Dear Bankless Nation,

Happy Q4! The markets are starting off the quarter right – dig into our Market Monday links at the very bottom to see what catalysts are driving investment.

But first, we're walking you through Umbra – a privacy-preserving protocol for sending and receiving payments in a stealthy way.

- Bankless team

A Beginner’s Guide to Using Umbra

Bankless Writer: William Peaster | disclosures

Earlier this year, Ethereum's Vitalik Buterin published a post called The Three Transitions, in which he called for a great "privacy transition" in crypto.

The big idea? More work needs to be done so there can be more options to ensure funds transfers and other emerging tools, like decentralized identity, can be privacy-preserving.

Toward that point, today, I wanted to highlight one of the projects that is already answering this call for enhanced privacy: Umbra.

Built by the Scopelift team, Umbra is what's known as a "stealth address" protocol designed for Ethereum and Ethereum Virtual Machine (EVM) networks like L2s.

In simple terms, this protocol allows users to send funds to a fresh address that only the sender and receiver are aware of, adding a layer of privacy to the transaction.

In other words, imagine giving someone a brand-new, never-before-used address every time they want to send you funds. This is the essence of Umbra.

The magic behind this system is made possible by elliptic curve cryptography. Thus, when a payment is made, the sender generates a "stealth address" using a combination of their own and the recipient's public keys.

This new stealth address is where the funds are sent, and only the recipient, with the correct private key, can access and withdraw these funds, ensuring privacy.

Pretty neat, right? Well, if you're interested in taking Umbra for a spin yourself, the process is straightforward. Here's a step-by-step guide:

- 👛 Prep your wallet — Have a wallet (e.g., Coinbase Wallet, MetaMask, Rainbow) with some ETH or tokens ready to send.

- 🔌 Visit Umbra — Head to the Umbra app, connect your wallet, and switch to your network of choice (Ethereum, Arbitrum, Gnosis, Optimism, and Polygon currently supported).

- 🔐 Set up an account — Use the Setup page to sign a message + transaction to generate Umbra-specific public and private keys. This step is not necessary but great for security as it ensures Umbra never accesses your main wallet's private key.

- 🔀 Sending funds — Use the Send page to enter the recipient's ENS name or address. Choose the amount and the token you want to send, e.g., ETH, and then confirm the transaction. There is a minimum send amount so the intermediary stealth address can safely cover gas costs.

- 🪙 Receiving funds — If you're on the receiving end, you can use the Receive page to scan for incoming transactions. Once identified, you can withdraw the funds to a safe address.

With regard to receiving funds, note that it can take a while for the scanning process to complete, and this is an open problem Umbra is working to improve.

Keep in mind that if you are withdrawing received funds, you'll also want to be careful about what address you withdraw to in order to maintain your privacy.

Here, the creators of Umbra have a few recommendations, but what you absolutely never want to do in any circumstance is to withdraw to an address that is publicly associated with your identity. To help mitigate this, the Umbra app will warn you if you're trying to withdraw to an address that owns an ENS name, POAP NFTs, etc.

All in all, Umbra stands as a testament to the fact that we can build empowering privacy tech in crypto, and we can answer Vitalik's call for a "privacy transition."

Especially in light of recent events, such as the OFAC sanctions against the Tornado Cash project, Umbra shines as one of the few beacons of hope for privacy on Ethereum's frontier, and it's worth highlighting and exploring accordingly.

For those interested in diving deeper, look to Umbra's FAQ, follow the team on Twitter, or check out their Gitcoin page!

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further than Kraken Pro, a highly customizable, all-in-one trading experience and our most powerful tool yet.

