Etherealize's Bull Case for ETH

This op-ed from Etherealize co-founder Grant Hummer highlights the core points of the firm's new 39-page report, which aims to sell institutions on the lasting value of ETH, the asset. You can check out the full report here.

ETH is emerging as a macro reserve asset—scarce, yield-bearing, and intrinsically integrated with the next financial system.

Global finance is digitizing. As trillions of dollars in money‑market funds, treasuries, corporate debt, equities, real‑estate titles and even AI‑generated IP migrate onchain, the world needs a neutral, programmable settlement layer. Bitcoin proved that a decentralized ledger can store value transparently and without intermediaries. Ethereum extends that breakthrough by letting anyone move and program value, enabling financial instruments to also live onchain.

ETH—the native asset that secures and fuels Ethereum—plays three simultaneous roles in the onchain economy:

- Digital oil (every computation, stablecoin transfer and tokenized asset issue burns ETH)

- Productive store‑of‑value (staking pays a native yield)

- Pristine collateral (censorship‑resistant, non‑sovereign, held inside the protocol rather than inside a bank)

Each of these roles ties ETH to core economic functions, making it uniquely reflexive. The more it’s used, the more it’s burned, locked and accumulated.

With gross issuance capped at a maximum rate of 1.51% (but net issuance actually averaging 0.1%/yr post-merge) and ~80% of transaction fees burned, increasing network usage drives supply growth towards zero or negative digits. The result is an asset that captures the upside of the entire digital economy with structurally limited dilution over time.

