Can friend.tech Go Mainstream?

Dear Bankless Nation,

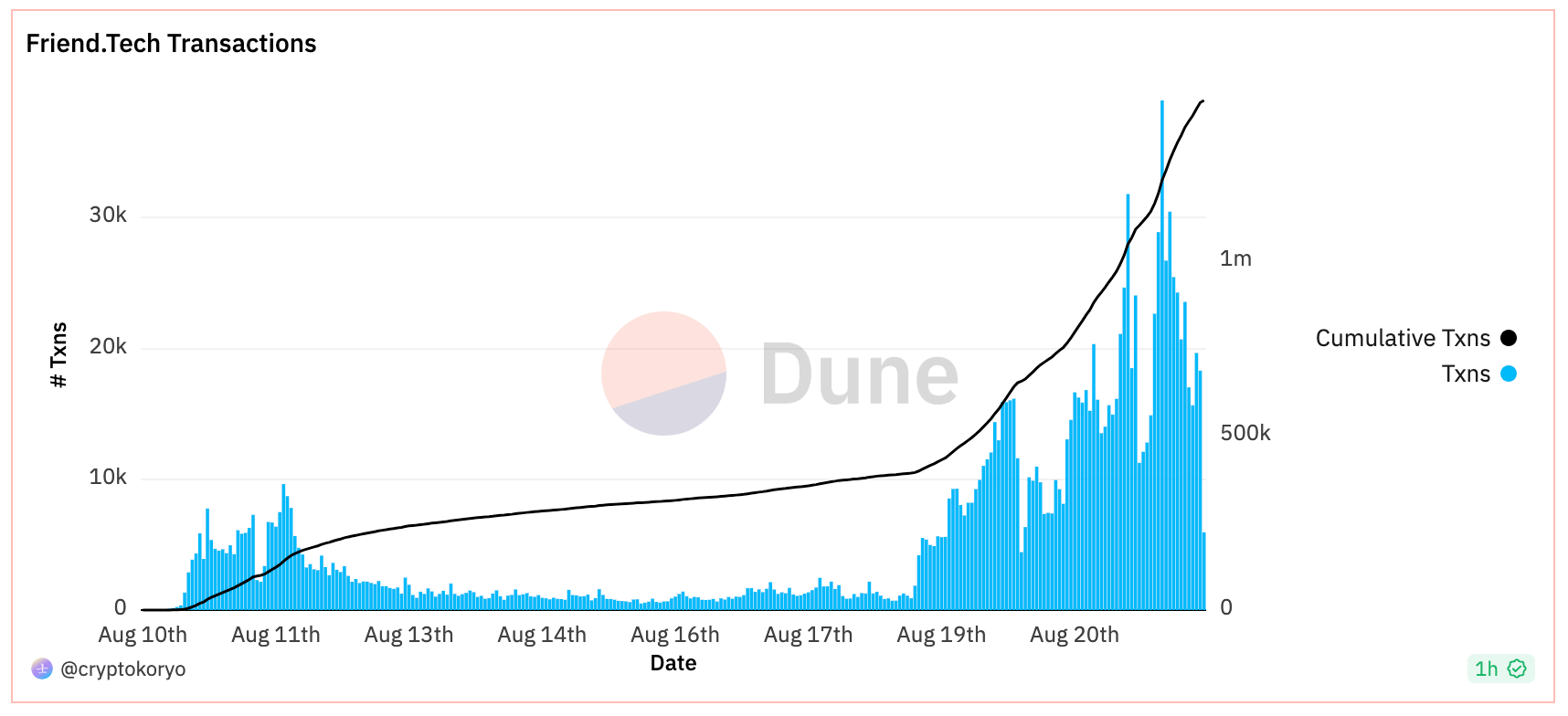

We talked your ears off about friend.tech last week. This weekend, it blew up.

Despite a bearish past week for crypto prices, users rallied around the new platform, injecting tens of millions into it. Today, we're digging into the traction friend.tech is seeing and looking to define where it could head next.

- Bankless team

Friend.tech is on Fire 🔥

Bankless Author: David Hoffman | disclosures

The friend.tech phenomenon has swept through Crypto Twitter and is showing few signs of slowing down.

