ETH Withdrawals One Week Later

Dear Bankless Nation,

Last week, we gave a quick update on what early market action was looking like post-Shapella. Today, we dig in further to showcase how Ethereum has been handling withdrawals after this huge update.

- Bankless team

Bankless Writer: Jack Inabinet

We’re officially over one week post-Shapella 🥳

Completion of Ethereum’s latest hard fork bestowed the withdrawal button upon stakers, providing liquidity on previously locked accrued consensus layer rewards and their 32 Ether initial node collateral.

In the months leading up to the event, ETH doomers painted horror scenes, projecting months-worth of full withdrawals and pent-up sell pressure set to be released from the Beacon Chain.

The reality has been decidedly rosier: the exit queue size and composition remains encouraging, net validator count is increasing, and the state of the liquid-staking derivatives (LSD) market is strong!

📤 Exit Queue

Users attempting to remove their entire 32 ETH node bond from the Beacon Chain, termed a full withdrawal, must enter the exit queue.

This type of withdrawal, unlike a partial withdrawal of accrued staking rewards, is not automatic and is currently a much more time-intensive process, with the exit queue only able to process a maximum of about 1.8k full withdrawals per day at current network constraints.

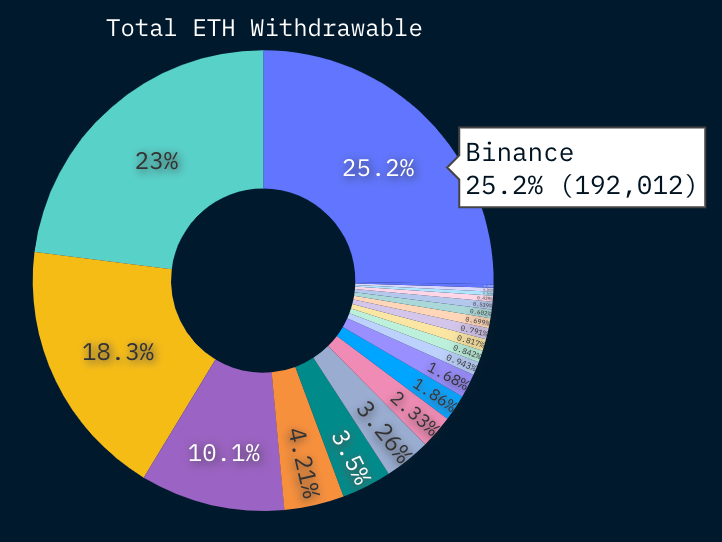

Binance, the recent target of numerous U.S.-based regulatory inquisitions and actions, has increased its share of the exit queue to 25.2%, stealing the top spot from Kraken, 23%, forced by SEC settlement to wind down U.S. staking operations. Fellow CEX Coinbase – one of the few LSD providers to enable redemption – rounds out the top 3 with an 18.3% share.

Centralized staking providers have been the clear net losers from withdrawals, with numerous factors fueling their foundering. Regulators at the SEC seem intent on declaring more centralized staking options, especially those with pooled features, as securities. Some stakers may be looking to frontrun the news and withdraw from these entities now.

