FTX Is Why We Need More DeFi, Not Less

Dear Bankless Nation,

“The failure of FTX proves a failure of decentralized finance.”

That refrain has been relentlessly echoed by all manner of Web3 skeptics over the past week amid the shocking implosions of FTX & Alameda.

The White House reiterated that FTX is why “prudent regulation of cryptocurrencies is indeed needed.” In a tweet, Sen. Elizabeth Warren characterized the crypto industry broadly as one of “smoke and mirrors”, arguing that the SEC should be pushed to pursue “more aggressive enforcement”.

The collapse of one of the largest crypto platforms shows how much of the industry appears to be smoke and mirrors. We need more aggressive enforcement and I'm going to keep pushing @SECGov to enforce the law to protect consumers and financial stability.https://t.co/uOPi8MV25J

— Elizabeth Warren (@SenWarren) November 10, 2022

It’s not just the politicians either. Ever the devoted acolytes, anti-DeFi Bitcoiners are seizing on the FTX blowup to preach their “why Bitcoin good only” mantra.

But a distinction must be made between crypto players operating by the rules of TradFi and those adhering to the rules of DeFi.

FTX isn’t DeFi

If anything, the FTX catastrophe represents a failure of the centralized finance mechanisms that DeFi has been working so hard to replace.

Consider where the troubled roots of the FTX catastrophe ultimately stemmed from — FTX lent out customer deposits, rather than holding them as redeemable 1:1 deposits. To make things worse, they over-leveraged their balance sheets by holding a disproportionately large amount of its own illiquid FTT token as collateral, instead of safer assets like stablecoins. In short, FTX tried to play the role of a bank where it wasn’t supposed to, and it played that role poorly.

Neither of the above would be possible for a DeFi exchange or bank.

DeFi is self-regulatory

Look at DeFi’s biggest exchange platform: Uniswap.

A Uniswap user would never lose a night of sleep over Uniswap trading customer deposits, for the simple reason that there aren’t any individual “deposits” to begin with. Unlike FTX, where users deposit their money before executing trades on a matching orderbook, users simply execute trades in the hundreds of permissionless liquidity pools.

Capital in these pools is supplied by liquidity providers/yield farmers who similarly would never worry about Uniswap trading their deposits. These liquidity pools are governed by immutable smart contract logic that makes it impossible for Uniswap to do anything funny with their funds.

Uniswap cannot lend your funds out to their friends, nor can they leverage it for their own personal trading. Their hands are bound by the very own rules they’ve created.

The same is true for any lending/borrowing DeFi platforms like Aave or Compound. If you take a loan out on Aave, you first need to deposit capital at a safe loan-to-value ratio. Should the value of your collateral backing the loan fall below a preset threshold, Aave automatically liquidates your loan - no arguments allowed, no questions asked. This is in contrast to the series of bad loans that FTX was making to its own sister hedge fund Alameda, which were then used as collateral for loans elsewhere. It’s a similar saga to ones we’ve already witnessed with Celsius and Three Arrows Capital.

The most competitive, market-tested DeFi protocols are chock full of these self-governing rules that were meant to avert scenarios like what’s currently happening at FTX.

Not convinced?

