ETH's 2025 Stress Test

View in Browser

gm Bankless Nation,

Ethereum ended 2025 with faster upgrades, new leadership, and growing institutional adoption, even as price lagged behind fundamentals.

Today's Issue ⬇️

- 🗣️ Analysis: Ethereum's 2025

It was a particularly wild year for Ethereum.

p.s. The Bankless newsletter team will be taking the next couple of days off for Christmas; we'll be back in your inboxes Friday. Happy Holidays!

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

Ethereum's 2025 was a year of agony, ecstasy, and refocusing.

The Ethereum community started the year on its heels amid dire ETH price performance, Solana garnering builder attention, and upstarts like Hyperliquid scaling quickly and attracting new users. Meanwhile, the Ethereum Foundation was critiqued as too slow, too quiet, and too disconnected from the ecosystem and institutional needs.

At 2025's end, the picture is different. New leadership shipped two hard forks in eight months. Stablecoin supply on Ethereum hit all-time highs. Digital Asset Treasuries and ETFs accumulated over 10% of total ETH supply. The path for staked ETFs was cleared.

It was a busy year – one defined by change. In today's Christmas Eve Eve newsletter, we're digging into some of those changes. 👇

1. Protocol Progress

For the first time in its history, Ethereum shipped two major protocol upgrades in a single year — Pectra in May, Fusaka in December — each focused on making Ethereum cheaper, faster, and easier to use.

Pectra Upgrade

Pectra marked Ethereum's largest upgrade since Dencun, bundling 11 EIPs across execution and consensus layers. The headline feature — EIP-7702 — let regular wallets temporarily act like smart contracts, unlocking transaction batching, gas sponsorship, and passkey authentication without requiring users to migrate to new wallet infrastructure. The upgrade also doubled blob capacity from 3 to 6 target blobs per block, dropping L2 data costs significantly and making the network less expensive for all.

Fusaka Upgrade

Then, this month Fusaka went live — proof that the new EF leadership meant it when they promised faster execution. The centerpiece was PeerDAS (EIP-7594), which let nodes verify network data without downloading everything, cutting bandwidth requirements dramatically. Fusaka also raised the gas limit, bringing a 33% throughput increase on L1, and added passkey support via EIP-7951. Users can now sign transactions using Face ID or fingerprint sensors. Wallets can finally work like the apps people already trust.

2. Ecosystem Reorganization

After months of very loud community criticism about slow execution, unclear communication, and lack of institutional outreach, the Ethereum Foundation underwent its most significant shakeup in years, instilling new leadership, new priorities, and new treasury strategies.

EF Leadership Restructuring

The changes started at the top. On February 25, Aya Miyaguchi transitioned from Executive Director to President, shifting her focus to vision-setting and external relationships. One week later, the Foundation announced her replacements: Hsiao-Wei Wang, an EF researcher since 2017 who helped build the Beacon Chain, and Tomasz Stańczak, founder of the Nethermind client. They took charge March 17 with a clear mandate for the next 12 months of scaling the L1, scaling blobs, and improving UX.

Etherealize

Another consequential organizational development was the founding of Etherealize to serve as Ethereum's institutional arm, solving the issue of Ethereum having world-class infrastructure but nobody to pitch it.

To achieve this, Etherealize conducts business development to help institutions tokenize assets, navigate ETH-native DeFi, and launch compliant infrastructure like enterprise-grade L2s. They also support Ethereum-aligned research, advocate for neutral public policy, and work to fuel feedback loops between institutions and core devs to ensure the protocol evolves for real needs. An example of this research was their Ethereum Digital Oil report earlier this year.

Looking back, it’s clear the Foundation acknowledged some of its gaps this year and made efforts to close them. Whether the new priorities hold remains to be seen, but the early results — two hard forks in eight months, productive treasury deployment, and a funded institutional arm — suggest efforts are being made.

3. Institutional Momentum

Last year, we discussed how Ethereum’s value proposition may be hard to grasp for Wall Street and, as a result, was holding it back. That’s no longer the case.

BlackRock, Fidelity, and JPMorgan now offer tokenized products on Ethereum rails, stablecoin supply hit all-time highs, and Digital Asset Treasuries became loud proponents for Ethereum as a critical piece of stablecoin infrastructure for Wall Street.

Tokenized RWA Dominance

Let’s begin with tokenization — an increasingly substantial venue as stock markets extend their hours, exchanges vie for tokenized equities, and asset managers deploy funds onchain. Here, Ethereum emerges the undisputed champion, commanding 66% of all the real-world assets (RWAs) existing onchain.

ETF Staking Breakthrough

The regulatory picture shifted dramatically on May 29 when the SEC issued a statement clarifying that staking does not constitute a securities transaction requiring registration. In other words, we have the green light for staking ETFs. Rex Osprey deployed the first one back in September, with BlackRock filing for one this month under the ticker ETHB. While it’s yet to be reflected in price, these developments mark a turning point: Ethereum’s graduation from "institutional curiosity" to "default infrastructure."