With 80,000 unique users joining friend.tech in the last 10 days, the crypto world is finding that breakout apps are well within reach. Even if this boom isn’t sustainable – and it’s not the app to take crypto mainstream – friend.tech is still providing lessons and market signals for what going mainstream is going to take.

If you were off touching grass this weekend, and need to get caught up with this app's traction, here’s the progress that friend.tech has made in reaching new audiences beyond crypto natives.

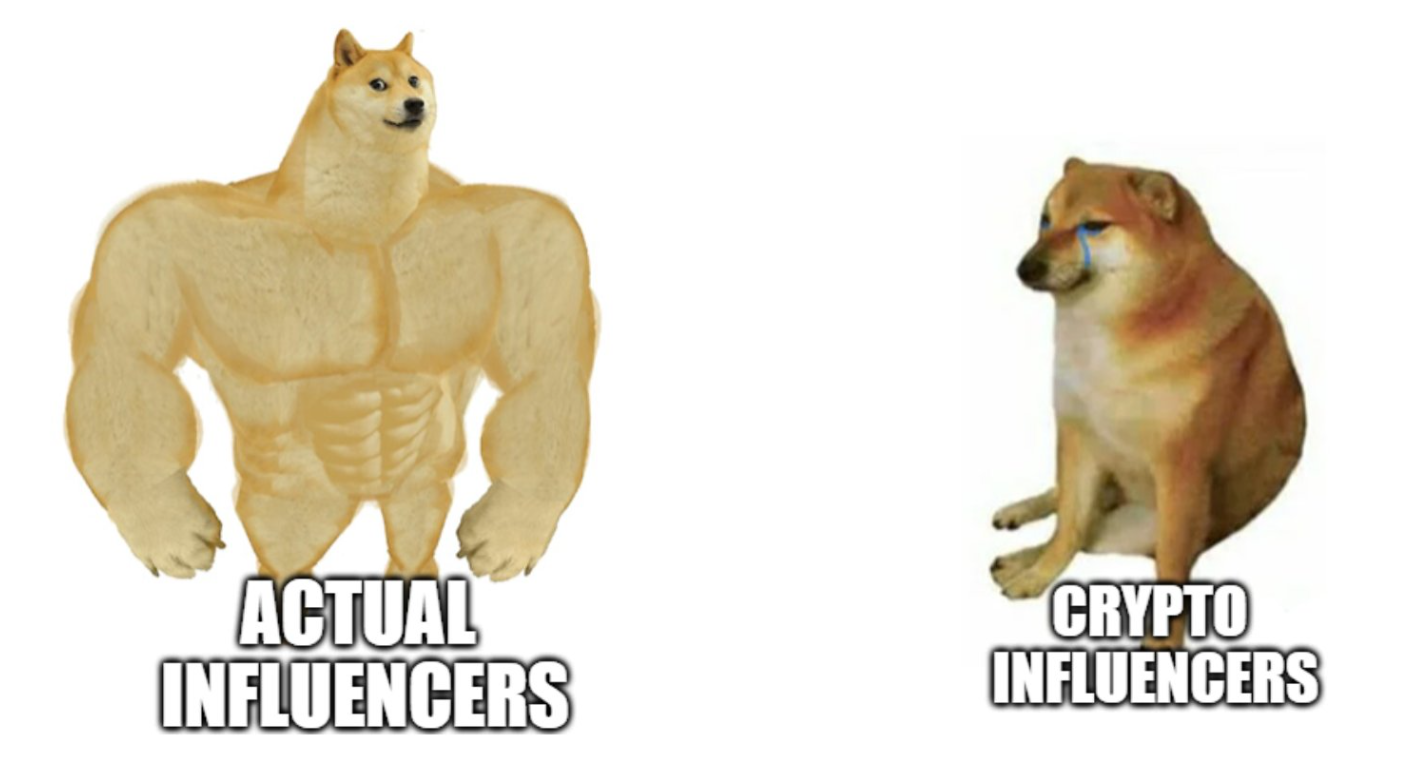

1. Non-Crypto Influencers Embrace the Platform

Friend Tech starting to pickup steam with people outside crypto twitter

— moon (@MoonOverlord) August 20, 2023

Pro gaming + OF + an NBA player among the top priced creators now pic.twitter.com/y6ZRBl6zgq

FaZe Banks (YouTuber), Gracie Hartie (OnlyFans), and Grayson Allen (Milwaukee Bucks) all entered the friend.tech leaderboards this weekend.