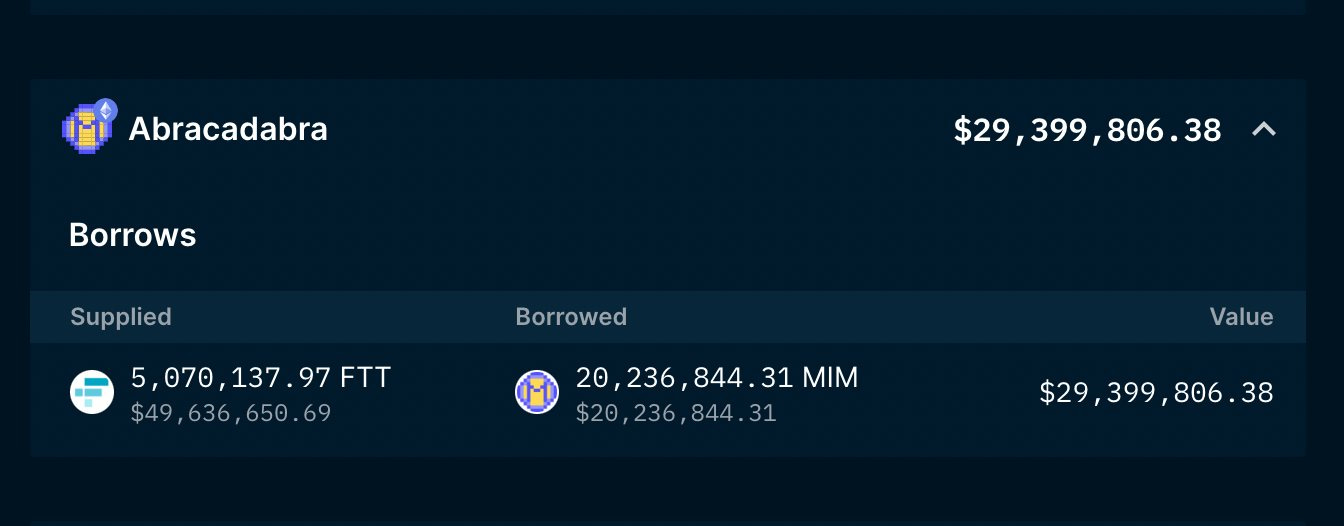

Consider another edge example. Prior to the fiasco, Alameda Research held an outstanding loan of 20M MIM (Abracadabra’s stablecoin) against 5M of FTX’s exchange token FTT. Say what you will of Alameda (or Dani Sesta) but despite everything, the debt was fully paid down on November 9 amid the market turmoil.

Why did they honor this? Alameda didn’t service the loan out of the goodness of their hearts. They paid it because there is no Chapter 11 bankruptcy to file in the world of the EVM. Had Alameda defaulted, their FTT collateral would’ve been immediately liquidated and sold by liquidators at the then-price of ~$17.

Paying off their loan and reacquiring their FTT was in their own best interests.

In short, DeFi worked.

How about the stablecoin part of the DeFi world? The test of a truly working stablecoin is its peg to USD value, which can be stressed in times of market volatility. Yet, Maker’s DAI worked fine throughout last week’s ordeal.

Even the MIM stablecoin, which was 35% collateralized by FTT, turned out fine. After a brief depeg on November 9th to $0.974, MIM regained its peg value.

4/9

— olimpio.eth ⚡️ (@OlimpioCrypto) November 7, 2022

Stablecoin MIM is 9% backed by FTT, down from ~35% 3 days ago

Yesterday MIM debt was repaid (↓ from 35% to 9% FTT backed) and 27M was newly available to be minted using FTT

Right now, only 1M MIM can be minted with FTT on https://t.co/o3t2kowHGahttps://t.co/uz6tOb2fU1 pic.twitter.com/FTNdiD08At

DeFi failed on the social layer

So when crypto skeptics hurl the charge of “failure” at the feet of DeFi, one may rightfully ask – in what sense is that true?

Did DeFi exchanges and lending protocols work as intended? Yes, they did. Did decentralized stablecoins depeg and collapse in value? No, they did not.

Ultimately, crypto-skeptics don’t seem to get this. Though, there is perhaps one sense in which DeFi failed.

DeFi failed because its community got complacent. We should’ve done proof-of-reserves a long time ago. DeFi failed because we failed to anticipate SBF’s intentions. We should’ve been more skeptical. DeFi failed because we embraced centralized intermediaries for convenience. Self-custody is hard, but placing trust in FTX left too many in the industry exposed.

The fault is not inherently in DeFi systems, but in a crypto community that compromised on the values of decentralized finance too much, too often.