Dear Bankless Nation,

Ryan and I had the pleasure of sitting down with Cathie Wood of ARK Invest on Friday to get her perspective on crypto. (Listen to it here 🔥🔥🔥)

ARK does one thing: invest in technologies that will define the future. And they do this extremely well. More importantly, ARK invests in paradigm-breaking technologies that the rest of the market is fundamentally mispricing.

Cathie thinks “the future of investing is investing in the future” and it’s this thesis that’s driven ARK to become a financial behemoth—over $75b in assets!

Where older financial institutions look at markets retroactively in order to establish metrics and models to guide investments, ARK looks at markets prospectively, by looking into the future and investing in the technologies that will shape it.

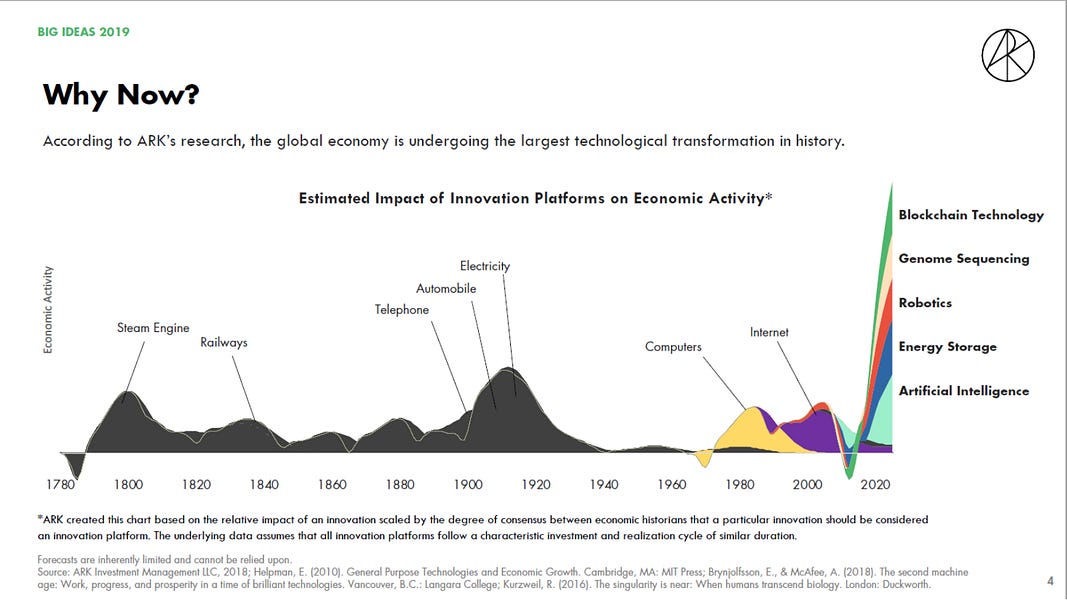

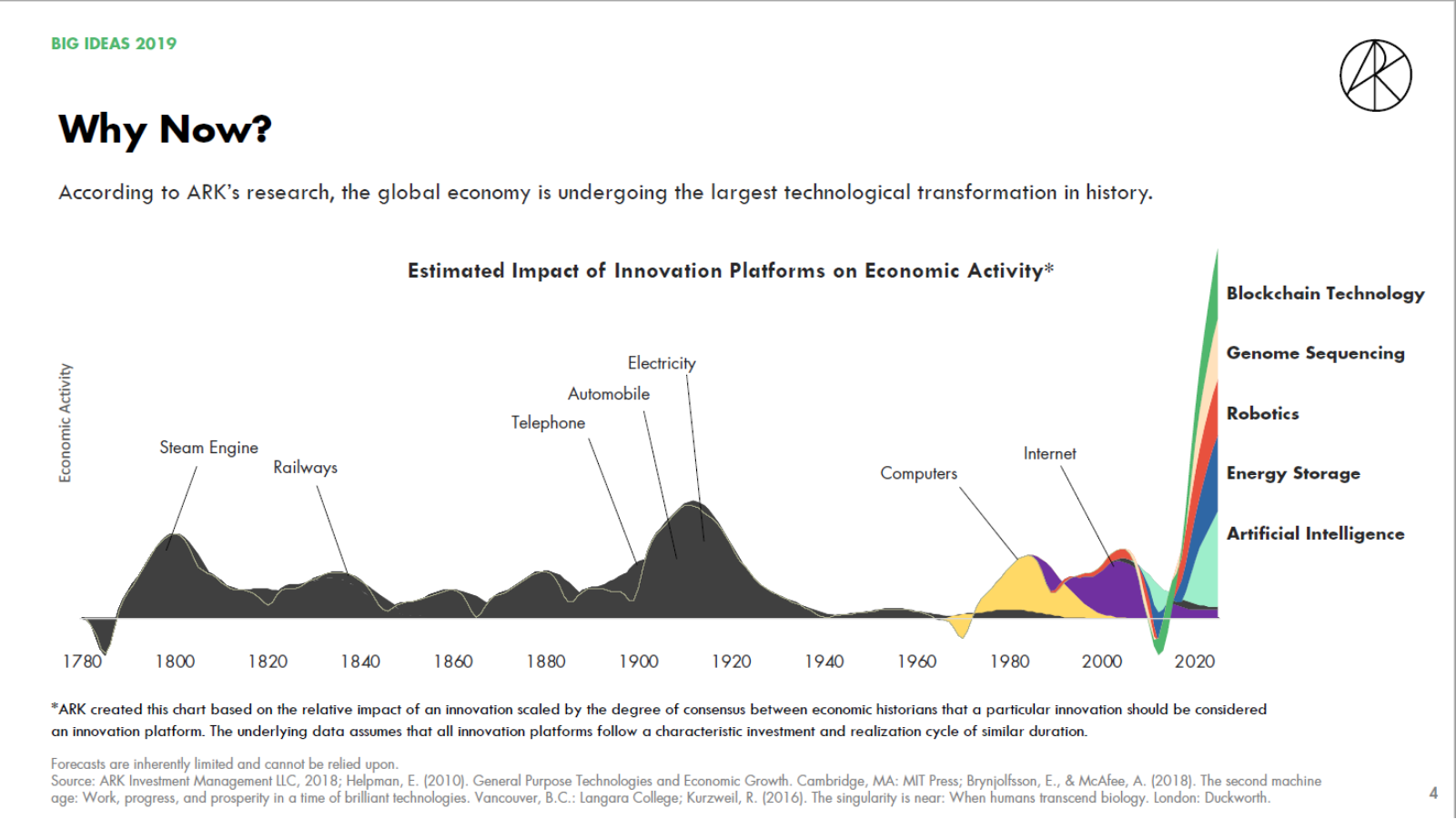

ARK believes that we’re on the cusp of five paradigm-breaking technologies which are all hitting their strides at once—blockchain technology being one of them.

In alignment with our Crypto Renaissance thesis (crypto will help usher in a new-age renaissance of similar magnitude as the Renaissance of the 1400’s), Cathie thinks that the next decade or two will include the largest technological transformation in history.

Cathie was also joined by Chris Burniske of Placeholder VC, who lead ARK down the crypto rabbit-hole back in 2014, and Yassine Elmandjra, ARK’s current crypto analyst.

People are calling this the best podcast we’ve ever recorded—it’s a must-listen 🔊👂

3 Key Takeaways From Cathie Wood

Here are the key takeaways.

1. DeFi is hollowing out the banks (and the banks know it)

Cathie listens to J.P. Morgan’s earnings call as a way to get a feel for the broader climate of the banking sector, and she was astounded to learn that loan growth during the economic recovery…was negative.

Why?

Because crypto! Given yield growth and demand in DeFi is absolutely exploding, even if that only causes a minor loss in revenue for the banks, this loss still has a meaningful impact on growth expectations for the entire banking industry. Stock price is set on the margin. Marginal growth rates matter.

Watch this 👇

And what if the regulatory pressure we’ve seen lately is because the banks are scared. What if DeFi’s threat to the banking sector is reverberating back as regulatory threats towards DeFi? 👀

Cathie’s implying this may be the case.

It wouldn’t be surprising given the banking system is one of the most entrenched incumbents there is…

