Dear Bankless Nation,

2023 has been a year of regulator aggression stateside; Gary Gensler has said that we don't need crypto because we already have the U.S. Dollar.

Last week, the Fed debuted its FedNow instant payments system. It's a step into the 21st century, but only if you're interested in a more centralized, more controlled future of finance.

- Bankless team

We Don't Want FedNow

Bankless Writer: Jack Inabinet | disclosures

Last Thursday, the U.S. Federal Reserve activated TradFi’s answer to the advancements offered by distributed ledger and blockchain technologies: FedNow, an instant payments system designed to modernize America’s archaic banking infrastructure and turn multi-day transaction wait times into a relic of the past.

Big TradFi institutions have signed on and customers of these early adopters will soon gain access to immediate 24/7/365 payment settlement, features all too familiar to stablecoin users but this is where the similarities between FedNow services and crypto technologies cease.

Unfortunately, FedNow further centralizes the U.S. banking system and increases the purview of big government into the financial activities of everyday American citizens.

The Federal Reserve touts that FedNow will not grant access to individuals’ bank accounts or the ability to control how they spend their money, but it is obvious that America’s Central Bank will not be without a voice in the transaction settlement process. Instead of having the ability to directly restrict an individual from accessing their bank account, the Fed will provide "fraud prevention tools."

While usage is optional for the first release of FedNow, we expect adoption of fraud prevention tools to be the norm among participating financial institutions.

Many FedNow commenters indicated concerns about the heightened risk of fraud when using real-time payments systems and noted the importance of fraud monitoring solutions in eliminating potential risks, leading us to believe they are likely to implement the Fed’s fraud prevention tools.

Despite current use cases for fraud prevention tools appearing innocuous, the ability for the Federal Reserve to self-anoint itself as the arbiter of good and bad transactions is frightening and has the potential to yield disastrous consequences!

Perhaps it is the first step towards an Orwellian surveillance state…

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

Undeniably, FedNow is superior to existing payments solutions and with the backing of America’s Central Bank, it's only a matter of time before FedNow replaces the legacy system.

When it does, the Federal Reserve – and by extension the United States Government – will have the ability to impose immense financial hardships on anyone under the auspices of a “fraud alert” and blackball them from the financial system without the need for warrants or due process.

Admittedly, redundancy in fraud alerts may help cut back on illicit transaction activity, but at what cost?

They could easily be transformed into tools of the state to suppress the payments activity of marginalized groups or enact draconian financial controls.

Pundits suggest that a successful launch of FedNow may save us from the horrors of a CBDC, however, it's clear that the Federal Reserve’s current solution to instant payments will also force Americans to cede marginal control over their financial autonomy to the government.

Whether the Fed’s newfound authority over the US domestic payments system is used for evil remains to be seen, and without any way to verify that it won’t be, we're forced to simply trust.

MARKET MONDAY:

Scan this section and dig into anything interesting

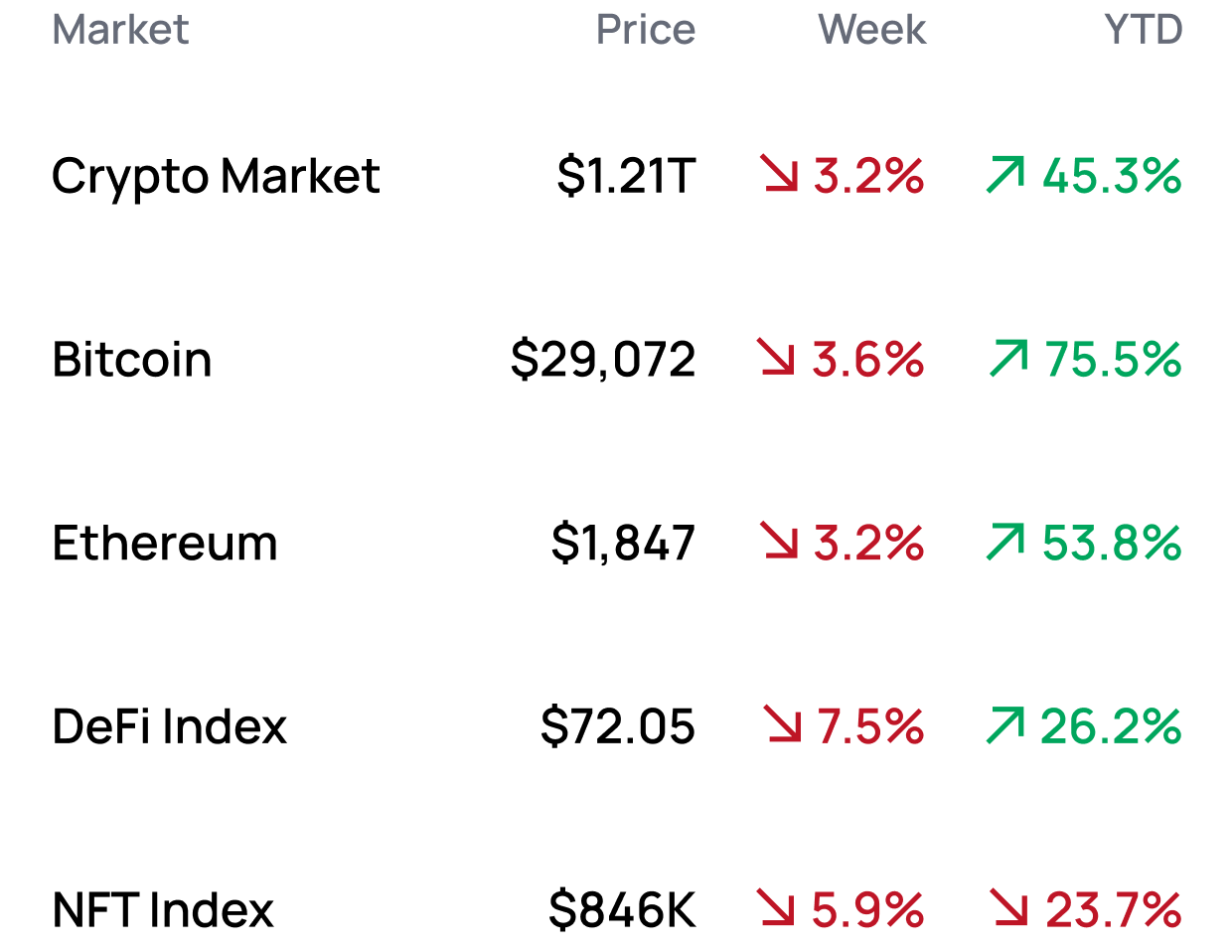

*Data from 7/24 2:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Check out Stader Labs 🧪

Market Opportunities 💰

- Access GRAI across Arbitrum, Optimism, or zkSync

- Inspect Stakewise V3, now deployed to testnet

- Explore the hottest Telegram Bot tokens on CoinGecko

- Check to see if you’re eligible for a GRAIN airdrop from Granary Finance

- Utilize Unibot, a Telegram trading bot (caution: you risk total loss of funds)

- Trade NFTs directly with others using OpenSea’s “Deals” feature

Yield Opportunities 🌾

- BTC: Earn 9.8% APR with O3Swap’s BTC vault on Arbitrum

- ETH: Earn 7.2% APY with Beefy Finance’s rETH-ETH vault on Ethereum

- ETH: Earn 26.1% APY with Ribbon’s stETH covered call vault on Ethereum

- USD: Earn 9.8% APR with Velodrome’s sUSD-LUSD pool on Optimism

- USD: Earn 12.3% APR with Velodrome’s USDC-BOB pool on Optimism

What’s Hot 🔥

- Uniswap looks offchain for UniswapX inspiration

- Solana introduces Solang compiler, enables devs to write code in Solidity

- Celo announces transition to L2 built on OP Stack

- Chainlink releases its take on cross-chain messaging: CCIP

- Lens Protocol introduces its V2

- Espresso announces partnership with EigenLayer

- Ethena, a delta-hedge stablecoin, announces $6.5M raise

- Crypto whales targeted in wave of home invasions near Vancouver

- Federal Reserve officially launches FedNow instant payment service

- Investor group nears $125M deal for CoinDesk

- Lawsuit claims SBF paying lawyers with stolen customer funds

- Conic Finance hacked for 1.7k ETH

- SEC asserts XRP case wrongly decided, signals appeal

- Optimism moves forward with two proposals to add zk-proofs

- Worldcoin completes migration to OP mainnet

Money reads 📚

- Updated Timeline for Rollup Expectations - polynya

- Get Up-To-Speed on Telegram Trading Bots - Patrick

- Why Pendle Finance Does Not Work - SimplePunts

- CCIP: A Revolutionary Change for Blockchain - Aylo

- Thoughts on biometric proof of personhood - Vitalik

Governance Alpha 🚨

- Arbitrum DAO votes against allocating additional tokens towards Camelot

- Rocket Pool community proposes adding rETH as collateral to Compound

- Polygon Labs seeks to address governance as part of Polygon 2.0 rollout

- MakerDAO votes to halt lending to Harbor Trade after $2.1M default

- The Future of Optimistic Governance

Token Hub: SOL 📈

Analyst: Jack Inabinet

We’re upgrading our rating of Solana from neutral to bullish.

Catalyst Overview:

After suffering with a TVL that managed to do nothing other than fall throughout 2022, Solana managed to increase this metric by 50% ($102M) during the first half of 2023. While Solana remains dwarfed by its primary L1 competitors (e.g.; ETH, TRX, and BNB), the ecosystem’s impressive growth in TVL mimics the relative success of Ethereum’s L2s.

Q3 has been off to an especially fruitful start for the Solana ecosystem, which has enjoyed a 14.1% increase ($38M) in TVL in the start of July alone, with renewed excitement emerging for select Solana DeFi projects.

Jito, a Solana LSD project tapping into MEV, and marginfi, a borrow/lend platform, are two examples of Solana DeFi protocols that have witnessed explosive growth in July. The two protocols have seen their TVLs increasing by a respective 86% ($11.9M) and 481% ($14.8M) just this month!

With the impending launch of Firedancer, a client from Jump Crypto that promises to massively boost Solana’s throughput to 1M transactions per second, there also exists a potentially bullish technical unlock for the ecosystem to achieve 👀

Price Impact:

Encouraging signs of life are emerging from Solana’s DeFi ecosystem at an inflection point where the chain walks the razor’s edge between high performance EVM alternative of the future and discarded alt-L1 of a cycle past.

Over the past month, Solana-native protocols have demonstrated that while the ecosystem’s liquidity is constrained, enough is present for projects to break out! We expect Solana’s TVL growth to continue to outpace that of Ethereum and we anticipate SOL price will appreciate further relative to ETH in the near term.

See more ratings in the Token Hub.

Meme of the Week 😂

— Bankless (@BanklessHQ) July 19, 2023