Getting Started with EIGEN

🎧 Check out today's Bankless livestream with the EigenLayer team to get the full scoop on EIGEN! 🎧

The most anticipated airdrop of all time is (almost) here: claims for EIGEN open on May 10th!

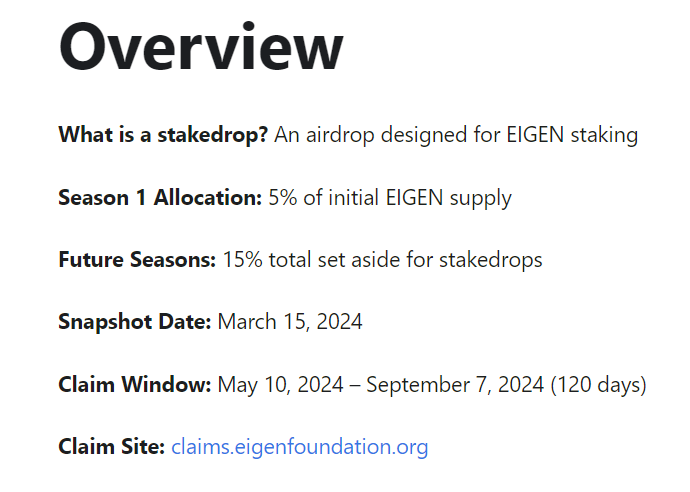

EigenLayer’s inaugural “stakedrop” will allocate 5% of the total EIGEN supply to all restakers – no matter how small their size – who deposited prior to the March 15th snapshot date with a minimum of 10 EIGEN.

While the majority of these tokens will be claimable next Friday, 10% of the distribution is being held back and reserved for users who had “complex interactions” with EigenLayer through liquid restaking tokens (LRTs). It will be distributed in approximately one month after the Protocol solicits further feedback on a potential distribution from ecosystem participants.

Eligible recipients (i.e.; anyone who staked directly through EigenLayer or participated through liquid restaking tokens) can check their allocations for phase one, season one ahead of claiming in two week’s through EigenLayer’s official claim portal.

Unfortunately, EigenLayer prevents residents from an extensive list of nations (including the United States and Canada) from claiming this airdrop and is restricting access from VPNs and other IP proxy technologies, meaning you’ll have to schedule a trip abroad if you are a citizen from one of these nations looking to claim your airdrop allocation.

The remaining 10% of the total EIGEN supply not being distributed through season one will be distributed to users in subsequent allocations, which will take into account not only actions made going forward, but the user’s entire history of interactions with EigenLayer.

Restakers who joined earlier, participated longer, and maintained their stake earned boosted allocations, as did native restakers who help to support network resilience and decentralization; future distributions will likely incorporate a similar weighting system.

While a minor EIGEN distribution was set aside for Goerli testnet participants inconvenienced by the EigenLayer deployment shutdown on the chain, the Protocol indicates that Holesky testnet participants will not receive airdrops in future allocations.

