Getting Started with Jupiter Lend

Jupiter recently opened the Jupiter Lend public beta, marking the DEX giant's expansion into money markets on Solana.

Built alongside the Fluid team, whose own protocol has become a dominant force in Ethereum’s lending scene, Jupiter Lend brings a streamlined UX for Solana lenders and borrowers.

Less than two weeks after launch, the new protocol has already crossed $1B in TVL, making it one of the fastest-growing DeFi rollouts ever. It's one to watch, so let’s walk through how you can explore it yourself.

Starting with Statistics

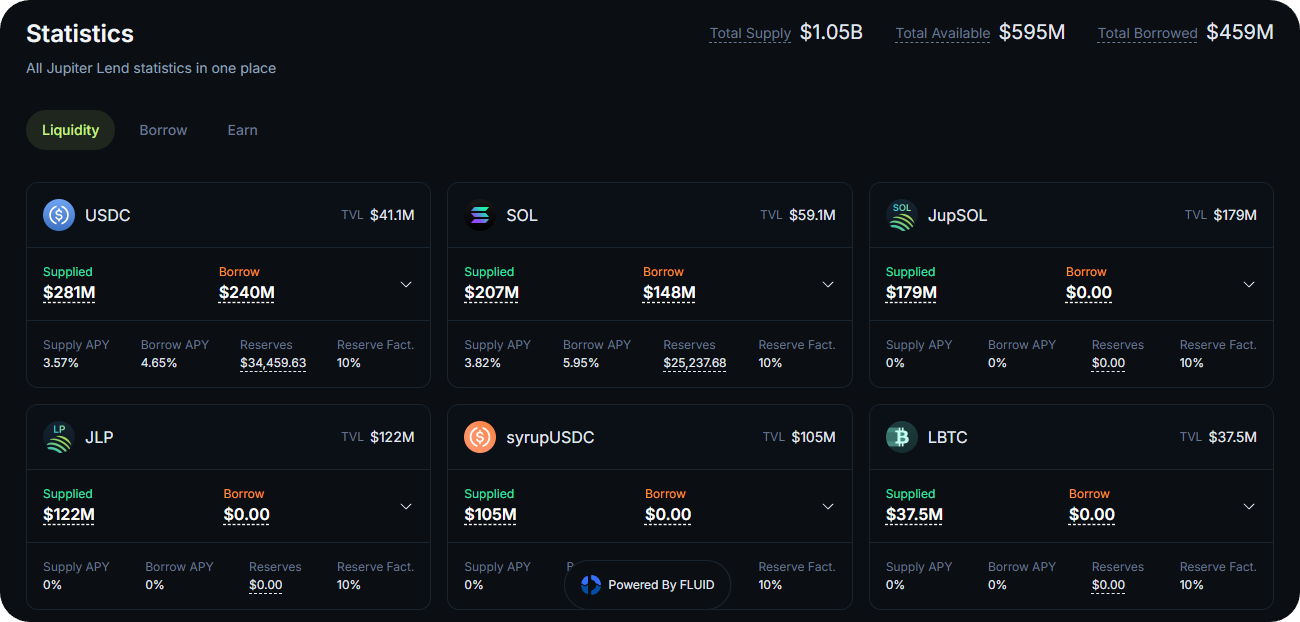

If you're like me, you like to get a bird's-eye view of a DeFi project before diving in. Accordingly, consider first heading to the Statistics hub at jup.ag/lend/statistics.

This page provides a one-stop overview of all Jupiter Lend's current activity, like TVL levels, supply APYs, borrow APYs, etc. You can flick through the "Liquidity," "Borrow," and "Earn" tabs to analyze and find opportunities that suit you.

Lending with Earn

After scoping things out, you can start locking in some passive yields by heading to the Earn hub at jup.ag/lend/earn.

Here, you can deposit SOL or stablecoins, after which Jupiter Lend automatically routes your funds for the optimal available returns. Just choose your asset, deposit, and the protocol handles the rest.

If you decide to take the leap in, click on your Vault of choice to bring up the deposit UI. Just keep in mind that Jupiter Lend enforces dynamic withdrawal limits, so how much you can withdraw may vary depending on the protocol's flows at the time.

Onto Borrowing

If you want to supply crypto and borrow against your funds, then head to the Borrow hub at jup.ag/lend/borrow.

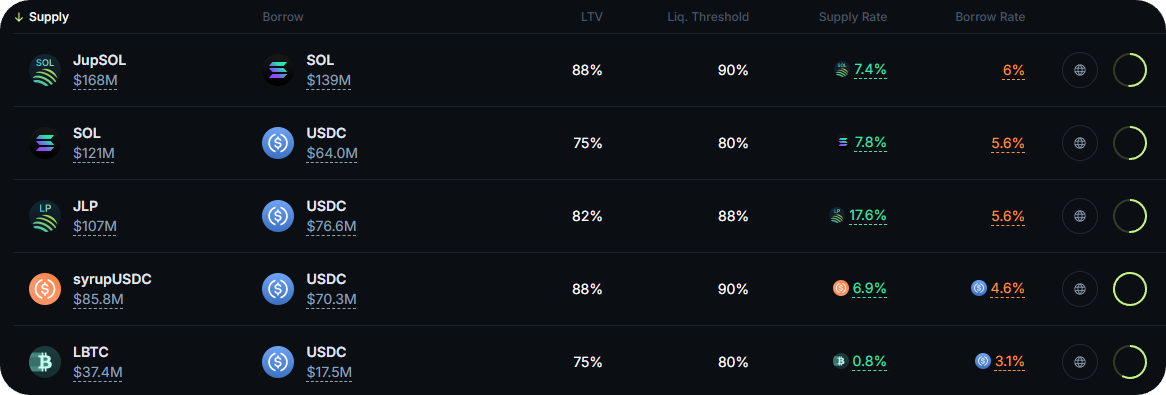

This is where Jupiter Lend uses isolated vaults and its new liquidation engine to facilitate onchain borrow positions. Here, you'll find pairs of supply assets and borrow assets, like SOL + USDC, LBTC + USDC, etc.

First, review the vaults' available metrics, like loan-to-value ratios (how much you can borrow against your collateral), liquidation thresholds (the limit at which some of your collateral may be liquidated), and supply and borrow APYs.

Once you've found a pair you like, click into it. Next you'll be prompted to deposit some of the required supply asset, after which the UI will let you draw your loan in the borrow asset up to the designated LTV amount.

Also, on the individual pair pages, you'll find "Bundled Actions" like Deposit & Borrow, Repay & Withdraw, Deleverage, etc. for easier management. Just remember to keep an eye on your loan's liquidation threshold and repay or add more collateral as needed.

Leveraging with Multiply

For the degens among us who like dabbling with leverage, you can also check out the Multiply hub at jup.ag/lend/multiply.

Here, you can readily loop your collateral with borrows to lever up exposure. In other words, you borrow against your collateral, then the borrowed asset is swapped back into your collateral asset, and you can do this up until a certain max leverage limit.

The hope is to amplify your returns. But with bigger potential rewards also comes bigger potential liquidation risks, so use caution if you decide to explore here!