Ethereum is winning the war for real-world assets (RWAs) and no other chain is even close.

RWAs work like a flywheel: the more liquidity there is, the more it attracts, and institutions follow the money. Power laws dominate here, and Ethereum’s network effects play out in three tiers: good, better, best:

- Good = Ethereum virtual machine (EVM)

- Better = Ethereum L2

- Best = Ethereum L1

Let's explore the different categories of RWAs and Ethereum’s dominance in each. 👇

Stablecoins

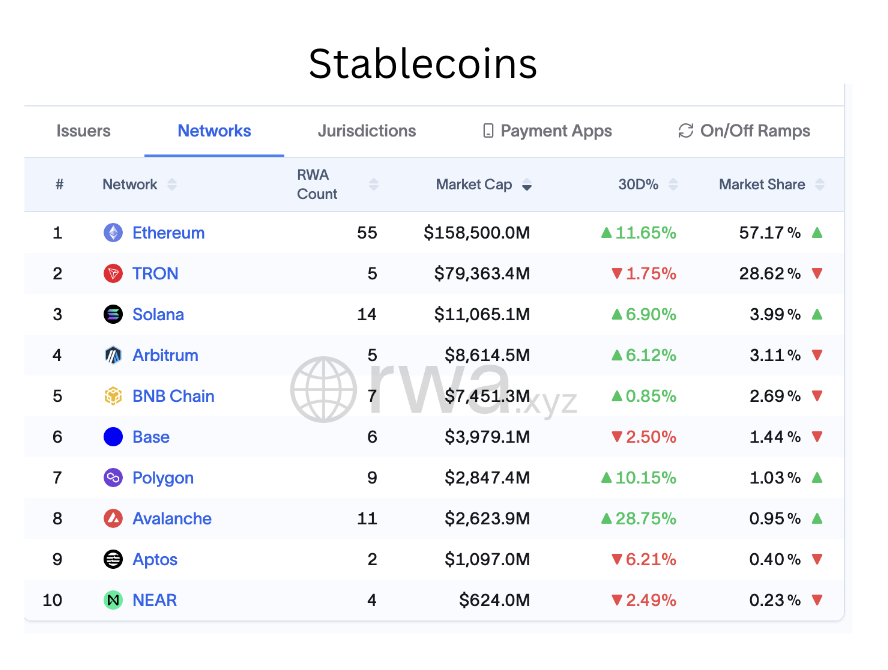

Stablecoins are the largest RWA category – 90% of all onchain RWAs are stablecoins. Stablecoins are the most mature RWA class, and since RWAs depend on stablecoin liquidity, they usually move together.

Ethereum already has nearly $160B of stablecoins on the L1. That's 57% of all stablecoins (an already impressive statistic), and when you include EVM-issued stables, you get to 95% market share.

This means that 95% of all stablecoins reinforce Ethereum's existing network effects. Even the flashiest new stablecoin-focused networks, like Stripe’s Tempo, Circle’s Arc, and Tether’s Plasma, are using the EVM.

Noteworthy stablecoins issuers range from centralized players – like Circle and Tether (combined $130B of stables on Ethereum) – to decentralized protocols – led by Ethena and Sky (combined $24B of stables on Ethereum).

Trump is also placing digital dollars on Ethereum via World Liberty Financial’s USD1 stablecoin, which already has a $275M market cap on Ethereum, with an additional $2.2B of USD1 existing on EVM chains.

Stablecoins have long been considered the lifeblood of the onchain economy, and they are also increasingly powering the real-world economy. Whether at the register or in billion-dollar deals, everyday people and the world’s biggest funds are turning to stablecoins to streamline payments.

Among stablecoins, the EVM reigns supreme, and its momentum is picking up. Winning the stablecoin race means winning RWAs, and the Ethereum network effects in the stablecoin sector are already staggering.

