1️⃣ FTX's Bear Market Claim Recovery

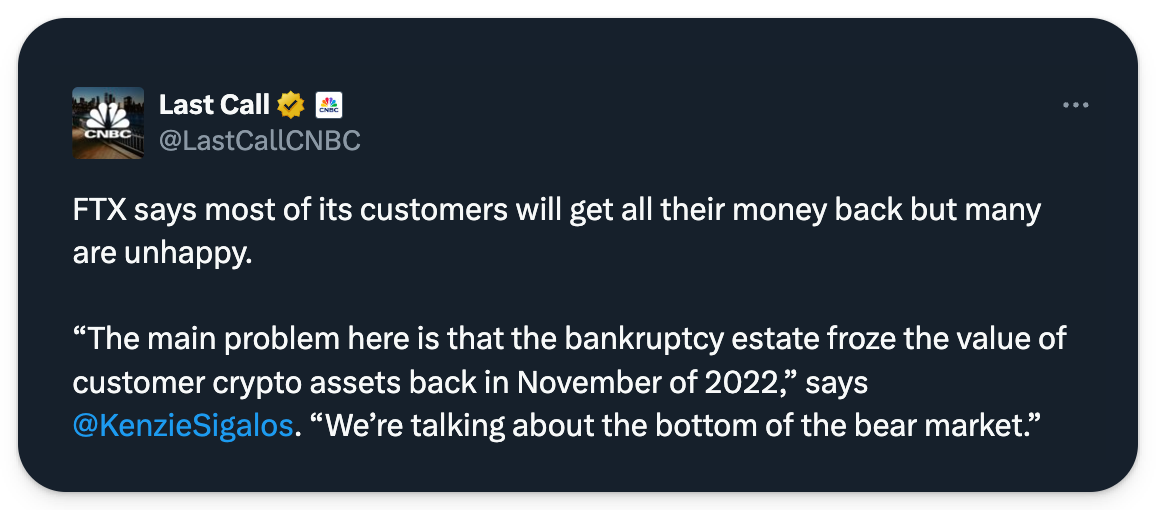

In an unexpected turn, claims from the FTX bankruptcy have surged above 100 cents on the dollar, according to a draft recovery plan estimating most creditors could see a recovery rate of 118%. In tandem, claim buying — where people’s claims are sold on secondary markets — continues to increase over concerns about tax implications and the ability to cash USD checks. As a result, FTX claims now trade between 101% and 112% — a seller’s market.

Of course, these percentages still aren't making claimants jump for joy; remember claims have been sized against Bitcoin’s price as of Dec. 2022, when the asset was priced at around $16k ☠️

2️⃣ Bitcoin Continues to Stumble

Despite a solid start to the week, Bitcoin erased the gains that brought it to a high of $63.5K. Friday morning, It fell sharply to trade at~$60K following disappointing U.S. economic data, hawkish comments about inflation and monetary policy, and >$56M of liquidations in the previous 24 hours. The University of Michigan's Consumer Sentiment Survey, indicating a drop in consumer confidence, did not help. Next Wednesday, May 15th, April’s Consumer Price Index data will be released, most likely impacting Bitcoin’s price — hopefully to the upside.

3️⃣ Trump's Crypto Embrace, Biden's Veto

Crypto found a spotlight moment in the Presidential campaign, this time with Trump. During the former president’s NFT trading card event, he stated he was “fine with crypto” — sending TREMP on Solana and TRUMP on Ethereum soaring 187% and 43%, respectively, over the next 24 hours.

Trump's comments offered a stark contrast to President Biden's recent action of a veto on legislation easing capital requirements for banks handling crypto. This stance by Trump has ignited discussions within crypto, where many see his potential re-election as a positive shift for the industry.

4️⃣ Nigeria Detaining Binance Exec

This week, Binance CEO Richard Teng called for the release of Tigran Gambaryan, a Binance executive detained in Nigeria for over two months. In a statement, he explained that Gambaryan was one of two detained executives, though the other executive managed to escape the country. The detentions occurred during a regulatory discussion, sparking international concern about the treatment of foreign business representatives.

Additionally, the Nigerian government's recent decision to ban crypto trading in the local currency, which they believe harms the Naira, has increased tensions. Added to this are claims from Binance of ransom requests from Nigeria, alleging they asked for $150M in crypto for the release of Gambaryan.

5️⃣ Robinhood Hit with Wells Notice

The SEC's weaponization of Wells Notices continues; this week, they hit Robinhood over its crypto division. In response, Dan Gallagher, Robinhood's Chief Legal, Compliance, and Corporate Affairs Officer, expressed disappointment over the SEC's approach, emphasizing the company's position that the listed assets do not classify as securities.

Gallagher also stated that the company had met with the SEC over a dozen times to try to register as a Special Assets Broker, although the SEC did not reciprocate the efforts and cut the process short. This latest announcement follows other Wells Notices sent to Uniswap and MetaMask over the past few months.