Ethereum in the New World Order

View in Browser

gm Bankless Nation,

Nothing says “global elite” quite like Davos and the World Economic Forum. This year, as Trump openly rejected the existing international order and flexed American power, crypto’s growing presence at the event felt less like a curiosity and more like a signal.

In today’s Ethereum Weekly, David explores what Ethereum represents in a world where global coordination is fragmenting rather than consolidating.

Thanks for being a subscriber,

luma 🫡

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

Davos is an interesting place this year.

It’s a “who’s who” of the crypto industry, with appearances from Brian Armstrong, Jeremy Allaire, CZ, and Larry Fink (who’s now one of us 😁).

Despite Crypto being front-and-center, the real story rocketing around the world is the explicit messaging from the Trump administration about the phase change of the global world order.

There were two big speeches coming out of Davos highlighting this. U.S. Commerce Secretary Howard Lutnick's “Globalism has failed” talk, and Canada’s Prime Minister Mark Carney’s response: “The rules-based international order is undergoing a rupture, not a transition.”

Rules-Based International Order vs. The Law of the Jungle

Ever since WWII, the international community has produced a semblance of orderliness and cooperation. The UN, despite being a relatively impotent organization, was regarded with respect and truly mattered when it came to State decision-making.

“International Law” was real, but mainly because we all believed in it. We collectively made it matter.

Donald Trump's administration has decided to puncture this shared illusion.

Trump’s opinion is that this “Rules-Based International Order” is only a thing because the U.S. allowed it to be so. Being the most powerful country with the most powerful military means that we are the ones actually producing this “Rules-Based International Order,” and Trump’s “America First” vision means that he doesn’t want to play nice with the rest of the world anymore.

According to Trump, and articulated by Lutnick in his speech, this paradigm is not in the best interest of America, and so we’re going to do something else now.

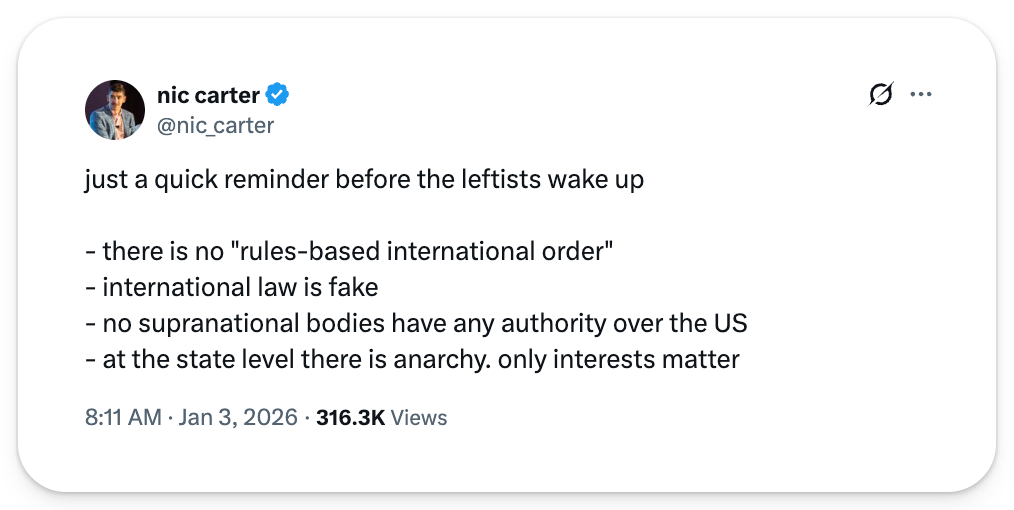

Nic Carter is right here – the State is the highest-order organizing body that humanity has produced. Before Nation-States, it was religion and monarchies that were the highest-order organizing structure that humans came up with, and before that it was feudalism and tribes.

We tried to create higher-order structures through “shared agreements” with things like the UN, but those things proved to be very weak and imparted very little influence upon the world.

So, here we are. In the year 2026, the U.S. is throwing in the towel on the attempt to create higher-order unifying organizational structures, and saying that we’re better off fending for ourselves.

For what it's worth, pariah states like Russia and Iran thrive on weak international order. They have always operated by laws of power, and have leveraged the weakness of “Rules-Based International Order” to expand their power and commit the human rights violations that the UN has simply scolded.