Treasuries

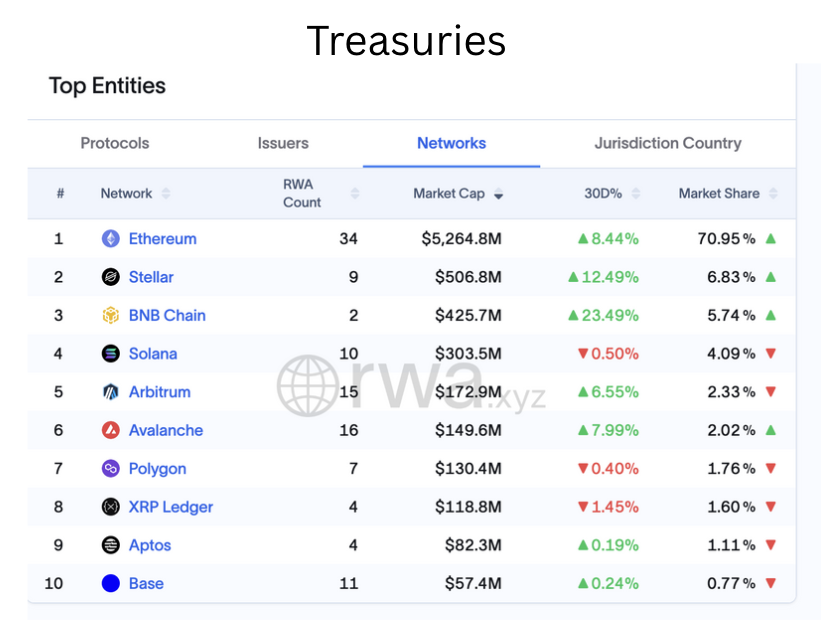

Treasuries are the world reserve asset and Ethereum is the onchain home for treasuries.

The Ethereum L1 secures $5.2B of treasury products, amounting to 70% market share. Including the broader EVM ecosystem gives you 86% sector dominance.

Many of the largest names in TradFi asset management have already launched their own tokenized treasuries on Ethereum.

- One-time investment manager for the Federal Reserve, BlackRock takes the crown of largest issuer with BUIDL, a $2.2B onchain money market fund for institutions that holds a stable $1 value and pays daily interest straight to wallets (90% on Ethereum).

- TradFi brokerage Fidelity recently jumped into the tokenized treasury space. Earlier this month, it minted $203M of FDIT – an onchain representation of the Fidelity Treasury Digital Fund (FYOXX) – and deployed it exclusively to the Ethereum L1.

Fidelity stealth launched a Money Market on Ethereum.

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams) September 8, 2025

Already $200m.

Fidelity has over $1.4 Trillion in money markets assets - the largest in the world.

Total U.S. money markets assets are $7.2 Trillion.

Ethereum is a gravity well for assets. pic.twitter.com/V3pD0KEBy0

For all other tokenized treasury issuers that follow, the logic is simple: no one gets fired for deploying on Ethereum. The trail has already been blazed by first-movers who recognized the chain’s virtues and required world-leading liquidity.

That’s why Ethereum now hosts 34 distinct treasury products (more than double the number of the next-closest network).

Gold

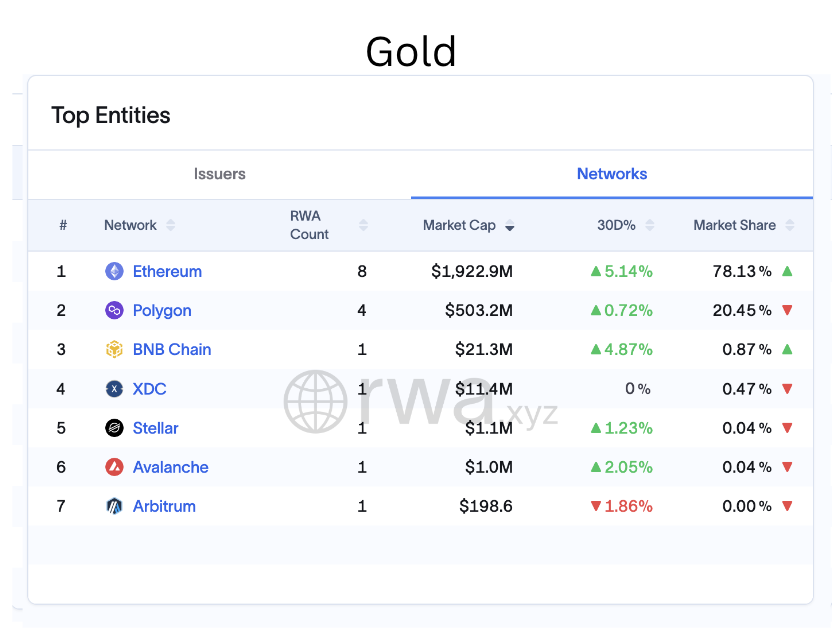

The Ethereum L1 is home to nearly $2B of tokenized gold, or 78% of the world's tokenized gold. If you add the EVMs, it jumps to 99.96%, a sign of utter Ethereum dominance.

