Getting Started with Diva Liquid Staking

Dear Bankless Nation,

There have been a lot of conversations popping off on crypto Twitter this week surrounding Lido and LST dominance.

One of the competing liquid staking protocols that is seeing some chatter amid this is Diva, which is looking to incentivize Lido customers to make the switch. Today, we take a look at Diva and showcase how you can get involved early.

- Bankless team

How to Use Diva Early Staking Vaults

Bankless Writer: William Peaster | disclosures

Diva is an upstart Ethereum liquid staking protocol that has been seeing some chatter in recent weeks.

At its core, the project aims to improve the staking landscape by employing Distributed Validator Tech (DVT), which enhances Ethereum staking by allowing small groups to collaboratively stake, a.k.a. squad staking.

Diva plans to use this tech to help many more stakers join in on the validation process, bringing better decentralization and security in kind.

Sound interesting? Well, take note, then, because the project has an early-bird opportunity right now, its Early Staking Vaults.

These Early Staking Vaults are a strategic initiative designed to gather total value locked (TVL) before Diva Staking’s mainnet launch (Q4 2023/Q1 2024) when the project’s divETH liquid staking token (LST) will go live.

To incentivize deposits of ETH or Lido’s stETH token into these vaults, participants will earn rewards as denominated in Diva’s native DIVA token. You can gauge your earnings with the Rewards Calculator here.

The big idea? Accelerate the adoption of Diva Staking while fostering a balanced and decentralized community in the process. If this opp seems up your alley, jumping in is straightforward:

- 📱 Visit the app — Navigate to diva.enzyme.finance/#vaults.

- 🪙 Choose your vault — Decide between depositing ETH or stETH based on your preference. Remember, stETH deposits offer both staking rewards and DIVA tokens.

- 📥 Make a deposit — Once you’ve picked your vault of choice, use the interface’s “Deposit” button to input your desired deposit amount. Note: you will need to sign a transaction to accept Diva’s terms and conditions before depositing.

- 🔍 Monitor your investment — Use the provided Enzyme dashboard to track your deposits in the ETH vault or stETH vault. Keep in mind you will need to keep your deposit in until the Diva mainnet launches to receive your DIVA rewards allocation at that time.

- 📣 Stay updated: Keep an eye on Diva’s comms for any updates, especially as the mainnet launch approaches.

MetaMask Portfolio houses our flagship swapping mechanism. The Swap feature allows you to swap tokens directly by aggregating data from various decentralized exchanges (DEXs) and market makers to ensure you get competitive prices and low network fees.

Can Diva's unique approach to staking make a crack in Lido’s reigning LST dominance? Will Distributed Validator Technology become the new standard for decentralized staking?

We'll have to wait and see once the Diva mainnet arrives. In the meantime, be sure to review the project’s docs and explore the protocol’s Early Staking Vaults if you’re keen to put some tokens into action.

Just remember, never deposit more than you can afford to lose where new projects are concerned!

The vaults here are facilitated on Enzyme, which has been audited and battle-tested for some time, yet since Diva is new, there’s execution risk and beyond going forward. Play smart if you do play!

Today's Podcast:

Market Monday:

Scan this section and dig into anything interesting

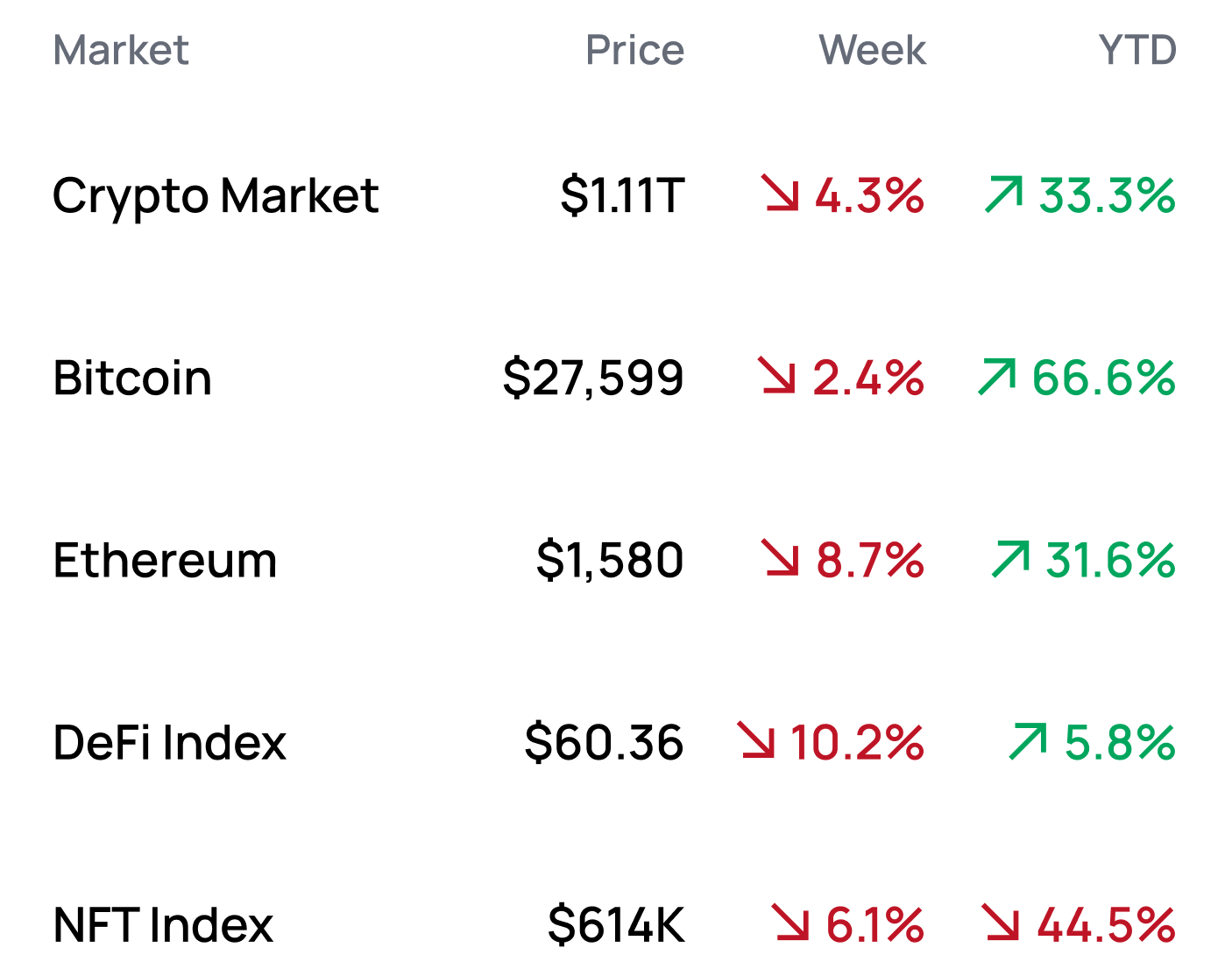

*Data from 10/9 4:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

🍏 Apply to CSS London before October 20

Market Opportunities 💰

- Trade volatility perps on GammaSwap

- Create NFT collections on Zora for free

- Earn the DSR with sDAI on Gnosis Chain

- Purchase exposure to US Treasuries on Base

- Trade Synthetix perps with Telegram bots

- Switch your friend.tech login method

Yield Opportunities 🌾

- BTC: Earn up to 5.8% APY with Ribbon’s WBTC covered call vault on Ethereum

- ETH: Earn up to 10.4% APR with Umami’s GLP WETH vault on Arbitrum

- USD: Earn up to 10.1% APR with Hop’s USDT pool on Optimism

- USD: Earn up to 11.8% APR with Umami’s GLP USDC vault on Arbitrum

- USD: Earn up to 13.0% APR with Aura’s DOLA-USDC vault on Arbitrum

What’s Hot 🔥

- Arthur Hayes calls for REKTober

- AI raise could make FTX creditors whole

- ETH futures ETFs launch to dismal debut

- Grayscale files to convert ETHE into spot ETF

- Judge denies SEC appeal of Ripple decision

- SEC asks judge to deny Coinbase’s motion to dismiss lawsuit

- UBS launches tokenized money market on Ethereum

- Friend.tech whales targeted with SIM swaps

- Yield Protocol makes tough decision to wind down

- Optimism fault proofs go live to Goerli testnet

- Starknet token unlocks delayed until April 2024

- DOJ says crypto used to facilitate payments for fentanyl network

- Massive tranche of SOL tokens unlocked

- Crypto-friendly representative becomes Speaker of the House

- Banking-as-a-service provider Synapse lays off 50% of staff

- THORSwap pauses swaps to curtail illicit activity

- Frax Finance releases documentation for V3

Money reads 📚

- An Incomplete Primer on Intents - Emperor

- Thoughts on Oracle-less Protocols - Tindorr

- 10 Ways to Destroy your Reach on X - NFT God

- Should Ethereum Enshrine More Things? - Vitalik

- LUSD is Our Only “A” Rated Stablecoin - Bluechip

- 90% of Solana Validators are Subsidized - arixon.eth

- Why There Won’t Be Millions of Rollups - Neel Salami

- Thread on Justin Sun’s Web of Deception - Dylan LeClair

- PYUSD is Safer than Dollars in Your Account - Moneyness

- DAOs pose an Alternative to Scientific Communities - Nature Biotechnology

Governance Alpha 🚨

