Finding Low-Risk Yields ($)

View in Browser

Sponsor: Bit Digital — ETH treasury that combines the two greatest assets of our time: ETH & AI.

- 🧑⚖️ Samourai Wallet Co-Founders Sentenced to Prison. The wallet's CEO and CTO were respectively sentenced to five and four years in prison.

- 💸 Coinbase Adds $ETH Collateral to Loans. Coinbase expands its crypto-backed loans by adding $ETH as collateral, with staked $ETH soon to come.

- 🇺🇸 Rep. Davidson Bill: 'Pay Taxes in Bitcoin to Grow U.S. Reserve.' Davidson introduced the Bitcoin for America Act on Thursday.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $3.00T | ↘ 3.2% | ↘ 10.2% |

|

BTC $87,540 | ↘ 4.0% | ↘ 12.5% |

|

ETH $2,870 | ↘ 4.9% | ↘ 11.6% |

Market Plays:

- 👻 Downloading the Aave app

- 👾 Joining The Metagame waitlist

- ↔️ Trading bond tokens on Bondi

- 💥 Staking AZTEC on Ignition Chain

- 🥞 Trying the syrupUSDT Plasma vault

- 🏆 Exploring the new Grails ENS market

Hot Reads:

- ⚖️ Stables Are Not Stable — YQ

- 📊 2025 Crypto Trends Report — Alana Levin

- ⚔️ The Perp DEX Wars of 2025 — Stacy Muur

- 📉 Why Your Coin Isn’t Pumping — Santiago Santos

- 💸 Yield-Bearing Stablecoin Landscape — Stablewatch

- 💡 Toward a Successful Onchain Options Market — Daniel Barabander

Top Farming Opps:

- 🟠 BTC: 20% APR with Ekubo’s WBTC-LBTC pool on Starknet

- 🟠 BTC: 5% APR with Aerodrome’s cbBTC-LBTC pool on Base

- 🔵 ETH: 19% APR with Convex’s pufETH-wstETH pool on Ethereum

- 🔵 ETH: 10% APR with Convex’s ETH-ETHx pool on Ethereum

- 🟢 USD: 13% APY with Exponent’s hyUSD PT on Solana

- 🟢 USD: 7% APR with Uniswap’s USDC-USDT pool on Arbitrum

Airdrop Hunter:

- 🔺 Aztec: Hunt Aztec network airdrop

- 🏦 Tydro: Hunt INK airdrop

- 💦 Liquid: Hunt Liquid airdrop

Crypto yield markets have assumed a notably heightened risk profile over the past month following a slew of lending market mishaps, making it more important than ever to understand the mechanics behind the farms you’re depositing into.

Today, we’re breaking down five of the most popular crypto yield opportunities that exist, weighing the risk versus the rewards of each yield generation model.

Read on for core onchain opportunities you can’t afford not to understand 👇

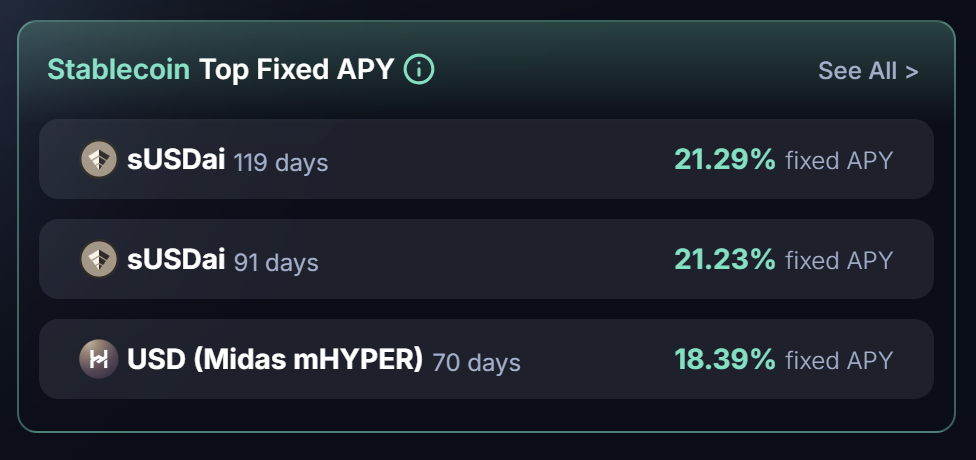

🕰️ Pendle

Website | Twitter

Best For: Guaranteed Yield

Risk Level: Variable

Reward Level: Low to High

About:

Pendle is a yield splitting protocol, a special type of DeFi primitive that creates two distinct tokens: principal tokens (PTs) and yield tokens (YTs). The first can be redeemed for an underlying crypto asset at a specified future date, and the second represents a claim to all yield generated from that asset in the interim.

