Explore the Frontier of zkEVMs

Dear Bankless Nation,

With Polygon zkEVM and zkSync Era going live, we want Bankless readers to get in early and taste the future of zero-knowledge scaling.

Today, we show you how to navigate these networks and explore what's happening in their ecosystems.

- Bankless team

Last month, the introductions of zkSync Era and Polygon zkEVM marked the start of Ethereum's next scaling stage. In today's article, we'll delve into a variety of apps that you can start experimenting with on these cutting-edge zkEVM platforms.

- Goal: Try your first zkEVM apps

- Skill: Intermediate

- Effort: 1 hour

- ROI: Becoming a pioneering zkEVM user

The First zkEVMs Have Arrived

zkEVMs are a special kind of Layer 2 (L2) scaling solution that seem poised to eventually become the pinnacle of the Ethereum scaling scene. Specifically, zkEVMs are “ZK rollup” L2s that are compatible with the Ethereum Virtual Machine (EVM), which is the transaction execution environment for the Ethereum L1.

Initially, “optimistic rollups” like Arbitrum and Optimism held an advantage here due to their EVM compatibility, enabling easier app migration from L1 to L2. In contrast, ZK rollups began with custom virtual machines, requiring more extensive work for developers. However, as of March, the cryptoeconomy saw its first two mainnet zkEVM deployments with the arrival of zkSync Era and the Polygon zkEVM.

These L2s not only make transactions much faster and cheaper compared to Ethereum, but they are also EVM-compatible. This seems to be the start of ZK rollups leveling the playing field with their optimistic rollup counterparts. This “catching up” aligns with Vitalik Buterin's 2021 prediction that ZK rollups, with their inherent privacy and security advantages, would eventually outcompete optimistic rollups as their technology improved.

Of course, zkSync Era and the Polygon zkEVM are still brand new and thus relatively small compared to, say, Arbitrum right now. But their futures are very bright, which is why it’s compelling to explore these zkEVMs so early on in their lifespans. This truly is the bankless frontier at the moment!

Starting With zkSync Era

The launch of the zkSync Era mainnet alpha marked a significant milestone for Ethereum as the first live zkEVM usable by anyone. After undergoing thorough testing, multiple security audits, public contests, and bug bounties, the new L2 opened for projects and users to start building on and bridging funds to late last month.

However, the operative phrase above is “mainnet alpha,” so during this initial testing period, users are advised to exercise caution and avoid putting large amounts of funds at risk. That said, if you’re curious about diving into zkSync Era’s app scene and testing out a few things, you’re in luck because there’s already a decent range of projects that you can consider trying.

