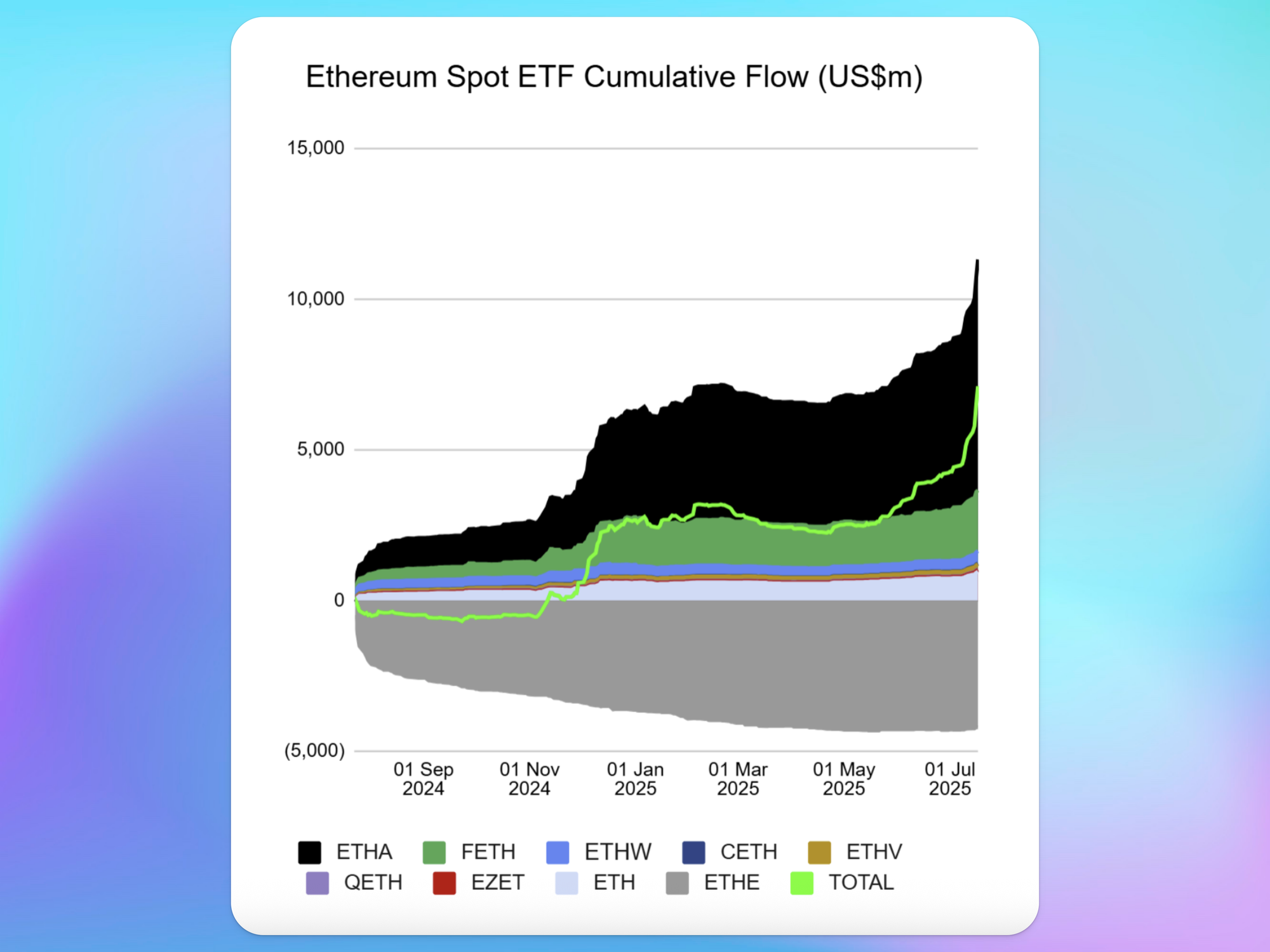

Ethereum ETFs kicked into overdrive this week and started sucking in cash like black holes as inflows went parabolic.

Barring one day of outflows on July 2, ETH ETF assets under management have been up-only throughout July, raking in an astonishing $2.88B of net inflows on the month.

BlackRock’s ETHA leads the charge, seeing record-shattering $546M one-day inflows on July 17 that brought net July inflows to $2.14B. In total, spot ETH ETFs have experienced $7.1B of net inflows since their inception last year.

Momentum isn’t limited to ETFs: Ethereum is undergoing a cultural revival moment among mainstream audiences. Public ETH treasury companies like Sharplink Gaming (SBET) and Bitmine Immersion Technologies (BMNR) are gaining traction, and tech billionaire Peter Thiel notably disclosed a 9.1% share in BMNR on Tuesday.

Unlike Bitcoin, which must constantly inflate to subsidize network security, ETH is designed to be deflationary and offers staking yields, allowing holders to passively grow their share of the network. This economic architecture appears increasingly appealing to long-term allocators.

In DeFi, ETH remains king. Crypto treasury companies are now taking advantage of this feature, with BTCS borrowing $17.8M USDT against its ETH holdings through onchain lending market Aave to further leverage its ETH exposure.

ETH is within 15% away from breaking out to new all-time highs, a move that could be feasibly completed within a week if recent price action can be sustained, meanwhile, the ETH/BTC ratio is up 30% since last Monday, achieving relative strength levels unseen since early February.