FaZe Banks, with his 2.4M followers on Twitter, roared into the #1 spot on friend.tech, passing by every crypto-influencer on the chart, reminding us how small the crypto-corner of the internet really is.

While these shareholders are likely crypto-native speculators at the moment, an influx of mainstream influencers entering friend.tech might introduce new inflows of mainstream users who may be compelled by the access that friend.tech offers.

Is Web3 simply herding new buyers of the friend.tech Ponzi? Or is the introduction of economic primitives into social apps truly a sustainable unlocking of new value?

2. More Attention from Crypto Native Celebrities

While some non-crypto-native influencers dove into the friend.tech fray, it was crypto's celebrities who were the busiest this weekend.

Disclosure is a very popular DJ duo, who also happen to be crypto-natives, making their embrace of friend.tech noteworthy, but perhaps less surprising. Still, while Disclosure has close ties to many crypto-natives, their fans are from... the real world.

Everyone go welcome @disclosure to @friendtech pic.twitter.com/HKKBN4qBJK

— Anil Lulla (@anildelphi) August 21, 2023

Meanwhile, Beeple, another crypto-native artist with a mainstream audience, dropped his daily 3D animation – this one featuring the crypto social platform of the moment.

It’s a pretty simple illustration of what friend.tech lets you do: buy your friends!

3. Tech & Community Experimentation

A little building and a little drama emerged out of the crypto-native side of friend.tech this weekend.

Foobar, a popular solidity developer, released a Friend Share tokenization wrapper, allowing people to fractionalize friend shares into ERC20 tokens – 1 share turning into 100 ERC20 tokens. But an unmentioned 5% royalty tax split between Foobar and the friend.tech account who uses it caused some drama. Other devs forked the code and removed the royalty fee, and now friend.tech users are going straight to the friend.tech contracts and fractionalizing their shares using these lines of code.

🚨Introducing $LEVI, an ERC20 token that represents fractionalized shares of my @friendtech chat💎⚡️$LEVI represents 1% of an underlying share of me on @friendtech. You can buy $LEVI on @VelocimeterDEX for $16🔥

— Levi (@0xCaptainLevi) August 20, 2023

By holding 1 $LEVI token, you get access to my discord preview…

The possibility of these fractionalization experiments have triggered some interesting questions.

Is the real value of friend.tech in the underlying contracts? What if we just jettisoned the friend.tech front end and built our own, using the same contracts as a foundation?

Hey friend tech wrapped shares ppl, @thepaulbalaji forked the code and removed the foobar fee.

— scoopy (@scupytrooples) August 20, 2023

Use this instead if you must.https://t.co/H6bds2jxXf

4. Plenty of Untapped Potential

With some venture money in hand, friend.tech's developer is staring down plenty of opportunities ahead of it.

The big question left to be answered: when friend.tech adds more basic features to their app, will the demand for friend-shares increase? Right now, the only utility that friend.tech gives is the ability to talk to the accounts that you own shares of.

The friendstech meta gonna vastly change once they add pictures

— Sisyphus (@0xSisyphus) August 21, 2023

But what if the app enabled sharing media – what new use cases might spring up? Are there other low hanging fruit feature updates for the platform to implement?

How much innovation is there left to unlock here?

Big Takeaway: Is SocialFi a thing now?

Friend.tech has dominated the Web3 narrative for the last 10 days.

Maybe it has another week left in it?

Maybe more?

Perhaps friend.tech is just the latest new Ponzi-game for the crypto-degens to play with. Maybe friend.tech isn’t it, but just a sign for things to come? Is SocialFi the hot new thing? Will social apps with crypto-native features be the bridge to the mainstream?