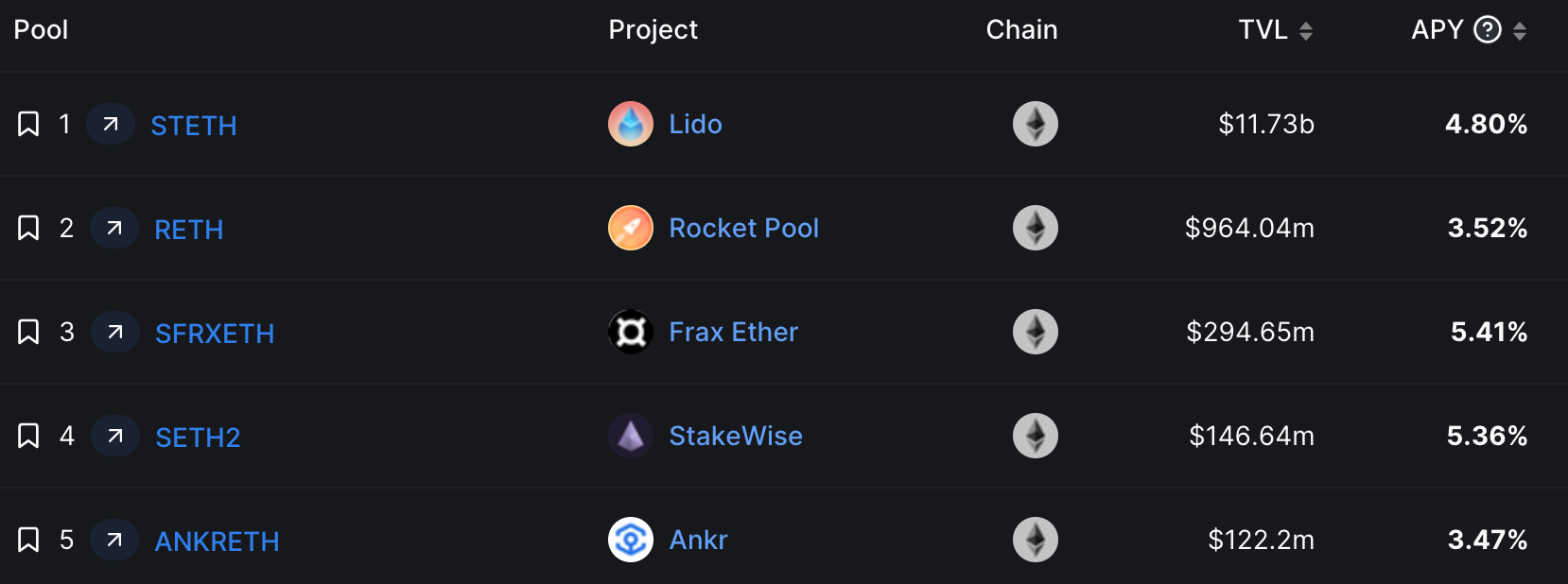

From a purely financial perspective, withdrawal from high-fee intermediated staking is highly attractive. Coinbase, for example, currently offers 3.95% on custodied in-app ETH staking. A simple switch to Frax yields 5.41%, an easy way to capture more on staking yield.

Select stakers may have ulterior motives beyond financial gain. Providing stake to centralized intermediaries presents network neutrality concerns, especially in an age of forced OFAC-compliant block production. Opting for decentralized solutions can help to mitigate network centralization vectors.

With a backlog of stakers stretching to December 2020, orphaned Kraken stakers in need of alternatives, stakers seeking juiced yield solutions, and decentralization maxis shifting stake, the exit queue remains at capacity!

While the size of the exit queue has marginally increased by about 100 validators since last week, now standing at 23.1k, the network has processed 17.5k full validator exits since last week. We expect this to decrease as time progresses, providing all categories of stakers with immediate access to liquidity.

At present, all full withdrawals are estimated to be processed within 17 days, inclusive of the mandatory minimum 27 hour delay period.

📈 Validators Up-Only?

