Relax, Ethereum Isn’t Getting Censored

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the third week of October.

Ethereum censorship

There’s a recent frenzy in crypto over Flashbots censoring Ethereum. Here’s the complaint broken down:

- Lots of validators (~60%) run Flashbots’ MEV-Boost software

- Most of these MEV-Boost blocks (~80%) run through Flashbots’ relay, which excludes Tornado Cash transactions

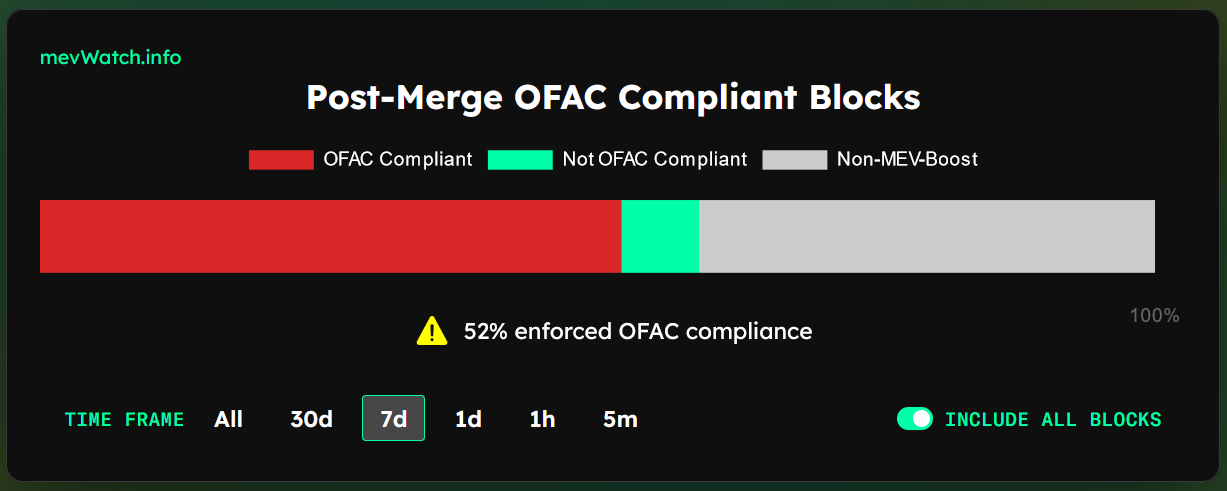

- This leads to more than half (~52%) of blocks being built in Ethereum being “OFAC-compliant”

- Flashbots is contributing to Ethereum censorship

- Therefore Flashbots is the enemy 🤡

Accompanying this train of thought is a scary-looking dashboard graphic from the mevwatch.info website:

Is Ethereum getting censored? The answer is sort of, but not really.

Yes, some validators are excluding Tornado Cash transactions by virtue of using MEV-Boost (and therefore Flashbots’ OFAC-compliant relay). But not every validator is running MEV-Boost relays, which means that other validators are still building on non-censoring blocks as per normal. There are various other non-censoring relayers offered by BloXroute and Manifold that are not censoring Tornado Cash transactions, and Ethereum validators are freely connecting to them.

This means that non-OFAC-compliant blocks i.e., Tornado Cash transactions are still making their way onto Ethereum.

This is a form of “inclusion level” censorship via relayers where validators are saying, “I know Flashbot’s relayers are excluding Tornado Cash transactions, and that censorship sucks, but I like extra profits from MEV-Boost so I’m going to continue to run the MEV-Boost software on my consensus client.” Ethermine, the largest Ethereum mining pool similarly excluded Tornado Cash transactions pre-Merge.

That isn’t ideal. But it’s not quite the pernicious form of hard “attestation level” censorship that many imagine is where Ethereum is headed, where validators go “I really don’t want to piss OFAC off, so I’m never building on another block if there are Tornado Cash transactions in it.”

It’s the latter that leads to a chain-wide form of censorship, and what would ruin the credible neutrality of Ethereum, and might lead to a 51% majority hard fork.

In sum, there’s a fragment of truth to the panic around Ethereum censorship in the past week, but that “censorship” at present amounts to Tornado Cash transactions coming in with a delay of seconds, i.e., a benign form of “soft censorship”.

For all the blame pinned on Flashbots, it’s worth considering a counterfactual world without them. Before Flashbots, miners/validators were colluding with searchers (these are typically proprietary trading desks scanning for profitable MEV opportunities with arbitrage bots) in a non-transparent, closed market to build blocks in ways that prioritized their own profits at the expense of the average user.

That was a centralization at the validator level, as opposed to the present centralization at the relayer level.

Flashbots thwarted this centralization risk at the validator level by creating an open marketplace that outsources specialized block building. This enabled your mom-and-pop Ethereum validator to access a portion of MEV profits, where previously it was exclusively available only to big mining pools. In a world without Flashbots and MEV-Boost, the centralization/censorship risks would be far heightened. Flashbots has improvements to make, but their existence has undoubtedly been a net improvement for censorship-resistance on Ethereum.

And they continue to be. Flashbots announced at Devcon last week its next product “SUAVE” (Single Unifying Auctions for Value Expression), a decentralized block builder that introduces encrypted mempool features.