While it's sad to see attempts at global cooperation being thrown out, at least we can finally speak plainly about how Russia and China were never playing by these rules anyway.

So here is our new world:

Bitcoin, Ethereum, and decentralized crypto protocols

Decentralized crypto protocols are powerful and sovereign “higher order organizational structures” that failed to manifest from the “Rules-Based International Order” paradigm.

Donald Trump's balkanization of the unified international community is exactly the world that Ethereum is designed to counterbalance.

While the unified world falls apart into regional powers, Ethereum reunifies it in cyberspace.

These protocols do not enforce laws or protect their people. They do not replace nation-states. But nonetheless, they are an omnipresent sovereign coordination layer for the people of the world to unite upon.

This power was expressed in Brian Armstrong's exchange with the French central banker. The central banker was doing what all central bankers do, which is misunderstand and underestimate Bitcoin, and Brian was correcting him about how “Bitcoin doesn’t have an issuer – it’s a decentralized protocol…” and then he followed up with the most important part about Bitcoin's role in unifying the world: “... [Bitcoin] is actually the greatest accountability mechanism on deficit spending.”

No, we’re not getting “Rules-Based International Order” from voluntary Nation-State coordination and cooperation. But are we getting “Rules-Based International Order” from a decentralized, cryptographic math-based internet protocol?

Bitcoin operates by if-this-then-that statements. Sounds like “Rules-Based International Order” to me. Does Ethereum not extend this same principle to Turing-complete smart contracts?

Despite the despair and negative sentiments of the current crypto industry, I still remain convinced we have not yet scratched the surface of what smart contracts can do.

So, maybe we don’t get “Rules-Based International Order” from the UN.

Maybe we get it from an unexpected place instead.

Maybe we get it from Ethereum.

Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS.

📈 The Asset

- ETH reached a new ATH staking ratio of 30%, with $120B now securing Ethereum

- SharpLink has now earned +11,000 ETH in staking rewards

🏛️ The Protocol

- The EF formed a Post Quantum team and hired Ben Edgington to work on fast finality for the Ethereum L1

- Vitalik proposed introducing native DVT (Distributed Validator Technology) for ETH stakers

📱 The Apps

- Aave is nearing $1T loans originated

- Avara passed stewardship of the Lens protocol to Mask Network

- Avnu introduced its V2 trading flow

- Ember Protocol is expanding its investing infra to Ethereum

- ETHGas launched its $GWEI eligibility checker

- Farcaster was acquired by the Neynar team

- Fileverse introduced its Walkaway Page V2, a resource for independently retrieving documents

- Gusto added support for USDC payments

- JPMorgan launched MONY, a tokenized money market fund, on Ethereum

- Maple deployed its lending infra on Base

- Morpho’s RWA-related markets have crossed $750M in deposits

- Rainbow is taking its $RNBW snapshot on Jan. 26th

- Uniswap deployed its new auctions protocol on Base

🤫 The Privacy Stack

- Aztec Network has proposed its official token generation event

- Shade Network opened up its testnet

- Privacy Pools arrived on Starknet

- Railgun published a primer on its new RAILGUN_connect DeFi privacy system

🐸 The Culture

- Hong Kong is slated to be the next Ethereum Community Hub opening

- Vitalik: “We need more DAOs”; “I’m more in favor of native rollups than before”; “I plan to be fully back to decentralized social”; and “2026 is the year we take back lost ground in computing self-sovereignty.”

💽 The Tech

- Bermuda’s government is running a USDC payments pilot on Base

- Sina proposed the creation of an Ethereum client dashboard

- ENS data is now supported in Google Cloud’s BigQuery

- Mantle evolved from a Validium into a ZK rollup via Ethereum blobs

- MegaETH announced a 7-day Global Stress Test for its mainnet, starting Jan. 22nd

- Scroll is dominating monthly crypto card volumes

Markets slide this week as Trump floats taking Greenland and tariff threats resurface, pushing investors toward gold.

Ryan and David break down what Davos revealed about a shifting world order, why crypto finally had a real seat at the table, and the moments from Brian Armstrong and Larry Fink that framed Crypto versus Central Banks. Plus: the NYSE unveils a tokenized trading platform, Farcaster and Lens are acquired as on-chain social hits a crossroads, and a Jefferies strategist drops Bitcoin over quantum fears. Finally, an update on the Clarity Act delay and the race for the next Fed chair.

Tune into this week’s Rollup! 👇

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.