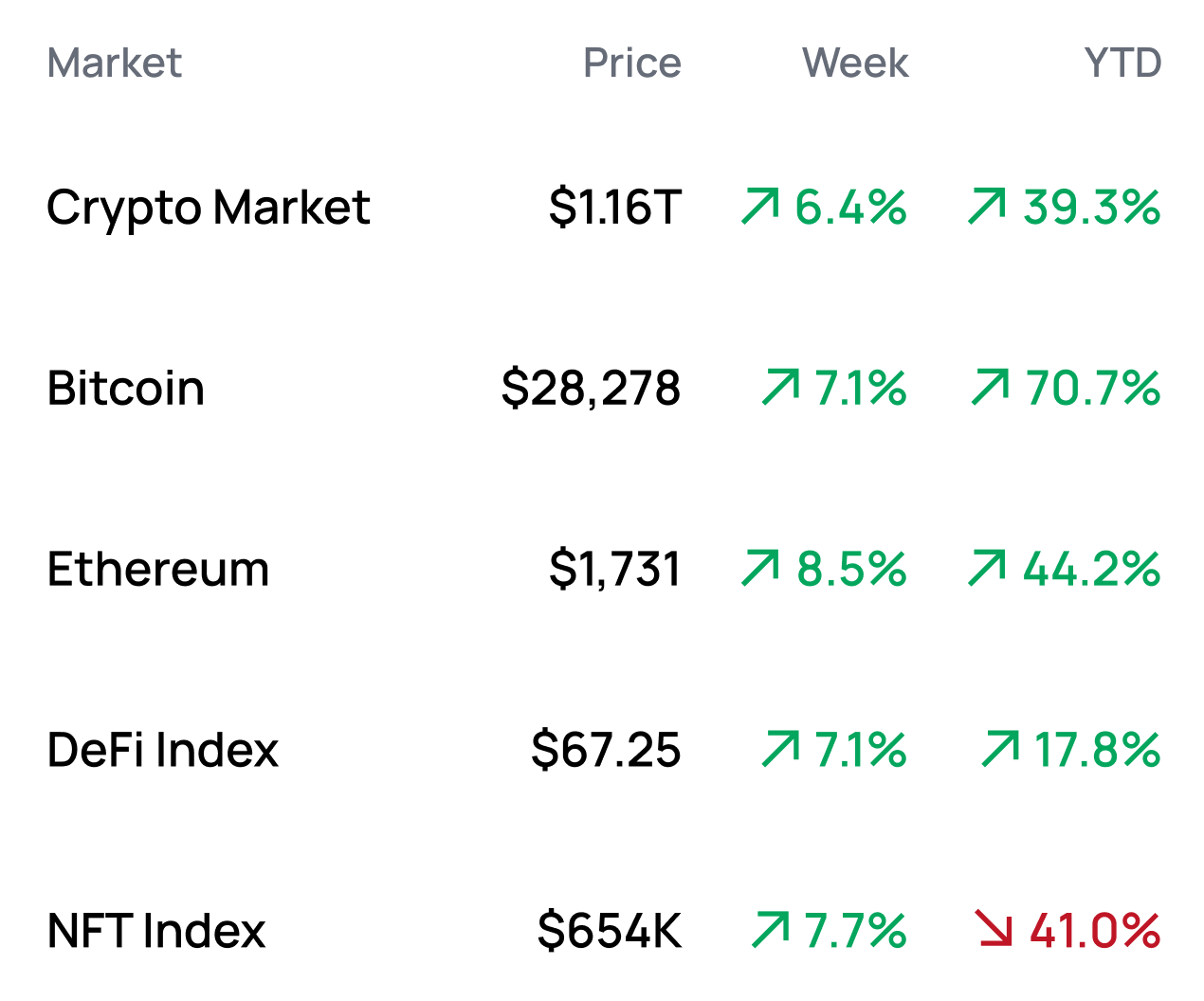

MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 10/2 6:00 am EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Claim your $TIA airdrop from Celestia

