Spark Protocol and how to use it!

- Goal: Try Spark Protocol

- Skill: Intermediate

- Effort: 30 minutes to 1 hour

- ROI: Learn how to lend on the DAI frontier!

Modeled after Aave V3 and developed by the Phoenix Labs research and development team for the Maker ecosystem, Spark Protocol is a decentralized liquidity market protocol that caters specifically to the DAI stablecoin.

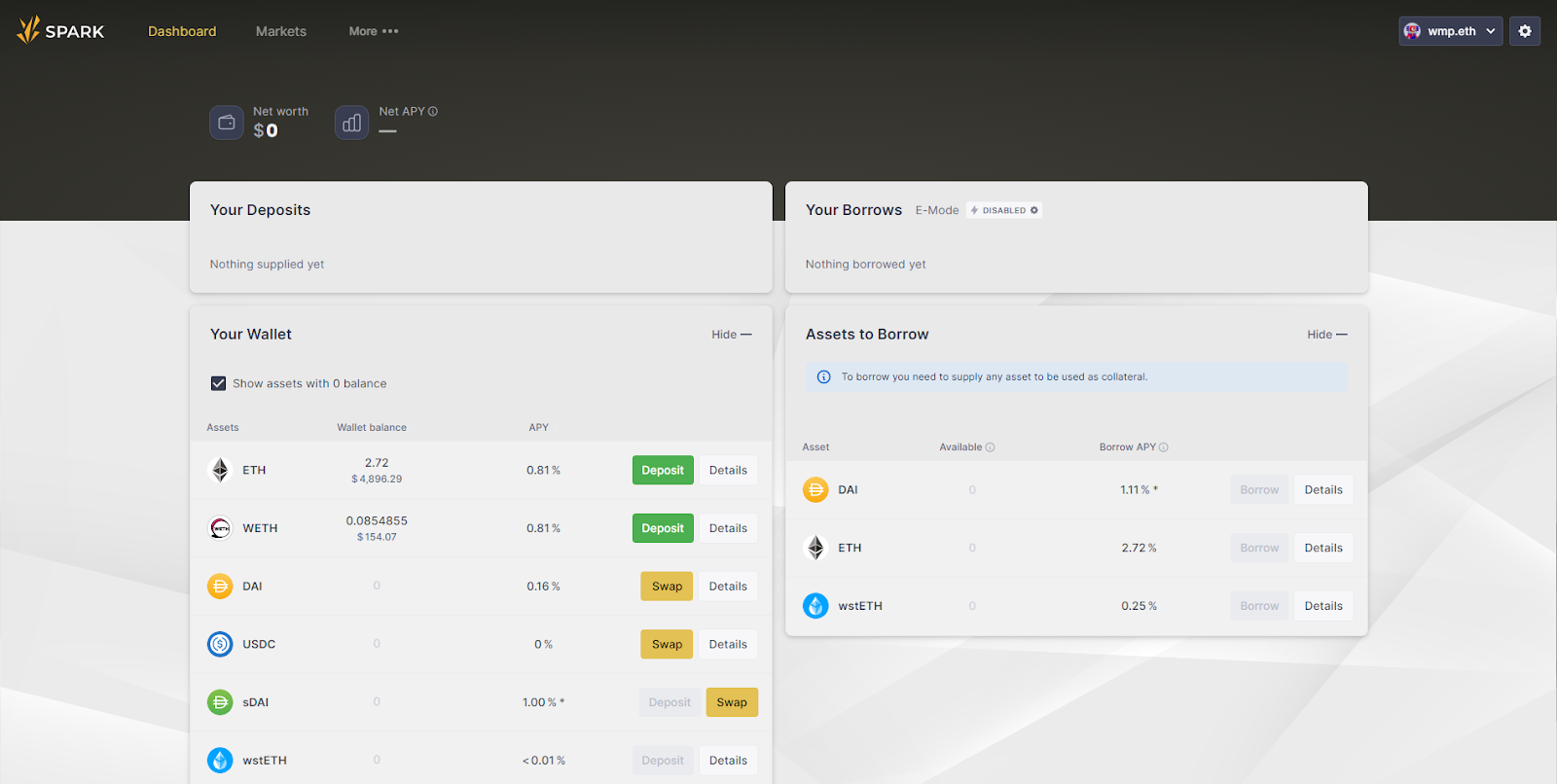

The first offering available at Spark Protocol is Spark Lend, a lending market that’s begun with supply and borrow support for ETH, Lido Staked ETH (stETH), DAI, and SavingsDAI (sDAI), the last of which represents DAI tokens that have been deposited into Maker’s Dai Savings Rate (DSR) protocol.

At the heart of this new lending system is Maker’s DAI Direct Deposit Module (D3M), a special Maker Vault that lets partner lending protocols generate new DAI at a fixed interest rate straight into their lending markets to keep pace with demand.

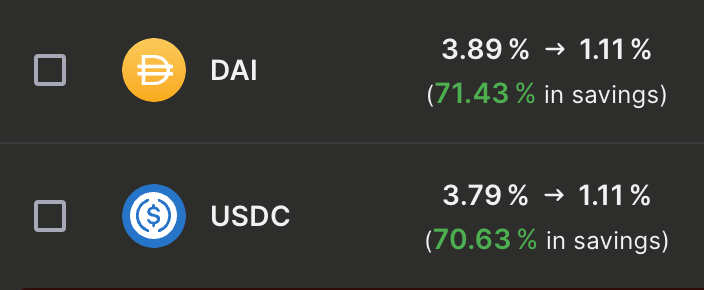

In the past, we’ve seen Maker use the D3M with projects like Aave and Compound, and now this wholesale, DAI-denominated credit line will serve as the foundation of Spark Protocol. As such, tapping into this credit line means Spark Lend can offer really great rates. For example, at 1.11% the project’s already offering the lowest DAI borrowing rate in all of DeFi right now!

