Ethereum's Endgame Transformation

Guest Author: Viktor Bunin

There’s been a lot of deserved excitement on Twitter lately in the Bitcoin and Solana communities, driven by fundamental improvements, increased fee generation, and, of course, hype from numbers going up. But the Ethereum community, which remains an epicenter of crypto adoption and innovation, has appeared at times muted. It led me to wonder, is it just that the number isn't going up?

I think there’s a deeper reason: the Ethereum blockchain is transitioning from B2C (execution) to B2B (settlement). This is a known technical consequence of the Ethereum Endgame, but I haven't seen much written about what it means for the Ethereum social layer and community, so I'll attempt to unpack the topic here.

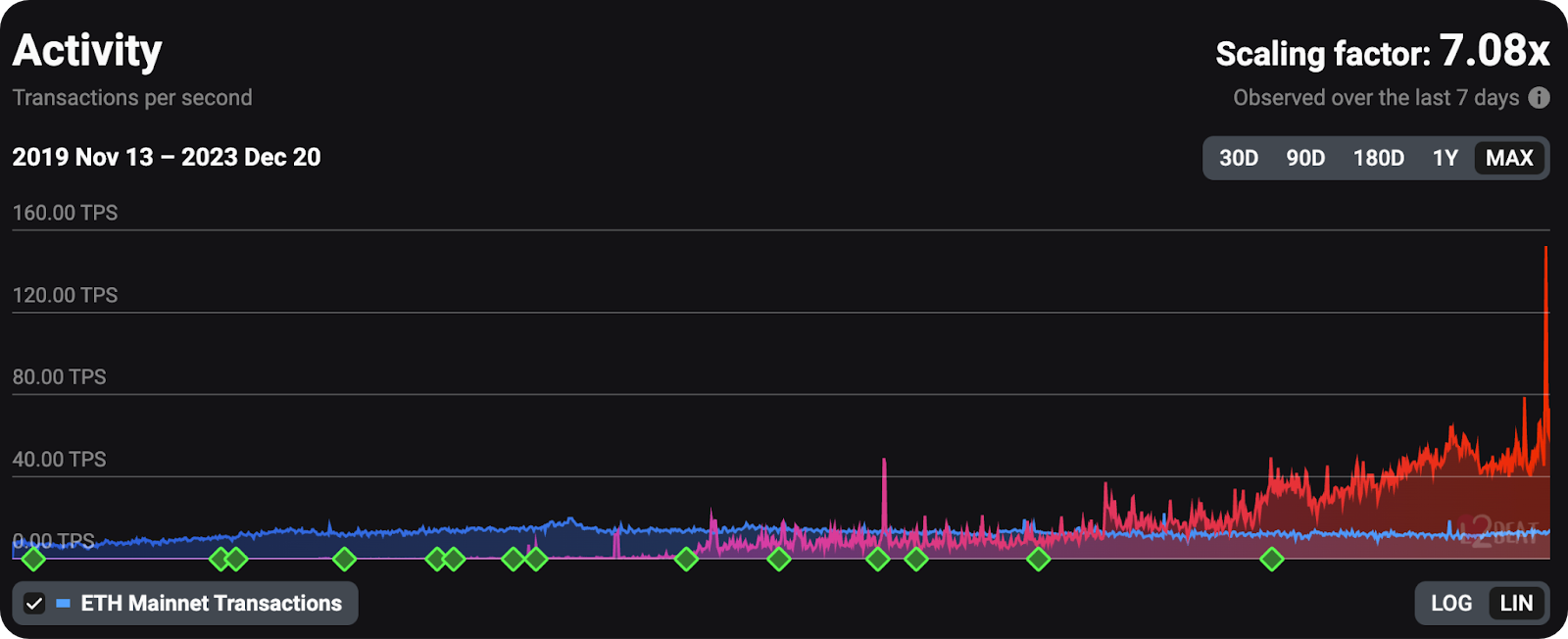

In the long run, will the number of users of the Ethereum blockchain increase or decrease from today? I think decrease. L2s already consume as much as 20% of the gas on Ethereum and I expect that percentage to keep rising in the coming years, even as advancements like EIP-4844 and Full Danksharding dramatically lower costs for rollups to settle to Ethereum. This decrease in end users of the Ethereum blockchain itself means that there will be relatively few people that are just part of the Ethereum community.