4. Onchain Health

The numbers tell a clear story: collective TVL across Ethereum and its L2s reached new highs, L2s scaled significantly past L1 activity, and network engagement hit fresh peaks before cooling in the back half of the year.

DeFi at Scale

Ecosystem-wide TVL (L1 plus L2s) touched $170B in September — a new all-time high for Ethereum's collective footprint. While L1 DeFi TVL topped out close to its previous cycle high at $96B in September, some of Ethereum's top applications blew past previous highs as the U.S. government's war on DeFi subsided. Aave hit $44B in October, Lido cracked $40B, and Uniswap, while still short of new TVL highs, crossed $3T in cumulative trading volume in May.

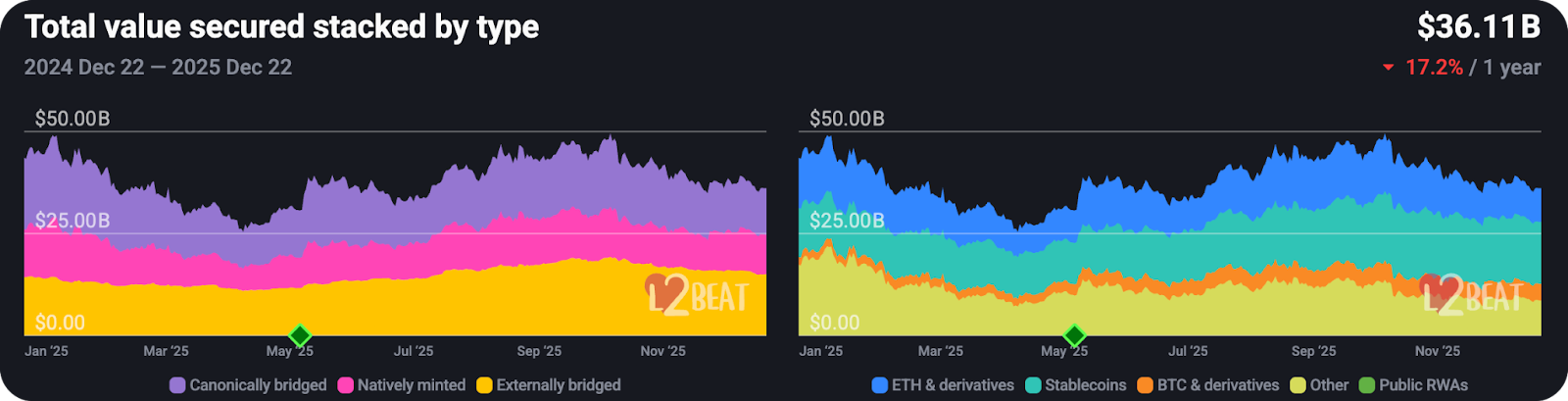

L2 Ecosystem Expansion

On the L2 side, while activity is up on the year, TVL is down 17% over the past year. Certain L2s like Base, which I wrote about last week, and World posted terrific growth. More recently, we’ve also seen Lighter arrive on the scene, helping Ethereum set new TPS records as the ZK-based L2 made the world computer a premier stop for trading perps.

5. Strategic Shifts

Three priorities crystallized for the world computer in 2025: returning to the L1 after years of L2-centric focus, privacy as a first-class citizen, and positioning for AI agent integration.

Returning to the L1

Shortly after Ethereum's 10th anniversary, researcher Justin Drake unveiled Lean Ethereum, a comprehensive vision for the decade ahead organized around two modes: "Fort Mode" (survive anything, including nation-state attacks and quantum computers) and "Beast Mode" (scale everything, with ambitions for orders-of-magnitude throughput increases on both L1 and L2). Accomplishing this means equal investment in the L1 alongside L2s — an effort that will make Ethereum not only more secure and scalable, but also set the stage for it to offer better privacy, as my colleague William Peaster detailed in his piece, Ethereum’s Manhattan Project.

Privacy Push

Privacy emerged as a first-class priority in 2025. The EF launched a dedicated privacy team in October. Vitalik even wrote out an entire privacy roadmap and demoed Kohaku at Devcon — an open-source wallet SDK that makes privacy the default.

Crypto x AI Positioning

Crypto x AI is certainly not at the same level of speculative fervor as it was this time last year, but it has matured into a series of legitimate efforts to bring the best of crypto to AI and vice versa. Naturally, the most important of these efforts are happening on Ethereum. The EF's dAI Team, announced in September, is advancing ERC-8004 — a standard giving AI agents blockchain "passports" for identity, reputation, and autonomous deal-making. Coinbase's x402 protocol, released in May on Base, resurrects a dormant web standard to let agents handle micropayments instantly during HTTP requests.

Looking Ahead

Ethereum matured in 2025 — technically, organizationally, and institutionally.

The network enters 2026 with its strongest technical foundation ever and its clearest strategic direction in years. Whether the market recognizes that is a different question — one that depends as much on macro conditions and narrative shifts as on protocol development. The protocol delivered. Whether price follows is 2026's story to tell.

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.