FTX Finds Closure ($)

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

📊 Fed up. TradFi indices reached for new all-time highs as the total crypto market cap continued to hammer against $1.6T weekly resistance. What big event impacted markets this week?

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $1.65T | 0.0% | ↗ 2.5% |

|

BTC $42,994 | 0.0% | ↗ 2.9% |

|

ETH $2,300 | ↘ 0.2% | ↗ 1.3% |

1️⃣ Curtains for FTX and Celsius

The good news: FTX will be fully repaying its customers. The bad news: repayments will be based on market fiat prices of assets tied to when it declared bankruptcy. This process will see FTX distributing $30-35B to roughly 15M people and canceling its relaunch plans.

Celsius has concluded its bankruptcy process and will begin returning $3b to creditors, along with stakes in Ionic Digital Inc., a mining operation that may soon be publicly traded. PayPal and Coinbase will facilitate the process, and Celsius will sunset its apps by the end of February.

Celsius also settled a $4.7B suit with U.S. authorities over fraud allegations. Ex-CEO Alex Mashinsky still faces his own trial over token manipulation.

2️⃣ Controversy Over $JUP

The Jupiter Airdrop saw 1b JUP tokens, valued at $700m at peak prices, claimed by close to half a million wallets. While Solana's network did buckle a bit, it held up very well overall.

The airdrop faced backlash, though, as some viewed a 250m JUP liquidity pool seeded by the team as a disguised ICO.

In response, Jupiter's founder, Meow, explained the team-funded liquidity pool was a move to support the market. He stressed that all information about the launch pool was also made available beforehand and urged people to read and understand before participating.

Meow argues this approach benefits JUP holders and that if the token's value increases over the seven days post-launch, it will have been a success. Doubtful of the cats? Meow has a message: sell.

