Ethereum is catching a major bid as the market adjusts to an eleventh-hour resurgence in optimism around the chances of approval for the first ETH spot ETFs!

With ETH climbing more than 25% in the past week, it’s clear traders are looking to up their exposure to the asset. Investors are also bidding up assets across the EVM ecosystem that they see as beta plays on potential ETF approval.

Today, we’re looking at some of the plays already catching fire, and the tokens and ecosystems that could be poised to take off at any moment 👀

Established ETH Tokens

While many major ETH ecosystem tokens have underperformed ETH for months, shifting winds may push investors to look for unrecognized upside.

MUH $ETH beta pic.twitter.com/lISmqY6Ag8

— Wazz (@WazzCrypto) May 22, 2024

💦 LDO

Lido’s governance token, netted a ~25% boost off of ETF approval rumors, showing how integral the protocol and its LST, stETH, remain to the ecosystem despite declining market share. While EigenLayer's restaking push has threatened to reshape the power dynamics of the staking landscape, LDO and competitors like RocketPool's RPL remain much-aped plays.

The #RPL token with new tokenomics is the best long term risk adjsuted bet on #ETH

— jasperthefriendlyghost.eth (@drjasper_eth) May 20, 2024

100% driven by #ETH fees from #ETH staking with no permissioned control.

Fee switch soon. 2x normal staking yield as a node soon.https://t.co/uI8P6wvpWS

🧑💻 ENS

The governance token of Ethereum Name Service has pumped 50% on the back of broader market games and a notable Vitalik endorsement, who questioned why more people weren't paying attention to what he called Ethereum’s most successful non-financial application.

Vitalik.eth gets it. Do you? 😌🤝 https://t.co/kO9t6a9uET pic.twitter.com/Mruba9nHaL

— ens.eth (@ensdomains) May 21, 2024

🥏 ARB

Amid the rise of fresh L2 competitors, Arbitrum has continued to shine with the largest TVL of all L2s. This strength has not always been reflected in its token, but ARB has climbed in the aftermath of the ETF news. Home to leading DeFi protocols like GMX and Pendle and being the primary infrastructure for L3s, Arbitrum sits securely at the top of the L2 ecosystem.

♻️ ETHFI

Ether.fi's governance token, ETHFI, caught a bid on the ETF news, rising ~20% in the following 24 hours. As a non-custodial liquid restaking protocol, ether.fi allows users to stake assets while retaining control over their private keys, receiving eETH in return. Being the largest LRT by TVL provides ether.fi credibility as an established player in restaking, one whose demand is further solidified by its ties to Pendle and the second season of its points program.

🤡 Memes

Looking to go more degen in your bets? While Base and Solana have been the primary memecoin arenas of this cycle, there are still some major players on mainnet. Just take a look at some established ETH memes like PEPE, BITCOIN, or MOG, which are up ~30%, ~40%, and ~50%, respectively, over the past couple days.

Which coin moves the hardest on the off chance that an $ETH ETF is approved?