- Stride core contributor proposes converting STRD supply to ATOM

- Maker to offboard rETH as approved collateral

- Arbitrum launches voting for short-term incentives program

- Alchemix DAO approves deployment to Arbitrum

- Lido decides to sunset Solana implementation

Token Hub: MNDE 📈

Analyst: James Trautman

We’re establishing our coverage of Marinade Finance with a bullish rating.

Catalyst overview:

Liquid staking tokens (LSTs) continue to play a role in supporting Solana and its DeFi landscape. Platforms such as Marinade Finance, Lido, and Jito have experienced triple-digit percentage increases in their TVL and have become the top three DeFi protocols on Solana in terms of TVL.

Marinade dominates ~53% of the TVL market share between these three protocols, with Lido capturing 24% and Jito 23%.

Two recent developments set the stage for market share to move in Marinade's favor.

On September 17, 2023, the protocol introduced Marinade Earn: Season 1, a three-month incentives campaign to reward stakers that use mSOL or Marinade Native.

Campaign Details:

- MNDE incentives will be active during Q4'23 or until capped out at 40 million MNDE.

- Every participant will receive one MNDE per one SOL staked over the three months.

- At the end of the campaign, the MNDE will be distributed as locked MNDE with a 30-day unlocking period.

On September 28, 2023, a proposal was submitted requesting 1.5 million DAI to cover 12 months of Lido operations on Solana. The rationale behind the proposal is Lido's unsustainable financial situation and the limited fees generated on the Solana network. Ultimately, it appears that Lido's activities on Solana are nearing an end.

Price impact:

With the launch of an incentive program coinciding with the halt of operations by its closest competitor, Lido, Marinade is poised to seize a chunk of Lido's 24% liquid staking market share.

Since the above developments unfolded at the end of September, Marinde's TVL has surged from ~$105 million to ~$132 million, marking a 26% increase. Despite this growth, Marinde's market capitalization has remained relatively stable, suggesting a potential shift toward a more favorable valuation. This bullish trend has the potential for sustained growth in the coming months.

See more ratings in the Token Hub.

Meme of the Week 😂