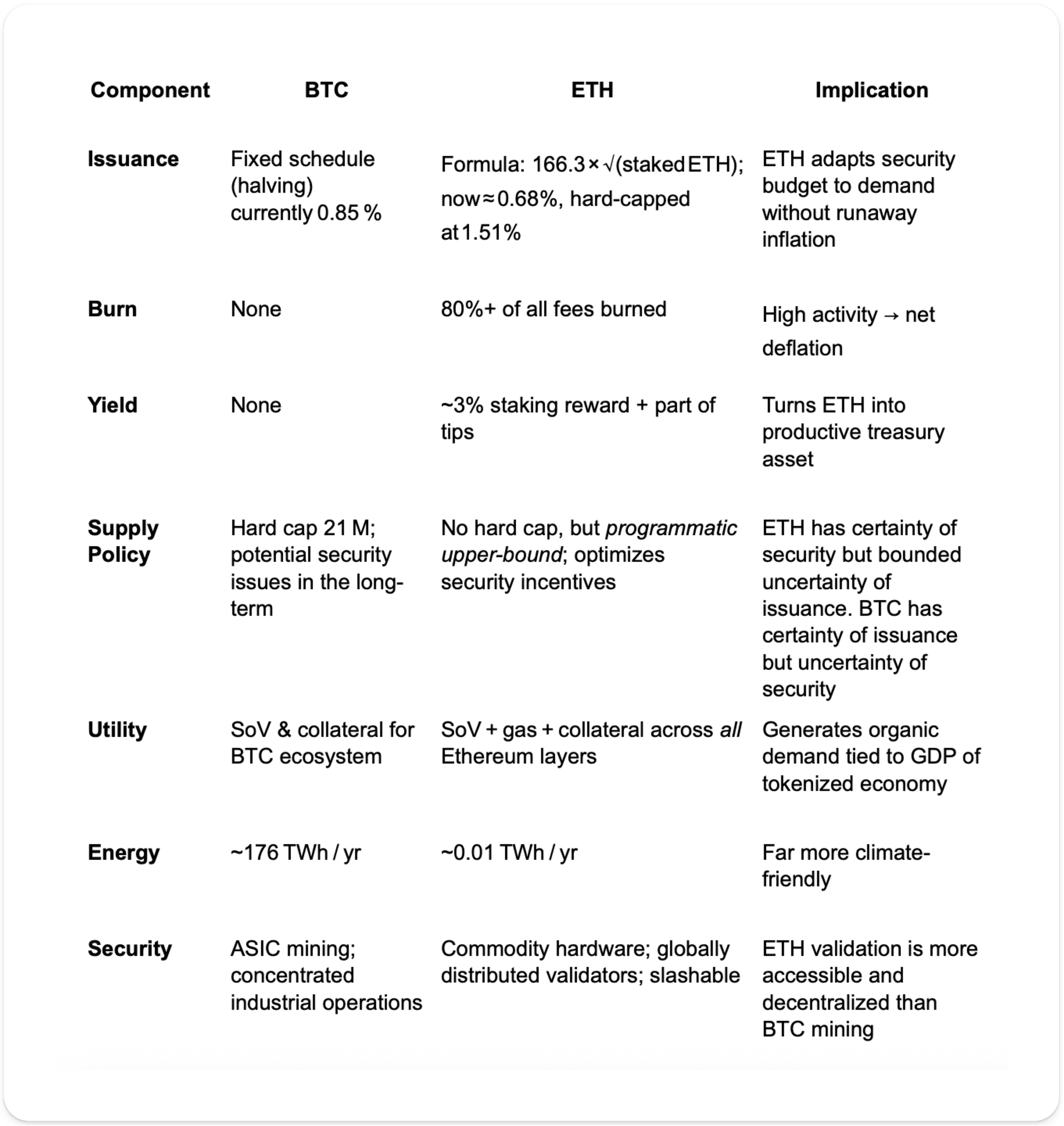

Why ETH is Structurally Different from BTC

Bitcoin’s “digital gold” narrative is simple, singular and institutionally understood, which is why BTC repriced first. ETH’s value proposition is more complex: ETH serves as the fuel, collateral, and broad ownership/investment stake across the new digital economy. That breadth has made the narrative slower to digest, but it also anchors ETH to a wider range of more durable demand drivers. ETH combines the monetary premium of a reserve asset with the necessity of an industrial input. Its value is not just tied to perception, but it instead scales with onchain economic throughput itself.

Monetary Design in One Page

Because Ethereum validators operate with minimal overhead, they need far lower token issuance to remain profitable. Coupled with the protocol’s fee burn mechanism, ETH’s supply curve resembles compressed oil production: low marginal issuance against rising demand, driving scarcity as usage grows.

Why ETH has lagged BTC — and Why that Gap is Temporary

ETH’s impending repricing isn’t due to weaker fundamentals, but instead greater complexity:

- Narrative simplicity: BTC’s “Digital gold” is easy to understand. Ethereum’s “digital oil + reserve collateral + yield” requires more explanation.

- Self‑disruption: Ethereum deliberately reduced L1 gas fees by shifting throughput to L2s, temporarily lowering L1 revenue and confusing cash flow-based models.

- Regulatory overhang: Until 2024, ETH’s legal status in the U.S. vacillated between security and commodity, deterring institutional inflows.

- Liquidity reflexivity: During crypto’s 2022‑2023 deleveraging, ETH was widely used as collateral and so frequently auto-liquidated, distorting price.

Those headwinds are fading. Fee burns have remained consistent, staking rewards have stabilized, and the ETH/BTC ratio sits near 2018 lows, even as Ethereum secures 10× more onchain value today than it did then.

