ETH Fights Toward ATHs

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- ✂️ Crypto Rallies as Powell Signals Rate Cuts Ahead. ETH prices surged nearly 15% and BTC popped 4% as the Fed chair set the stage for a September rate cut.

- 🇪🇺 EU Considering Public Blockchain for Digital Euro. EU officials are reportedly considering placement of their CBDC on a public blockchain "such as Ethereum or Solana."

- 🇺🇸 CFTC Opens Next Phase of 'Crypto Sprint'. The agency is seeking public feedback on its working group's recommendations through October.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $4.04T | ↗ 5.9% | ↗ 2.0% |

|

BTC $116,931 | ↗ 4.4% | ↘ 0.3% |

|

ETH $4,835 | ↗ 14.8% | ↗ 9.5% |

When Yearn burst onto the DeFi scene in 2020, it pioneered automated onchain yield strategies with its vaults.

Since then, the team has optimized and expanded its offerings such that today, five years later, Yearn remains one of crypto’s best hubs for passive investing.

The project may not be the biggest by total value locked (TVL), but that hasn't stopped it from providing some of the top yields in DeFi.

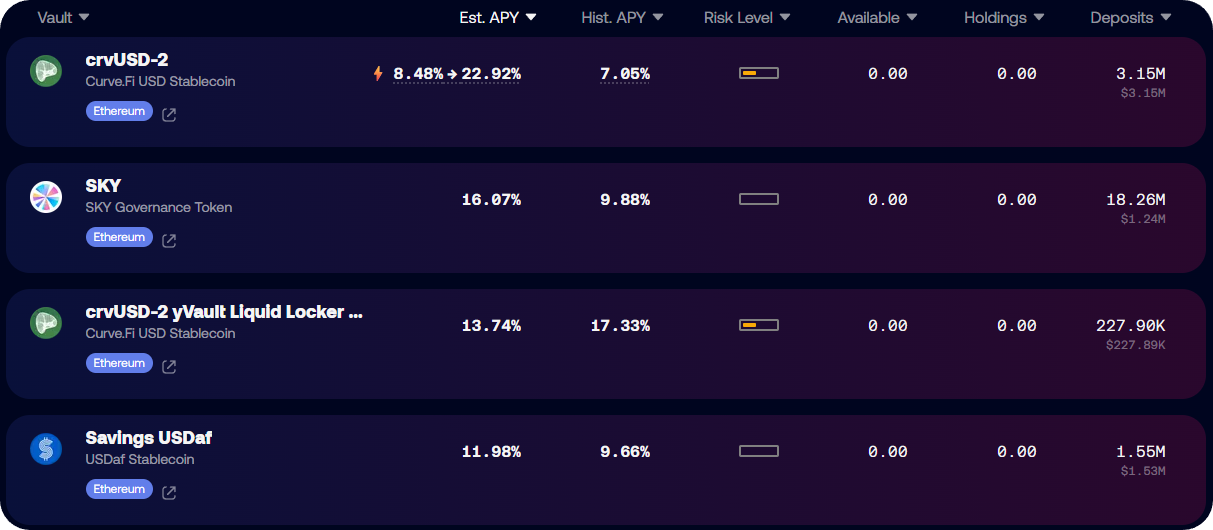

For example, over the past 30 days:

- The USDC.e-2 vault on Arbitrum yielded 11% APY

- The USDS-1 Liquid Locker on Ethereum yielded 13% APY

- The crvUSD-2 Liquid Locker on Ethereum yielded 17% APY

If you haven't used Yearn before or in a while, there are two things you'll probably want to wrap your head around at first. These pillars are...

v3 Vaults

Yearn’s v3 vaults are the latest generation of its yield strategies. They’re modular, flexible, and can run on a single strategy or bundle multiple strategies together. Here, users have more choice over where their funds go and the level of risk they’re comfortable with.

On the backend, v3 vaults are also more efficient. They’re built on the ERC-4626 "Tokenized Vaults" standard, which makes them easier to integrate across DeFi, cheaper to run, and safer thanks to their streamlined code.

yVault Tokens

When you deposit into a Yearn vault, you get a receipt token back, called a yVault token. For instance, if you deposit USDC into the USDC.e-2 vault mentioned above, you'd receive yvUSDC-2 tokens in kind. The "yv" prefix denotes multi-strategy vaults, while the "ys" prefix is used for single-strategy vaults.

These tokens represent your share of the vault and automatically track your yield. As a vault grows and earns profits, the value of your yVault tokens increases. When you’re ready to withdraw, you burn your yVault tokens to redeem your original deposit plus any yield earned.

Getting Started

Yearn has a range of interesting offerings, like yETH, yBOLD, and a PoolTogether Prize Vault. But if you're a newcomer, you'll probably find the main v3 vaults dashboard to be the most straightforward starting point.

To begin here, navigate to yearn.fi/v3 and connect your wallet of choice. Then:

- Review the available vaults. You can filter by chain, category, or strategy type until you find a vault that suits you. Each vault tab will show its current APY, risk profile, and total deposits.

- Make your deposit. Select your target vault, enter the amount you want to deposit, and click "Approve" (if it’s your first time) or "Deposit." Once you confirm the transaction(s) with your wallet, you’ll see your new balance reflected in the vault’s dashboard.

- Track your yVault tokens. Your receipt tokens will grow in value (in spurts per harvest, not second by second) in your wallet as yield accrues. You can track them directly in the Yearn UI or through portfolio trackers like Zapper and Zerion.

- Withdraw to cash out. When you’re ready to close your position or partially exit, go back to the vault, click the "Withdraw" tab, enter your desired amount, and confirm the transaction in your wallet. Your original tokens plus yield will return to your wallet once the transaction clears.

And that's all it takes to jump in!

If you have some idle funds sitting around onchain, Yearn is handily one of the most straightforward ways to put them to work, and it's reputable with a long, proven track record. The vaults keep evolving, the yields stay competitive, and the doors are always open. It's DeFi done right, and it's worth another look if you're on the sidelines.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.