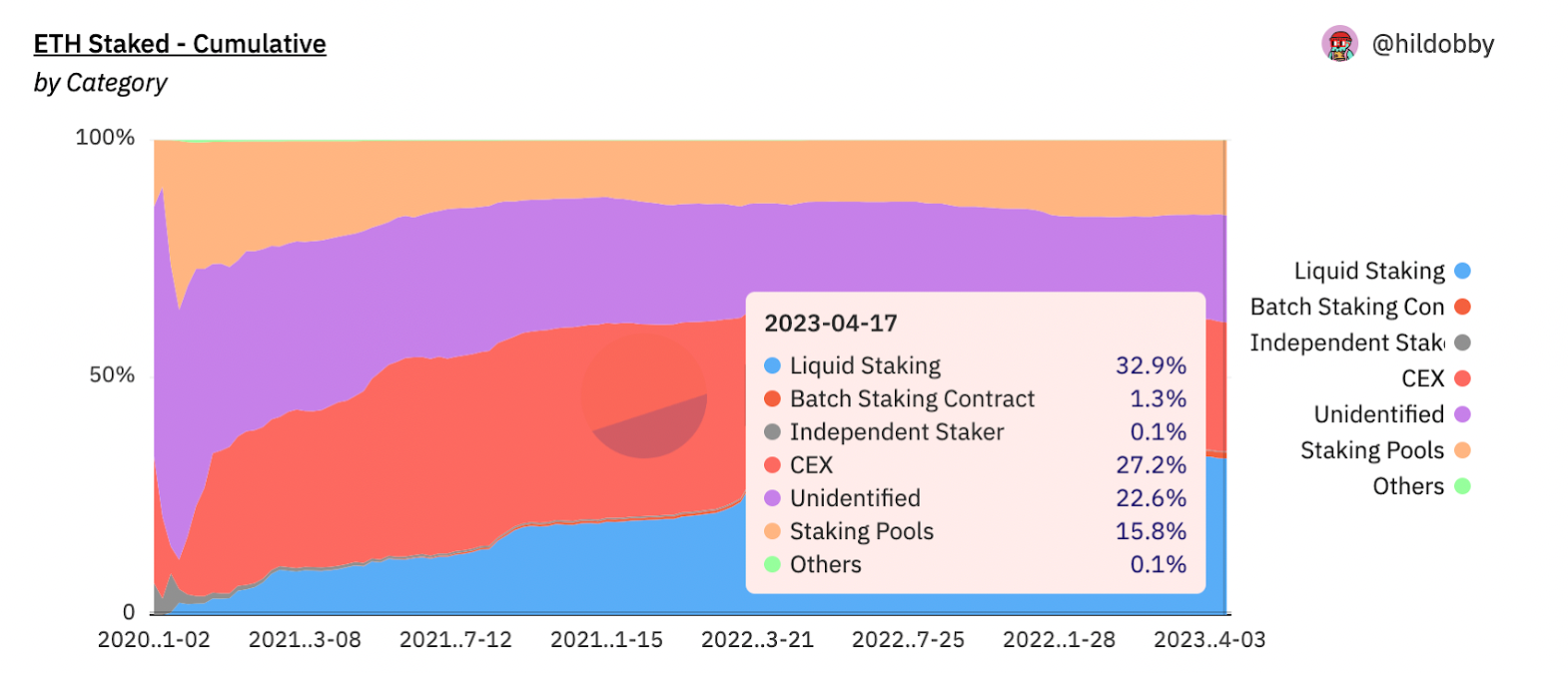

LSDs had previously provided liquidity on stake. However, outstanding regulatory and tax concerns, combined with limited liquidity relative to the underlying, prevented many ETH investors from staking via this route.

Staking on Ethereum’s Beacon Chain is now a two-way door. Undeniably, Shapella was a massive derisking event for many categories of stakers. For the first time since the inception of the Beacon Chain, staking-as-a-service and solo staking solutions are viable options for ETH holders looking to retain liquidity of stake.

