Impending Approval? Denial of spot ETH ETFs was certain to occur at the outset of the week, but from the depths of multi-year lows on the ETH/BTC ratio echoed a “we’re so back” that has radically shifted the prevailing perception. Why are markets now anticipating approval, and have we already priced in the immediate upside?

Bloomberg’s ETF analysts increased their odds of spot ETH ETF approval threefold to 75% yesterday afternoon after hearing information that the SEC may have reversed its looming decision to deny the applications because crypto has increasingly become an election issue.

News that the SEC had asked exchanges SEC to update their 19b-4 filings for spot ETH ETFs on “an accelerated basis” broke shortly after Bloomberg updated its approval odds; this request likely would not have been made if denial was certain.

The Eethness Stakes is pretty good. Nice look at all the entrants dealing w this fire drill. Hearing the SEC wants revised 19b-4s returned to them by 10am tmrw morning (based on a bunch of comments they just received today) for likely approval as soon as Wed. https://t.co/rmkSfnX45W

— Eric Balchunas (@EricBalchunas) May 20, 2024

Despite the increasing pervasiveness of expert-driven negative approval sentiment throughout 2024, the eventual listing of spot ETH ETFs had already guaranteed by the approval of commodity futures-based ETH ETFs as of last October.

While these experts had extolled that a lack of meaningful communication between the SEC and proposed issuers was proof of denial, it looks increasingly probable that the same level of communication required to approve spot BTC ETFs was unnecessary to approve spot ETH ETFs. In the final months leading up to spot BTC ETF approval, issuers were consulted by the SEC about proposed creation and redemption processes, the roles of authorized participants, and matters related to custody.

3/ All of these issues were figured out and are identical when comparing spot #Bitcoin to #Ethereum ETFs. The only difference is rather than the ETF holding bitcoin, it holds ether. So in many ways, the SEC already has engaged and issuers simply have less to engage on this time.

— Craig Salm (@CraigSalm) March 25, 2024

Crucially, the approval of futures-based ETH ETF had occurred after Ethereum’s transition to Proof-of-Stake, nullifying concerns that staking could result in Ether’s classification as a digital asset security.

