Elizabeth Warren’s Crypto Holy War

Dear Bankless Nation,

After completely cleansing every bit of corruption from Big Finance, Elizabeth Warren is pivoting to become the face of aggressive crypto regulation.

She's bragged about raising an "Anti-Crypto Army," but is this fight actually about helping "working families" or is it just a lame attempt to villainize something flashy to stay relevant with her base? Hint: it's the second one.

Today, we dig into why Warren's holy war against blockchains makes no sense.

- Bankless team

P.S. Minting for our episode with Lyn Alden just went live!

Elizabeth Warren Wants Progressives to Hate Crypto

Bankless Writer: Donovan Choy

Crypto doesn’t care about your politics.

Consider how it's been used across the political spectrum. Black Lives Matter activists have embraced the immutability of the blockchain to raise awareness of police brutality, Canadian right-wingers turned to Bitcoin in their protests against the Trudeau government, rogue nations have used it to evade the Western sanction regime and libertarians of course, love it.

That’s why it's been weird to see crypto getting so politicized by one party or another.

In her run-up to a third Senate election, Elizabeth Warren is erecting an anti-crypto position as a central plank in her policy platform. A tweet from her official campaign account last week referenced that she was “building an anti-crypto army” for the sake of “working families”.

Anti-crypto? For the working family? It’s a deeply puzzling position considering Warren’s history as a progressive icon.

Warren rose to national prominence as an ardent crusader against Big Finance corruption. In the wake of the Global Financial Crisis, Warren made her name as a cheerleader for increasingly stringent banking regulations, serving as chair of the Congressional Oversight Panel that oversaw the 2008 bank bailouts.

With such an anti-Wall-Street streak, one might have presumed a natural alliance between Warren and the crypto sector. What better way to revolt against Big Finance than to join hands with an industry that's sole purpose has been to design a new financial system out of Big Finance’s control?

Prior to her foray into politics, Warren the academic also strongly opposed bankruptcy laws that would favor big corporations over small businesses and families. What better way to level the legal playing field and hold creditors accountable than in the world of the EVM, where the concept of bankruptcy is moot?

When Celsius was hit by its bad loans to Three Arrows Capital last year, the crypto lender rushed to pay down $400M+ of DeFi loans across Maker, Aave and Compound before they were automatically liquidated by code. We saw the same thing play out in the FTX fiasco, when Alameda quickly resolved its stablecoin loans on the Abracadabra protocol before liquidation.

In DeFi, “a deal is a deal” – you can’t back out.

— Dan Morehead (@dan_pantera) July 13, 2022

Celsius was forced to prioritize paying down its $400mm+ loans on Maker, Aave, and Compound to avoid liquidation.

There is no ability to “re-structure”/renege on smart contracts.

Why DeFi works great: https://t.co/F5q70gBc84 pic.twitter.com/Q3rF0e3EeR

In both cases, debts from loans to CeFi institutions were relegated to the legal system to be sorted out, and they’re still being hashed out by lawyers a year later. It’s not hard to understand. You can spend millions of dollars and years fighting for a better deal in a court of law, but there’s no arguing with a DeFi smart contract. The rules are efficient, transparent and egalitarian.

Despite all of the benefits that crypto might lend to Warren’s professed causes, she’s sought to cast crypto as universally bad. For Warren, crypto might just be the very spawn of the devil itself. It is used to finance terrorism, scam consumers, and is burning down the planet. In her mind, there’s nothing useful about crypto – buying Bitcoin is equivalent to “buying air”.

But fret not – she believes the above are all problems that can be fixed with the stroke of a legislative pen. Warren’s proposed Digital Asset Anti-Money Laundering Act is a draconian bill that, if passed, would introduce KYC requirements for all blockchain validators and crypto wallet providers, ban institutional use of Tornado Cash, and mandate reporting of transactions from offshore bank accounts.

I argued last week why most regulatory fears around crypto are misplaced, but I also know how little facts matter in the realm of public policy.

The truth is crypto has a PR problem. When the average person hears crypto, they aren’t thinking about the potentials of the tech for financial inclusion. They’re thinking about million dollar hacks and scams, and overpriced JPEGs of monkeys as a plaything of the rich. The open nature of crypto transactions and market maneuverings presents a ripe political opportunity for anti-crypto politicians like Warren to misrepresent.

And misrepresent the industry Warren has. Positioning herself as crypto’s public enemy number one makes sense for Warren. For one, the optics are picture-perfect. She gets to throw potshots at financebros and techbros (the amalgamation of which form the grotesque “cryptobro”), boogeymen that she has been vocally critical of.

At the same time, she gets to prop up her brainchild, the anti-corporate Consumer Financial Protection Bureau (CFPB) that she formed in 2011 alongside Barack Obama -- one that's funding scheme is currently undergoing legal scrutiny. The CFPB’s regulatory powers covers the entire gamut of American consumer finance, but it is now treading into speculative advocacy and branding itself as opposed to crypto, wanting to shield teens from crypto and even taking issue with marketing spend by private companies on Super Bowl crypto ads. New CFPB chair Rohit Chopra singled out stablecoins as used purely for speculative purposes and as “a risk to the financial system”.

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. Consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

Going full anti-crypto is nearly costless for Warren. It's unlikely to hurt her electoral chances in her home state. Massachusetts is one of the most well-off states in the U.S., coming up on top with highest median household incomes in 2019 and highest GDP per capita in 2020. Warren’s campaign rhetoric panders to the proverbial “working family”, but Massachusetts holds a disproportionately small number of the 7.1 million unbanked U.S. households that might benefit from new DeFi pathways and products.

Ultimately, Warren’s anti-crypto platform is disingenuous, because it nitpicks the worst of crypto, and tries to present it as "business as usual" to an unknowing public. There is of course nothing wrong with calling out crypto's problems, of which there are many. But Warren’s fixation on crypto's worst amounts to nothing more than populist fear mongering for political profit, and all the while traditional finance stakeholders cheer on the sidelines.

What can the crypto industry do?

The industry will always have political enemies; that's by design. But crypto, shouldn't be losing the support of "progressives" who are frustrated by the status quo financial systems. Warren's message that crypto is merely another plaything for the wealthy has resonated with her base, in part, because of our industry's own blindspots in broadcasting its strengths and successes.

We'll have to realistically assess what we choose to dignify, celebrate or condemn as metrics of industry success. How can we market what we believe to be a once-in-a-lifetime technology responsibly to the mainstream, in a way that doesn't reek of "have fun staying poor" extravagance? The defeat of anti-crypto political populism like Warren's will depend on how well the industry can resolve its own PR problems.