Catalysts in Motion

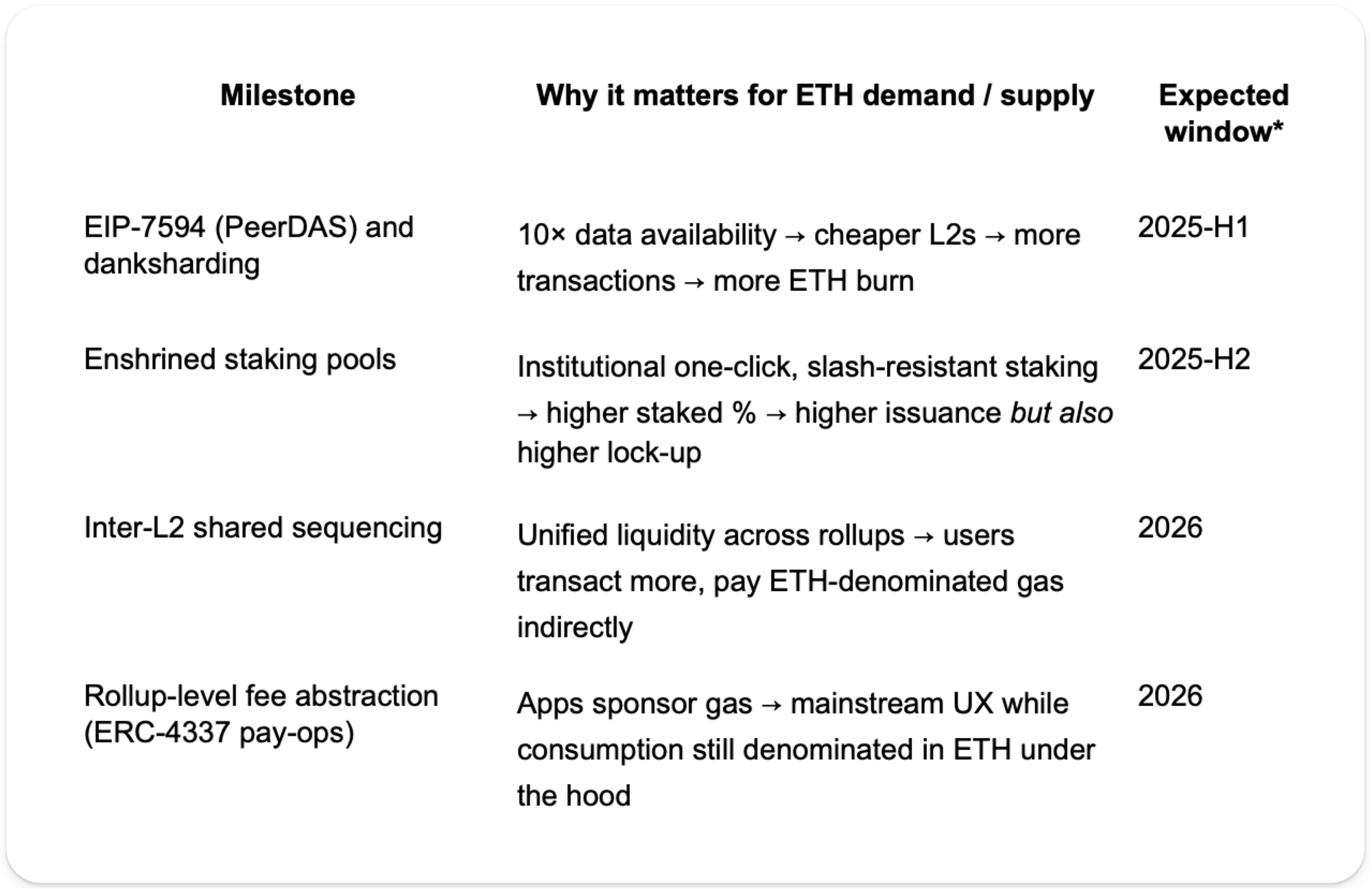

- Layer‑2 explosion: Rollups such as Base, zkSync, Optimism’s Superchain and enterprise app‑chains run at thousands of TPS while inheriting Ethereum’s security. Furthermore, interoperability research to seamlessly connect these L2s together is advancing rapidly. Single-block, synchronously composable L2-to-L2 transactions will be achievable soon.

- Technological Breakthroughs: From real-time proving of L1 blocks, to L1 scaling, account abstraction, and numerous other breakthroughs across the stack, Ethereum becomes more scalable, more secure, and easier to use with each day that passes.

- Regulatory clarity: ETH was reaffirmed as a commodity in the U.S., spot‑ETH ETFs launched in 2024 and the EU’s MiCA and Singapore’s PS‑Act amendments formally recognize staking as a service.

- Institutional tokenization wave: BlackRock’s BUIDL fund, Franklin Templeton’s FOBXX, UBS’s VCC and Sony’s World Chain all settle on Ethereum or L2s that anchor to it.

