Ethereum’s Quiet Giant

View in Browser

gm Bankless Nation,

The beauty of Ethereum’s decentralization is that critical infrastructure isn’t all locked in one company’s hands.

Today's article from David Christopher focuses in on Nethermind and the tech they build that keeps Ethereum resilient, diverse, and secure.

Scroll a bit lower in today's email to see our rundown of links to updates across the Ethereum ecosystem and the latest Weekly Rollup episode from RSA and David.

Thanks for being a subscriber,

luma 🫡

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

If you've used Ethereum in the last few years, you've relied on Nethermind's infrastructure whether you know it or not.

There’s a running joke in tech about how the internet runs on half-forgotten GitHub repos, kept alive by a few thankless maintainers. Nethermind is sort of Ethereum’s version of that.

Today, we're shining a light on the Ethereum development shop (founded by Ethereum co-ED Tomasz Stańczak) that builds and maintains essential open-source tools that not only keep the network running, but help it decentralize. Their main product, the Nethermind Client, powers over 30% of Ethereum validators, but their contributions to the Ethereum ecosystem go way beyond this product.

Let's take a closer look at what they build 👇

Nethermind's Core Products and Tools

The R&D shop started in 2017, originally as a small team building an Ethereum client (the Nethermind client). In 2018, the Ethereum Foundation awarded them a grant for this work and helped them kickstart broader operations. Since then, Nethermind has grown from a small team into a global company with over 300 employees. As many know, their founder Tomasz Stańczak recently moved on to co-lead the Ethereum Foundation itself. Now, Daniel Celeda, who had been co-CTO since 2021, operates as the company’s CEO.

Beyond offering a suite of development tools, Nethermind plays an essential role in the Ethereum ecosystem, partnering with teams like Lido and Aave to push DeFi advances, and publishing research alongside TradFi players like Deutsche Bank to drive the world computer forward. Nethermind recently announced participation in Lantern Capital, an early-stage fund focused on the intersection of Ethereum, crypto, and AI.

At its heart, Nethermind builds stuff, and while our developer audience may be extremely familiar with a number of tools and resources they've shipped, here's a rundown for the rest of you.

Nethermind Client:

Their flagship product. It's one of several software implementations that validators use to run Ethereum nodes. Having multiple clients for the network isn't redundancy — it's insurance. If one client has a bug and drops, the others step in and keep the network running. Nethermind's version comes built on .NET Core which works across Windows, macOS, and Linux, making it accessible to more operators and supporting Ethereum’s decentralization in the process.