— HORSE (@TheFlowHorse) May 20, 2024

My guess is $PEPE

🖼️ ETH-Native NFTs

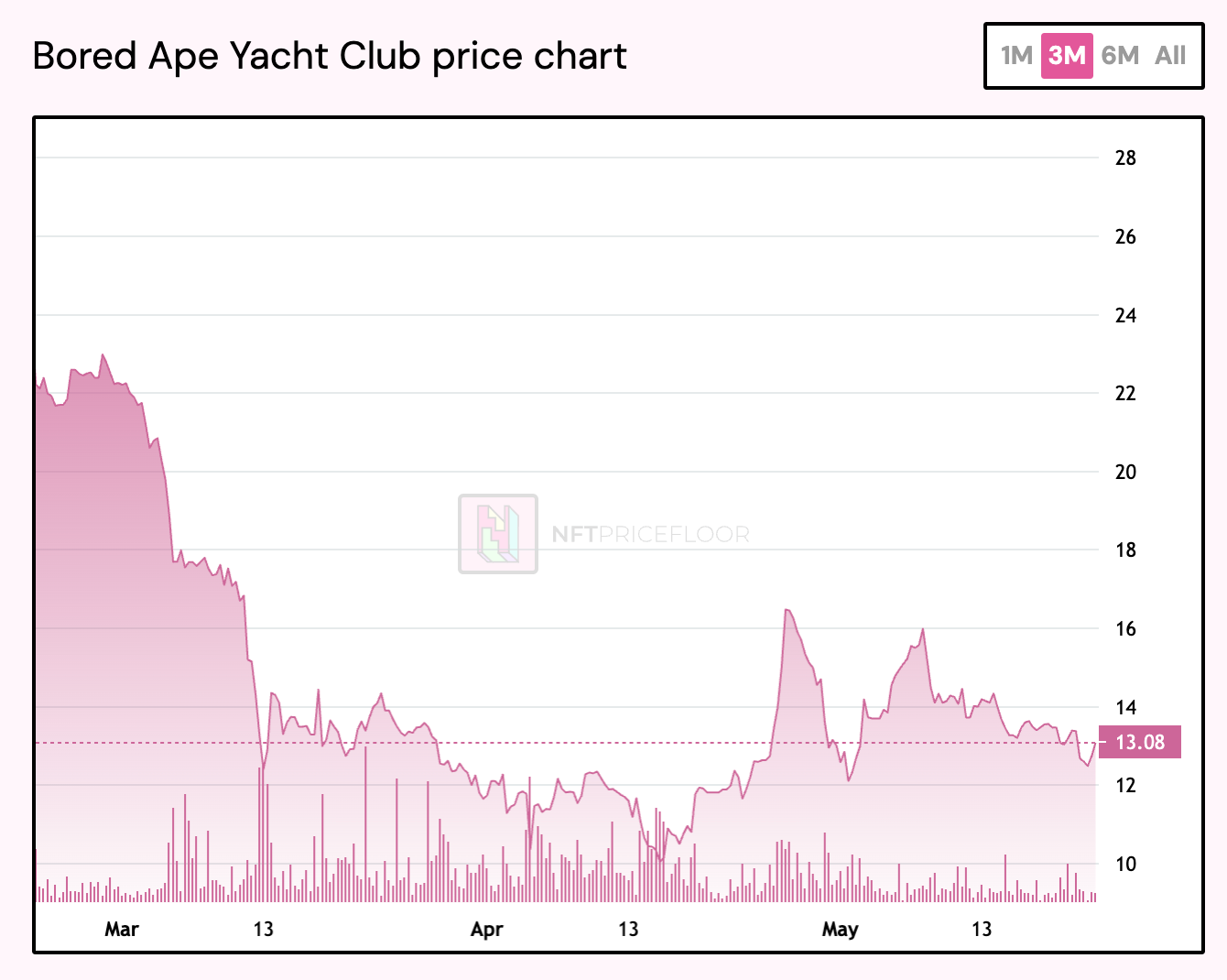

NFTs have been tricky this cycle, with most blue-chip collections underperforming the market or collapsing altogether. Yuga's assets have been dropping for months, but even the stalwart CryptoPunks saw their floor dip below 35 ETH this week for the first time since 2021.

Meanwhile, the most promising ETH NFTs performers have been PFPs that didn't moon during the 2021 cycle, including collections like Miladys, Remilios, Mocaverse, and, shockingly, Pixelmon, which have seen double-digit jumps in their ETH-denominated floor prices this week despite ETH's pump. Overall, the price action suggests more interest in grass-roots communities with more open ocean ahead of them, compared to projects that have already raised venture funding or are deep into complicated roadmaps.

🔵 Base

Yes, there's not a native token (yet), but betting on Base could still be a solid play. Despite stagnating TVL growth, Base continues to offer a convincing narrative as a the consumer L2 hub for Ethereum. Activity and related assets has been pumping since rumors of an SEC reversal on the ETF decision caught fire. Leading ecosystem tokens like DEGEN are up around ~30% this week, with PRIME also up ~20%. Memecoins have performed even better, with some netting three-figure gains.

Make Your Bets

The potential approval of an Ethereum ETF has added to the market’s exuberance, boosting established ETH tokens, ETH-native NFTs, and Ethereum’s popular L2s.

While nothing is certain until the SEC makes its final calls on ETF applications, savvy ETH investors know where Ethereum is going in the long-term and should be loading up their bags accordingly.

I done a 100x long on $ETH back towards Q4 of 2022 during the FTX crash.

— 0x3mp1r3 🇦🇺 (@0x3mp1r3) May 20, 2024

Been paying funding fees on this bad boy since 2022.

Some might call it a flukish gamble, some may call it high conviction on the bottom. pic.twitter.com/lU58dfQPMg