Here, keep in mind that Spark Lend has been launched with an initial max credit line of 5 million DAI as a trial, but the plan is to raise that to 200 million in short order.

How to use Spark Lend

If you’ve used Aave or Compound before, then you’ll find Spark Lend familiar. To use Spark, you supply your preferred asset and desired amount, which then starts earning you passive income via lending based on borrowing demand. Moreover, supplying assets allows you to borrow the supported borrow assets, i.e. DAI, ETH, and wstETH.

To start supplying, you would:

- Go to https://app.sparkprotocol.io/ and connect your wallet (Note: US users are geoblocked from interacting with the frontend)

- Select your asset of choice, e.g. ETH, and press its “Deposit” button

- Input your desired deposit amount, review the transaction overview info, and then press “Deposit” again

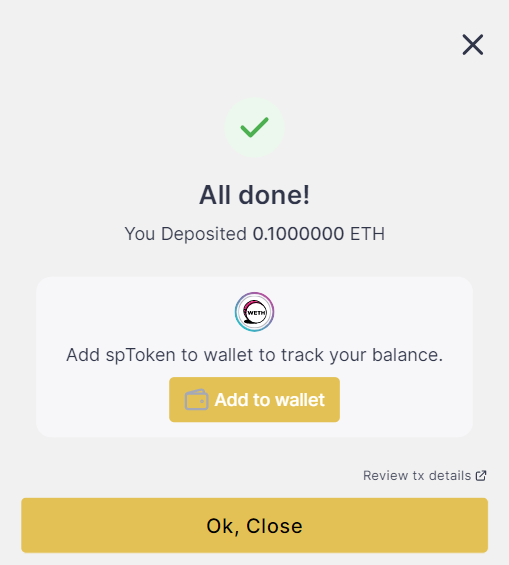

- Complete the deposit transaction with your wallet and wait for the transaction to confirm

- That’s it! You’ll receive an “sp” token, e.g. spWETH, that represents your deposit; at this point you’d be lending and could then open up a borrow position on Spark Lend!

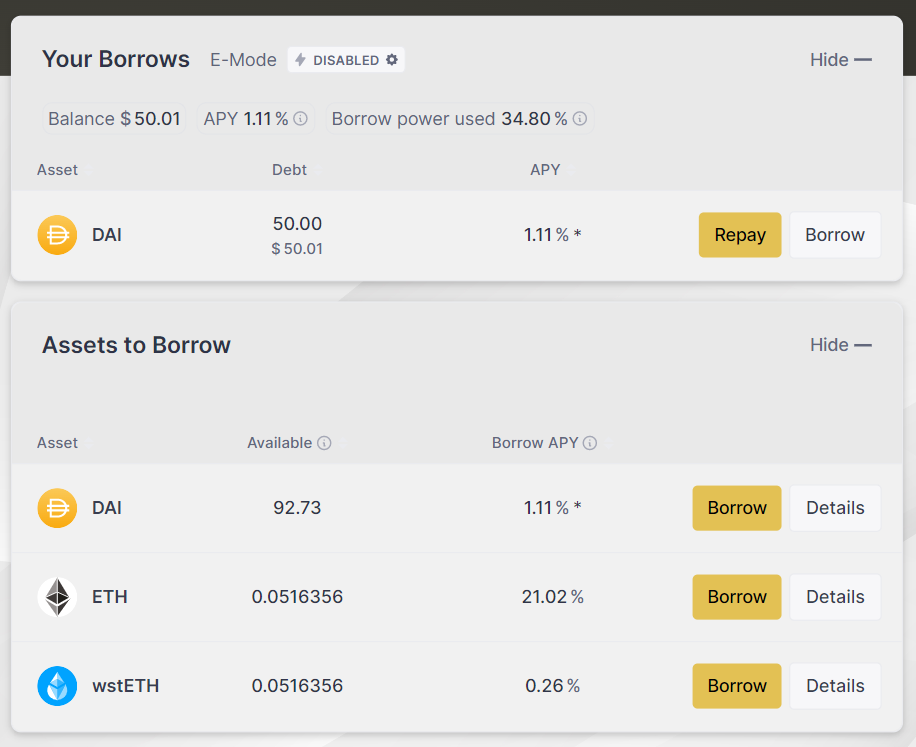

As for making a borrow on Spark Lend, you would:

- In the “Assets to Borrow” section of the frontend, select your asset of choice, e.g. DAI, and press its “Borrow” button

- Input the amount you’d like to borrow, review the Health factor (i.e. closeness to liquidation) and ensure it looks good, and then press “Borrow” again

- Complete the borrow transaction with your wallet and wait for the transaction to confirm

- That’s it! Now you can use the Spark Lend dashboard to borrow more or repay your loan over time

The big picture

Spark Protocol and its Spark Lend offering provide a new and innovative way to borrow and lend DAI within DeFi. By leveraging Maker's DAI Direct Deposit Module (D3M) and its credit line, Spark Lend provides attractive borrowing rates and opportunities for passive income through lending.

The platform is user-friendly, and interacting with it only requires a few simple steps such as connecting your wallet, selecting assets, and completing transactions. With the potential for an increased credit line in the future as well, Spark Protocol can grow considerably from here and help accelerate new opportunities around the DAI frontier!

Action steps

- Try Spark Lend: supply/borrow assets in this new DAI lending market! ⚡️

- Check out restaking: see last week’s write-up on How to Try EigenLayer Early 🧠