Dear Bankless Nation,

EIP 1559 has been approved for the London hard fork in July.

For those unfamiliar, EIP 1559 is known as “ETH’s burn mechanism” or “Ether’s scarcity engine”. The burn mechanism is what generates all the attention and excitement surrounding the implementation, as burning ETH implies an increase in ETH scarcity as more of it gets burnt from transaction fees.

However, this is only one aspect of the EIP—there are other crucial, non-monetary policy benefits that the implementation brings.

It’s about aligning the growth of Ethereum to the people that protect the Ethereum economy. It’s about long-term sustainability. It’s about producing a system that will last for generations because we built it correctly.

But first, the beginning.

What’s an EIP?

An ‘EIP’ is an '“Ethereum Improvement Proposal”, which follows from Bitcoin’s BIPs, for, you guessed it, Bitcoin Improvement Proposal”.

In open-source software development, anyone can write code and add it to a repository. But including that new code into what is canonically known as ‘Ethereum’ requires the approval of Ethereum core developers, i.e. people who manage the Ethereum depository on Github.

Anyone remember this guy? Bill?

An EIP is like Bill. He needs to go through the process of inclusion in order for the EIP to become the law of the land in Ethereum.

They get proposed, evaluated, edited, tested, and included (or not).

EIP 1559

EIP 1559 is arguably the largest upgrade to any crypto economic system ever. Not only because it changes the monetary policy of the world’s second-most valuable crypto-asset, ETH, but because it is a paradigm shift on how a crypto economic system choose to include transactions into its blocks.

EIP 1559 sort of feels like the blind men and the elephant metaphor:

Depending on the perspective, EIP 1559 does different things:

1. Establishes the “Market Rate” for Transaction Inclusion

EIP 1559 uses a mechanism similar to Bitcoins PoW difficulty adjustment, to automatically find a dynamic equilibrium for gas prices. The difficulty for mining a Bitcoin block automatically adjust upwards when Bitcoin blocks are found faster than 1 block per 10 minutes, and downwards when blocks are mined slower than 10 minutes.

This is how Bitcoin blocks maintain a steady 10-minute average, and importantly this function is built directly into the Bitcoin protocol.

EIP 1559 does the same thing, but with the price for transaction inclusion.

EIP 1559 changes Ethereum to have double the blockspace, but then it targets blocks to only be 50% full. Over time, Ethereum’s blocksize will average out to be the same exact size, but this extra capacity allows for flexibility with transaction inclusion.

If Ethereum blocks are more than 50% full, then the gas costs for inclusion increase. If blocks are less than 50% full, then the gas costs for inclusion decreases.