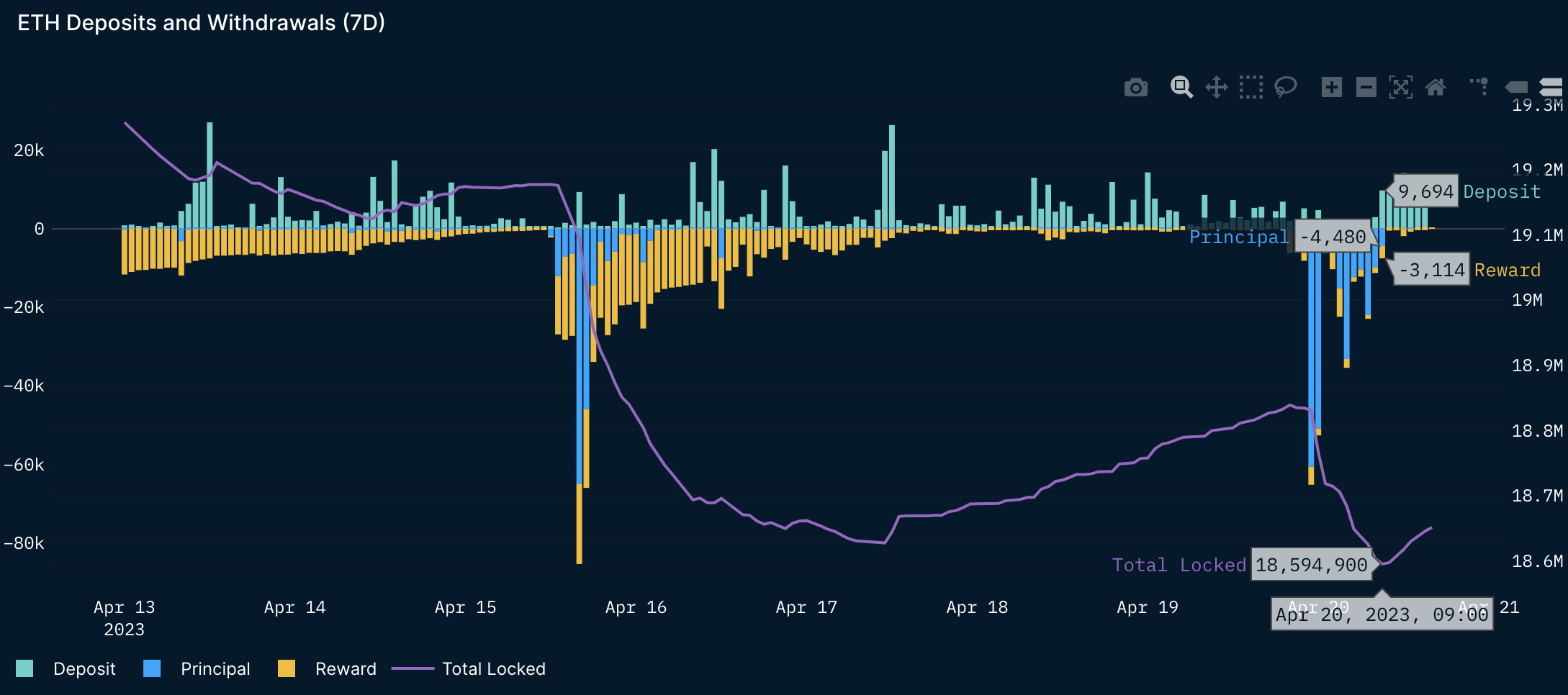

More than just an Ether-head conspiracy, the proof is now in the pudding. Although locked ETH, including staking rewards, on the Beacon Chain was down only for the five days following Shapella, the trend reversed for 2 days on April 17, before falling on April 19.

Due to the sweeping clock-like nature of the exit queue, earlier depositors receive priority exits, front loading withdrawals to the beginning of a given withdrawal round, observed in intermittent withdrawal spikes below. As of this morning, net flows once again turned positive, a trend expected to continue until the current withdrawal round ends in slightly over 4 days, when a similar spike in withdrawal activity will be observed.

While partial withdrawals turbocharged outflows in the early days post-Shapella, we have largely overcome this hurdle. The vast majority of withdrawals are now full, or principal, withdrawals. Deposits have continued and net flows are turning positive earlier on in the withdrawal round, a testament to the now derisked nature of staking and decreasing number of future exits.

To date, the major beneficiaries of these flows have been staking pools, which have seen their net cumulative share of ETH staked increase by 30 bps to 15.8% since April 10, with LSD and CEX staking providers seeing decreases in share of 10 and 20 bps, respectively, over the same period.

Solo staking has yet to enjoy upside from the downfall of LSD and CEX dominance. However, we anticipate that as withdrawals progress and an increasing number of staking providers enable withdrawals, increased solo staking participation become evident in the data.

🏋️ Strong LSD Markets

Many liquid staking providers have not enabled withdrawals.

Coinbase, issuer of staking derivative cbETH and provider of various retail and institutional staking solutions, is the exception and provided withdrawal capabilities within 24 hours of Shapella deploying to mainnet.