- Trade the Celestia airdrop on Aevo

- Deposit ETH to earn DIVA tokens

- Purchase a Pudgy Penguin from Walmart

- Collect official Bugatti ordinal NFTs

- Download the Rainbow browser extension

- Call your Congressperson and ask for clear rules on crypto

Yield Opportunities 🌾

- BTC: Earn up to 5.7% APY with Ribbon’s WBTC covered call vault on Ethereum

- ETH: Earn up to 12.3% APR with Umami’s GLP WETH vault on Arbitrum

- USD: Earn up to 19.3% APY with Beefy’s USDC-USDT vault on Polygon

- USD: Earn up to 13.8% APR with Umami’s GLP USDC vault on Arbitrum

- USD: Earn up to 15.8% APR with Aura’s DOLA-USDC vault on Arbitrum

What’s Hot 🔥

- Blocknative’s relay shuts down

- Gary Gensler grilled by Congress

- SEC expedites ETH futures ETF approval

- Valkyrie ETF unwinds ETH futures positions

- Nine ETH futures ETFs ready to launch on Monday

- Curve founder reduces debt, repays Aave V2 loan

- Kraken to offer trading for US-listed stocks

- MicroStrategy announces purchase of even more Bitcoins

- Congress demands Gary Gensler and SEC approve spot BTC ETF

- SEC delays decision on four spot BTC ETFs

- Binance sells off Russian operations to CommEx

- Chase UK bans crypto purchases over fraud fears

- Gemini withdrew $280M in prop funds from Genesis prior to collapse

- Federal Reserve says stablecoins could be source of financial instability

- DOJ investigation into Binance could result in billions in fines, prison time

- Yuga restricts trading on latest collection to platforms enforcing royalties

- Coinbase receives approval to offer perps to international retail

- 3AC’s Su Zhu arrested in Singapore, Kyle Davies convicted in absentia

Money reads 📚

- The Heist - Fred Wilson

- The Canto Bull Case - Taiki Maeda

- Introduction to EigenDA - EigenLayer

- An Unreal Primer on RWAs - Jack Chong

- Is stUSDT a Justin Sun Exit Scam? - Patrick Tan

- Why Bringing RWAs Onchain is Important - Variant

- The OP Stack & Superchain Vision - zerokn0wledge

- Playing the Arbitrum Grants Rotation - Ouroboros Captial, et al.

Governance Alpha 🚨

- IndexCoop considers reducing fees to 0bps on dsETH index

- ENS looks to put an additional 16k ETH to work earning yield

- dYdX community approves 6-month incentives program

- Uniswap foundation requests $62M to complete initial funding round

- Lido considers whether to sunset Solana implementation

Token Hub: AVAX 📈

Analyst: James Trautman

Rating: Bearish

Risk: Medium

Sector: L1

TL;DR:

- While the Avalanche ecosystem is developing and expanding its subnet landscape, expansion on the C-Chain continues to be relatively uneventful.

- Avalanche C-Chain remains the primary driver for the value accrual of AVAX, which has not sustained value-driving activity since its peak in May 2022.

- The demand for AVAX from subnet security and value-driving activity on the C-Chain does not appear strong enough to change asset performance trajectory over the near to mid-term.

Catalyst overview:

The Avalanche subnet landscape is growing on the heels of several developments that have led to hundreds of subnets in the pipeline (on testnet) and enterprise partnerships, including those with GREE, Loco, T. Rowe Price, and WisdomTree.

However, Avalanche's general purpose EVM chain (C-Chain) remains the primary driver of value accrual of its native token AVAX. Competitive forces continue to put downward pressure on the C-Chain, which has yet to sustain value-driving activity since its highs in early 2022.

Until May 2022, Defi Kingdoms was the C-Chain's top transaction and revenue driver. However, its migration from the C-Chain to an individual subnet put downward pressure on C-Chain daily transactions, transaction fees (by design), and revenue (in AVAX). Since Avalanche burns 100% of transaction fees, the reduction in transaction fees also puts downward pressure on the burn rate of AVAX.

Price impact:

The activity and value applications like DeFi Kingdoms drove have yet to be backfilled despite applications like Uniswap going live on Avalanche in Q3'23.

As it stands, the outlook is such that the rollout of subnets, which expands the Avalanche global validator set, and demand for subnet security has largely become the value accrual mechanism for AVAX.

The value accrual from expanding the validator set is much different and may take longer than what comes from revenue and burning transaction fees on the C-Chain. It is also significantly dependent on the value proposition and success of subnets.

Until a significant number of subnets provide and demand security, AVAX becomes a more substantial part of the subnet landscape or catalysts for activity return to the C-Chain; the outlook is bearish for Avalanches' native token.

See more ratings in the Token Hub.

Meme of the Week 😂

Action steps

- 👀 Scan today's Market Monday links for any opportunities

- 🪙 Check out Umbra: Send a stealth payment

- 🌈 Catch up on the previous tactic: Checking Out Rainbow's Browser Wallet