Don't Lose Hype ($)

View in Browser

Sponsor: Uniswap Labs — Uniswap Labs launched a $15.5 million bug bounty to help secure V4.

- 👨⚖️ Do Kwon's Criminal Trial Date Set. The Terraform Labs founder faces up to 130 years in prison.

- 💸 CFTC Subpoenas Coinbase Over Polymarket Customer Data. The CFTC isn't done with its war on predictions market platforms.

- 💰 Circle Donates $1M in USDC to Trump’s Inaugural Committee. The stablecoin giant joins Ripple and Coinbase in donating to the organization.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $3.23T | ↘ 2.7% | ↘ 5.3% |

|

BTC $92,412 | ↘ 2.8% | ↘ 4.5% |

|

ETH $3,219 | ↘ 3.2% | ↘ 6.6% |

Pendle has blazed a trail as one of DeFi’s top players this cycle. Its interest rate marketplaces match crypto users looking to lock returns with others seeking to purchase pure yield exposure on a variety of tokens.

Today, we demystify this game-changing crypto app in hopes of making yield swaps accessible to all 👇

The Pendle Basics

Anyone with money on Ethereum, Arbitrum, Base, BNB, Mantle, or Optimism can interact with Pendle.

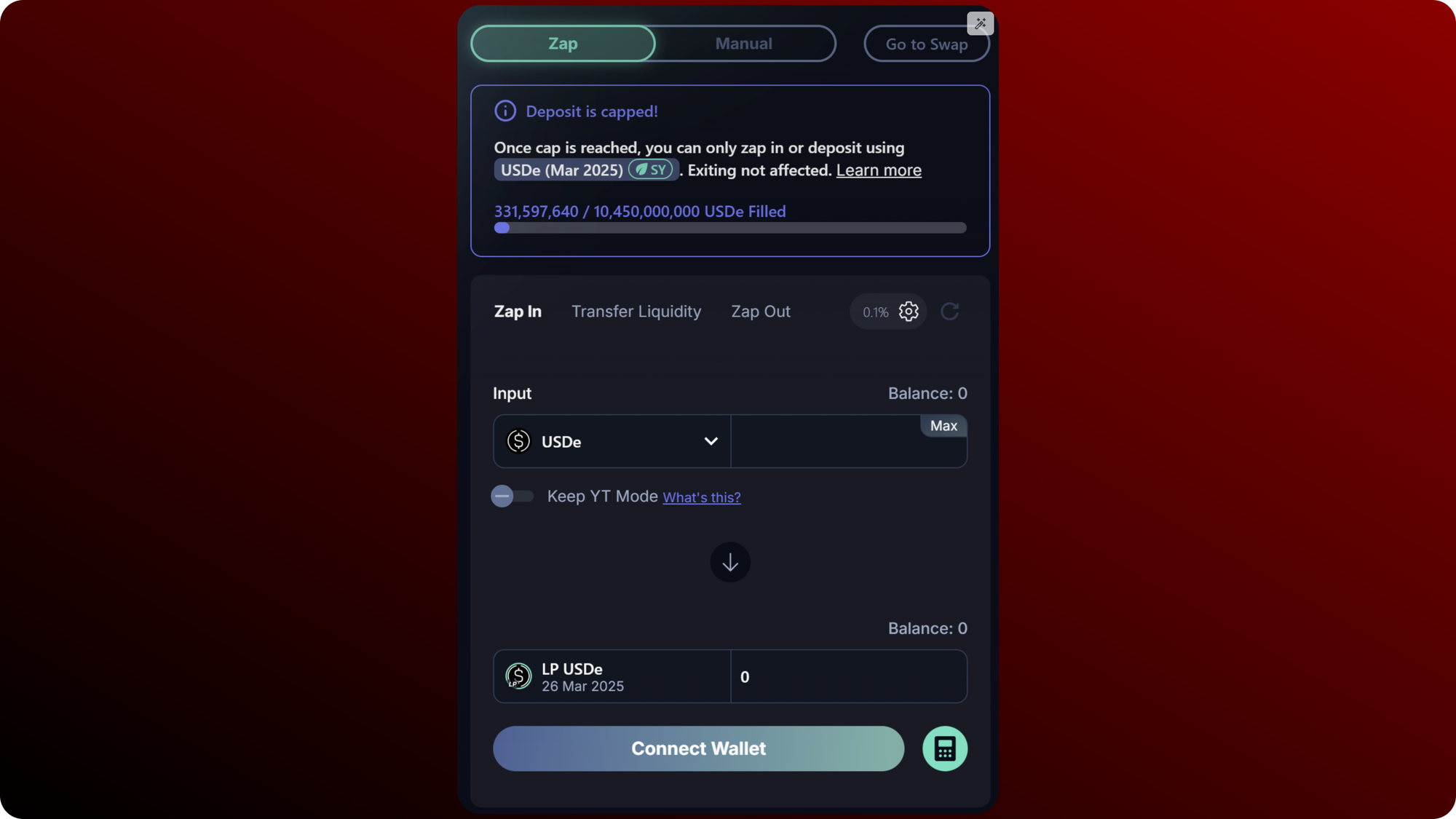

To get started, liquidity providers add their tokens to Pendle’s on-demand trading pools. While only certain tokens can be deposited, Pendle offers markets for many of the most popular yield-bearing assets, and with the aid of Pendle’s “Zap” functionality, users can deposit into pools using virtually any token.

As proof of their deposit, liquidity providers receive LP tokens, which confer ownership over their share of the liquidity pool and can be redeemed at any time for a share of the assets backing the pool (and any accumulated swap fees).

