ETF Rumor Roller Coaster

1️⃣ Will the spot BTC ETF get approved?

It's in the SEC's hands now. The final filings are in, and Crypto Twitter is expecting a euphoric next week with multiple approvals. The confidence was tested throughout the week as the market dealt with mixed signals and crossed timelines.

The biggest shock was a report from the analytics firm Matrixport signaling that spot ETF applications were unlikely to be approved. The report's wide release was believed by some to have triggered a crypto selloff that momentarily gave crypto one of its worst single-day declines in more than a year.

But as news emerged Friday of continued negotiations between applicants and the SEC, the broader consensus shifted towards optimism, believing that the SEC has been boxed into a corner and will have to ship some approvals early next week. We shall see!

2️⃣ What about the spot ether ETF?

Amid all of the Bitcoin ETF chatter, there have been whispers about whether its approval would mean that a spot ETH ETF is inevitable as well. There are some mixed signals here, too.

This week, Bloomberg ETF analyst James Seyffart said that spot ETH ETF approval was still likely this year since the SEC had basically accepted ETH as a commodity by approving the ETH futures ETF.

But the approval situations are still quite different, according to industry insiders.

From The Block:

A high-placed executive at an issuer claimed that the notion of a spot ether ETF is still up in the air... The source said that the SEC's approval of futures-based bitcoin ETFs forced its hand to eventually approve a spot fund. This is because the agency disapproved previous proposals based on price manipulation, which issuers for a spot fund were able to address. It also provided a legal basis to fight for a spot fund, which was evident in Grayscale’s fight with the SEC.

As for ETH, the SEC hasn’t provided disapproval for such a fund and thereby has not back itself into a corner.

3️⃣ Solana NFTs beat out ETH's Dec volumes

ETH's relative underperformance to SOL in this bull run is being felt by NFT traders in those ecosystems, too.

Solana NFT trading saw more volume in December compared to NFTs on Ethereum, according to CryptoSlam, with $366.5 million versus $353.2 million. These numbers filtered out transactions flagged as "wash trading" by the analytics platform.

This volume flippening comes as NFT traders also have begun more earnestly chasing volumes on Bitcoin Ordinals.

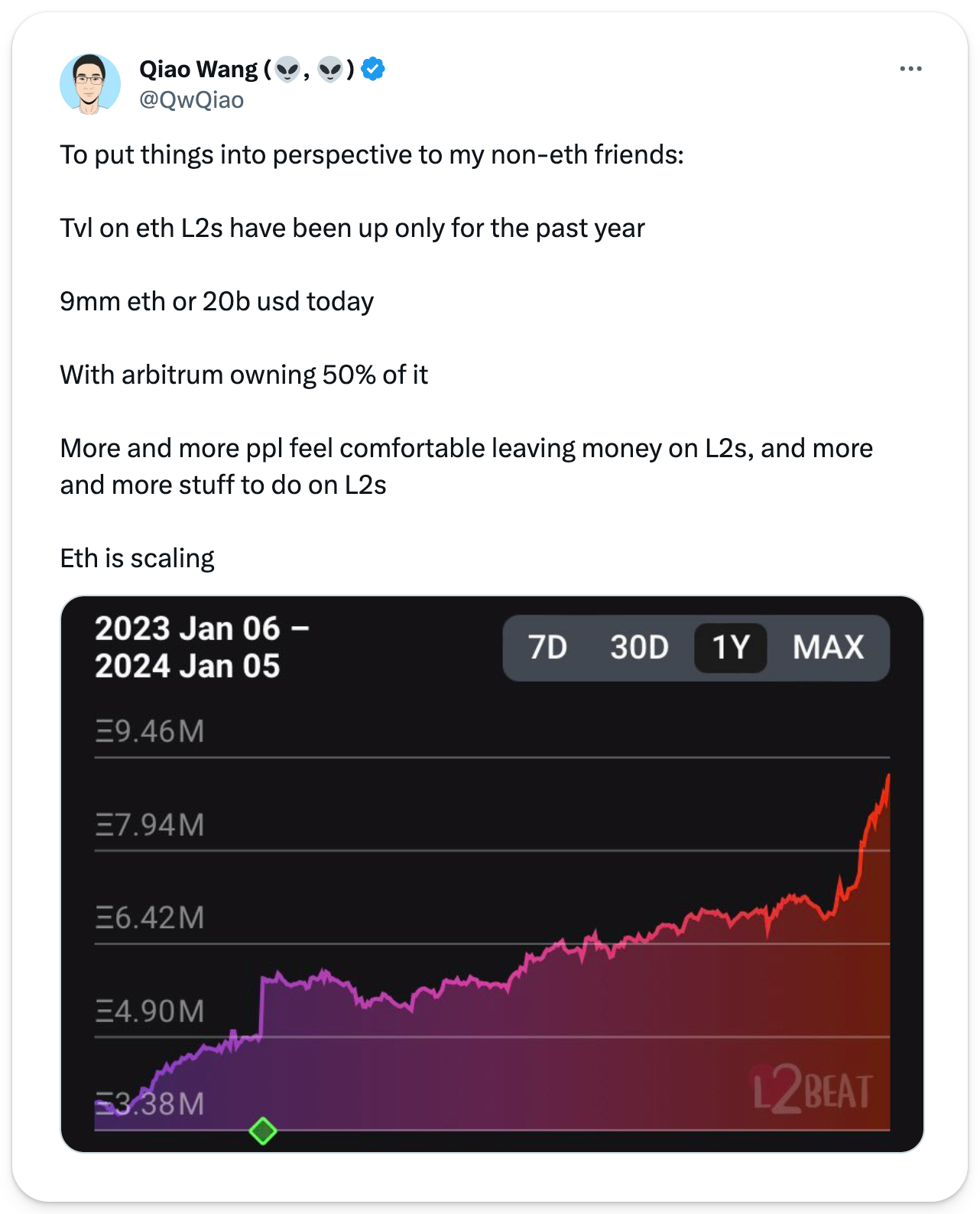

4️⃣ Arbitrum's revenge

While Arbitrum spent much of 2023 playing second fiddle to Optimism narratives around the Superchain, the network has been on a tear over the past month, amassing TVL and seeing its native token reach new ATHs.

Arbitrum crossed the $2.5 billion TVL marker this week, and its native token ARB hit a new all-time high at $2.08 before retracing some of those gains on Friday. The token is currently trading at a $17.7 billion FDV.

5️⃣ Celestia's TIA keeps climbing

Celestia continues to be one of the hottest networks in crypto. Despite a mixed week for most native tokens, TIA is up nearly 30% on the week as traders continue to ape into Cosmos ecosystem tokens and other tokens that fit the "modular blockchain" narrative.

Stay tuned to the Daily Brief next week, where we'll have a guide on staking TIA!