Dear Bankless Nation,

If anything, this week has reaffirmed how critical it remains to build out our industry with resilience in mind. While regulators take shots at crypto's biggest entities, many in crypto are also looking at other threats to the resilience of the sector.

Earlier this week, we interviewed EigenLayer's Sreeram Kannan. The EigenLayer protocol has triggered plenty of excitement in recent months, but has also raised plenty of concerns. Today, we dig in.

- Bankless team

Risks and Rewards in Restaking

Bankless Writer: Ben Giove

Crypto infrastructure projects are not typically all that exciting or controversial.

But EigenLayer is proving to be the exception as it continues to capture the attention of crypto natives in recent weeks. The EigenLayer protocol aims to enable something deceptively simple: taking already staked ETH that secures and validates transactions on Ethereum, then restaking it for other purposes.

But amid the hype for earning double-digit-plus yields on staked ETH, concerns have come bubbling to the surface, with some fearing that technologies like restaking could pose systemic risks to Ethereum and its social consensus.

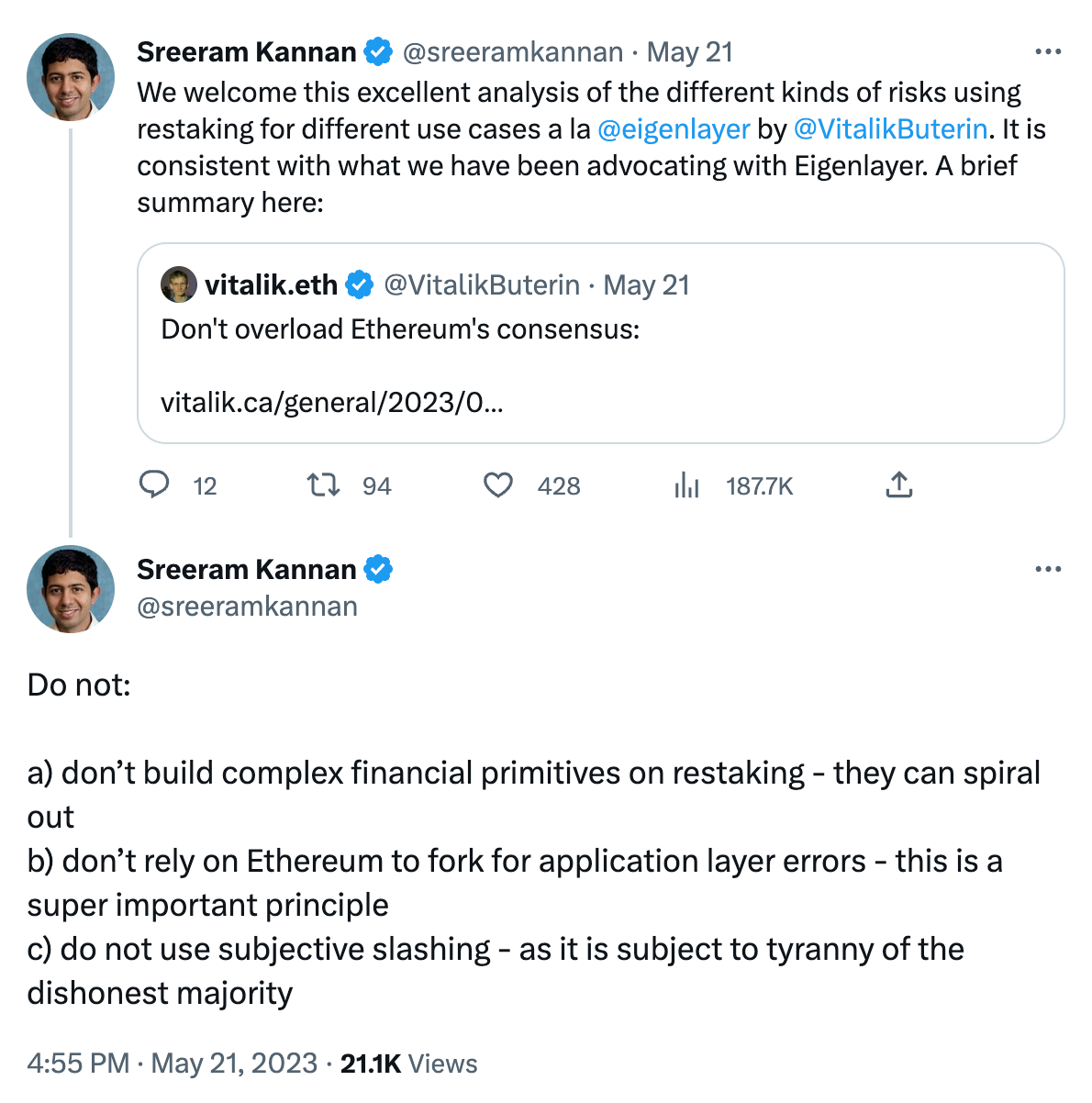

This sentiment was signal-blasted by Vitalik Buterin in a recent post on his blog.