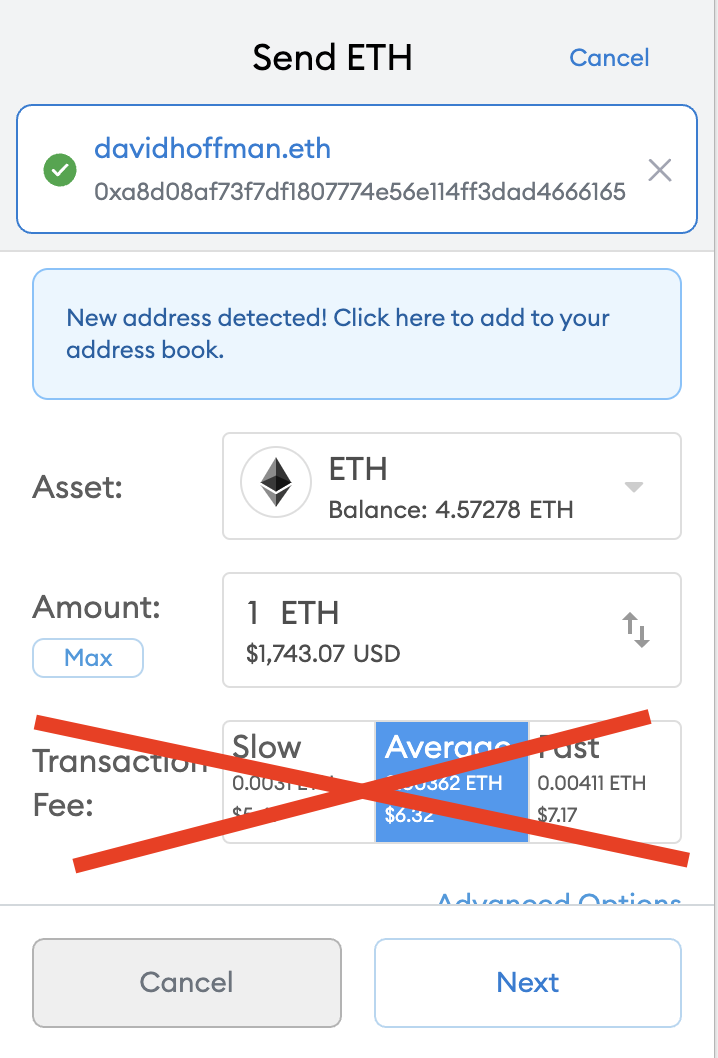

This creates the possibility to eliminate an entire step in the process of making a transaction: setting the gas price:

While crypto-natives and DeFi power users have gotten used to gas management, the process of understanding how to select a gas fee is one of the biggest hurdles that prevents the adoption of crypto. It’s just too foreign for most people to be comfortable with.

EIP 1559 is a UX improvement on how to make a transaction on Ethereum.

2. Mitigating Miner Extractable Value (MEV)

Miner Extractable Value (MEV) refers to the amount of profit that miners can extract from reordering and censoring transactions on-chain. Those that have the power to order transactions (Miners in PoW, Stakers in PoS) have the ability to order the transactions in ways that are maximally profitable for themselves.

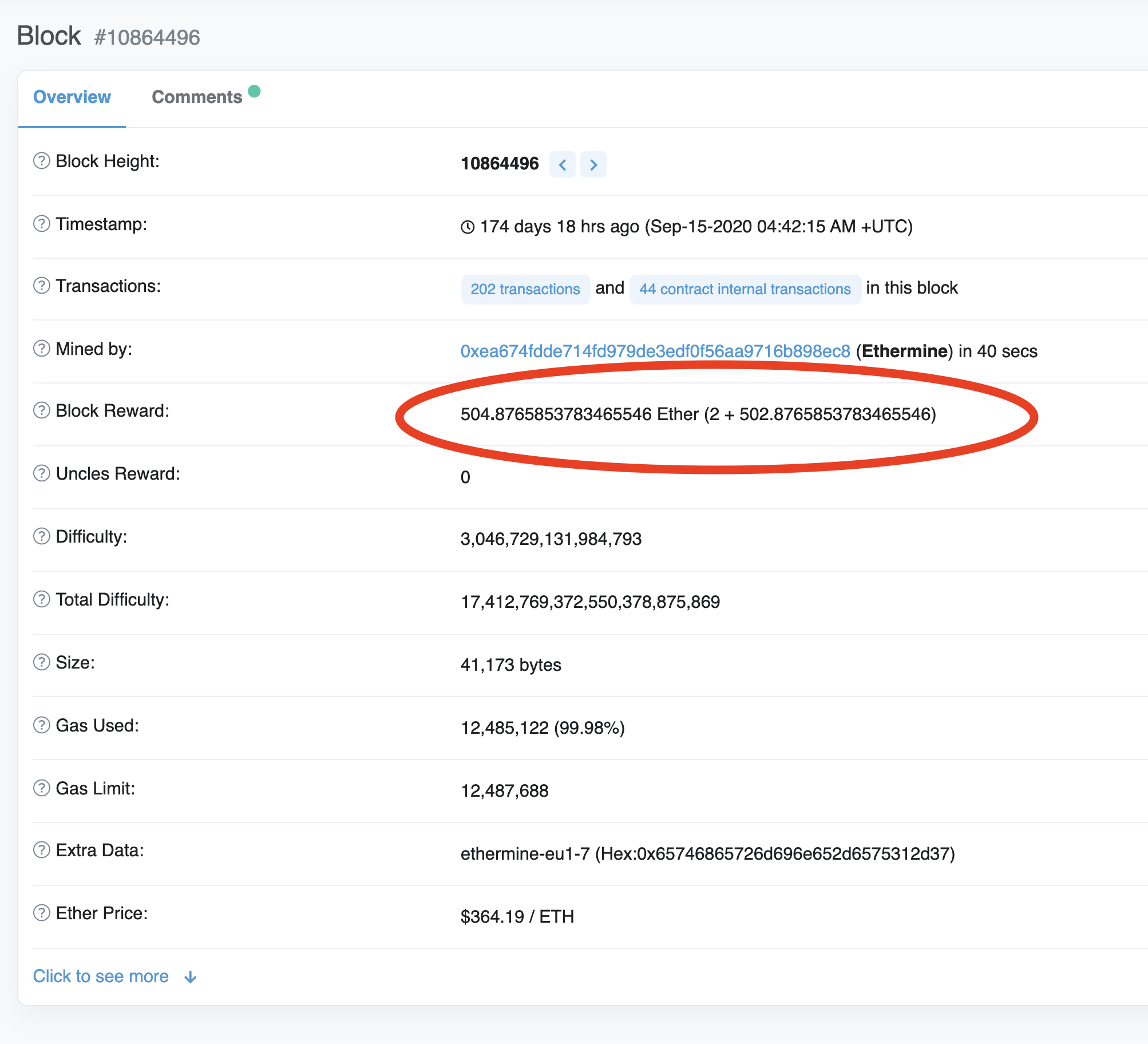

Sometimes, blocks in Ethereum have fee rewards that are significantly higher than the ETH issuance. This is because arbitrage bots engage in bidding wars to extract some amount of arbitrage from Ethereum. Ultimately, this bidding war goes into the hands of the Miners, because the arb-bots will bid an amount of ETH that is up to the value of the arbitrage they will receive.

This is destabilizing for a blockchain. If Block N has 30 ETH paid out in rewards, 2 ETH from ETH issuance, and 28 ETH from fees, then Ethereum won’t be stable for 14 more blocks. All miners are incentivized to not mine on the longest chain, and instead try and re-mine the 30 ETH reward block to claim the fee for themselves.

EIP 1559 fixes this instability by burning all ETH fee rewards paid to miners anyways, significantly reducing the incentive to attempt to mine on an older block, after new blocks have already been propagated.

3. Deflationary Pressure on ETH

While the above mechanisms are fantastic upgrades to Ethereum, EIP 1559 is famous for its impact on the supply schedule of ETH, the native currency of Ethereum.

EIP 1559 formally links the growth of the Ethereum economy to the scarcity of ETH the asset.

Ethereum’s monetary policy is ‘Minimum Viable Issuance’. Enough ETH will be issued to ensure sufficient Ethereum security, and no more. EIP1559 is a mechanism that enables Ethereum to reclaim spent ETH, and to reduce the net issuance of Ether as a function of the demand to transact on Ethereum.

EIP 1559 burns the ETH spent on a transaction fee. That ETH is removed from the supply. Under Proof-of-Stake, the cost to attack the system is a function of how scarce the staking asset is. Under EIP 1559, ETH becomes more scarce, as all transactions on Ethereum burn some amount of ETH. EIP 1559 makes Ethereum more secure.

Because ETH is more scarce due to the deflationary pressure of EIP1559, by proxy we are making ETH more valuable. If the supply of ETH is decreasing due to EIP1559, then it logically follows that the value of ETH is increase. Supply, demand.

But there is a synergistic effect going on here. If EIP 1559 is making ETH more valuable, that means Ethereum doesn’t have to issue as much ETH to achieve the same level of security.

Not only does EIP1559 create a deflationary force upon ETH by burning transaction fees, but it also creates the possibility of reducing ETH issuance as block rewards. If we are issuing 2 ETH per block at $2k per ETH, then we can achieve the same level of security by issuing 1 ETH per block at $4k per ETH.

By burning ETH today, we reduce the need to issue ETH tomorrow.

Ethereum is generating an insane amount of fees (~$15M in the last 24 hours). Under EIP 1559, $15M of ETH burn translates into an additional amount of lesser ETH issuance in the future, according to the “Minimum Viable Issuance” monetary policy.

4. Links ETH to Ethereum

EIP 1559 formally links ETH (the asset) to Ethereum (the network). It does this in a way that returns the value from the Ethereum economy back into the hands of the people who are most aligned with its well-being: ETH holders.

Ethereum as an economy is protected and maintained by ETH holders. Those that believe in the value of ETH are the ones that purchase it and hold it, and protect it from risk. EIP 1559 rewards these individuals who bear the risk of Ethereum and protect it from attack.

With EIP 1559, the GDP of Ethereum is formally captured by ETH, and the value of the Ethereum economy is returned back to the hands of the people that protect the network from attack.

This is simply good mechanism design.

To me, the successful inclusion of EIP 1559 illustrates the balance between centralized innovation from Ethereum researchers and developers, the decentralized community that is capable of identifying a good upgrade when they see one, and loudly rallying behind it until it gets included.

This illustrates that humans can identify good things, coordinate around it in a decentralized fashion, and materialize it into existence.

That’s a positive sign for the future.