Gold is up 10% since late August, and while we’ve experienced daily moves larger than this in ETH, it’s clear we’re in another leg of gold’s 2025 rally.

During this period, total tokenized gold values issued by sector leaders Paxos (PAXG) and Tether (XAUT) have surged. PAXG is available exclusively on the Ethereum network and 99.9% of XAUT is issued on the L1.

There's ~$2.4 billion worth of tokenized gold on @ethereum.

— Token Terminal 📊 (@tokenterminal) September 6, 2025

The tokenized gold supply is up ~100% year-to-date. pic.twitter.com/rq1ZjNNNdZ

Compared to the $231B gold ETF sector or estimated $27.4T market capitalization of physical gold itself, the tokenized gold space is now just getting started. But when the big gold institutions decide to tokenize (say the BlackRock iShares Gold ETF), tried and tested Ethereum is the obvious place to deploy.

If you're bullish onchain gold, you're bullish Ethereum.

Stocks

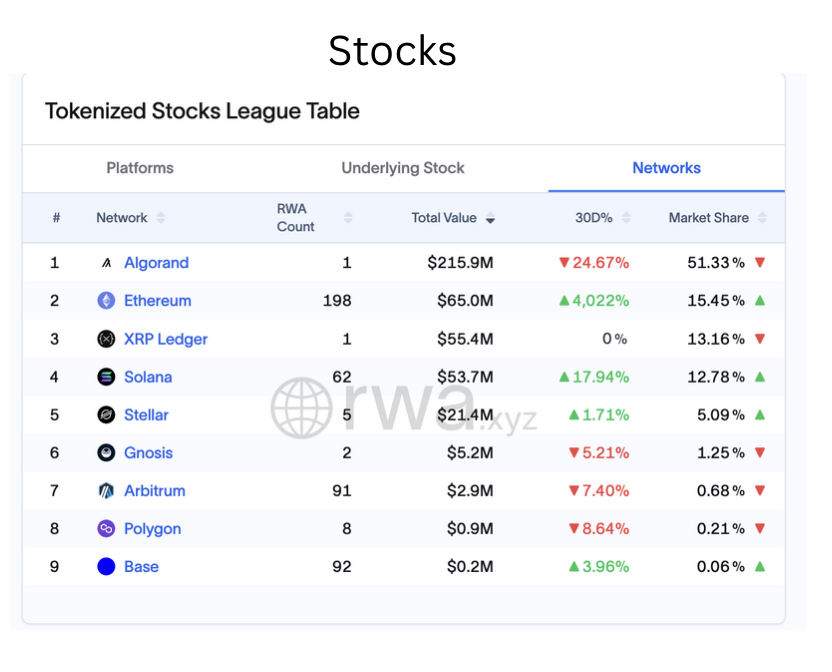

Tokenized stocks are the youngest RWA market, limited by regulatory uncertainty around putting equities onchain.

Today, the tokenized stock market is small, representing just $420M of value. It’s also the lone RWA category where Ethereum is not the clear leader. Ethereum L1 hosts just 15% of onchain stocks, a rare exception to its usual RWA dominance.

Looking more closely, however, leading competitors Algorand and XRP only have one stock each, whereas Ethereum has 200. Additionally, Exodus Movement (the single stock on Algorand) recently announced it will issue equity on Ethereum (and Solana).

Remove Algorand and XRP from the competition, and the Ethereum L1 controls 44% of all tokenized stocks, trailed closely by Solana at 30%.

Does Solana stand a chance here? Maybe, but consider the prevailing headwinds.

Much like with tokenized treasuries, many top tokenized stock issuers have already selected the Ethereum L1 as their home.

Case in point, the recently deployed Ondo Global Markets – which has already issued $63M worth of tokenized receipts for 103 different single stocks, stock indexes, and ETFs – is available exclusively on the Ethereum L1 network.