- Strategic ETH reserves: Protocol treasuries, DAOs and corporates (e.g., Coinbase, Kraken, Deutsche Bank’s Memento) are openly stockpiling staked ETH, echoing the way sovereigns once hoarded gold.

Together, these shifts are transforming ETH from a speculative tech token into a core macro reserve asset.

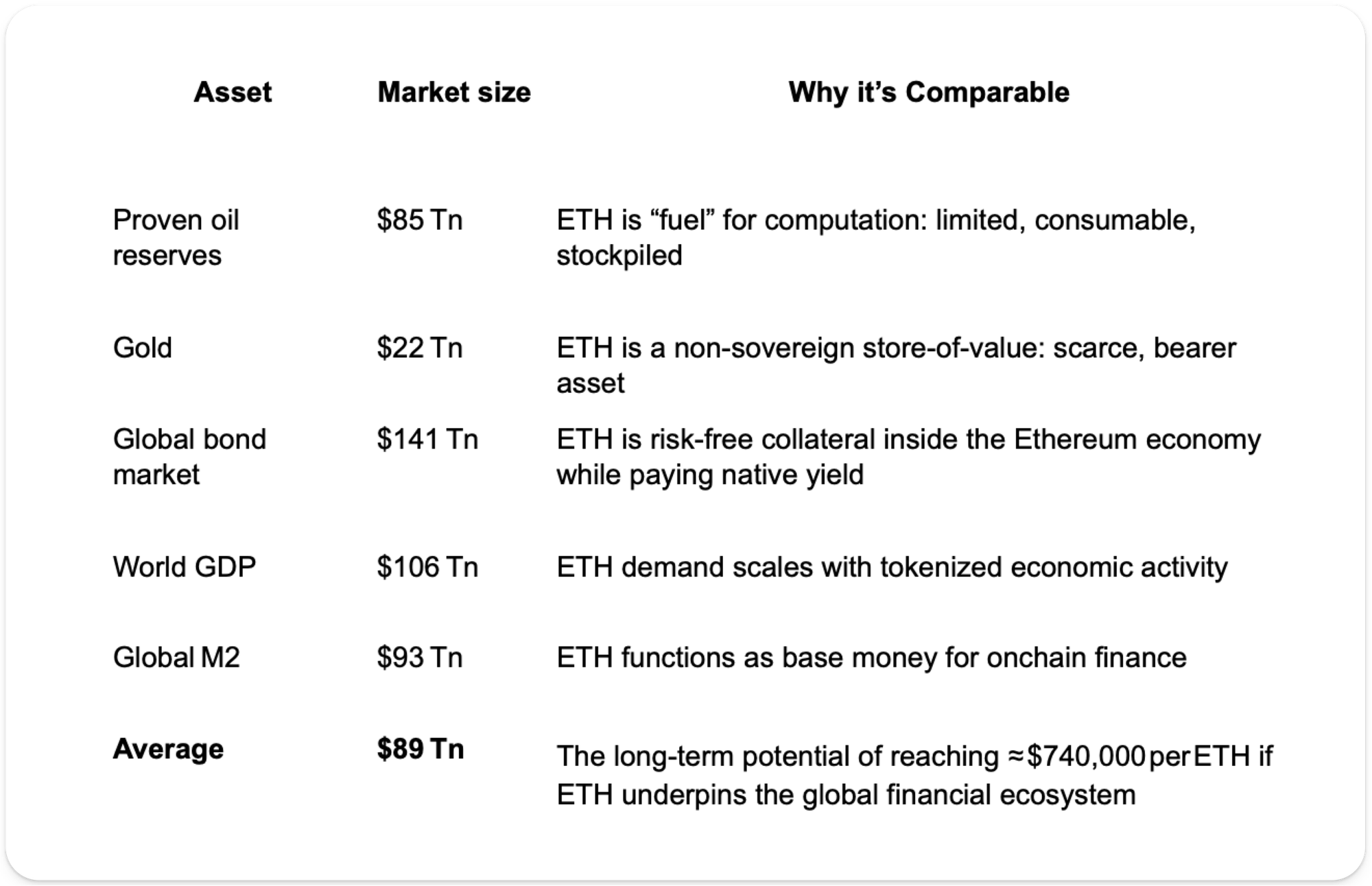

Valuation: From Tech Equity DCF to Global‑Reserve Comparisons

ETH transcends traditional valuation frameworks. ETH does not fit a discounted cash flow model because “revenue” (fees) is burned, not distributed: there are no cash flows to discount. ETH is a hybrid commodity-reserve asset: It’s consumed like fuel, staked like a bond, used like money, and stockpiled like gold.