2. ETH staking could become the new “risk-free rate”

Chris Burniske asked Cathie is she could “envision a future where Ethereum’s risk minimized rate offers a new baseline for valuing internet assets?”

This is the idea that ETH’s staking rate might be used as a new benchmark for digital asset portfolio performance, but Cathie took it further by contrasting the reliable yield of staked ETH versus the ‘unhinged’ monetary policies of central banks.

This is elevating ETH beyond just an internet-native economy, and toward the status of a global macro force, akin to the U.S. bond market.

Watch this 👇

In short, Cathie thinks that ETH can become the internet bond.

3. DeFi will accelerate innovation in non-crypto sectors

I asked Cathie and Chris “Do you think Ethereum’s capital coordination powers and DeFi’s open financial services will allow for innovation in other sectors to occur at a faster rate?”

Part of ARKs core thesis about why the future is so much closer than the market thinks is that the growth in each technology platform has the power to accelerate growth in all others.

Cathie identified Ethereum’s capital coordination powers with ‘The DAO’ collecting $150M of $ETH in 2016, and has been an outspoken proponent about how DeFi offers ‘friction-free finance’.

What happens to the pace of innovation when financial and capital coordination tools are made free and open?

Watch what Chris Burniske had to say 👇

The Biggest Lesson: Don’t Look Back

Probably my biggest takeaway of all was Cathie’s juxtaposition between backward-looking institutions and forward-looking retail investors.

The institutions are not looking into the future to inform their investments. Rather, they’re using historical analysis and financial modeling to allocate their investments, which fundamentally bakes in the assumption that the future will look like the past.

No wonder they’ve missed crypto!

If we’ve learned anything about the 2020s, it’s that we are in a much more chaotic time than what we could have ever predicted, and if you’re looking to history to inform your models of the future, you are making a fundamental error.

This means the door of opportunity is wide open for retail investors.

We saw this with TSLA….we’re seeing it with crypto too.

Where institutions resist change, retail embraces it.

This makes me bullish for the sovereign individuals of the world, and bearish for institutions that aren’t able to embrace this change.

Don’t look back.

- David

Actions

- Execute any good market opportunities you saw

- Listen to Investing in the Future | Cathie Wood