View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

📊 Deep Value Territory? ETH doomer boomers are out in full force after the ETH/BTC ratio took a turn for the worse, breaking below the key support at 0.05 to reach their lowest point since 2021. What happened in markets this week?

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $2.53T | ↗ 0.2% | ↘ 4.5% |

|

BTC $68,035 | ↘ 0.4% | ↘ 2.9% |

|

ETH $3,335 | ↗ 0.5% | ↘ 5.7% |

1️⃣ Solana Faces Major Congestion

Solana is experiencing severe congestion, with ~75% of transactions failing last week. While many culprits exist, one in particular, the new PoW token Ore, is certainly not doing anything to remedy the problem. Solana's founder Anatoly and Helius Labs co-founder Mert acknowledged the issues across the network on Twitter, citing the QUIC feature as a key issue. TL;DR on what's next? Fixes will come, but it will take time.

2️⃣ Bitcoin Down Despite Inflows

Bitcoin's anticipated “Upril” looks delayed, with a ~5% dip this week despite its highest monthly close ever. A healthy chunk of the $2B in BTC that the US Gov seized from the Silk Road is being transferred to Coinbase. That, alongside more GBTC outflows, contributed to the dip.

However, the trend looks to be reversing, with consecutive daily net ETF inflows and only one day of outflows last week. Further, today BlackRock announced they had added Goldman Sachs, Citigroup, Citadel, and UBS as participants to their IBIT ETF. This expansion, despite Goldman Sachs saying their clients had no interest in the assets, speaks volumes.

3️⃣ Ethena's Big Week

Following an airdrop of ~$1.4B this week and widespread adoption that has caused some of crypto's largest DeFi protocols to enter a blood feud over it, Ethena is just looking toward the future. Ethena's second season, the Sats Campaign, kicked off officially on Thursday, introducing Bitcoin as collateral in the protocol. Adding Bitcoin not only expands Ethena's total addressable market but also aligns with the original vision from Arthur Hayes in March ‘23.

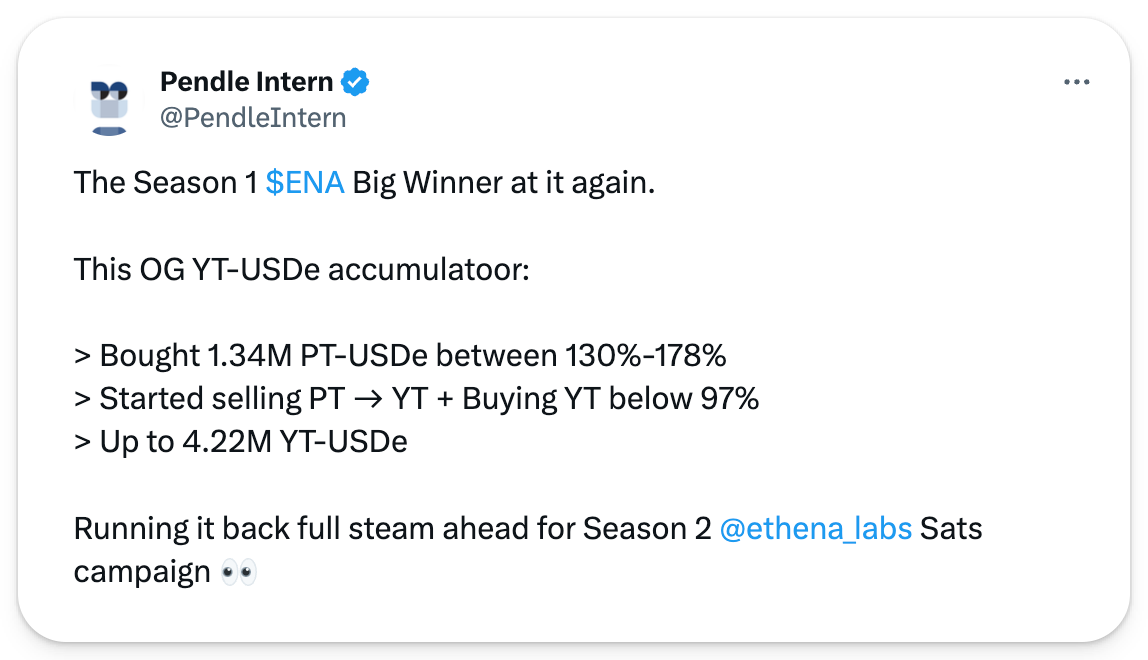

4️⃣ Pendle Winning Airdrop Season

We may all be feeling some wonderful effects of Airdrop April, but Pendle has been the biggest winner. The yield splitting protocol continues to grow exponentially, with its total value locked jumping 40% to ~$4B in just two weeks. A strong proponent of this surge comes from the airdrop hunting for restaking protocols and Ethena — exposure to all of which can be multiplied using Pendle. Consequently, Pendle achieved a record $530M in daily trades this past week, mainly from new USDe pools.

5️⃣ Layer 2s to $1 Trillion?

Whether or not Arbitrum had its market cap flipped by WIF, layer 2s continue to play a significant role in the ecosystem overall. VanEck projects the L2 market to be valued at at least $1T by 2030. Issues like those going on with Solana, as well as with L2s like Base even in the wake of Dencun, signify a demand and need for inexpensive, scalable solutions for blockchains — which VanEck believes will drive this growth, an outlook based on analysis of transaction revenues, maximal extractable value, and the ecosystem's overall health. Yet, they caution that fierce competition will likely mean only a few Layer 2s dominate.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

Crypto's hottest investment is worrying plenty. But is Ethena really something the industry should be losing sleep over?

Ryan is out, and Anthony Sassano is filling in! David and Anthony discuss the week's hottest topics, including the major airdrops we witnessed and the major drama we saw unfold.

Hear their thoughts 👇

📰 Articles:

📺 Shows:

Thousands of Bankless Citizens scored an average of $3,500 worth of tokens after Ether.fi's recent airdrop. Did you miss out again?

Ether.fi was in the Bankless Airdrop Hunter, and you could have gotten into the latest drop by following our quests! There are nearly 80 other crypto protocols in Airdrop Hunter waiting for you.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.