ETH Ecstasy

View in Browser

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

- 😳 Ethereum Community Holds Breath as ETH Nears ATH. ETH came within 3% of its all-time high on Wednesday amid a historic pump.

- 🐂 Bullish's BLSH Stock Surges as Crypto Exchange Raises $1.1B in IPO. The crypto exchange trading under the BLSH stock ticker raised more than expected as demand came in hot.

- 👔 Stripe Names Paradigm's Matt Huang as CEO of New 'Tempo' Blockchain. The payments giant is reportedly bringing on the crypto veteran to lead its EVM-compatible L1's development.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $4.15T | ↗ 2.1% | ↗ 10.4% |

|

BTC $122,751 | ↗ 2.4% | ↗ 6.6% |

|

ETH $4,509 | ↗ 2.5% | ↗ 28.5% |

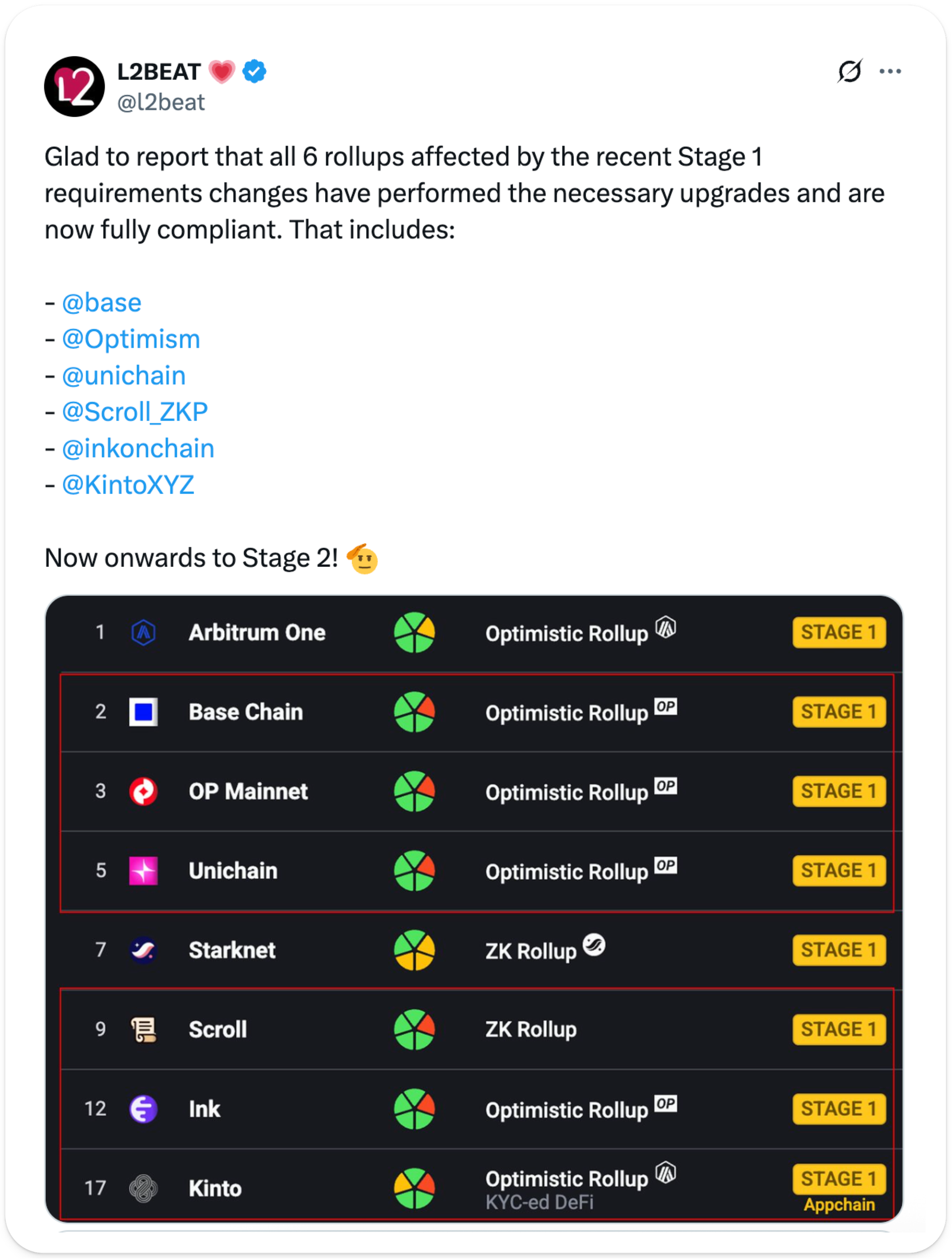

Last week, Vitalik saluted the six Ethereum L2s that had made the necessary upgrades to meet L2Beat's updated Stage 1 decentralization requirements, while highlighting the work ahead to reduce trust assumptions across the Ethereum network.

If you don’t already know, L2Beat performs an invaluable service, operating as an independent analytics and research platform on the World Computer’s L2s. The firm evaluates L2 security architecture — including proof systems, data availability, and governance — and classifies projects under its Stages Framework, a system developed in collaboration with Vitalik to grade how decentralized and trustless these networks are, aiming to make risks clear to users and push the ecosystem toward higher standards.

These six recently upgraded L2s (Base, Optimism, Unichain, Scroll, Ink, and Kinto) join Arbitrum One and Starknet as the rollups currently meeting Stage 1 designation.

But what does it mean that these chains are now Stage 1? What security benefits do they come with and what else is new in this updated Recategorization framework from L2Beat? Today, we’ll explore that while providing an overview on all of L2Beat’s major efforts to support and guide Ethereum’s scaling with clear, productive definitions and expectations for its network of chains.

Inside the Recategorization Framework

So, we’re now four years into Ethereum’s rollup-centric roadmap.

By December of last year, when L2Beat formally announced its Recategorization framework, there were around 50 rollups and 70 alt-data availability (DA) L2s live, collectively holding over $50B in TVL.

Most of these “L2s” lacked proof systems entirely though, meaning users needed to fully trust the multisig’s operators with their funds. Beyond OP Mainnet and Base, most OP Stack deployments and (Arbitrum) Orbit chains fell into this category too, with some even configured so a single entity could propose state summaries or deal with future fraud challenges.

Beyond the troubling technical architecture, the governance situation proved worrisome, too.

At that time, only six projects — Arbitrum One, OP Mainnet, ZKsync Era, Fuel Ignition, Kroma, and Kinto — had proper Security Councils (multisigs with at least 8 members, 75% voting thresholds, and meaningful geographic distribution). The rest were controlled by small internal multisigs.

For alt-DA L2s like EigenDA or Celestia, the trust assumptions at the time were "abysmal," L2Beat's team wrote. Most relied on tiny committees with no guarantees about where data was actually published, or blindly trusted centralized sequencers to accurately relay proofs about the chain’s transaction data.

Put most simply: for most L2s, permissioned operators could steal or freeze user funds. This reality prompted Recategorization — the major update here being that, to classify as a Rollup, an L2 must use a proof system and verify every state transition on Ethereum, enabling permissionless exits so users can withdraw even if all operators vanish.

For Stage 1 rollups this may still require help from the Security Council, while Stage 2 rollups allow exits entirely without intervention. Alt-DA L2s don’t escape this requirement, and must also include a data-availability bridge to Ethereum or a robust data-availability committee. Without this, a rollup doesn’t classify as even Stage 0.

When this framework went live in mid-June, and after reviewing all 136 listed projects under the new framework, only 26 retained their L2 status, and, to date, only 8 have achieved Stage 1 classification.

The Stage 1 Upgrades

Stage 1 serves the middle-ground for L2s meeting 'rollup' classification requirements but still failing to achieve some important checks against centralization (Stage 0) and those showcasing fully autonomous smart contracts (Stage 2).

Under the new Recategorization framework, for a rollup to be classified as Stage 1 it must meet two core requirements:

- Security Council threshold — A large, diverse, and geographically distributed multisig must approve major protocol changes with at least a 75% consensus, and at least 26% of members must be independent of the core team. This means the only way to permanently block a withdrawal or push through a fake one is if 75% or more of the Security Council is compromised.

- Permissionless exits — Users must be able to withdraw their funds even if the people in charge of running or approving the network, such as multisig members or sequencers, go offline or act maliciously. This can only happen if the system uses a built-in proof process on Ethereum that ensures the network’s transaction history is correct, removing the risk that those in control could block or steal withdrawals.

The proof system requirement isn't just about technical strength. Without one, a Security Council exposes itself to someone bribing just a few members to ignore a malicious update and compromising the chain. But, with a proof system in place, that kind of attack becomes much harder — proposers can’t just submit false information, and an attacker would need to bribe a majority of council members to actively approve the change.

Other L2Beat Upgrades

While Recategorization certainly stands out as the most significant update L2Beat has made in recent months, it certainly isn’t the only one.

- On July 8th, the team upgraded their Liveness Tracking — which monitors if L2s are regularly posting transaction data, state, and proofs to their settlement layers. If this data flow stops, recent activity could be lost and withdrawals blocked. The update adds an Anomalies view, showing when an L2 hasn’t posted for unusually long (e.g., over 24 hours), with total downtime, last update time, and average frequency — giving users early warning of potential instability.

- Next came the UOPS/TPS Ratio Chart on July 23rd, which tracks the ratio of user operations per second (UOPS) to transactions per second (TPS) — a key signal of smart account and bundling protocol adoption. High ratios often mean the chain uses its own smart wallets or supports account abstraction, with standouts here being World Chain, Base, and Starknet.

A Critical Magnifying Lens

The shift from December’s assessment to August’s achievements shows Ethereum's L2 network maturing through clear standards and accountability, with momentum driven not just by price or institutional buys, but by a concerted push toward genuine decentralization.

Thanks to L2Beat's recent upgrades, users can more easily differentiate between the mature chains aligned with this vision, and those that are either still scaling up or just along for the ride. This transparency matters. For users, we can make informed decisions about where to deposit funds. Meanwhile, developers have a clear benchmark to hold themselves to.

But as Vitalik Buterin noted in his spotlight, reaching Stage 1 is just a checkpoint. The next critical priority is reducing withdrawal times from the current multi-day delays to under an hour — ideally seconds. These lengthy delays still force users to rely on risky third-party bridges, reintroducing the very trust assumptions that rollups were meant to eliminate.

With Vitalik's pledge to only endorse Stage 1+ rollups now in effect and L2Beat's stricter framework providing clear benchmarks, the path forward is set. Now, it's time to push more teams to get on board.

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Jake Chervinsky and Amanda Tuminelli join us to unpack the Roman Storm verdict — what it means for DeFi, why Section 1960 is a looming threat to open-source developers, and the strong grounds for appeal.

We discuss the legal, political, and legislative paths forward, the role of Congress in protecting developers, and how the crypto industry can mobilize to prevent future prosecutions.

Listen to the full episode 👇

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.