How to Try EigenLayer Early

Dear Bankless Nation,

You're a Bankless reader because you want to be on the cutting edge. One of the cutting edge scenes of Ethereum right now is "restaking."

We gave you the full rundown last week. Today, we're showing you how to take action early.

- Bankless team

How to Prepare for EigenLayer

Bankless Writer: William Peaster

The next big thing in the Ethereum staking scene is EigenLayer, a new “restaking” protocol that’s poised to provide tons of new earning opps for ETH stakers. Today, we’ll walk through the basics of trying EigenLayer on testnet to prepare for the protocol’s arrival and a potential future airdrop.

How to Try EigenLayer Early 🌅

EigenLayer is an up-and-coming protocol built on Ethereum that enables restaking – a new and innovative approach to cryptoeconomic security.

In short, restaking allows users to extend the security of their staked ETH or liquid staking tokens, e.g. Lido’s stETH, to other applications on Ethereum, earning additional rewards on top of ETH staking yields for their service.

Zooming in further, the EigenLayer protocol offers two key innovations: pooled security via restaking and free-market governance.

- Pooled security enables Ethereum validators to extend the security of their staked ETH to additional “modules” on EigenLayer, providing additional revenues for security and validation work.

- Free-market governance empowers validators to decide their risk-reward trade-offs by opting in or out of various modules, making EigenLayer an open marketplace where actively validated services (AVSs) can access the pooled security provided by Ethereum validators.

As Bankless’s very own David Hoffman noted in his article on EigenLayer last week, this restaking concept is similar to the older idea of PoW "Merge Mining," which allowed multiple networks to be mined simultaneously using the same hashing power.

Accordingly, for a Proof of Stake blockchain like Ethereum, restaking lets multiple networks be secured at the same time using the same capital stake i.e., staked ETH.

For example, a consensus protocol built on EigenLayer could employ ETH stakers for security while imposing slashing conditions to mitigate attacks. Anything from bridges to virtual machines can use EigenLayer in this way, thus the project has the potential to significantly enhance the security and profitability of Ethereum's ecosystem!

Stake with Swell 🌊

The current state of EigenLayer 🌐

On April 6, 2023, EigenLayer announced the release of its Stage 1 Testnet, the first phase of the protocol’s three planned launch stages.

The Stage 1 Testnet, built on the Ethereum Goerli network, specifically focuses on onboarding stakers for restaking on EigenLayer. Prospective users should note that this is an early, non-incentivized testnet with code under active development. Treat this like an experiment, because it is one!

