Dear Bankless Nation,

The market went down! Is this the end of the bull run?

In last week’s Market Monday, I wrote “This is the time of year when people ease off work, and tune into “Crypto Twitter and Charts.”

This past week, that was especially true 😅

Omicron placed a lot of fear in the markets. And when the macro markets sneeze, crypto often ends up in the hospital.

Here’s 5 reasons to remain zen:

- Don’t be a weathervane

- The bears aren’t rational

- Crypto markets look…reasonable

- The tweet that marked the ETH killer top

- ETH the safe haven asset

Let’s take them one by one!

1. Don’t be a Weathervane

A lot of market participants (first-cyclers especially) operate as market-weathervanes.

Weathervane: a revolving pointer to show the direction of the wind, typically mounted on top of a building.

They sell when they get scared, then they buy when the market turns around. A lot of these people look at their charts way too zoomed in. They look like this all the time.

Here are two Bitcoin charts, one with 1-hr candles spanning the last 30 days, and one with 1-day candles spanning the last 18-months:

Same chart, two perspectives. The more you zoom in, the more you miss the forest for the trees. And the more your emotions tend to be correlated with the shape of the chart.

Bull markets can get choppy; it’s trying to buck you off along the way.

2. The bears aren’t rational

There’s been a lot of bearish sentiment around. I’ve seen a lot of people calling for the top, saying it’s down from here on out for at least a year.

What?

I have no clue where people are getting it from. It makes no sense to me. I think we’re in a very healthy place in Q4. Both BTC and ETH have set new highs, but just by a little bit, and are now retesting recent lows. There is absolutely no blow-off top action anywhere, albeit for a few Metaverse tokens that traders have been apeing into.

This is the healthiest December in crypto I’ve seen.

Even the macro-markets seem overly fearful for some reason. I am pretty convicted that Omicron is a highly contagious nothing-burger. It spreads fast, and it doesn’t do much in terms of actual harm. Previous podcast guest Demetri Kofinas (a very grounded, evidence-based rationalist) agrees. Plus, we already have vaccines, testing, masks, and covid-mitigating behaviors in place.

Omicron fears just seem totally nonsensical to me.

The only macro things that seem rationally bearish are:

- Fed increasing interest rates due to rising inflation

- Possibilities of broken supply chains breaking even more.

3. Crypto Markets look…reasonable

Crypto markets seem extremely reasonable right now.

Funding rates (the costs of going leveraged long) have been flat for a long time and even went very negative for over 24 hours during BTC’s drop from $57k to $47k. While negative, this means that those who are short-BTC or short-ETH are paying those who are leveraged-long BTC or ETH.

Bears are paying the bulls for their position.

Negative funding rates don’t usually last for long, and they’ve since climbed back into positive territory, but the fact it got to its lowest point since May is indicative of the unsustainability of bearishness.

Here’s BTC’s funding rate over time, with the price chart above.

The negative funding rates that occurred earlier this week is nothing compared to what happened in May-July, but it’s still indicative of two main points:

- The market isn’t rewarding bearishness

- There’s not a lot of leverage in the system.

Ever since the run-up and subsequent drop in April and May this year, the market has stayed away from crazy leverage. This indicates that the recent new highs are sustainable. Recent inflows are more long-term oriented and less short-term speculation.

What caused the May drop?

I think traders expected new capital inflows into the markets to come much faster than they actually did. The market got over-levered on this expectation and Bitcoin took its infamous nosedive from $64k to $30k in May. Since then, actual capital has continued to flow in. That’s the primary reason for the new ATHs of $69,000 BTC and $4,900 ETH—new capital flows.

A market without significant leverage gives me peace of mind that May-level drops are less likely than they were earlier this year.

