Fintech Giants Double Down on ETH ($)

View in Browser

Sponsor: Uniswap Extension — Say goodbye to pop-ups. Download today.

1️⃣ Institutions Embrace Ethereum

It’s been a big week for TradFi.

- First, PayPal announced that it's extending crypto services to U.S. business accounts, opening up custody, swapping, and transfer functionalities, as its stablecoin, PYUSD, grows to become the 6th largest with nearly $750M in circulation.

- Meanwhile, Visa debuted its upcoming Tokenized Asset Platform (VTAP), which will allow banks to issue fiat-backed tokens, such as stables, bonds, and commodities, on Ethereum.

- To wrap it up, investment firm Guggenheim tokenized $20M in corporate debt on Ethereum. Ethereum’s role at the center of these efforts signals TradFi may be waking up to the world computer’s value prop as a premier global settlement layer.

2️⃣ Stablecoin Innovation

It’s been a big week for stablecoins, too.

- Synthetic dollar protocol Ethena announced UStb, a new stablecoin backed by Blackrock’s BUIDL, offering a different risk profile from USDe, which the protocol can use as a backstop during negative funding rates. With UStb, BUIDL has officially gone beyond just an onchain treasury fund to being a foundation for deeply crypto-native products.

- Next, Robinhood joins Revolut as whispers spread about it exploring a stablecoin launch, though no immediate plans have been announced.

- Finally, OP Stack-based L2 Celo has overtaken Tron in daily active stablecoin addresses, driven by Africa’s booming market, especially in countries like Nigeria and Kenya, which rank high in crypto adoption.

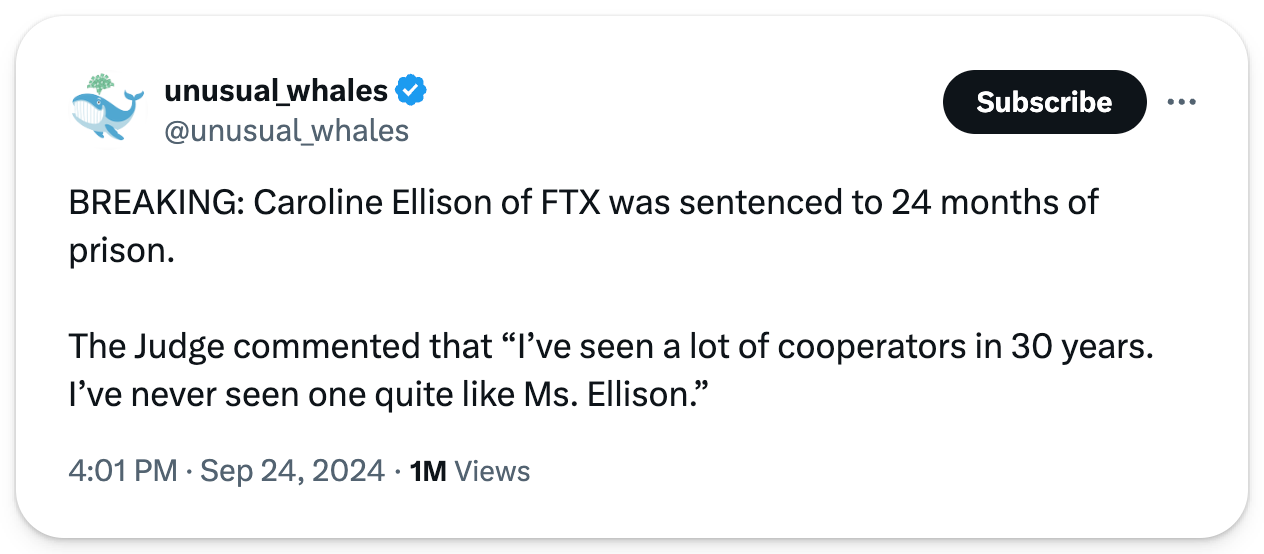

3️⃣ CZ Free, Caroline Ellison Sentenced

On Friday, Changpeng Zhao stepped out onto the streets of Long Beach, California, as a free man for the first time in months. Since April, CZ has been in federal custody after agreeing to return to the U.S. from Dubai to serve a four-month sentence for failing to implement proper anti-money laundering controls at Binance. Now, with his $60B fortune intact, CZ will return to society, free of legal troubles.

Meanwhile, former Alameda CEO Caroline Ellison has been sentenced to two years in prison for her involvement in FTX’s collapse. Ellison pleaded guilty to multiple fraud and conspiracy charges, admitting to following SBF’s directives, though her standout cooperation with the government resulted in a much lighter sentence.

4️⃣ Celestia Secures $100M

As VC coins pump, Celestia returns to the headlines, raising $100M in a new round led by Bain Capital Crypto, with backing from Syncracy Capital, 1kx, Robot Ventures, and Placeholder.

Known for its "data availability sampling" tech, Celestia allows users to validate large blocks without downloading all the data — a key innovation for scaling. Plans to scale Celestia to 1-gigabyte blocks are already in motion, and over two dozen rollups have launched on the network since its debut. However, eyes are on the late October token unlock, injecting 82% more into the circulating supply, leaving the market wary of whether or not to buy in. Despite this, TIA is up ~9% on the week.

5️⃣ EIGEN Trading Going Live

EigenLayer is set to lift transfer restrictions on its EIGEN token by this Monday, September 30, marking a significant moment for restaking protocol. Holders will need to endure a 7-day withdrawal period for unstaking their tokens, with the countdown to transferability officially on.

Over the past few months, restaking’s flagship protocol has experienced a sharp drop in total value locked (TVL), falling from $20B to $12B as market sentiment cooled, exacerbated by initial restrictions and increased competition from rivals like Symbiotic. With limited Actively Validated Services (AVS) currently live and a high fully diluted valuation, it’s unclear how EIGEN will fare once trading kicks off, though the broader market will be watching closely.

Say hello to the Uniswap Extension, the first wallet to live in your browser’s sidebar. Swap, sign, send, and receive crypto anywhere on the web without dealing with pop-ups. Designed for a multi-chain world, with support for 11+ networks.

This week we break down China’s massive new economic stimulus package – its biggest move since the pandemic – and what it could mean for the global markets.

Gary Gensler faced intense bipartisan grilling in Congress, and Nic Carter dropped shocking new insights on ChokePoint 2.0’s legal implications.

Plus, Eigenlayer’s token unlock is finally here after months of non-transferability. We’ll also dive into the key moments from Solana’s Breakpoint Conference. Buckle up.

Dig into all the analysis 👇

📰 Articles:

📺 Shows: