ElizaOS Goes Multichain

View in Browser

Sponsor: Bit Digital — ETH treasury that combines the two greatest assets of our time: ETH & AI.

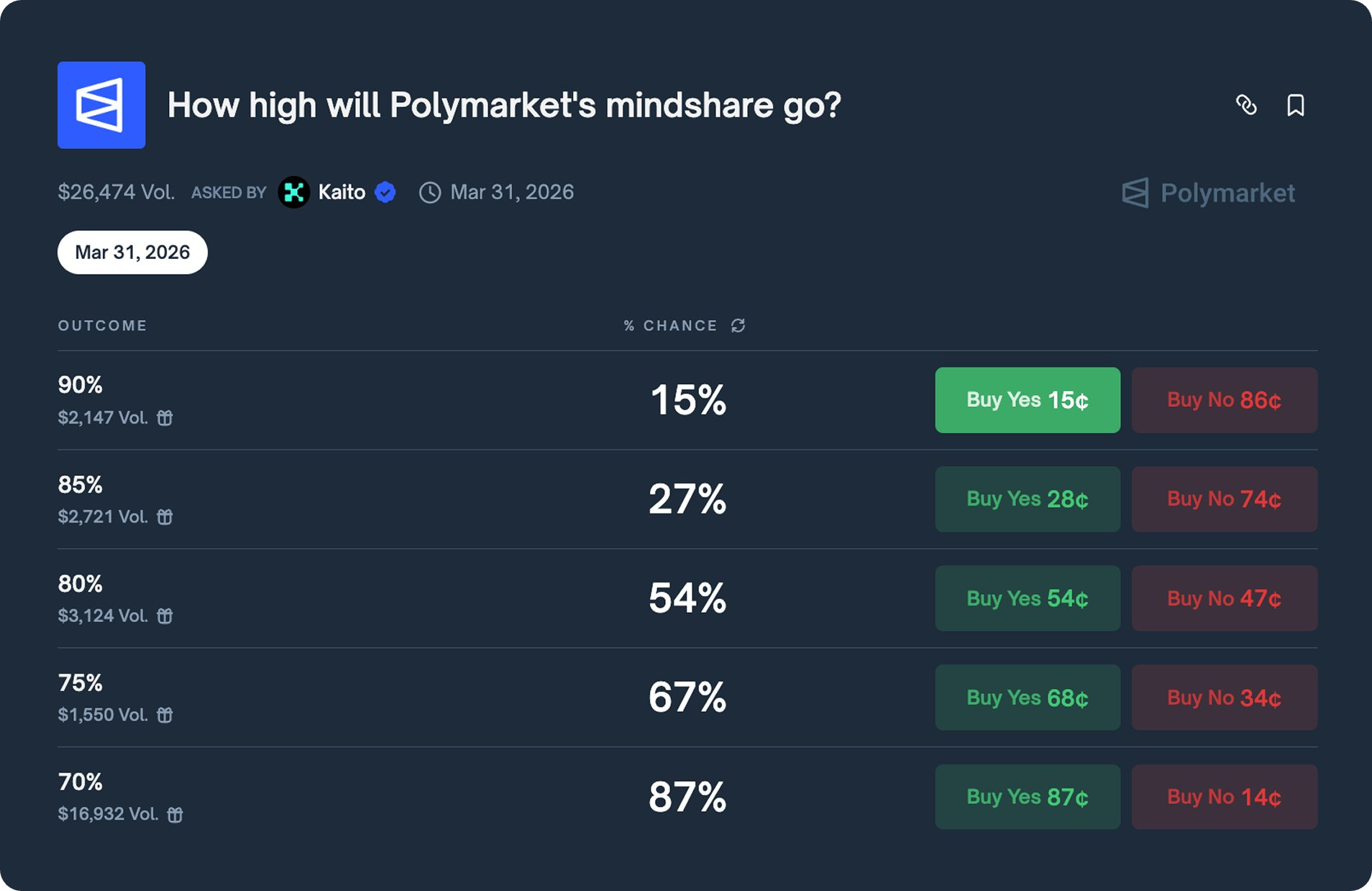

This week, a brand new category landed on Polymarket: verifiable mindshare markets, powered by Kaito and EigenCloud.

Mindshare signals how much attention a project is getting across crypto's social sphere. Kaito's bread and butter is scraping, modeling, and ranking this data, and now you can trade directly on this info.

Under the hood, Kaito is using EigenCloud’s verifiable AI stack (running atop EigenLayer) so that its mindshare inferences can be cryptographically checked. Additionally, Brevis's zk layer ensures the mindshare calculations themselves can't be spoofed.

As such, the first mindshare market just went live: How high will Polymarket’s mindshare go?

This particular market will run until March 31st, 2026, and you can bet here across multiple thresholds (70%, 75%, 80%, 85%, and 90%), all of which reference finalized daily mindshare values from Kaito’s Info Markets page.

If you're already a Polymarket fan, this new class of AI markets is worth checking out. And more mindshare markets will be rolling out in short order, so expect a growing range of opportunities to predict attention flows in crypto.

Two weeks ago, ElizaOS completed one of crypto's quieter yet more consequential recent infrastructure moves: migrating from Solana-native $AI16Z to a fully multichain $ELIZAOS token that calls Ethereum and the EVM its homebase.

Currently live and ongoing, the migration began on November 7th with the project executing a full redenomination and deploying identical token contracts across Ethereum, Base, BNB Chain, and Solana simultaneously, with the help of Chainlink's CCIP.

Old $AI16Z holders burn their tokens and receive new $ELIZAOS at a 1:6 ratio — six tokens go directly to their wallet on the chain they choose, while four flow into the protocol's "Generative Treasury," a pool managed entirely by autonomous agents.

Amid a flurry of other announcements from Eliza, the upgrade itself can seem confusing, especially since Eliza and Shaw, the project's founder, have been banned from Twitter, making it harder to cobble together the full picture.

As such, in this article, I'll explain the crux of the Ethereum migration and ElizaOS upgrade, touch on the state of the ecosystem and some standout projects building in it, and shine a light on what we know of the product releases and Eliza roadmap still to come.

What Actually Happened in the Migration

Beyond Chainlink's CCIP being at the heart of ElizaOS's new token, it also powers their agent framework. Thanks to the integration, agents can move both tokens and arbitrary messages (intents, instructions, state) between major EVM and non-EVM chains.

The result? An agent can observe a signal on Solana, analyze another on Base, execute a trade on Ethereum, and route the profits to BNB Chain — all in one coherent workflow, without wrapped tokens, locks, or trust in a third-party bridge.

Vector memory remains with the agent the whole time, so knowledge learned on one chain (e.g. a profitable trading pattern on Base) is instantly available when the same agent acts on Ethereum.

Eliza's fusion with Ethereum doesn't end there. Alongside this commitment and migration to Ethereum comes more tangible integrations like:

- Full native support for ERC-8004, meaning Eliza agents can have a portable ERC-721 identity, so they can develop reputations — useful when corresponding with other agents.

- Integration with EigenCloud as an execution environment, letting agents prove they ran the exact code and model you deployed — particularly useful when agents are handling real capital.

Put together, these features "freeEliza" as the team likes to say — meaning agents are finally free to live, learn, earn, and move anywhere, with Ethereum and its L2s as the natural settlement and coordination hub.

The Ecosystem That's Already Live

Despite Virtuals dominating the agentic discussion in recent months, ElizaOS's ecosystem has been anything but stalling. The framework currently clocks in at 50K+ deployed agents, ~17K GitHub stars, and 1.3K+ contributors.

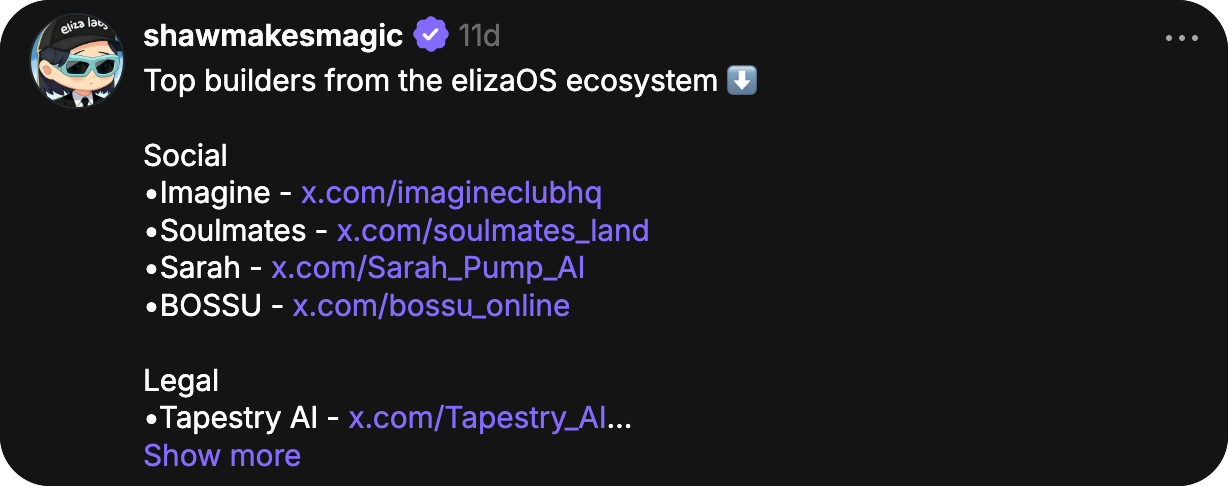

If you're interested in playing around with some of the agents in the ecosystem, Shaw recently spotlighted the "top builders in the ecosystems." Since it's a rather long list, I pulled together the ones which stood out most to me below:

- Imagine – agents autonomously generating and minting videos/images on Zora, paid via x402

- Metalos – AI-driven vaults for farming and optimizing yields

- Senpi — an AI-powered wallet which helps surface signal, execute trades, and manage your portfolio

- Reveel – stablecoin payments agent embedded in DMs, 250k+ users, $180M+ annualized volume

I've included the full list below if you'd like to do more digging on your own.