On Monday, the Bankless podcast brought on Sreeram Kannan, the founder of EigenLayer, to talk through his protocol and all things restaking, including his response to Vitalik’s claims, which we've broken down further below.

Let’s take a deeper look at what both Vitalik and Sreeram had to say on the topic...

♦ Follow along with Asymetrix Protocol ♦

The EigenLayer tl;dr

EigenLayer wants to do the equivalent of rehypothecation in traditional finance: re-using previously pledged collateral as the collateral for a new loan.

When restaking, investors take on a new set of slashing conditions (i.e. risk). In exchange, ETH restakers can receive additional rewards to supplement their traditional staking yields.

EigenLayer will act as a marketplace to facilitate this risk transfer, as it connects stakers who want to increase their returns beyond the 4-6% staking yield with applications that are looking to leverage Ethereum’s security and, as Sreeram puts it on the podcast, a network of “decentralized trust.”

The protocol is poised to unlock an entirely new design space of infrastructure protocols and applications including decentralized oracle networks, enshrined rollups, and new liquid staking derivatives (LSDs).

EigenLayer is currently on testnet and freshly funded, as the project announced a $50M Series A raise back in March.

Want to learn more? David has you covered with his piece on the “Restaking Meta.” You can check it out here.

Vitalik’s View on Restaking Risks

Now that we have a basic understanding of EigenLayer, let’s look at what Vitalik has to say.

In his blog post “Don’t overload Ethereum’s consensus”, Vitalik states that while there is nothing inherently wrong with using Ethereum’s validator set for other purposes, these applications should not “recruit its social consensus.”

Put more simply, protocols that utilize technologies like restaking should not be created with the intention of relying on a fork or re-org in order to recoup potential losses that they may suffer. If your protocol screws up, don’t come looking to Ethereum social consensus for a bailout.

Vitalik then walks us through some examples of ways in which the Ethereum validator set could be re-used, and the risks associated with these applications.

One example he describes would be proving that you are the owner of a validator to join a Web3 social network. Under Vitalik’s criteria, this would qualify as a low-risk re-use, as it describes an application “where, even if everything completely breaks, the losses are kept contained to the validators and users who opted in to participating in and using your protocol.”

The Ethereum co-founder also goes in depth on higher-risk applications that could “overload” the network’s social consensus.

In typical Vitalik fashion, he walks us through how something as innocuous as a decentralized oracle network reporting ETH/Forex price feeds could, as a result of political turmoil, lead to a fork where world governments and the community alike are unable to come to consensus on which Ethereum is canonical. Vitalik is not usually one for hyperbole, so it’s alarming that, even as an edge case, he is able to outline how an instance of validator re-use going wrong could have catastrophic consequences for both the on and off-chain worlds.

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

Sreeram’s Take

It's not everyday that Vitalik comments on a rising project. What does Sreeram have to say in response? Towards the end of his interview on the podcast, the EigenLayer founder touched on Vitalik’s critique.

Sreeram stated that he “completely agrees” with the notion that applications which reuse Ethereum’s validator set should not be bailed out by the social consensus of the network.

Furthermore, Sreeram stressed that re-stakers should choose what they secure wisely and not take on excessive amounts of risk, as no white knight fork will be there to save them. He also touched on the various risk mitigation measures within EigenLayer itself, such as the slashing veto and the prevention of over-financialization through means like preventing re-stakers from natively borrowing within the protocol.

This is all reassuring to an extent, but these conversations taking place so early in the protocol's development showcase just how critical it is that the founding team and contributors continue to think thoughtfully about the ecosystem they're shaking up.

We're opening the pandora’s box of restaking, and good intentions are not a systemic risk mitigant.

The Onus is On Us

In the end, it is going to be up to Ethereum’s social layer to defend the sanctity of its social consensus. As long as economic incentives exist, so too will actors that wish to ruthlessly maximize profit for their own ends at any cost.

Whether it be on EigenLayer or any platform, we as a community should advocate for a strict “no bailout” policy when it comes to recouping losses from restaking, or as it relates to any large entity on Ethereum including an L2 or dapps.

Furthermore, we should call out and discourage restaking with applications which explicitly or implicitly imply that they are backstopped by Ethereum social consensus. It’s important, albeit easier, to arrive at these standards now, deep in the throes of a bear market, all before EigenLayer is even live. Down the road, if and when prices soar once again and money is falling from the restaking sky, it may be much more difficult to do so.

EigenLayer could transform Ethereum staking, but with this great power comes a responsibility from the community to ensure it is wielded wisely.