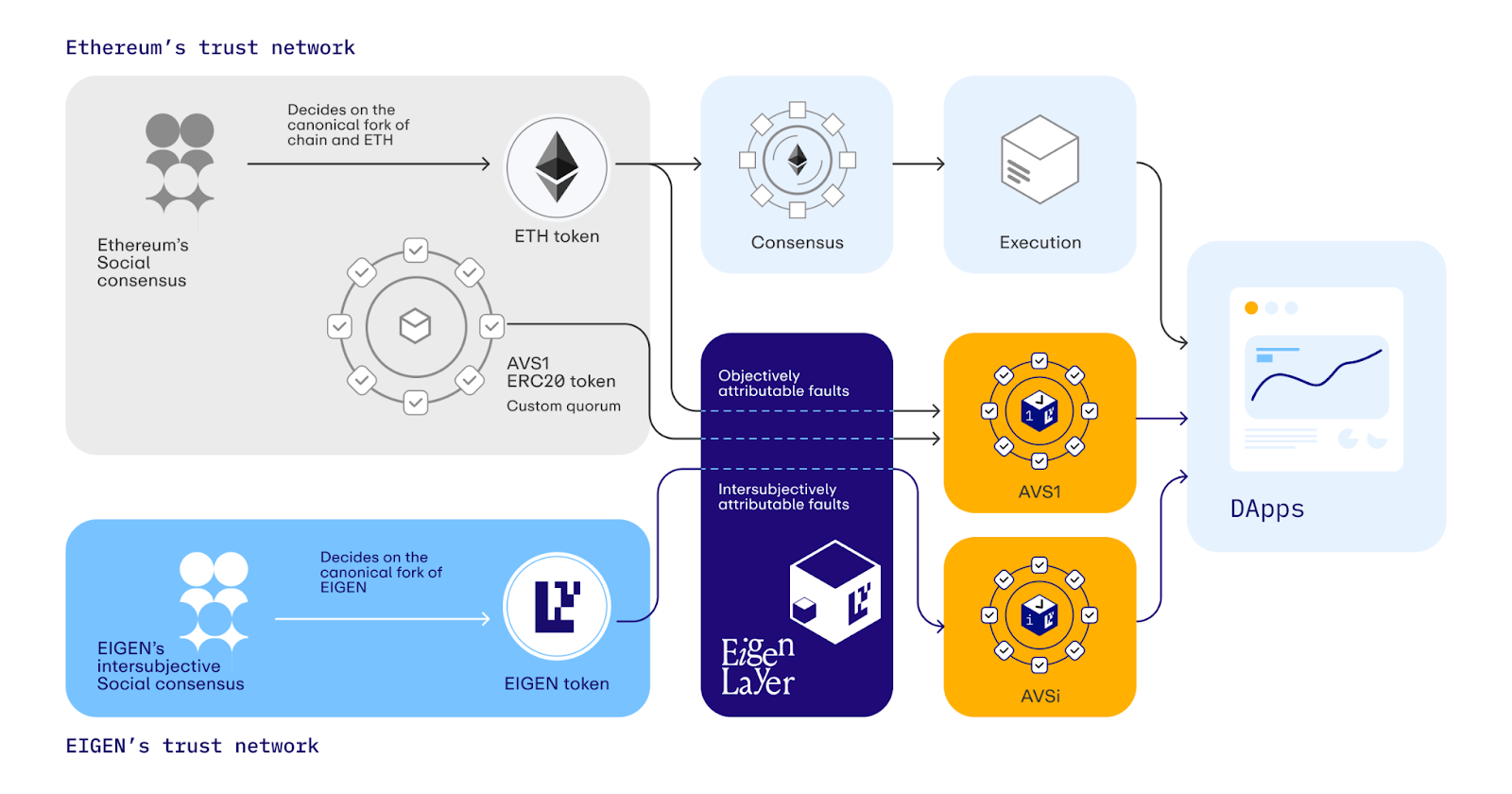

Upon launch, the EIGEN token will be imbued with intrinsic utility, enabling recipients to stake their tokens to secure the EigenDA network. Additionally, there is potential for further integration of EIGEN staking should other Actively Validated Services (AVSs) opt to include EIGEN – and other tokens – as eligible staking collateral to secure their network.

Core to the EIGEN token will be a governance mechanism facilitating “intersubjective forking” that allows token holders to challenge incorrect slashing behaviors that cannot be objectively identified onchain, but for which reasonable observers would agree that a penalty is warranted.

This process allows the EigenLayer application to fork itself at the token level, allowing control over the assets inside of the Protocol’s smart contracts to transfer without needing to involve Ethereum’s social consensus.

To create a fork in response to an improper slashing event, a “significant fraction” of EIGEN tokens must be committed by a challenger as a bond; EigenLayer’s social consensus will then vote whether the fork is legitimate.

In the event that the proposed fork is validated, the challenger recuperates their bond and earns a challenger reward, meanwhile tokens belonging to voters who voted against the fork will be penalized. Alternatively, if consensus votes against the fork, the challenger’s tokens will be burned.

While EIGEN will be claimable next Friday and come with some form of utility at launch à la staking, the token will be locked by an initial “non-transferable period” until token forking is enabled, meaning that recipients will be unable to sell their tokens for an indefinite period of time.

Further, the Eigen Foundation claims that the creation or trading of EIGEN derivatives would be detrimental to the community, and warns that engaging in such activities will impact eligibility for future seasons of EIGEN airdrops.

At launch, EIGEN will have a supply of 1,673,646,668.28466 tokens, a figure derived by encoding the phrase “Open Innovation” onto a classic telephone keypad.

In addition to the 15% of total supply earmarked for stakedrops, a further 30% of the initial token supply is reserved to fund EigenLayer development and bucketed under the community allocation, split 50/50 between the Eigen Foundation and direct community control.

EigenLayer’s private investors are set to receive 29.5% of the EIGEN supply and the core team is taking home the remaining 25.5%, both of which are subject to a one-year lock followed by a linear unlock of 4% of their total allocation each month over the next two years.

To sustain ongoing deposits, EigenLayer anticipates the need to adopt inflationary tokenomics in the future; control over these emissions will be given to the community, allowing them to decide how to best distribute them across EigenLayer’s diverse group of stakeholders.