For a much fuller view on how Ethereum is combating censorship, see the Bankless podcast with Justin Drake. 👇

Aptos launch

There’s a new blockchain in town this week and it’s quickly wearing out its welcome on Crypto Twitter.

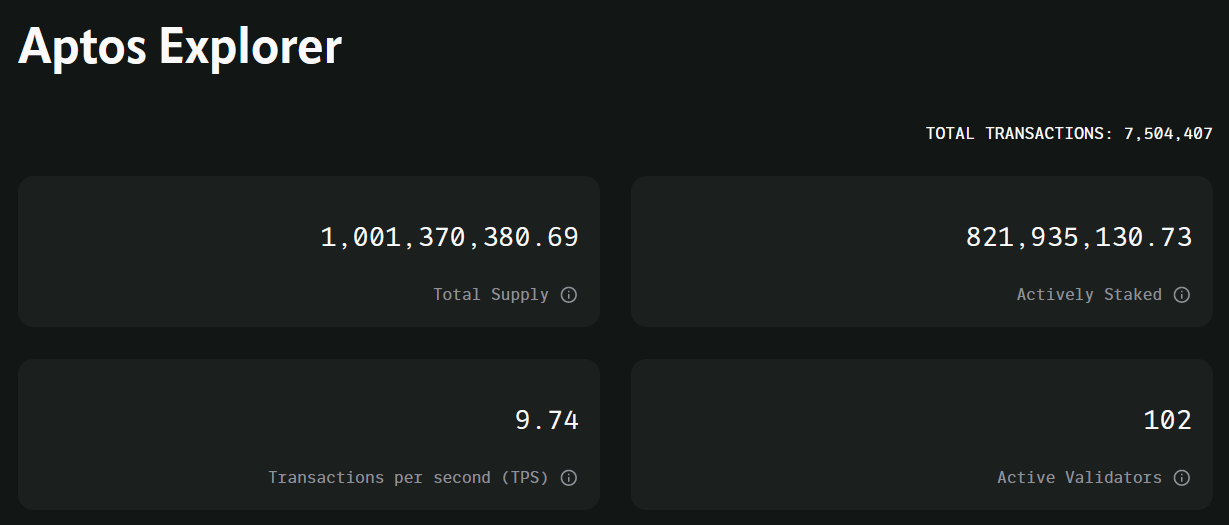

Aptos (APT) is a Layer-1 Proof-of-stake blockchain running on its own Move programming language. Its mainnet finally launched this past week after being in development for a couple years.

Why is Aptos gaining so much attention? For one, the chain has lots of institutional backing, notably founded by the team behind Diem – Meta’s blockchain that was squashed by regulators. Aptos Labs, the company behind Aptos, is valued at over $4B, having raised $150M in July and $200M in March from a range of star-studded VC names like FTX Ventures, a16z, etc. As of today, its APT token has a non-trivial FDV of $7.4B.

Second, APT has an awful token distribution that is drawing ire from lots of folks. If you look at its official page, Aptos claims to have a token distribution split of 51% for the “community”, 19% for “core contributors”, 16.5% for “foundation” and 13.5% for “investors”. Pretty fair on first look, except there’s a definitional sleight of hand going on here. The 51% chunk for the “community” is actually held by the Aptos Foundation themselves, and will be distributed not through the traditional route of airdropping to your average user (AKA the community!), but to selectively support Aptos projects and “other community growth initiatives”.

To quell some of the unhappiness, Aptos quickly announced one day after its launch that it would airdrop 20M of its tokens to 110K network participants.

Finally, the chain is broken (sort of). Its advertised transaction speed is 160,000 TPS (25% faster than Solana) but is working at a measly ~10 TPS at the moment.

Another quick cash grab from retail? I’ll let readers decide.

Web3 News Roundup

Digital Commodities Consumer Protection Act

The most talked about crypto bill in Washington lately is the Digital Commodities Consumer Protection Act (DCCPA), which is the CFTC would use to regulate the crypto sector, and one that Sam Bankman-Fried has been openly supportive of. A leaked draft on Github finds that the language has been amended to exclude software developers from being counted as digital commodity brokers.

SBF talks regulations

In a highly publicized note this week, Sam Bankman-Fried sets out a series of suggested “Digital Asset Industry Standards”. A summary:

- Regulators should be allowed to maintain a sanctions list on wallets addresses that is updated in real time (yes, you read that correctly)

- The industry should deal with DeFi hackers as per an informal “5-5 standard” that lets hackers retain a portion of their hacked funds as long as customers are made whole first

- Clear regulatory processes should be written for how to register digital assets as a security

- Stablecoins should be backed by the USD 1:1, along with KYC of individuals creating/redeeming the stablecoin

More on this next week.

Other news:

- 🐻❄️BitBoy vs Bankless — the ultimate bottom signal?

- Uniswap to launch on zkSync

- zkSync successfully completes Proof Merging

- Reddit has onboarded 3 million crypto wallets

- Olympus DAO is hacked for 300,000 OHM

- Cosmos uncovers a major security vulnerability on IBC

- dYdX partners with Banxa to offer direct USDC deposits on your credit card

- Lattice announces OPCraft, an on-chain 3D game built on Optimism’s rollups

- BNYM launches Digital Asset Custody trading platform