Using PTs, Pendle yield farmers can safely guarantee their yields until a specified future date, denominated in units of the underlying asset. PT holders can also redeem early by purchasing an equivalent amount of YTs, which can be used in combination to create a liquidity provider position and redeemed for the underlying.

While Pendle users are responsible for evaluating the safety of the individual yield markets they deposit into, there is zero risk of protocol-wide contagion if the value of any single Pendle-onboarded crypto asset becomes impaired. The Protocol’s smart contract logic is solely responsible for ensuring that users can redeem their tokens for a pre-specified amount of underlying assets, insulating the broader system from any specific asset shocks.

Exponent Finance is a popular alternative to Pendle deployed to the Solana Network, yet the benefits of network effects and trusted reputation in this sector are undeniable; Pendle’s lesser known competitor safeguards just 2% of the segment leader’s total value locked.

Top Yield Opps:

Get risky and receive a guaranteed 21% APY on sUSDai (a GPU-backed stablecoin) for the next three months, play it safe and lock in 3% APY on Lido’s stETH until Christmas Eve, or select another risk-return combination that meets your needs with Pendle’s principal tokens.

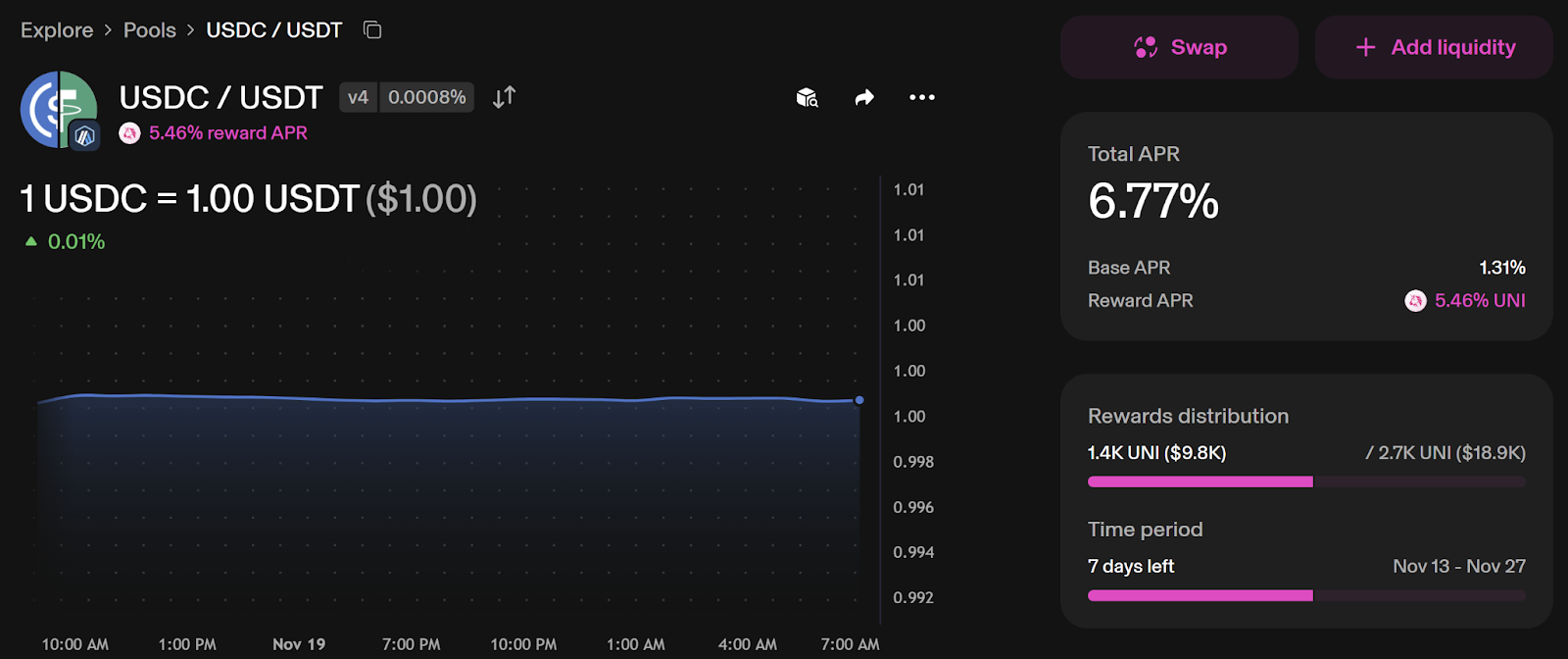

🦄 Uniswap

Website | Twitter

Best For: Swap Yield

Risk Level: Variable

Reward Level: Low to Extreme

About:

Uniswap is one of the longest standing and most simplistic crypto yield generation protocols. At the highest level, Uniswap “liquidity providers” (users who deposit two different crypto tokens into a Uniswap pool) get paid every time a trader’s swap is intermediated through their tokens.