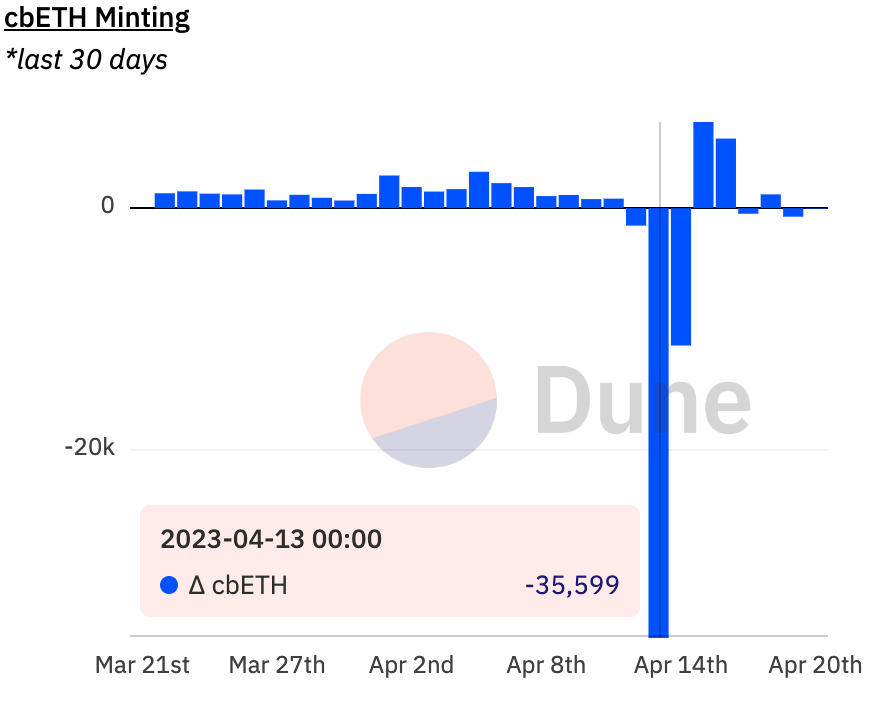

Immediately post-withdrawals, cbETH redemptions surged, hitting 35.6k on April 13.

Despite serving as an exit to staking, net cbETH minting activity has been (surprisingly) positive on multiple days, similar to the pattern of net inflows observed into broader Ethereum staking. Increases to the cbETH supply display ETH holder confidence in staking and run counter to narratives of withdrawal pandemonium.

Rocket Pool offers some ETH liquidity to stakers, fulfilling rETH withdrawal requests from accrued validator rewards, however for the vast majority of LSD protocols, staking derivatives are unable to be redeemed for the Ether backing it. For some, we saw their peg, instead of their circulating supply of staking derivatives, suffer.