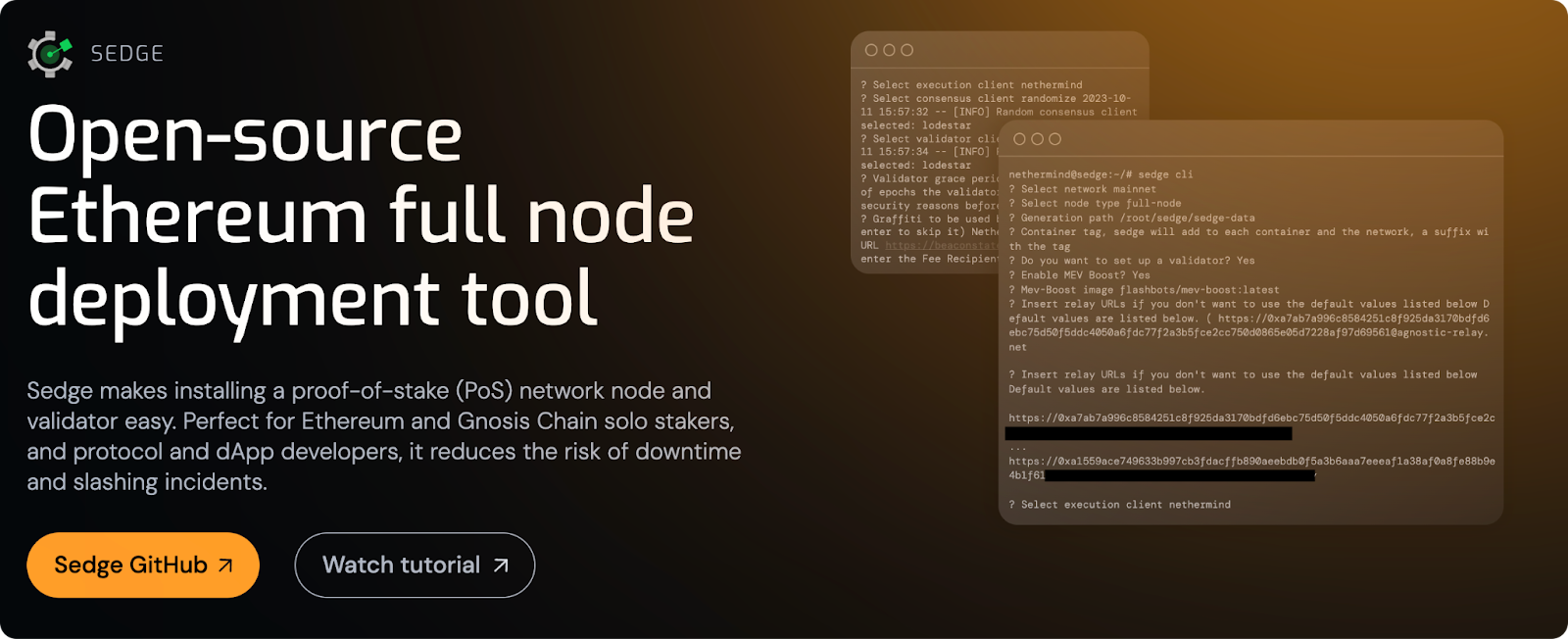

Sedge:

Running an Ethereum validator is notoriously complex — you need to configure multiple pieces of software, secure keys, and keep everything in sync. Sedge turns this into a one-click setup. It also comes integrated with Lido's Community Staking Module, letting anyone easily run a Lido validator as well by putting up ETH as collateral.

Clear:

A verification tool that lets developers mathematically prove their smart contracts work as intended. It converts Solidity code into formal proofs, catching bugs that automated tools may miss.