The Uniswap model of risk management is extremely bare bones and outsources all decision making onto the liquidity provider. Users must navigate between thousands of available pools to identify ones with safe asset pairings. They are also responsible for manually setting a liquidity range distribution, essentially a tradeoff slider between position efficiency and risk.

While long-tail asset pairings can earn higher token-denominated yields on Uniswap, the dollar value of these yields cannot be assured. Additionally, tighter liquidity position ranges may increase a position’s capital efficiency (and thus its returns), but can leave users exposed to unexpected losses when token values rip beyond their expected range.

Hundreds – if not thousands – of sudden token rugs have occurred on Uniswap, yet this AMM’s design ensures that losses are fully contained within the affected pools, leaving Uniswap’s overall solvency untouched every time.

Top Yield Opps:

Earn turbocharged yields on Uniswap with volatile cryptocurrency pairs, like 120% APY on WBTC-wstETH. Alternatively, lower your yield farming stress level (and returns) with stable pool pairings to receive 7% APR with Uniswap’s USDC-USDT pool on Arbitrum.

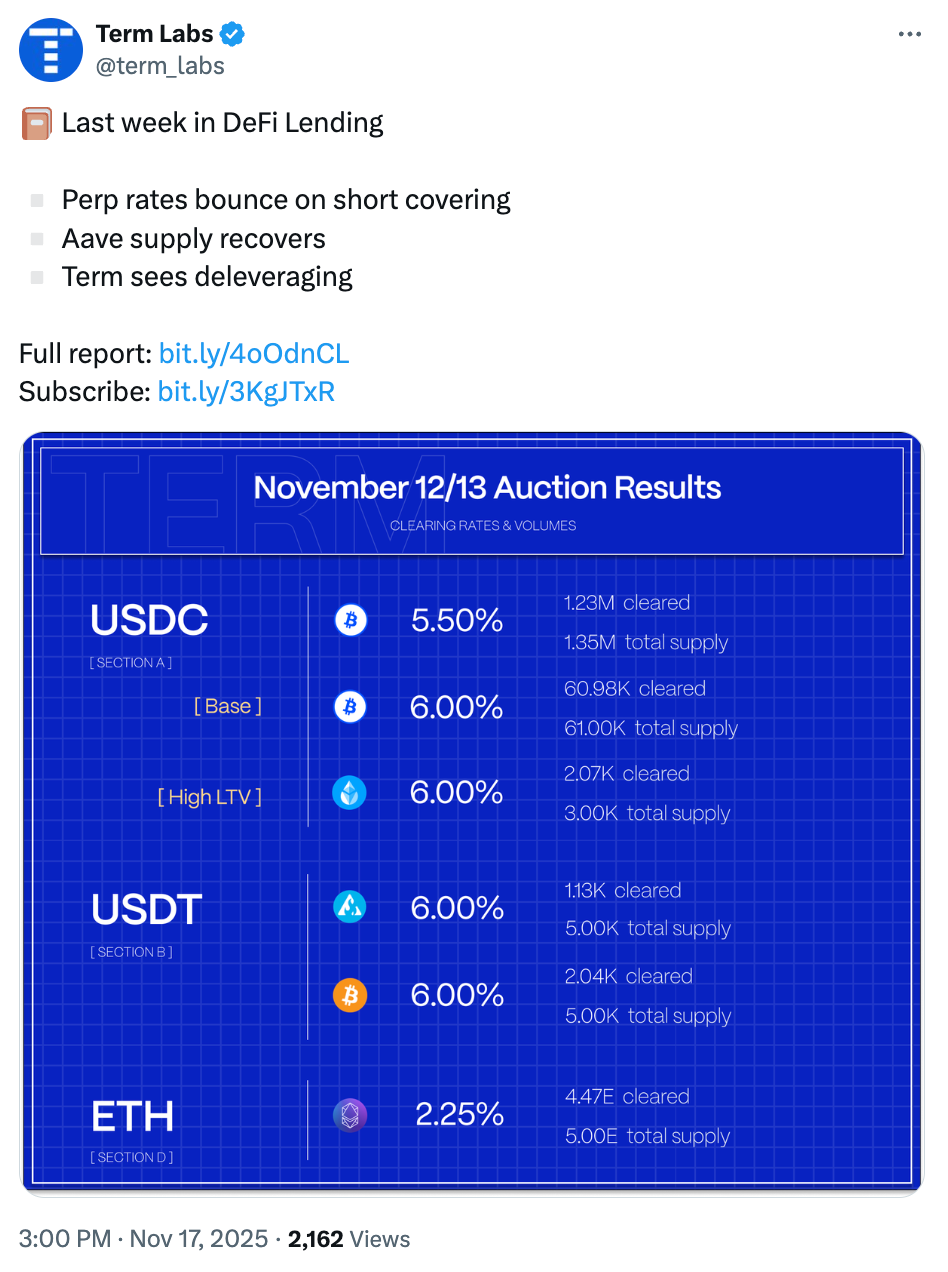

🔒 Term Finance

Website | Twitter

Best For: Incentivized Yield

Risk Level: Low

Reward Level: Low

About:

Term Finance is pioneering fixed rate lending to DeFi through a novel auction approach, allowing users to fix both the term and rate they borrow at!