Chris Burniske thinks so. He says it's a natural progression for the UX and UI designers to take over and polish the rough edges that the degens who aped in early have been ignoring.

To pull us from the depths of last bear, DeFi games were built to get the apes aping. It follows that social games, like FT, are the catalyst for the apes this cycle.

— Chris Burniske (@cburniske) August 21, 2023

Apes always ape first — then, the rest of society comes later as follower apps clean up the experience.

One of my big takeaways from ETH CC is that our protocols are ready for prime-time. There are still improvements to be made in our base-layer protocols, but they’re mature enough to be able to enable most any app that can be imagined.

Just a month after I voice that take, we get friend.tech. I feel validated 😅

No more waiting in line: the “Buy” feature in MetaMask Portfolio lets you instantly convert your money into crypto using top providers. Embrace the speed and convenience of our direct-to-wallet on-ramp and go from fiat to DeFi with ease.

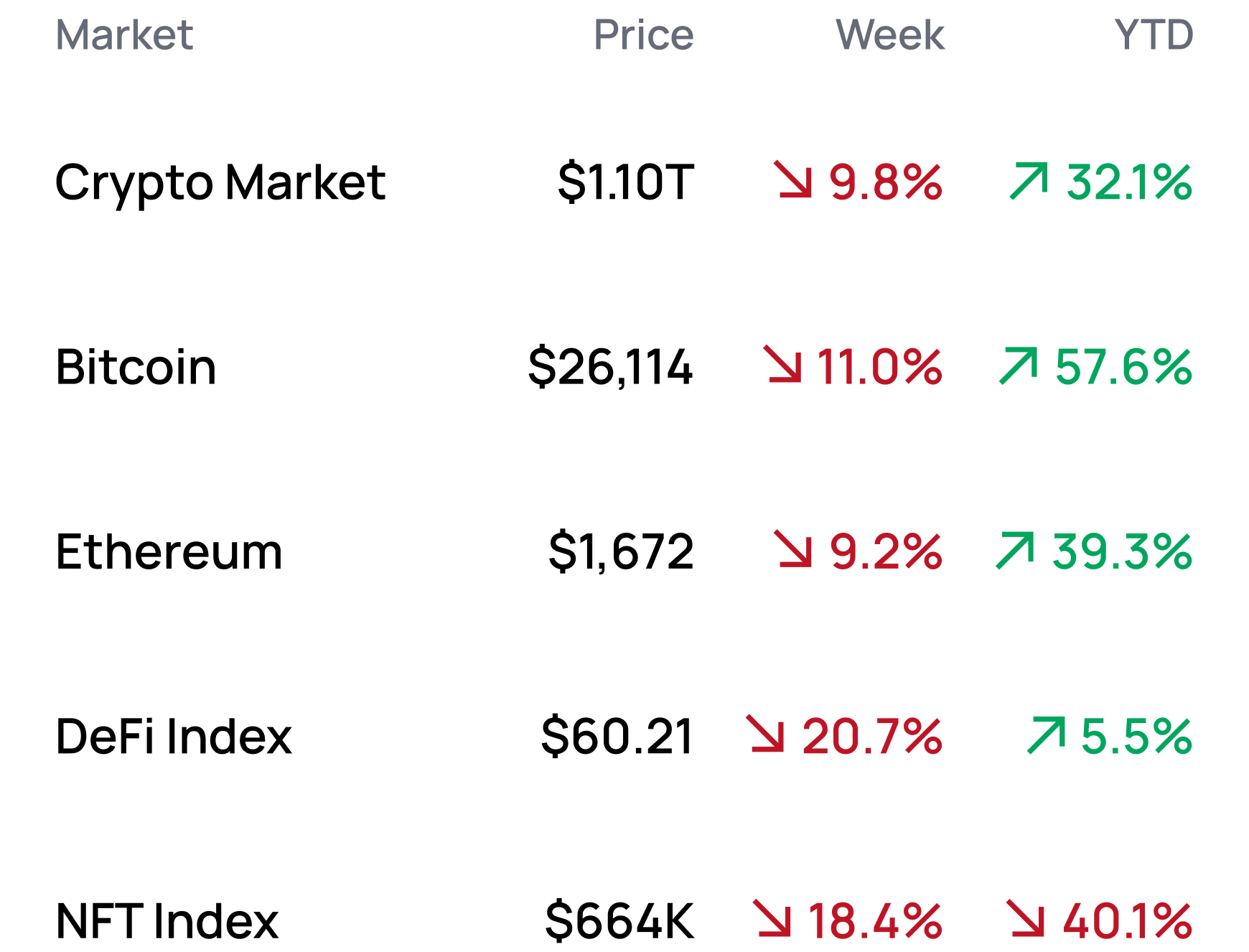

MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 8/21 5:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

✳️ Learn more and build on core.safe.global ✳️

Market Opportunities 💰

- Earn points from friend.tech throughout the 6-month beta period

- Check your eligibility for the Connext airdrop

- Qualify for Sei’s crosschain airdrop by bridging

- Trade the market cap of friend.tech accounts with Aevo

- Fractionalize your friend.tech shares

Yield Opportunities 🌾

- BTC: Earn up to 15.6% APR with Umami’s BTC vault on Arbitrum

- ETH: Earn up to 11.9% APR with Hop’s ETH pool on Base

- USD: Earn up to 27.1% APY with Beefy’s DOLA-USDC pool on Arbitrum

- USD: Earn up to 15.5% APY with Yama’s USDT pool on Arbitrum

- USD: Earn up to 8.7% APR with Velodrome’s USDC-DOLA pool on Optimism

What’s Hot 🔥

- Behemoth Chinese property developer Evergrande files for bankruptcy

- Yuga Labs to cut ties with OpenSea over optional royalties

- Court allows SEC to file appeal in XRP lawsuit

- friend.tech announces Paradigm as seed investor

- Crypto experiences largest liquidation day since FTX blow up

- Europe launches first spot BTC ETF

- SEC set to greenlight ETH futures ETF