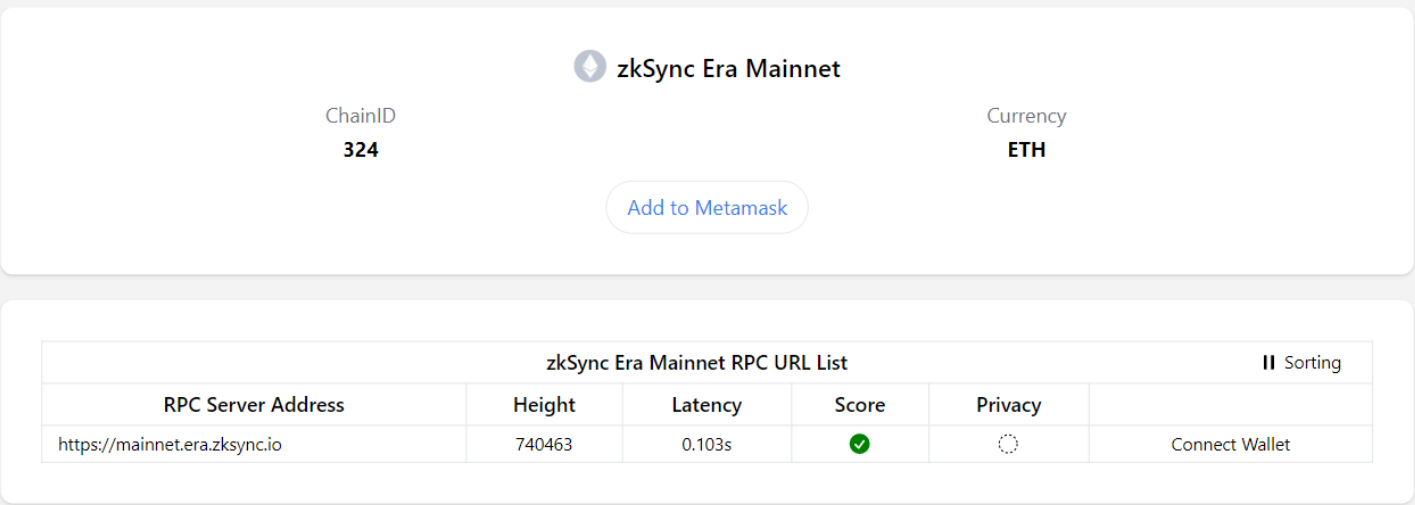

For a wallet, you might start with the popular and proven Ethereum + zkSync wallet Argent, or you can simply add zkSync Era support to your existing MetaMask account using a tool like Chainlist.

Following this, you’d need some ETH to pay for your transactions on zkSync Era, so you’ll need to send some funds over to the L2. For this you can consider bridges like Meson, Multichain, or Orbiter Finance.

🛸 Until now, over 115,000+ transactions have been bridged to zkSync Era∎ @zksync via https://t.co/9cMfrwR2pm. 🎉🎉