Additionally, Robinhood, eToro, and Coinbase are all preparing to list tokenized securities. Each appears likely to issue them on proprietary Ethereum L2s once the SEC green-lights tokenized stocks…

Nasdaq has filed with the SEC to allow listing and trading of tokenized stocks.

— fabda.eth (@fabdarice) September 8, 2025

Coinbase, Robinhood, Kraken all are racing to bring equities onchain.

All three are building an L2 on Ethereum. Massive W. pic.twitter.com/1rtmRplMjJ

Network Effect End Game

TradFi shows clear network effects too. The NYSE, the world’s largest exchange, holds over a quarter of global stock market value and lists most major U.S. companies.

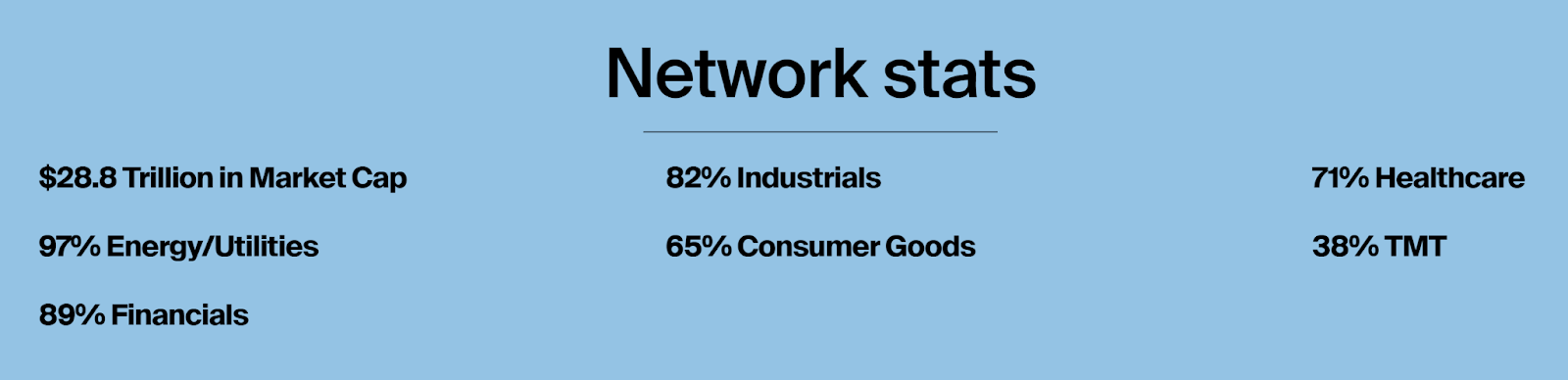

Wall Street industry groups are already experimenting with EVM-based technologies as they look to tokenize assets, and in this context, it’s hard to imagine any chain winning out against Ethereum’s profound network effects.

- Ethereum L1 controls $160B in RWAs (79% share)

- Add Ethereum L2s, and that rises to $185B (86% share)

- Include all EVMs, and “Ethereum” accounts for $200B (93% share)

In other words:

- 93% of RWAs are at least good for Ethereum

- 86% of RWAs are at least really good for Ethereum

- And 79% of RWAs are really really good for Ethereum

This is why people like Tom Lee say that institutions are building on Ethereum.

It’s because they are.

Ethereum is winning the RWAs game and nothing is close.

*But what if the EVM wins but Ethereum doesn't?!?

Some people still find a way to believe that the EVM will win but Ethereum won't.

They point to permissioned corporate chains building separate L1 EVMs and exclaim, “See! They’re building a better version of Ethereum.”

Conversely, every centralized EVM chain only serves to cement Ethereum's lead. The only thing corporate chains agree on is using Ethereum for security and neutrality, and none can compete on this dimension.

**But what if Ethereum wins but ETH doesn't?!?

Others contend that RWAs don’t add value to ETH the asset, postulating that the sector is not directly accretive to Ethereum revenues.

Yet if Ethereum becomes the world ledger, it’s not farfetched to believe ETH the asset will supplant alternative stores of value, such as bitcoin and gold.

In a world starved for pristine collateral, Ethereum is uniquely positioned to succeed: it has deflationary mechanics, accretive supply dynamics, and carries no counterparty risk.

Once the market understands this powerful trifecta, the world will catch on to the truth.

Ethereum = world ledger

ETH = world reserve asset