What's Coming Next

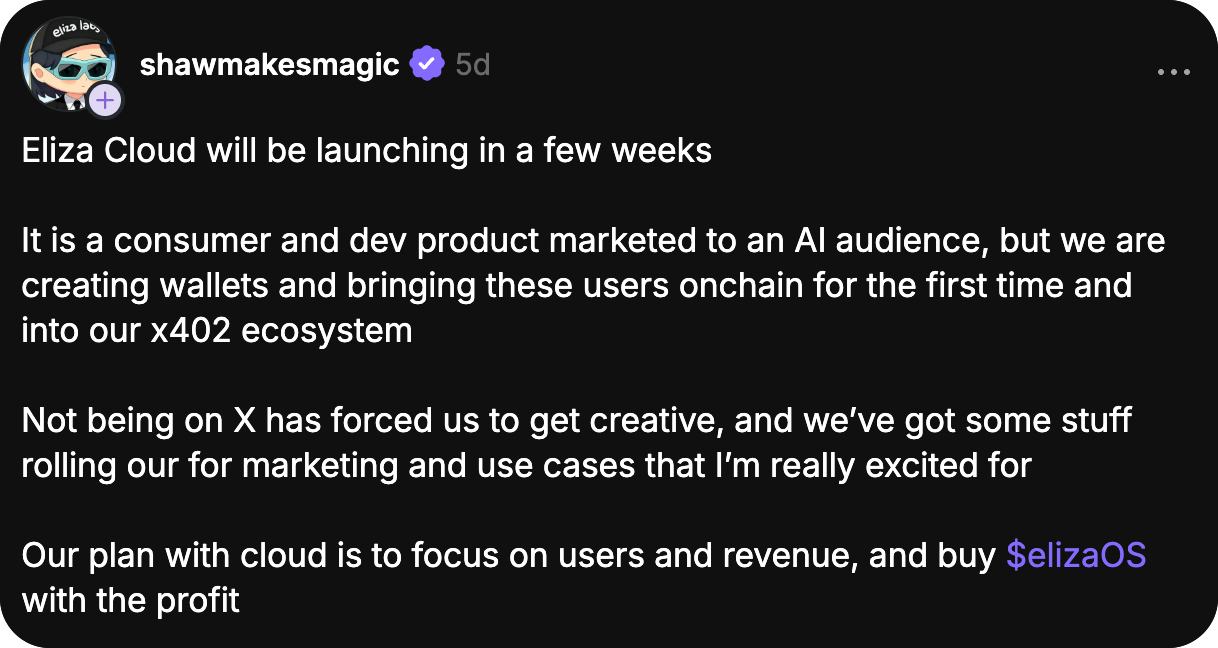

From what's been shared on socials, the next big release for Eliza seems to be Eliza Cloud, which will be a "consumer and dev product marketed to an AI audience," intended to bring users onchain through the use of x402 and wallets on the backend. Shaw has stated the goal here is to grow revenue for the project, which will be used to buyback and burn $ELIZAOS.

The Token Question That Remains

For all the technical progress, one gap stands out: the role of $ELIZAOS itself within the ecosystem remains undefined.

The migration forced a 40% "tithe" from holders into the Generative Treasury, effectively reacquiring a massive position for the protocol. Yet the tokenomics page in Eliza's docs offers no clarity on what the token actually does. Will it be required to pay for services across the network? Is staking on the table? The documentation doesn't say.

This creates a disconnect between the token's value and its actual function. You have a strong, evolving framework with real usage and real builders shipping products — but the token that's supposed to represent that value doesn't yet have a clear connection to those projects.

As such, it's easy to write this migration off as an opportunity for the protocol to recapitalize, but it also highlights a broader issue in crypto: the gap between technical depth and token design.

Investor and researcher Knower recently wrote about this disconnect — how fundamentals often fail to map cleanly to token price, or vice versa. It's different from other markets, where building a cohesive thesis can more reliably translate into returns. The state of Eliza's token exemplifies that gap perfectly.

I'm glad Eliza moved to Ethereum which has become the central hub for crypto x AI thanks to the success of x402, the evolution of the Ethereum Foundation's focus on this intersection, and, of course, the steadfast dedication of builders in the ecosystem.

But, to reach its full potential, Eliza needs to make clear its token's role in the ecosystem it's meant to represent.

If you're still holding legacy $AI16Z, the migration window closes February 4, 2026. After that, the old token is done. Hopefully by then, we'll have more clarity on what the new one is actually for.

Plus, other news this week...

🤖 AI Crypto

- TheoriqAI — Integrated with Lido's stETH for yield farming and attracted $50M+ in under a week.

- Venice — launched Video generation, with 9 models available

- 🔥 Virtuals — Agentic Commerce Protocol passes $100M in aGDP, amount generated from agent-to-agent tasks

- Zyfai — Launches two new agents with Virtuals ACP for crosschain yield farming

📣 General News

- 🔥 Google — Gemini 3 launches as best model to date, introducing new agentic tools, smarter reasoning, and the Nano Banana Pro for image generation

- OpenAI — Group Chats now rolling out globally, allowing users to collaborate with ChatGPT in realtime alongside GPT5.1-Codex Max for coding

- Perplexity — launched mobile version of its Comet agentic browser for Android (be careful!!)

- xAI — Releases Grok 4.1, ranking top among benchmarks for "emotional intelligence"

📚 Reads

- 🔥 a16z — Gas-Fired Intelligence

- Baheet — The New AI Economy

- CoinGecko — x402: Coinbase and the Beginning of the AI Agent Era

Bit Digital: The premier ETH treasury that combines the two greatest assets of our time—ETH & AI compute. Harness massive Ethereum holdings with institutional-grade staking for optimized rewards, while powering cutting-edge AI infrastructure for unparalleled innovation. Unlock the future of digital assets where blockchain meets intelligent computing.

*We’re being compensated by Bit Digital (NASDAQ BTBT) for this ad promoting their company and BTBT. The compensation is paid in cash as a one time payment. You can find additional information about Bit Digital and BTBT on their Investor page at bit-digital.com/investors. Not investment advice.