- Machi Big Brother withdraws defamation suit against ZachXBT

- Coinbase can now offer BTC and ETH futures to eligible US customers

- 3AC founders fined $2.8M by Dubai regulator for bankruptcy exchange OPNX

- Donald Trump owns $2.8M in ETH

- $1.7M of Ether stuck in Shibarium, a meme L2

- Grayscale ETF team is hiring

Money reads 📚

- Claim Your Chain: An Open Letter to Monoliths - sydney

- Sei’s airdrop was a total disappointment - Leshka.eth

- Understanding Crypto in Africa - Patrick McCorry

- What do I think about Community Notes? - Vitalik

- Rollups are Real - Davide Carpi

Governance Alpha 🚨

- Synthetix’s Spartan Council approves deployment of V3 to Base

- LUSD approved as collateral in Aave with unanimous vote

- Mantle community considers prohibiting Alameda from converting BIT to MNT

- Wintermute proposes dYdX V4 adoption and token migration plan

- Aave taking temp check for potential RWA investment with Centrifuge Prime

Token Hub: Ribbon Finance (RBN) 📈

Analyst: Jack Inabinet

We are initiating coverage of Ribbon Finance with a rating of bullish at medium risk.

Catalyst Overview:

One month ago, RBN token holders overwhelmingly voted to unify Ribbon Finance and Aevo, a decentralized options and perpetuals exchange developed by the protocol.

TVL on Aevo has been up-only since the exchange went live in early April and the exchange currently has $6.05M in value locked within its smart contracts. This represents an early signal of demand for the wide variety of trading products Aevo offers, like options on long tail crypto tokens like PEPE, despite the exchange’s lack of integrations with Ribbon.

Integrating Ribbon’s suite of structured products, which service liquidity providers, with Aevo's existing exchange, a marketplace, will build synergies to improve the experience, execution price, and returns for counterparties on both sides of the trade.

Price Impact:

Like many DeFi tokens, RBN has struggled to find the footing it needs in 2023 to outperform ETH; eight months into the year and the token is at the same place it started! The merger of Ribbon and Aevo could help turn the tide for RBN HODLers and we lean bullish on the token versus ETH.

See more ratings in the Token Hub.

Meme of the Week 😂