👾 Check out CryptoTaxCalculator.io

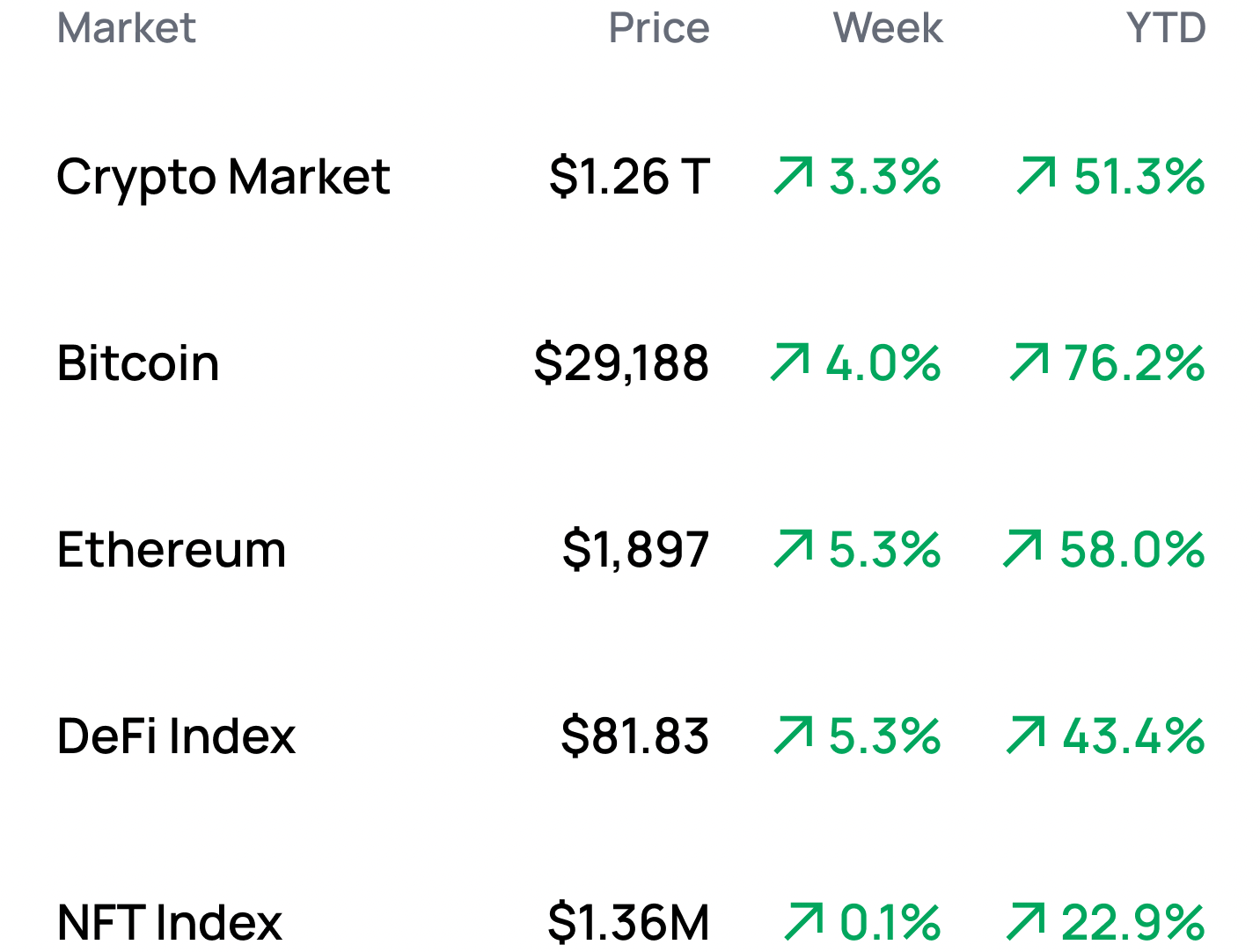

📊 MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 4/10 2:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Learn how to implement single-token strategies on Uniswap

- Participate in V2 of Lyra Governance

- Monitor upcoming Token Unlocks on DeFi Llama

- Play around with Derivio’s testnet

Yield Opportunities 🌾

- ETH: Earn 24% recursive looping stETH with Index Coop’s icETH on Ethereum

- ETH: Earn 12% staking ETH-rETH Curve LP tokens in Convex on Ethereum

- USD: Earn 12% staking alUSD-FRAX/USDC Curve LP tokens in Convex on Ethereum

- USD: Earn 17% staking NOTE-USDT LP tokens in the CLM on Canto

- BTC: Earn 5% LPing the wBTC in Across (bridging protocol)

What’s Hot 🔥

- MicroStrategy buys more BTC and now owns 1/150th of the total supply

- Uniswap volumes surpass Coinbase

- OpenSea launches their OpenSea Pro platform

- Astria announces its shared sequencer network

- OpenEden announces its tokenized treasuries product

Money reads 📚

- How will Ethereum's multi-client philosophy interact with ZK-EVMs? - Vitalik Buterin

- The Web3 Passport Stack - Crypblizz

- Thread on Ordinals - @JamesonMah

- Thread on Mechanics of Market Maker Deals - @thiccythot_

- Building Psychological Attachment — Not Just Ownership — Into Web3 - Li Jin

Governance Alpha 🚨

- Arbitrum debates whether the foundation should return their 700M ARB allocation

- Uniswap weighs deploying on Gnosis Chain

- Redacted votes to launch DINERO

- Gearbox explores overhauling their tokenomics

- GMX proposes allocating 10% of V2 fees to their treasury

Trending Project: [Redacted] Cartel 📈

Analyst: Ben Giove

- Ticker: BTRFLY

- Sector: DeFi

- Network: Ethereum

- FDV: $202.1M

[Redacted] teases their new stablecoin.

- Redacted Cartel is a DeFi conglomerate. Redacted operates several different DeFi products including Hidden Hand, a marketplace for governance bribes and Pirex, a protocol that enables the issuance of LSDs for locked or staked yield bearing tokens like CVX and GMX. Redacted is governed by the BTRFLY token, which holders can lock for rlBTRFLY to earn 50% of protocol revenues and a share of the returns generated from yield farming with the project’s treasury assets (both of which are paid out in ETH).

- On April 6, Redacted released their whitepaper for DINERO. DINERO is a CDP-based stablecoin that will be backed by ETH and pxETH, an LSD that will be issued via Pirex. Redacted also announced that they will be releasing a relayer (called Redacted Relayer), which will use pxETH for validation. Notably, the Relayer will allow users to make meta-transactions, using DINERO as the gas token.

- The price of BTRFLY has risen to begin April, with the token rising 15.6% against USD and 19.3% against ETH month-to-date. This suggests that the market is optimistic that DINERO will help increase Redacted’s revenues. In addition, Nansen Smart Money balances for BTRFLY have increased 22.1% over this time, suggesting that whales are similarly bullish.

The Takeaway: DINERO and the Relayer should help grow and diversify Redacted’s cash-flows, in turn increasing the yield paid to for rlBTRFLY holders who will be the prime beneficiaries of the DAO’s foray into both the stablecoin and LSD markets. With LSDs being all the rage in the lead-up to Shanghai, investors looking for projects that will benefit from the growth of the sector (while still gaining exposure to other areas) may want to take a closer look into Redacted.

Meme of the Week 😂

— Bankless (@BanklessHQ) April 4, 2023