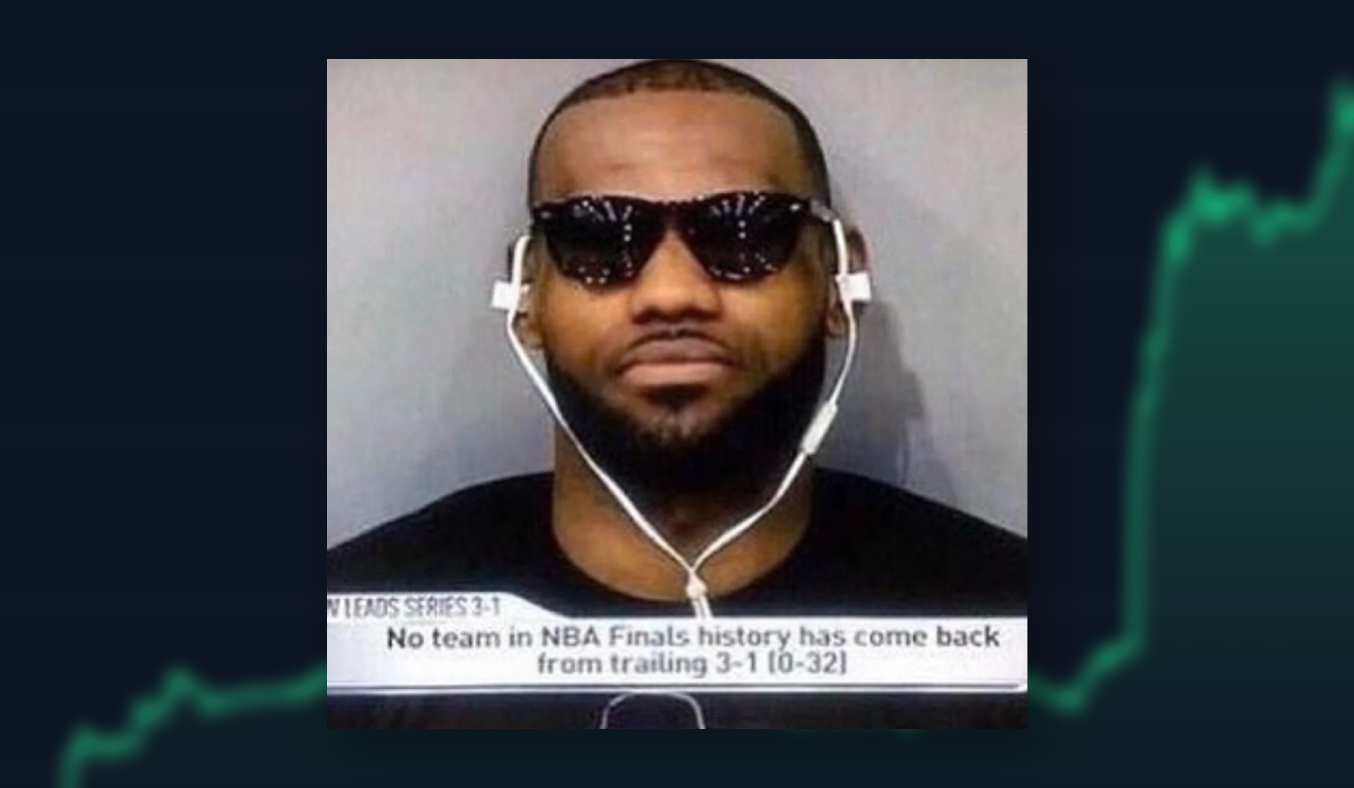

With the experts close to confident on approval and Polymarket’s prediction odds now at 66% – the highest level since early January – consensus is forming that ETH ETF approval is certain to occur this Thursday, leaving those who had prepared for denial caught offsides by a monstrous pump for Ether!

Reminder:

— Brian Quintenz (@BrianQuintenz) March 20, 2024

1/ When the SEC allowed ETH Futures ETFs to trade on its regulated security exchanges, it explicitly acknowledged the status of the underlying, ETH, as being a non-security and outside of its jurisdiction.

ETH gained nearly $600 in dollar-denominated terms yesterday, its largest single-day gain in price corresponding to a market capitalization increase nearly the size of Solana's total MC, meanwhile the ETH/BTC ratio rallied 20% on the heightened odds of spot ETF approval and regained key support at 0.05 after plunging to new multi-year lows last week.

In just under a day, erratic crypto traders went from heavily underweight Ether to trampling over each other for ETH longs, and although we can now anticipate the approval of spot ETH ETF products with confidence, questions remain over whether it will be a bullish catalyst for markets.

BTC price fell by 20% in the twelve days following its spot ETF debut, with hefty redemptions on the Grayscale Bitcoin Trust (GBTC) suppressing any net flows that could be generated from alternative products until the end of January; Ethereum faces a similar situation, with over $10B in ETH set to become redeemable upon the conversion of the Grayscale Ethereum Trust (ETHE) into a spot ETF.

Although regulatory filings have revealed a smattering of BTC ETF holdings among institutions, the majority of shares are held by investment advisors on behalf of their retail clients who can easily access crypto through alternative routes and hedge funds that are unlikely to be assuming directional exposure to BTC price.

The arrival of Ethereum's spot ETFs is theoretically bullish, but only if they result in net inflows from buyers who are not hedging against price risks (i.e.; hedge funds).

Traditional market participants have demonstrated interest in purchasing Ethereum, attested to by the $100M they have put into ETH futures products, but it's unclear if initial inflows will be powerful enough to counteract Grayscale outflows.

$ETH literally added Solana’s entire marketcap in one single candle

— bx1 (@bx1core) May 21, 2024

Sit down the king is home pic.twitter.com/eDziukrHw1