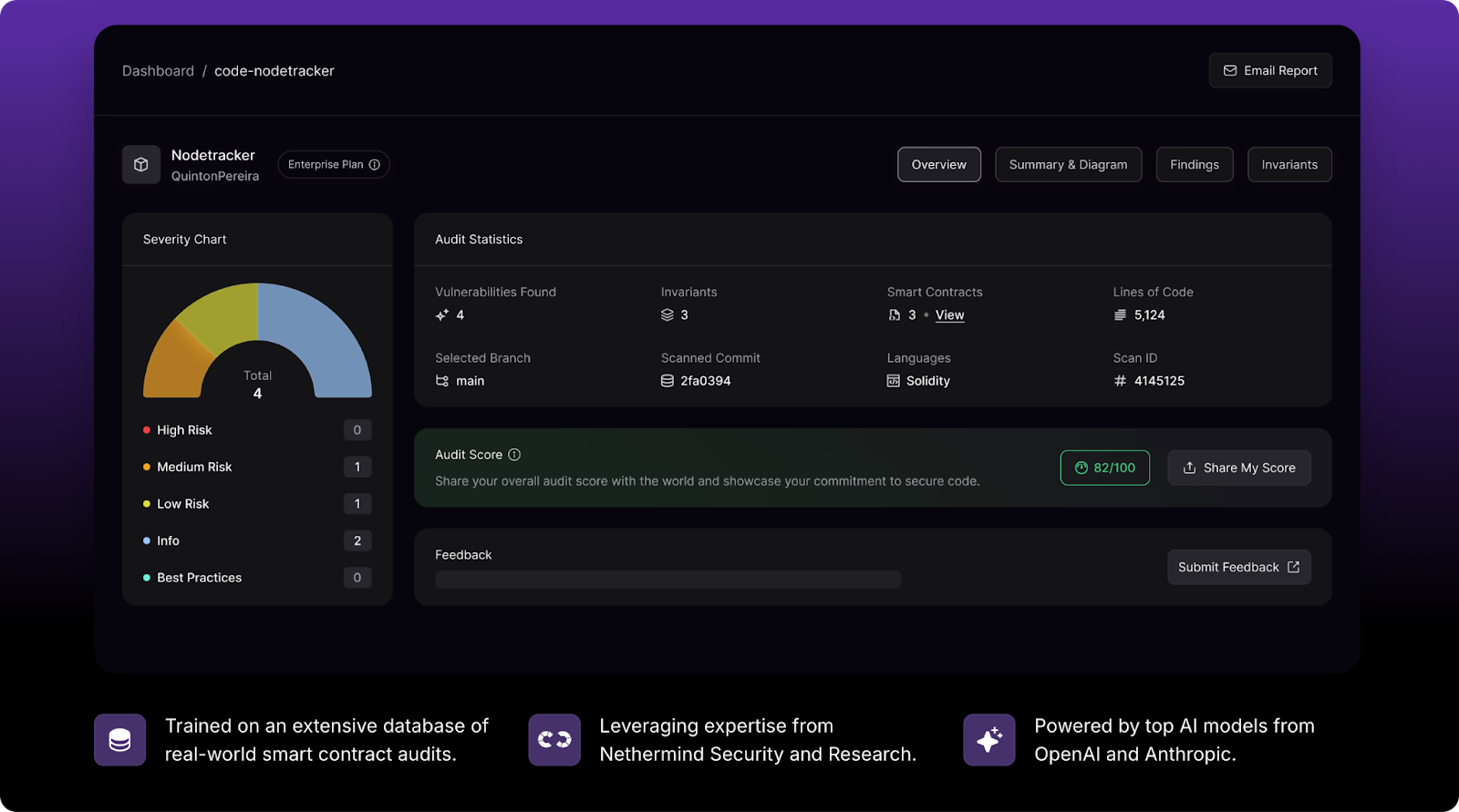

AuditAgent:

AI-powered tool that audits, as well as continuously scans Ethereum and Starknet smart contracts for threats. It simulates possible attacks and gives real-time feedback, helping devs fix issues both before and after launch. The tool recently gained attention through I.R.I.S, an AI agent built using AuditAgent that launched on Virtuals as their debut Ethereum-based agent. I.R.I.S acts as a 24/7 security assistant — scanning code, monitoring GitHub changes, and watching Twitter conversations for potential vulnerabilities.

Beyond Ethereum, Nethermind's work has become essential infrastructure for Starknet, too:

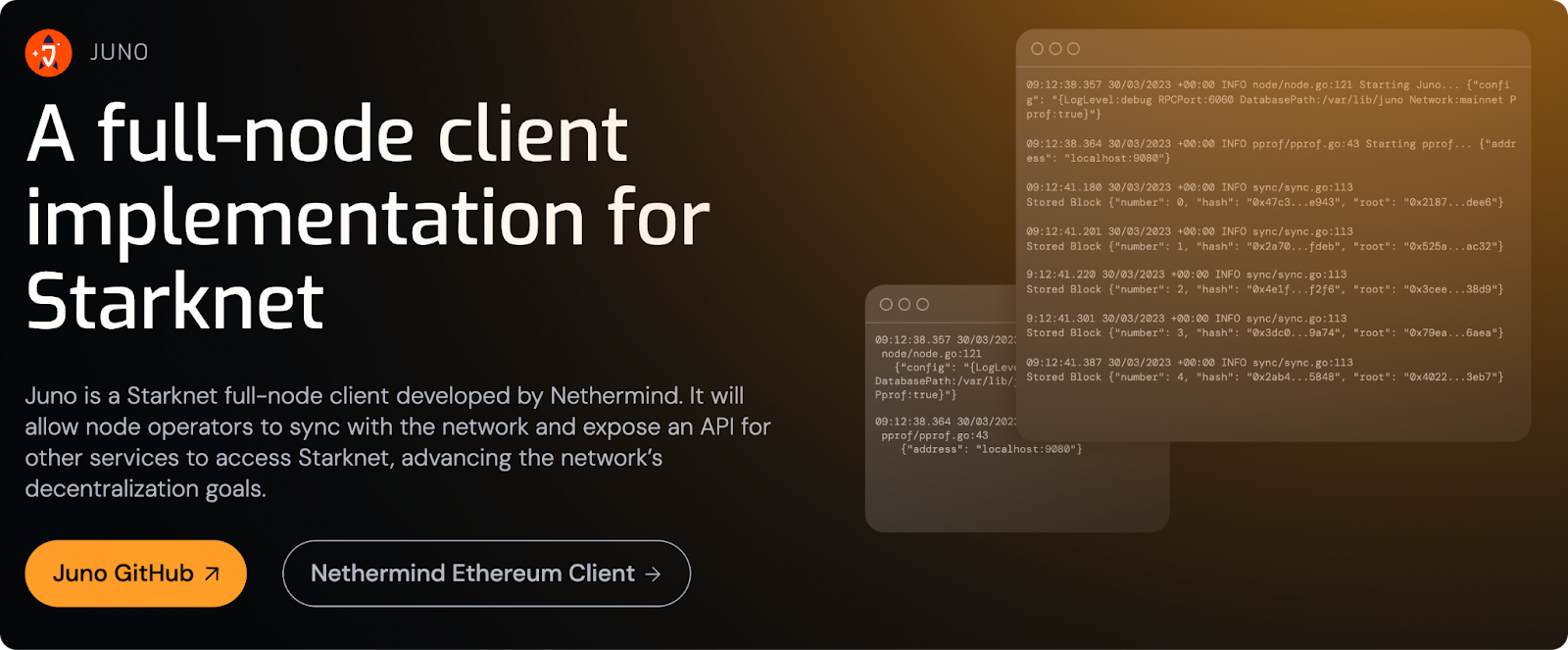

Juno:

A full node client for Starknet that helps users and developers run their own Starknet nodes, syncing data and maintaining network state, while contributing to Starknet’s decentralization overall. Over time, Juno aims to become a full sequencer — meaning it will help order and process transactions.