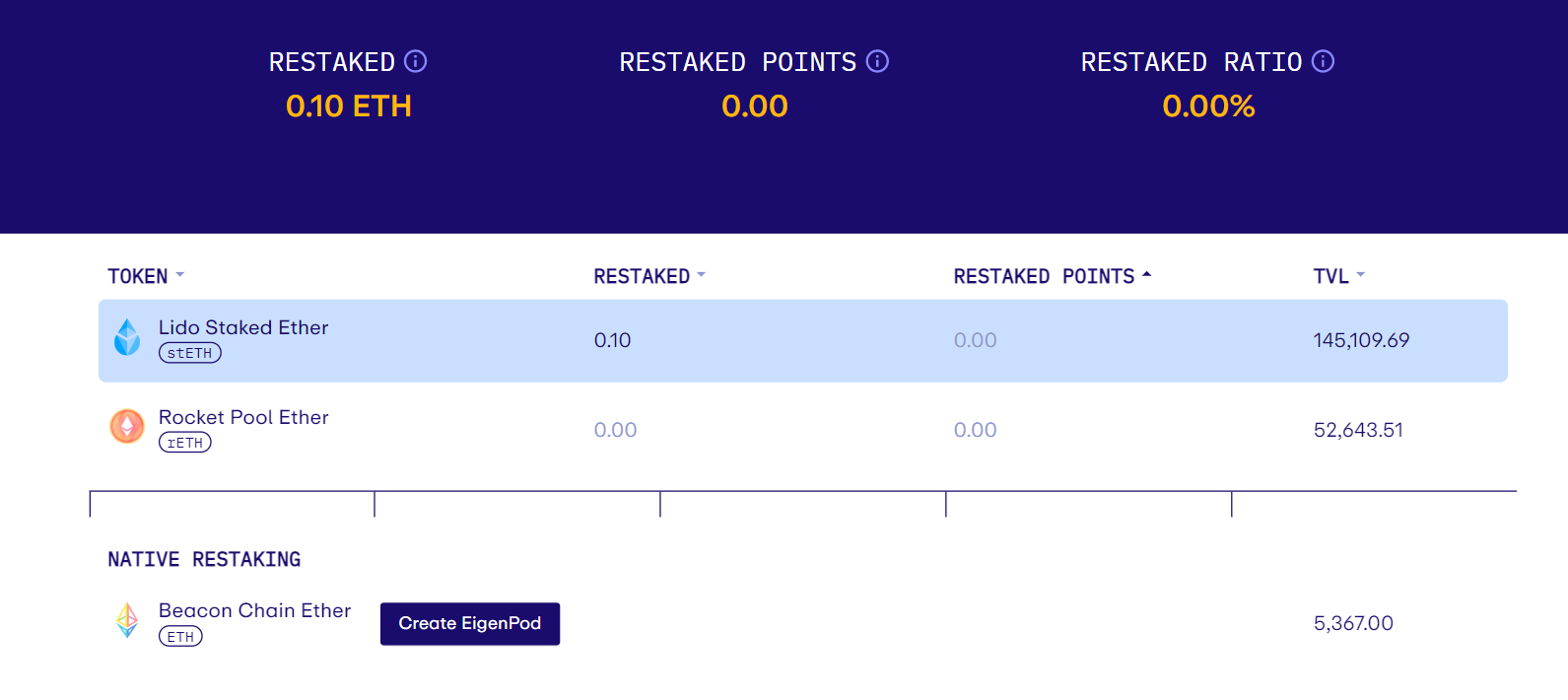

For this initial phase, EigenLayer supports liquid staking tokens like Lido's stETH and Rocket Pool’s rETH for restaking on the platform's contracts, although in the future, restaking native ETH will also be supported.

How to restake on testnet 🪙

The EigenLayer mainnet is set to launch soon, so trying the project on Ethereum’s Goerli testnet now will give you an opportunity to familiarize yourself with its flow and interfaces. That way, when the project is finally live, you can be among the first users to really dive in.

All that said, using EigenLayer on testnet is pretty straightforward, but you’ll need an Ethereum wallet and some Goerli ETH (gETH) for gas costs in order to begin. You can add Goerli to your wallet via Chainlist, and you can use a Goerli faucet if you need to nab some testnet ETH.

Finally, when you’re ready to proceed, you could follow these three general steps:

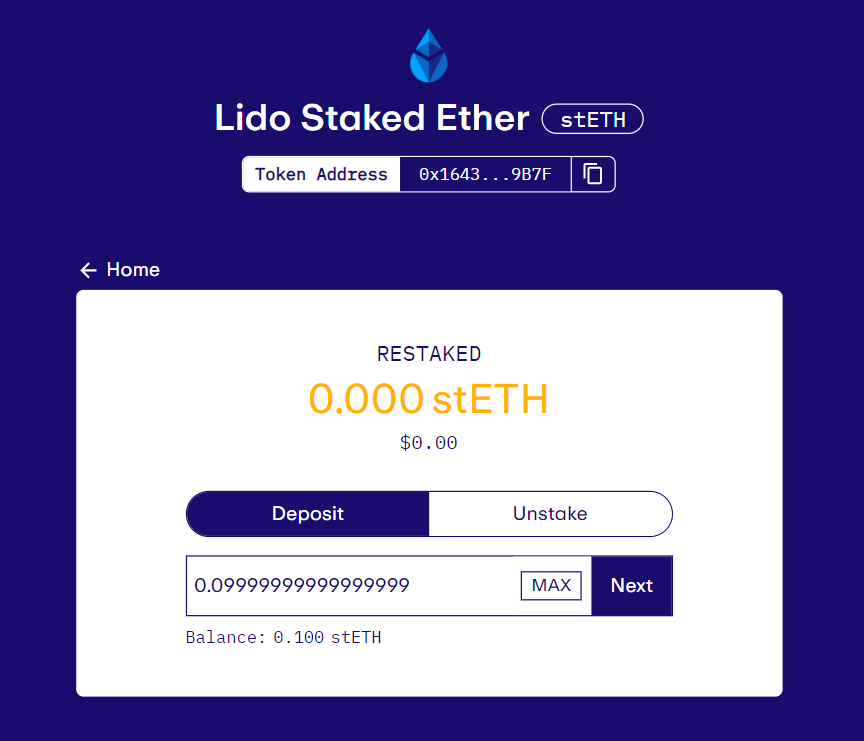

- Acquire testnet stETH — The easiest way forward here is to switch your wallet to the Goerli network and send a small amount of gETH to Lido’s 0x1643E812aE58766192Cf7D2Cf9567dF2C37e9B7F address; this is a smart contract that will automatically send you an equivalent amount of testnet stETH in return!

- Visit EigenLayer — Go to https://goerli.eigenlayer.xyz/, connect your wallet, and switch to the Goerli network if you haven’t already.

- Make your deposit — Click on the “Lido Staked Ether (stETH)” option, input the amount of testnet stETH you want to deposit, and then approve and confirm the transaction with your wallet.

That’s it! That’s the gist of restaking through EigenLayer, nothing too crazy, right? Also, keep in mind that you can unstake your testnet stETH through the same interface you deposited through as you please.

The perks of being early ⌚️

Being ahead of the curve of EigenLayer will be useful in the near-future.

Why? Because there will be key benefits to becoming one of the first restakers on the mainnet EigenLayer deployment.

Among these benefits is earliest access to projects launching on EigenLayer, as certain services might impose limits on their initial restake amounts, leaving latecomers on the outside looking in.

As such, if you try a practice restaking run or two on testnet now, you’ll be more than ready to spring into action and become one of the first official users once EigenLayer drops on mainnet!

You can now stake your ETH through MetaMask with liquid staking providers, Lido and Rocket Pool. Head over to MetaMask Portfolio to get started! You can also view your assets in one place and discover other features such as Buy, Swap, and Bridge.

Action steps

- Try the EigenLayer Stage 1 Testnet: get ready for mainnet by exploring the protocol today! 🌅

- Check out other staking opps: see last week’s tactic write-up on 5 Staking Opportunities for Beginners 🪙

Help us improve Bankless ⚑