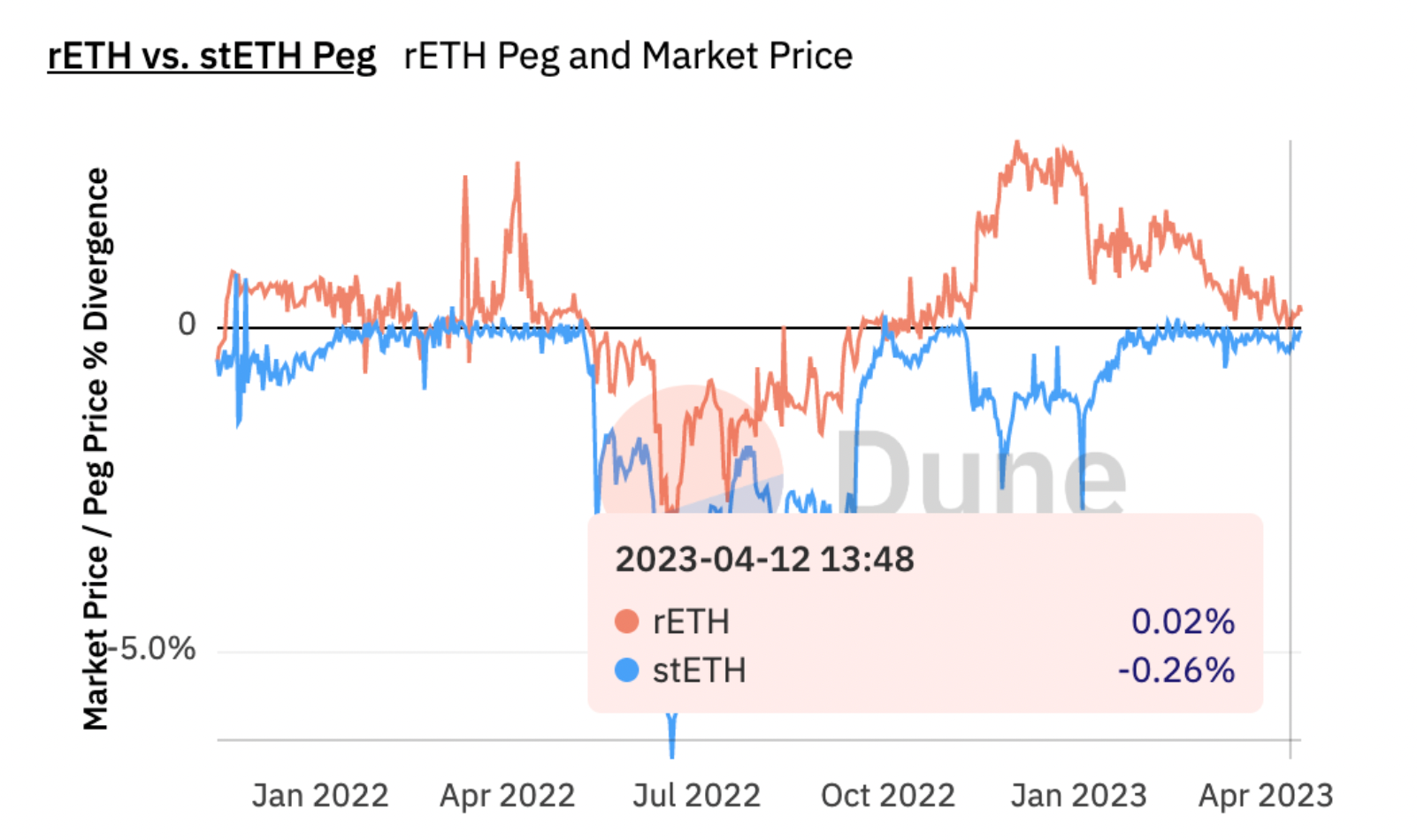

Lido’s stETH was plagued with outsized sell pressure, depegging to a 0.26% discount from the underlying on April 12. While not dipping below peg, Rocket Pool’s rETH traded at 0.02% premium, a low not seen since October 2022.

Since these local lows, however, stETH has come within 4 bps of its peg and rETH is now trading at a quarter point premium. As the promise of redeemability becomes a reality, pegs should, theoretically, begin to stabilize as holders will be able to swap freely between staked Ether derivatives and the underlying.

DeFi lending markets have shown signs of a resurgence in supply of and demand for LSDs once again.

Utilization on Compound’s Ethereum borrowing market, collateralized by stETH and cbETH, hovered near 40% on April 4, with collateral supply and borrowing activity also falling precipitously at the start of the month. Today, utilization is 60%, with supplied collateral increasing to 29.4k ETH and borrowed Ether increasing to 24.1k ETH, up a respective 17.1% and 38.7% from early April lows.

Decentralized crypto lending platform Aave has also seen a resurgence in lending activity, with lender yields on stETH up to 0.02% from 0.0% and the cost of borrowing doubling from 0.3% to 0.6% since withdrawals were enabled.

👷 A Busy Week

While it is likely too early to celebrate the resumption of the bull market, our worst fears around staking have yet to materialize.

Despite a week’s worth of data, we have yet to observe a mad scramble for the exit to immense ETH sell pressure. In fact, quite the opposite has been true. The price of ETH spiked past $2.1k (before receding a bit) and trends of net staking outflows are reversing.

Primary outflow drivers stem from entities being forced to unstake by regulators, as well as a flight from high-fee centralized providers, a trend that marks an encouraging sign for the decentralization of network security. We expect this trend to continue as additional intermediating platforms add withdrawal features for clients and protocol users.

On-chain data suggests LSD providers remain beneficiaries of net inflows to staking and clear demand for derivatives is evident in the return to peg of stETH (or premium in the case of rETH) and increased utilization of lending pools.

While the effects of Shapella are just beginning to be felt, it's safe to say this Ethereum hard fork has been a resounding success, empowering depositors with liquidity and further decentralizing network security.

Action Steps

- 📰 Read Everything You Need to Know About Shapella on the newsletter

- 📺 Watch the Bankless Shanghai-Capella livestream with Tim Beiko, Justin Drake & Anthony Sassano