Once tokens are deposited into a Pendle pool, they become standardized yield (SY) tokens, unifying the functionalities across all Pendle deposits regardless of their original token type. From here, liquidity deposits can be further broken down into two distinct types of Pendle-native assets: principal tokens (PTs) and yield tokens (YTs).

Principal tokens represent 1:1 claims on a given crypto asset. They can be purchased for less than the market price of the original token but cannot be converted into the underlying token until the specified maturity date for that individual market. PT holders “fix” their payout upon purchase, as this type of token grants the right to receive a known quantity of crypto tokens at a future date.

Conversely, yield tokens grant their holder with all returns generated by a crypto asset – including any airdrop rewards! YT holders speculate on the “variable” side of the equation and make fixed payments today in exchange for the rights to whatever unknown rewards can be produced by a crypto token until pool maturity.

Advanced Applications

Any token that produces yield or airdrops is theoretically compatible with Pendle, and users can trade yields on a wide range of assets, from receipts in Aerodrome’s VIRTUAL/cbBTC liquidity pool to ether.fi’s liquidBeraBTC Berachain pre-deposits.

The PENDLE token is emitted as an added deposit incentive for liquidity providers, and holders who lock for vePENDLE are entitled to share in protocol fees and receive boosted rewards on deposited liquidity.

Third-party applications, such as Penpie, take advantage of these reward dynamics by pooling together the liquidity deposits and PENDLE of numerous users to gain the maximum possible rewards rate.