— Orbiter Finance 🛸 (@Orbiter_Finance) March 30, 2023

To the zkSync Era! 🛫️ pic.twitter.com/DlEluXBxMQ

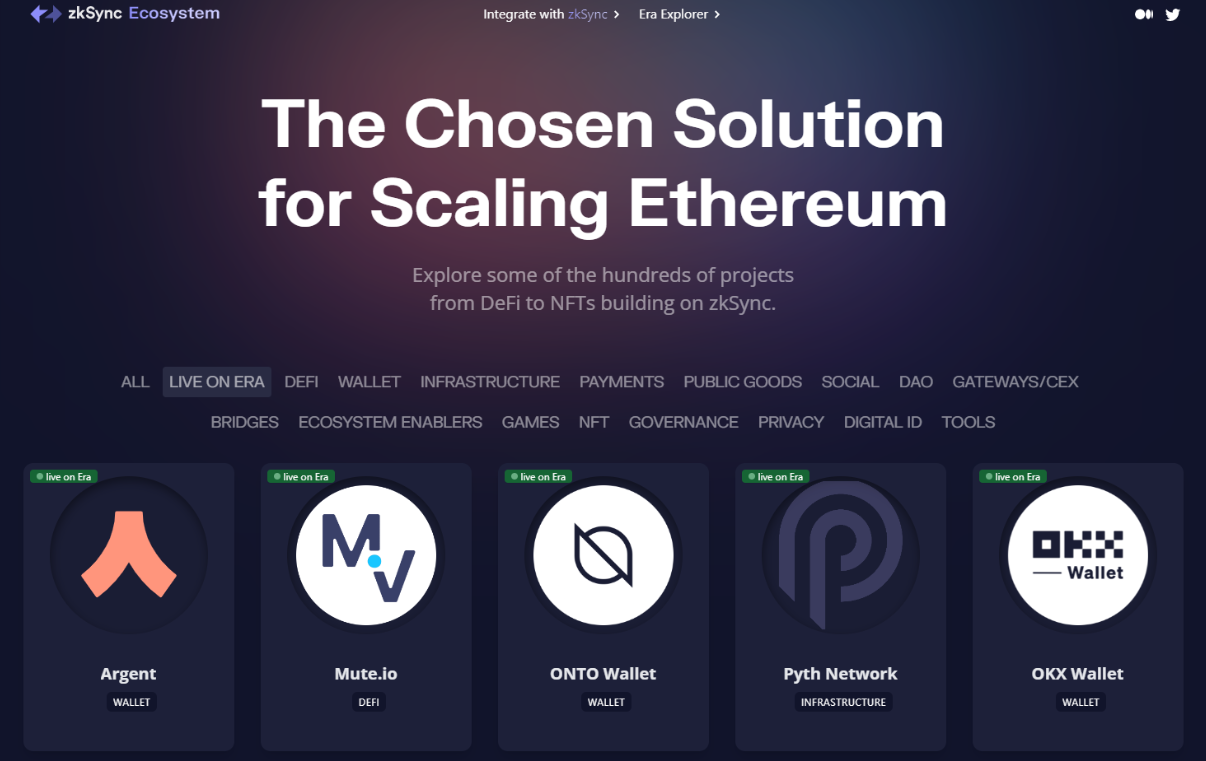

Once you have your initial funds in your zkSync Era wallet of choice, it’s time to start exploring. The best place to begin sourcing ideas right now is ecosystem.zksync.io, which is an app directory that offers a “Live on Era” category you can search through.

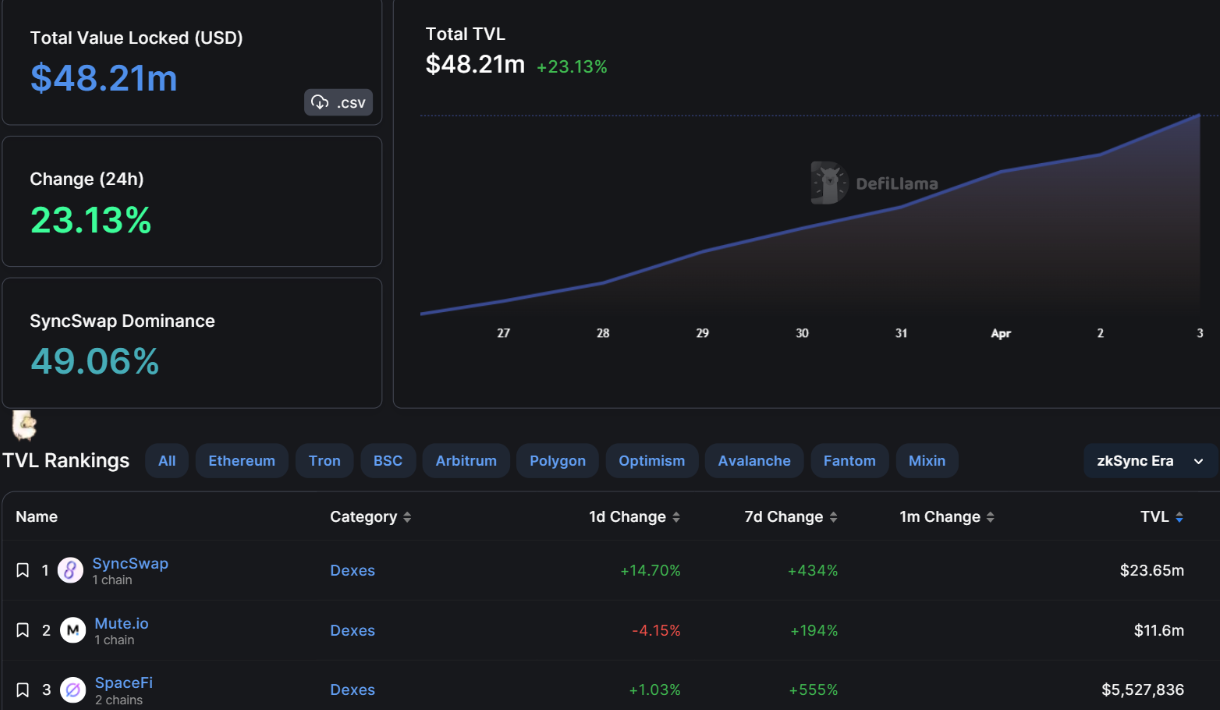

If you’re a DeFi aficionado and want to start with DeFi apps, I recommend cross-checking any projects you find against the zkSync Era DeFiLlama dashboard, which can help you quickly check the pulse of the projects that are currently operating in the Era DeFi scene.

Zooming in here, there’s already a few categories of DeFi projects you can try on zkSync Era. The biggest by total value locked (TVL) stats right now are decentralized exchanges, with SyncSwap, Mute.io, and SpaceFi being the three largest on Era at the moment. Trading on these platforms feels like trading on Ethereum DEXes, just with much cheaper and much faster transactions.