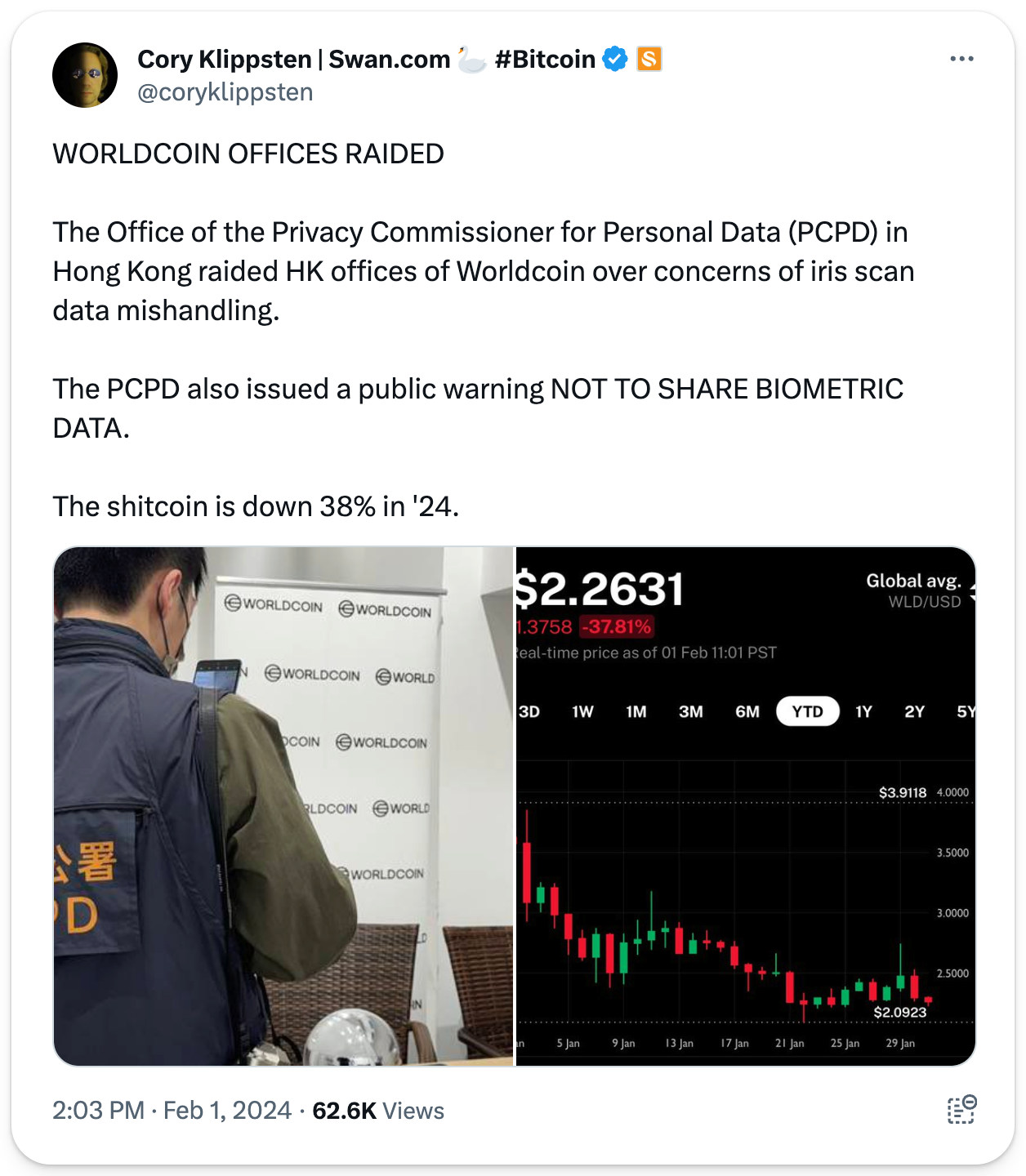

3️⃣ Worldcoin's Privacy Hurdle

Worldcoin has hit a snag in Hong Kong, where officials have begun to scrutinize the project over privacy concerns, going so far as to raid six iris-scanning locations on Wednesday.

The eyeball coin has seen global pushback, with countries like Kenya and India pausing sign-ups. We can expect this pushback to continue as the project potentially heralds a crucial juncture for privacy standards and identity verification in a world with AI.

4️⃣ SIM Swaps Rocked FTX During Collapse

2FA just keeps getting more material to support their case. On Wednesday, the U.S. federal government charged a trio with pilfering $400m from FTX during its collapse — shining a light on some of FTX's missing millions.

On Nov 11, 2022, the group accessed the phone of an FTX employee via AT&T and used it to snag millions amidst the chaos of the exchange's demise.

With SIM swaps seemingly growing at a rapid clip, the precedent for all of us having 2 Factor Authentication as a standard security measure proves tremendously important.

5️⃣ OP and ARB Play Tug-of-War

Earlier this week, Ben Jones, Optimism's co-founder, proposed TreasureDAO migrate to Optimism — promising enhanced scalability, integration into the OP Stack's web of L2s, and a community dedicated to decentralized gaming.

Taking to Twitter to counter, Arbitrum's Hunter emphasized TreasureDAO's deep roots and major role within Arbitrum's ecosystem, even going so far as to say Treasure is the biggest ecosystem on ARB.

ZK Sync tossed their hat in the ring, too, launching a proposal hoping to entice Treasure to their chain. The Treasure Wars heat up. It will be interesting to see where Treasure goes, if anywhere, and the reasons they cite for doing so.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

Ryan and David are talking airdrops following this week's majorly hyped JUP drop, but they're also discussing the latest ETH ETF rumors and what's happening with the crypto market broadly.

Get the full rundown👇

🏹 New in Airdrop Hunter:

- 💧 Haedal Protocol [liquid staking for Sui]

- 🐡 Puffer Finance [Liquid Restaking for Eigenlayer]

- ✨ Ekubo [Decentralized Exchange on Starknet]

📰 Articles:

📺 Shows:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.