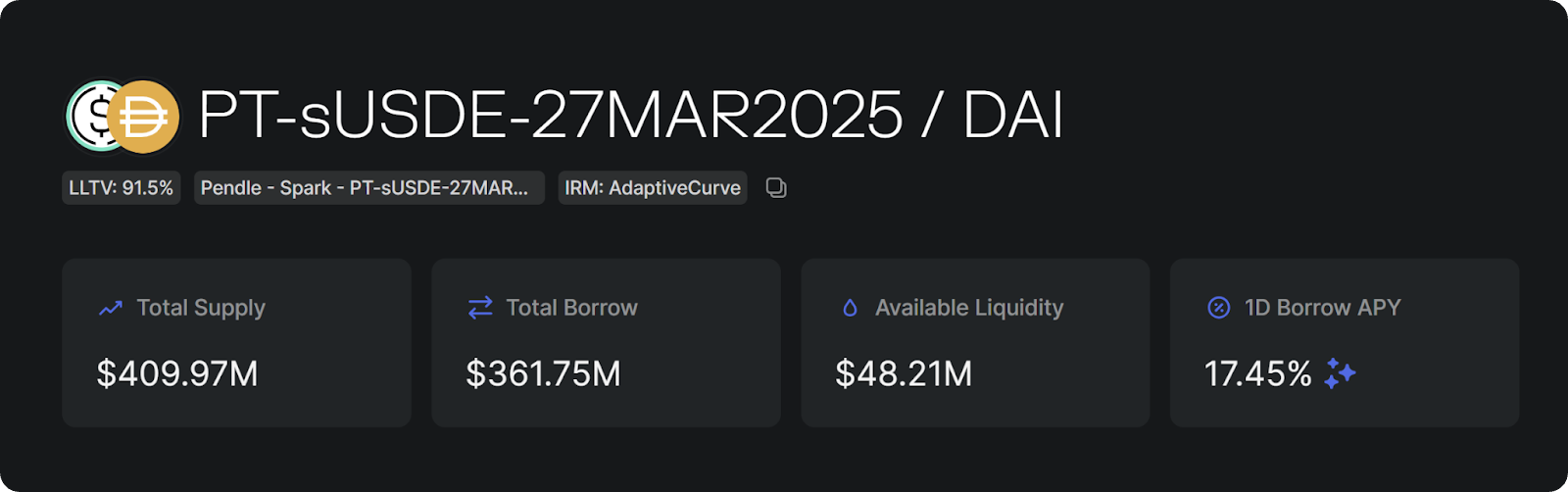

Additionally, Pendle users can borrow against select types of PTs through certain high-risk lending markets, like Morpho and Dolomite.

Catalyst:

Ai16z is an AI agent that was promoted at its launch as an AI hedge fund made to compete with a16z. While the name and goal of the agent caught a lot of traction as is, its open-source framework has prompted many developers to launch their own AI agent, using the same framework called “Eliza” and building off of it.

The GitHub repo for the Eliza framework has gained a lot of attention since its launch, reaching over 10K stars and 2.8K forks. This not only shows that the Eliza framework is one of the best when compared to other AI agent frameworks but also the developer team behind ai16z is one of the best in the space.

The ai16z team has also been working on the tokenomics for the project and the value that it brings back to token holders. In a discussion forum discussing tokenomics, it seems like the team is working on an AI agent launchpad, as well as creating their own L1 sometime in the future. This creates buy pressure around the AI16Z token as users will likely have to burn AI16Z tokens to interact with the launchpad and L1.

Price Impact:

The Bankless Analyst Team is assigning a bullish rating to AI16Z, citing the still nascent interest around AI agents and this team’s foundational plans to create an AI agent launchpad and L1.

Market Plays:

- 🎆 Staking HYPE on Hyperliquid

- 🔃 Trading with leverage on f(x) v2.0

- 🚴 Earning Aerodrome Slipstream LP rewards

- 💸 Lending ETH against Pendle liquidity on Loop

- 🔮 Trying perpetual futures trading on Raydium

Hot Reads:

- 🤖 AI, Crypto, and America - Derek Edws

- 🐂 It’s Still a Bull Market Relax - Kain Warwick

- ✨ Future of Ethereum: Beam Chain - Seungmin Jeon

- ⚔️ A Starter Guide to the Crypto MMO - jez

- 🌐 The Open Source Network Theory - LGHT

Farming Opps:

- 🟠 BTC: 62% APR with Aerodrome’s tBTC-cbBTC pool on Base

- 🟠 BTC: 17% APY with Pendle’s liquidBeraBTC PT on Ethereum

- 🔵 ETH: 19% APR with Aerodrome’s weETH-WETH pool on Base

- 🔵 ETH: 16% APY with Pendle’s liquidBeraETH PT on Ethereum

- 🟢 USD: 24% APR with Convex’s crvUSD-sFRAX vault on Ethereum

- 🟢 USD: 18% APY with Gearbox’s crvUSD vault on Ethereum

Airdrop Hunter:

- 🐻 Berachain: Deposit into Boyco vaults

- 🦁 Derive: Deposit and trade options

- 🪙 Resolv: Buy and hold USR

- 🖥️ Nillion: Interact with testnet

- 💫 Jupiter: Swap assets

Uniswap Labs is offering the largest bug bounty ever: $15.5M for critical bugs in Uniswap v4! Built with community contributions and rigorously audited, v4 will be one of the most audited codebases ever to be deployed onchain, and continues Uniswap’s commitment to security.