If you’re interested in branching out beyond just DEXes, there are also a few derivatives protocols on Era that are currently available to try. I recommend these for more veteran DeFi users because derivatives can be complicated. That said, you might consider exploring projects like Onchain Trade, UniDex, or Deri Protocol.

As for the lending category, the one project live on Era today you can try is Nexon Finance, a lending protocol that currently lets you borrow USDC against ETH collateral.

It’s also worth noting that zkSync Era has a blossoming NFT scene, too – a great beginning point is Mint Square, an NFT minting platform and marketplace that specializes in ZK-based L2s and is among the first NFT projects on Era.

However, you’ve got other NFT platform options on Era as well. Even newer entrants to Era are Omnisea, which makes it simple to do DIY NFT drops on Era, and Kreatorland, an NFT launchpad and marketplace. If you want to explore zkSync’s NFT scene, these are good places to start experimenting.

Starting With Polygon zkEVM

On March 27, Polygon Labs announced the opening of the Polygon zkEVM mainnet beta, the next huge milestone in Ethereum’s new zkEVM phase.

Notably, Polygon zkEVM is permissionless, public, effectively EVM-equivalent, open-source, and fast. All of the good things in crypto, right? The future of the L2 is already looking impressive even if it did just launch in beta.

For example, it’s already been announced that the Polygon zkEVM is going to underpin the new Immutable zkEVM infrastructure, which aims to help revolutionize web3 gaming in the years ahead. So it’s fair to assume that the Polygon zkEVM is going to have lots of room to grow with regard to both its DeFi and NFT scenes going forward.

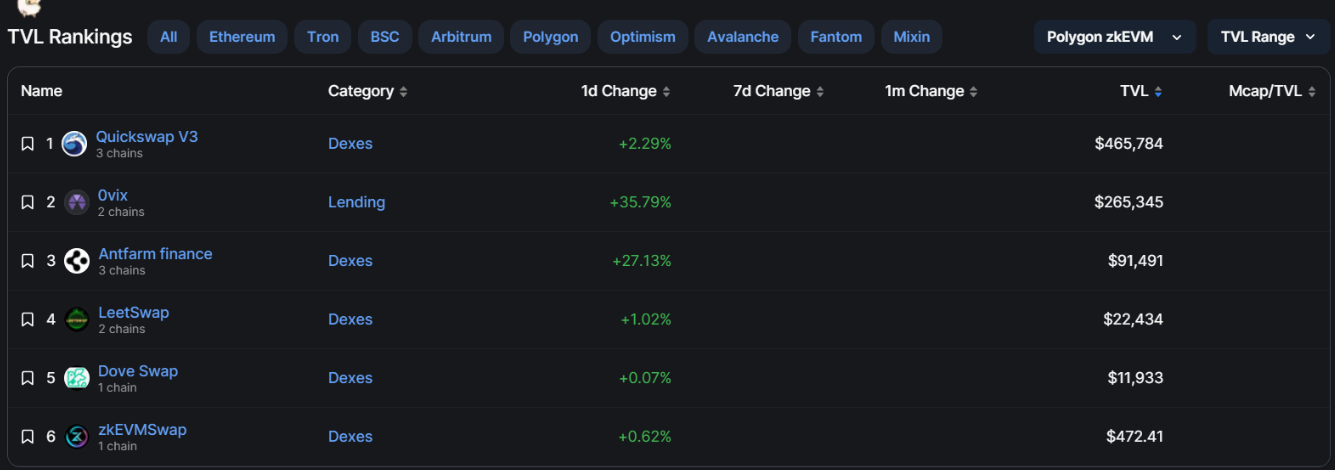

So with that introduction out of the way, where to begin? According to DeFiLlama, Polygon zkEVM’s DeFi TVL right now is just under $1M USD, which is much smaller than zkSync Era’s $48M USD TVL at the moment. Yet there are still a handful of projects you can consider trying on the new L2 right now, but first you’ll need to get your wallet + funds set up.