The following is a more appropriate comparison to asset classes that share these traits:

At the above valuation, ETH’s fully diluted market cap would mirror the aggregate size of traditional reserve assets, a plausible outcome if Ethereum becomes the global base layer for just 10% of global financial activity.

The AI Multiplier

Trillion‑dollar AI platforms will require a financial system that is machine‑native: cheap, deterministic, programmable, borderless and capable of final settlement in seconds. Ethereum already provides this foundation:

- Atomic composability: AI agents can swap assets, pull price oracles and post collateral in a single state‑change. This is impossible within siloed TradFi rails.

- Code‑enforced property rights: No courts, no jurisdictions. Smart contracts offer agents global, transparent enforcement.

- Permissionless liquidity: Stablecoins, tokenized U.S. treasuries and RWAs provide onchain instruments agents can hold, deploy, or reallocate without intermediaries.

If autonomous agents grow to control trillions in assets, Ethereum is the only permissionless balance‑sheet scalable enough to support them. Every interaction will either burn ETH directly or pay L2 fees that settle back to L1, further tightening ETH’s supply.

Roadmap Signals to Watch

Each milestone reduces friction or increases functionality, broadening Ethereum’s total addressable economic surface area, while leaving the supply curve unchanged. This creates an asset whose demand scales with technological progress, but whose supply remains structurally constrained.

Putting Numbers on the Opportunity

If Ethereum captures 10% of the $500 Tn global asset base through tokenization, and if 30 basis points of annualized fees on those assets flow back as ETH‑denominated burn and tips, the result would be negative net issuance. This would create a monetary dynamic with no historical parallel, demand-scaled, supply-constrained, and self-reinforcing over multiple decades.

Under the earlier reserve‑asset comparisons, an $89 Tn aggregate valuation translates to ~$740 k / ETH. Even if that target proves optimistic, reaching just gold’s $22 Tn market cap (~$185 k / ETH) represents nearly a 66× upside from mid‑2025 prices near $2.8 k… all while paying a 3% native yield during the wait.

Investment Takeaways

- ETH is mispriced relative to its structural role. It trades at less than 0.03 BTC and under 40% of its 2021 USD peak, even as Ethereum’s network usage, value secured and institutional penetration all sit at all‑time highs.

- Yield reshapes the risk‑reward equation. Staking turns ETH into a productive asset enabling it to be compounded over time—something that’s unavailable to BTC holders.

- In portfolio construction, ETH is the natural second core position in a digital asset sleeve that already holds BTC. It offers broad beta to onchain GDP and a deflationary supply schedule, none of which Bitcoin provides.

- Risk factors include execution risk on the roadmap, consensus bugs, fat‑protocol competition (e.g., Solana), regulatory pressure, and macro liquidity. Crucially, however, none of these change ETH’s programmed supply mechanics. They shift the adoption curve’s timing, not its final destination.

Conclusion

Ethereum is no longer an experiment, it is the settlement layer for the internet of value. ETH is not just “gas”: It is the scarce, yield‑bearing, non‑sovereign commodity money that secures and regulates that settlement layer.

As tokenized assets, AI agents and institutional treasuries converge on Ethereum, demand for ETH becomes reflexive: Usage burns it, scarcity builds conviction, conviction attracts treasuries, treasuries lock supply and locked supply deepens scarcity.

In the most conservative scenario, ETH simply re‑rates to its present utility and yield. In the base case, it earns a gold‑like monetary premium. In the high-conviction case, it becomes the reserve asset of an onchain economy larger than the GDP of many nation‑states.

The question is no longer “Why own ETH?” but instead, “How underexposed am I to the reserve asset of the next financial system?”