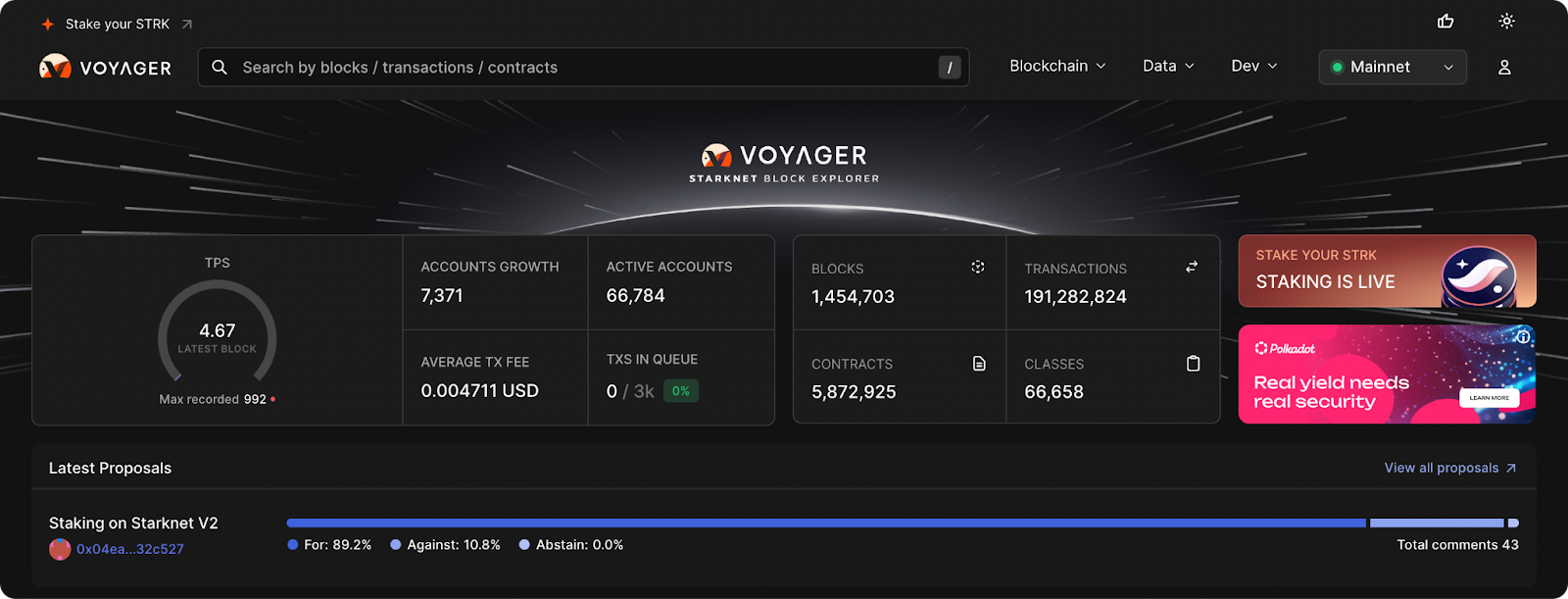

Voyager:

Starknet’s main block explorer, letting users look up addresses, contracts, and overall communications flowing between Ethereum and Starknet. It’s the main tool for seeing what’s happening on Starknet in real time.