Via Dutch Auction, Term matches borrowers with lenders, achieving the highest possible yield for lenders and lowest possible cost of capital for borrowers. Participants submitting bids and asks outside of this market clearing rate have their capital returned to them at the conclusion of the blind auction process, allowing Term to utilize 100% of their users' capital.

Unlike alternative lending models, such as Aave, in which protocol governance determines how much risk to extend in each lending market, Term Finance’s fixed rate auction markets have a single collateral and supply asset, empowering lenders to select what exposure they are comfortable holding and mitigating the risks of protocol-wide insolvency.

Top Yield Opps:

Earn 2% APR on ETH and 6% APR on USDC by supplying these assets as liquidity to ongoing Term Finance fixed rate auctions.

🪙 Ethena (USDe)

Website | Twitter

Best For: Synthetic Yield

Risk Level: High

Reward Level: Low

About:

Ethena creates dollars with native yield from volatile crypto assets, like ETH and BTC. By holding spot crypto exposure and shorting an equal notional value of perpetual futures, Ethena can stabilize the value of its portfolio in dollar terms and (typically) earn funding payments from its perpetual short position.

Although numerous pseudonymous crypto personalities insisted in the wake of last month’s 10/10 liquidation crisis that Ethena has secured guarantees from centralized exchanges that they will not “auto-deleverage” the synthetic dollar issuer’s crypto asset short positions, no supporting documentation has been released and Ethena itself has not made these representations.

It remains unknown whether Ethena has any actual agreements that would prevent auto-deleveraging of its leveraged perpetual positions in a future crisis. However, even if such agreements exist, they offer limited protection in the event of a deeper failure, like an exchange bankruptcy.

Furthermore, Ethena’s monthly custodian attestations are insufficient to ensure protocol solvency with 100% certainty. Custodians simply confirm the value of assets held in off-exchange wallets, not for whose benefit those assets are being held. An unexpected auto-deleveraging or exchange bankruptcy could potentially force the custodian to freeze such funds pending a dispute resolution process.

Top Yield Opps:

Earn 5% APY by depositing into Ethena’s staked synthetic dollar product (sUSDe), or push your yields upwards of 6% APY by purchasing Pendle PTs on (s)USDe.

👻 Aave

Website | Twitter

Best For: Managed Yield

Risk Level: Medium

Reward Level: Low

About:

Blue chip lending platform Aave is the largest blockchain-based protocol in existence, entrusted with nearly $50B of user assets, half of which is actively lent out into the crypto economy. At the time of writing, Aave held over $4.3B of exposure to Ethena’s USDe synthetic dollar stablecoin, more than half of the token’s total supply.

Across all current Aave deployments, the DAO is exclusively responsible for controlling risk management parameters – including what assets can be borrowed against and the maximum amount of leverage that can be obtained. End users have limited ability to manage risk, and as lender capital can be borrowed in by market in that deployment, unexpected losses from a single onboarded Aave market could devolve into deployment-wide insolvency.

Although Ethena claimed its delta neutral operations went unaffected by October’s disastrous liquidations (see above), the drawdown and resulting USDe depeg highlighted that it may be impossible for Aave to clear this position without becoming insolvent. Aave currently lends against USDe at up to 94% loan-to-value ratios.

Top Yield Opps:

Mitigate your risk of Ethena USDe contagion by avoiding Aave’s Ethereum and Plasma deployments, which contain the lion’s share of synthetic stablecoin supply. Earn 4% APY with Aave when you supply USDC on Base or 3% APY when you supply WETH on Arbitrum.

Bit Digital: The premier ETH treasury that combines the two greatest assets of our time—ETH & AI compute. Harness massive Ethereum holdings with institutional-grade staking for optimized rewards, while powering cutting-edge AI infrastructure for unparalleled innovation. Unlock the future of digital assets where blockchain meets intelligent computing.

*We’re being compensated by Bit Digital (NASDAQ: BTBT) for this ad promoting their company and BTBT. The compensation is paid in cash as a one-time payment. You can find additional information about Bit Digital and BTBT on their Investor page at bit-digital.com/investors. Not investment advice.