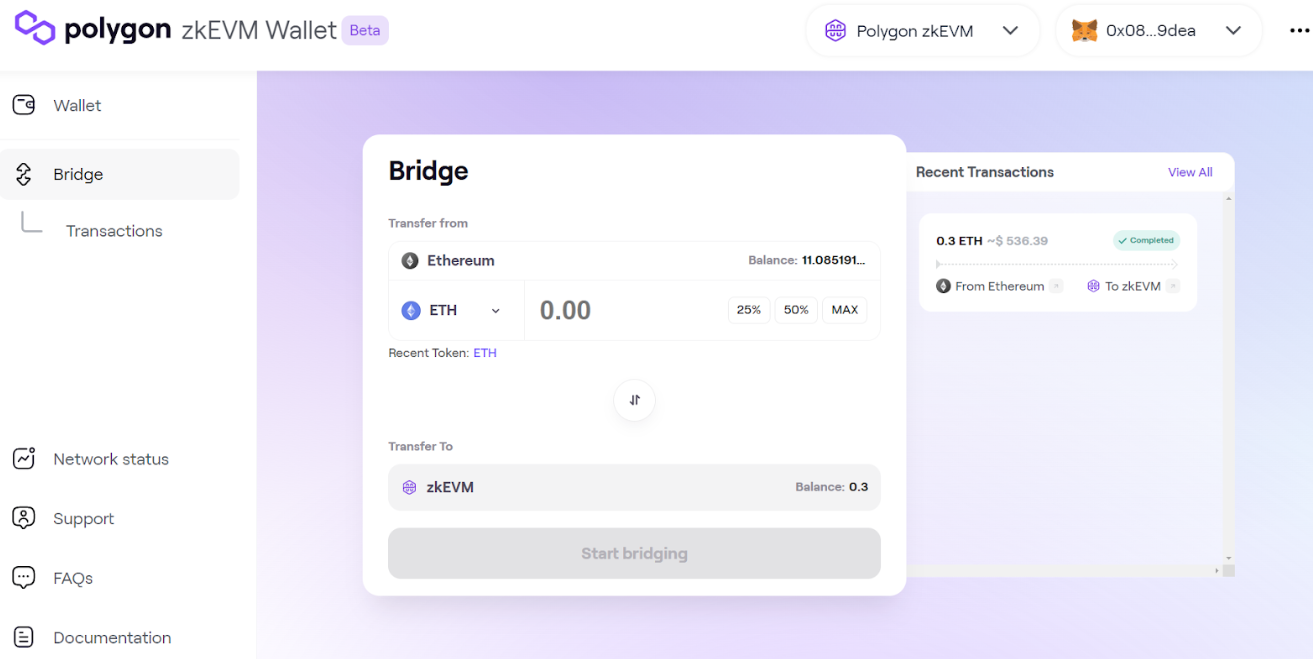

To start here, you can add support for Polygon zkEVM to your wallet using Chainlist. Then you can use something like the native Polygon zkEVM bridge to transport funds over as needed.

Once you have funds over on Polygon zkEVM, you can start exploring. An easy place to get ideas for this currently is on the Polygon zkEVM DeFiLlama dashboard, which has a growing list of DeFi projects live on the L2 that you can consider trying.

Again, this L2 is fairly small at the moment, but if you’re familiar with the Quickswap DEX, which is popular on the original Polygon sidechain, then you’ll feel right at home using this exchange’s Polygon zkEVM deployment. Behind Quickswap, the second-largest app live on the L2 right now is 0vix, a lending protocol.

The Big Idea

The arrivals of zkSync Era and Polygon zkEVM have ushered in the next phase of Ethereum's scaling scene, offering users a new frontier to explore.

With a variety of apps available on these cutting-edge zkEVM platforms, users can take advantage of the speed, security, and EVM compatibility they provide.

While still in their early stages, these zkEVMs present an opportunity for pioneering users to become familiar with the technology and their growing DeFi and NFT ecosystems.

As Ethereum's scaling solutions continue to advance, zkEVMs may eventually outcompete their optimistic rollup counterparts and solidify their place in the Ethereum landscape, so learning how to navigate them now can serve you well later!

Action steps

- Explore zkSync Era and Polygon zkEVM: try some DeFi and NFT apps on these new, powerful L2s ⛓️

- Learn how to fight for crypto: join us, see my previous Tactic Tuesday write-up if you missed it ✊