Instead, people’s identities will become a nesting doll, with their primary affiliation to the most user-facing components with which they interact, such as networks like Base, Arbitrum One, or the Polygon zkEVM. You see this today on Twitter—the communities of the aforementioned L2s are growing rapidly, but they mostly focus on their respective chains, not on Ethereum more broadly.

This reality makes it harder for folks, especially critics, to reason about Ethereum as it is no longer a single chain and community, but an ecosystem of chains and communities. Ironically, this also made it very hard for folks to reason about the Cosmos community for many years.

people think the kimchi arb was the greatest arb in crypto but you can make a lot of money just taking ideas from cosmos and implementing them on ethereum a few months later

— frankie (@FrankieIsLost) July 27, 2023

This change also means that, by definition, there is no longer a single overarching narrative for the Ethereum ecosystem. Plurality of communities and opinions IS the narrative, which is at odds with what we’re used to seeing in the crypto ecosystem (e.g., Ethereum transitioning to PoS, Solana launching Firedancer, Bitcoin usage transitioning to Lightning).

To be sure, the Ethereum blockchain itself has a vision via core devs and EIPs, described in Vitalik’s updated roadmap, but it's just one out of many Ethereum narratives including optimistic rollups, zk-rollups, shared sequencing, privacy rollups, data availability, identity, NFTs, use-case specific rollups (e.g. gaming), etc.

This trend of community diffusion will only accelerate, not just on Ethereum, but on every general purpose smart contract chain. After all, the crypto ecosystem is planning on onboarding 8 billion people. It would be ludicrous to assume there will only be a single Ethereum community or a single Solana community over time because scale breaks intimacy.

What do we do now, then? What does it mean for the Ethereum community to successfully complete this transition? Here, I look for three indicators.

The first is that Ethereum’s most important social principles are upheld across the rollup ecosystem. These principles are decentralization, credible neutrality, and permissionless access and innovation. It will not matter to an end user if the Ethereum blockchain is credibly neutral if they are being censored or have their assets seized by the rollup ecosystem.

The second is that from a user perspective, they are entitled to the same level of security from using a rollup as they would from transacting on Ethereum mainnet. Tactically this means that rollups should inherit the security properties of Ethereum and even if the sequencers of the rollup are untrustworthy, they should not be able to steal the users’ funds.

Lastly, and I think most importantly for Ethereum, is that the rollup ecosystem should use ETH as its primary money. Aside from the tactical considerations (rollups need ETH to settle to Ethereum, users already have and like ETH, ETH already has great monetary properties, etc.), there’s a deeper raison d'être for crypto: to make the best form of money the world has ever seen. The Ethereum community must not lose sight of that goal. It's time for a money controlled by no one, but used by everyone. And we've got a great shot at that.

This isn't to say every rollup must perfectly execute on these pillars. Some will be KYC-gated, others will use their own tokens for gas, etc. But these indicators give a directional sense of whether the rollup ecosystem is furthering the abstract concept of “Ethereum.”

So, again, what does this all mean for the Ethereum community?

It means over time you’ll hear less and less about the Ethereum blockchain itself, and more and more about the sub-communities within it. The Ethereum blockchain will be the ol' faithful, taken-for-granted stalwart whose existence and support we assume through the trials and tribulations of crypto’s growth in the coming decades.

This dynamic will mirror web2 where although the initial focus was on the internet, now we focus on online communities, while taking the internet itself for granted. In many ways, the Endgame for Ethereum’s community is both that everyone is in the Ethereum community and also that no one predominantly identifies themself as an Ethereum community member.

Of course, the concepts of L1 chains fading into the background isn't new either. Anatoly Yakovenko, Solana's founder, has spent years advocating for a greater focus on the things built on top of blockchains rather than the blockchains themselves.

The crypto rankings I want to see is 1-99 made up entirely of dapps natively built on solana, and then solana.

— toly 🇺🇸 (@aeyakovenko) December 20, 2023

As Solana continues to grow and gain adoption, I’ll be curious how the Solana community evolves over time with it. Its monolithic design will likely keep the community tighter for longer, so its flavor of community diffusion will be different from what we’re seeing on Ethereum today. In the meantime, all eyes are on Ethereum’s community as it makes this fascinating transition into greater diversity.