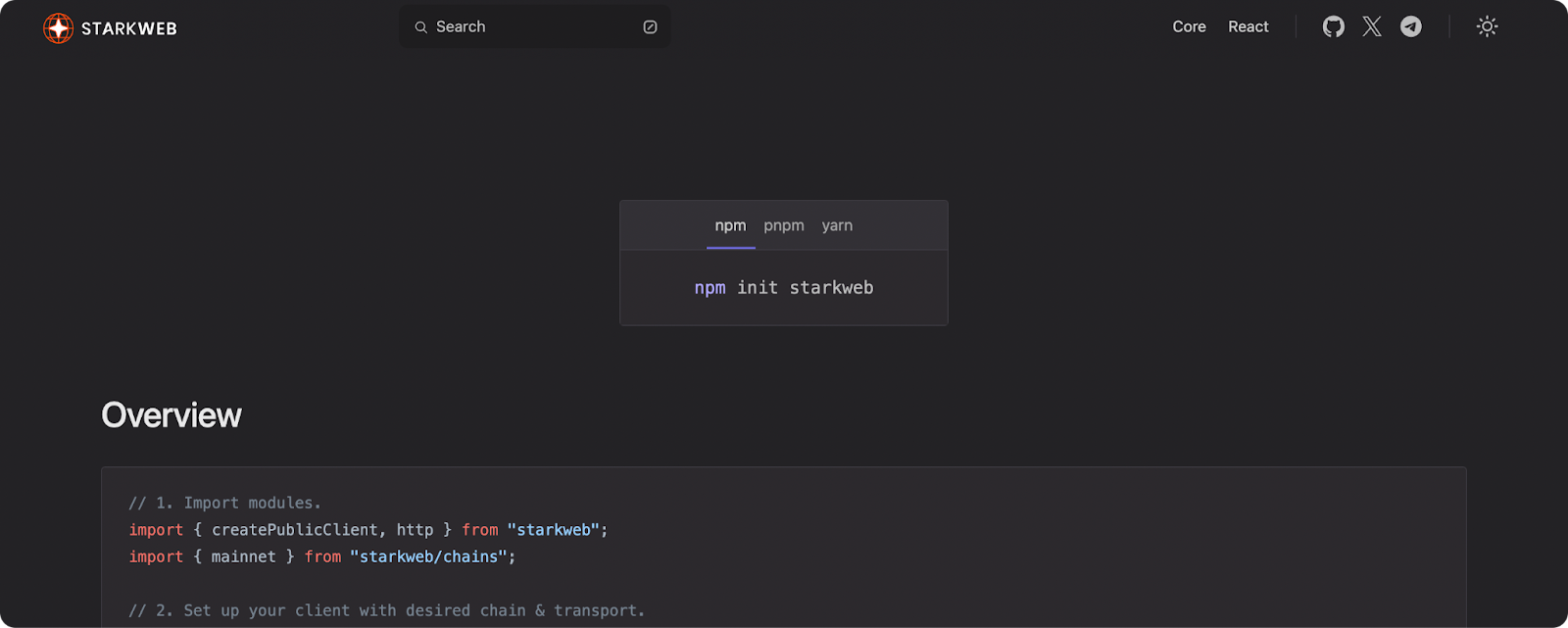

Starkweb:

A developer toolkit for building apps on Starknet. It includes templates, testing tools, and web libraries to help turn Cairo smart contracts into usable websites or apps.

Overall, Nethermind’s tools are designed to make every part of operating on Ethereum and Starknet — from running nodes to writing contracts — more decentralized, more secure, and more accessible.

As we move into an era shaped by AI, agent systems, and decentralized networks, Nethermind is building the infrastructure to support it all — from base-layer protocol engineering to advanced zero-knowledge tools. All in all, their work underpins some of the most important parts of Ethereum and Starknet today.

You can follow their latest developments on Twitter at @NethermindEth.

📈 The Asset

- BitMine bought another $200M of ETH

- Tokenized gold on Ethereum reached $2.4B

- Cboe plans to launch continuous ETH futures

- SharpLink repurchased ~1M $SBET shares

- The SEC punted on BlackRock’s Ethereum ETF staking plans

🏛️ The Protocol

- EIP-7503, which effectively creates a privacy pool atop all of Ethereum, is gaining attention

- Tomasz K. Stańczak highlighted leanroadmap.org, a new dashboard tracking progress on the Lean Ethereum vision

- Ethereum devs agreed on a new Fusaka timeline

- Protocol Guild released its 1st compensation insights report re: Ethereum core devs

- Reth published a post-mortem on its recent state root mismatch bug

📱 The Apps

- Ethena integrated USDe across Binance for its 280M users

- Zora unveiled the Top Trader Competition

- Etherscan integrated Chainabuse scam reports

- Fidelity unveiled $FDIT, a tokenized share of its Treasury Digital Fund (FYOXX), on Ethereum

- Forkcast added videos, transcripts, and chat logs for Ethereum protocol calls

- L2BEAT unveiled “DABEAT: Liveness” feature for real-time system status tracking

- MegaETH is developing a $USDm stablecoin in collaboration with Ethena

- Synthetix is building a perps DEX on Ethereum

- TokenWorks launched PunkStrategy, a protocol that acquires and sells CryptoPunks to buy and burn $PNKSTR

- Velodrome introduced the VerifiedERC20 token standard in collaboration with Self Protocol

🐸 The Culture

- dGEN1 Ethereum phone shipping has begun

- Virtuals opened submissions for “Ethereum is for AI” Hackathon with $100k in prizes

- @ethereum highlighted Focus Tree, a productivity app built on Starknet

- EF’s Jason Chaskin summarizes highlights of Ethereum App Builders X Space #11

- OpenSea is acquiring historic NFTs for its new +$1M Flagship Collection

💽 The Tech

- Base published a deep dive on Flashblocks

- ZKsync is the largest L2 holder of RWAs with 15% market share

- Celo underwent its Ice Cream upgrade

- Linea opened $LINEA claims, kickstarting the L2’s unique tokenomics

- Ronin selected the OP Stack to power its L2 infra

- Upbit, a South Korean crypto exchange, is building an L2 using the OP Stack

In this week's Rollup, Ryan and David discuss whether the crypto bull market is over amid rising unemployment and market uncertainty.

We cover stablecoin competition for Hyperliquid partnerships, Justin Sun's frozen WFLI tokens, and Nasdaq's tokenized equities. They also reflect on SEC Chair Gensler's lost texts and the rise of DAOs, alongside major moves from Fidelity and Robinhood.

Tune into this week's Rollup! 👇

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.