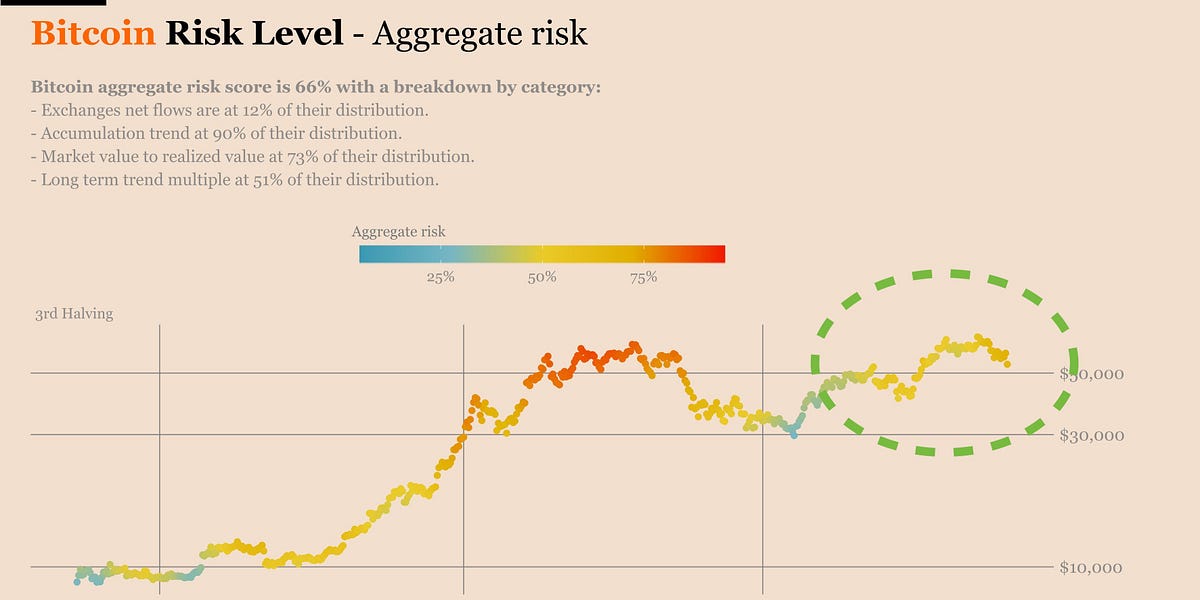

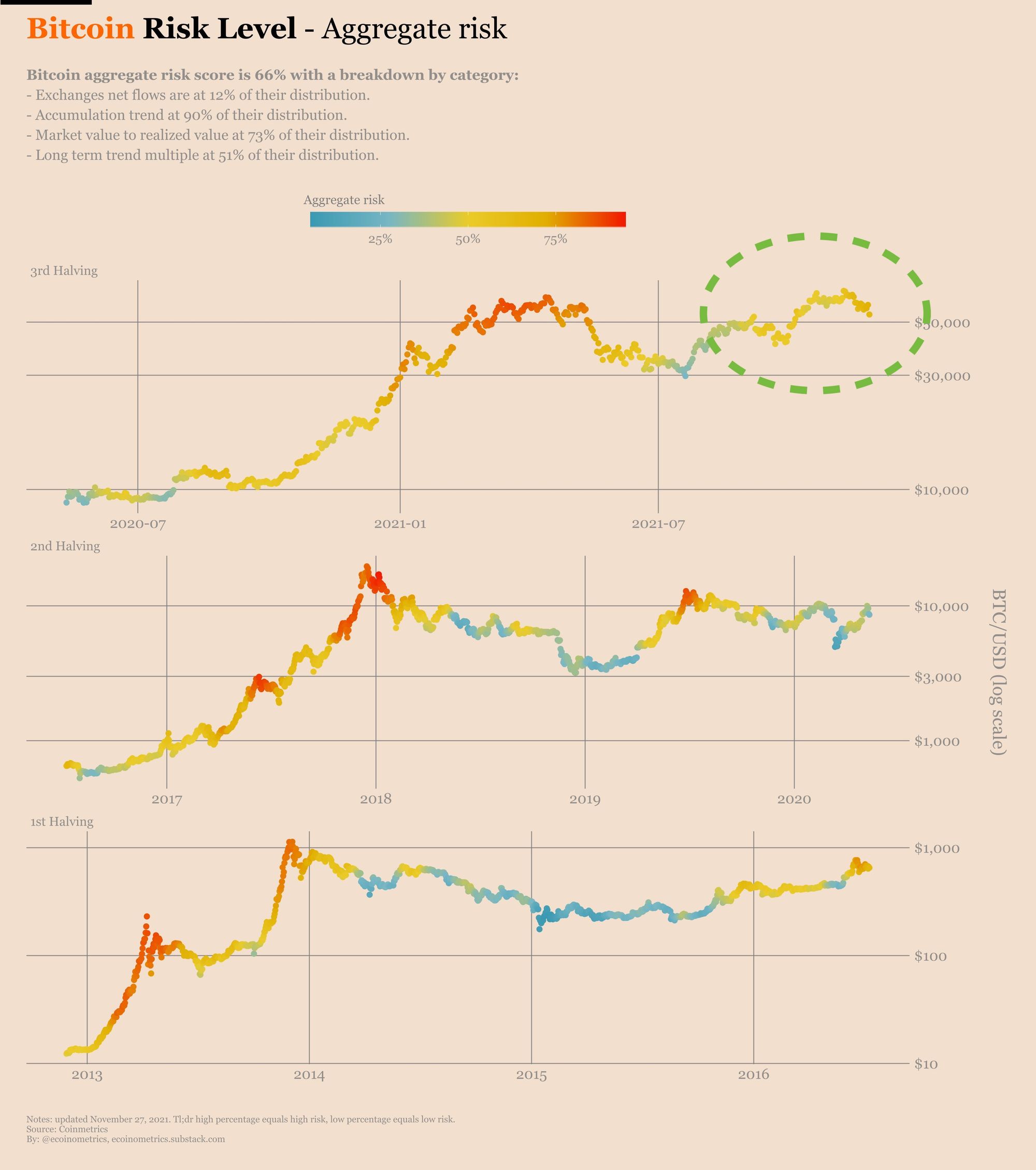

You can see this echoed in the ‘risk level’ for Bitcoin. Markets are modest right now. Not too overextended.

4. The Tweet that Marked the Top

A few weeks ago, we covered the drama between Su Zhu and the Ethereum community, which drew in the Avalanche and Solana communities into one gigantic Crypto Twitter 💩-fest.

Anyway, that happened to be the moment that AVAX stopped going up vs ETH.

Funny how these things work. We’ll see if AVAX can return to its previous highs vs ETH. While I continue to be an uncompromising decentralization maximalist, there’s no telling that the rest of society with resonate with that ideology ¯\_(ツ)_/¯

5. ETH the safe haven asset

Last week, we wrote “All Eyes on the ETH/BTC Ratio” on the 29th.

Since then, ETH has continued another week of outperforming Bitcoin, up 10% in 7 days. The drumming about the flipping is heating up (just a lil bit, still lots to go).

One week of outperformance against BTC isn’t inherently newsworthy (I’m looking to see years of it personally 😏), but this is happening during a week in which $300B was wiped from the total crypto market cap, and BTC dropped 13% in 7 days.

ETH has only dropped 2.2% in the same time frame.

You almost never see ETH dropping less than BTC during a market-wide selloff. In fact, ETH actually went up versus BTC during this time. Historically, this is absolutely crazy. It used to be that when BTC sneezes, ETH gets sick, and small caps go to the hospital.

Lots of small caps did indeed go to the hospital last week (we send our thoughts and prayers), but ETH seemed to have actually gotten stronger.

ETH appears totally allergic to being below $4,000 right now.

Now, if we had another -15% day, this could totally change. Lots of crypto market participants are capable of taking a -15% gut punch, but…two of them?

That might actually change things.

But if not…the ETH/BTC ratio continues to be the hottest chart in crypto. I just can’t keep my eyes off it, 🙈

Let the Fear Wash Over You

As I said, despite all this, there’s still bearishness sentiment in the crypto markets. Maybe it’s because so many people are here for their first cycle, and they’re still in the hyper-sensitive, zoomed-in chart phase of their journey with crypto?

I don’t know. I’m seeing some bearish veterans right now too.

Emotions are not a result of market movements, they’re the cause of them. Markets are emotions. It was called “The Great Depression” for a reason; all the market participants were depressed. Emotions guide markets.

It’s not about learning to not feel fear, but instead, it’s about accepting fear. Acknowledge your emotions, and learn to not act on them.

Does the market have you down? Go on a walk. Pet your dog. Kiss your partner.

If these things don’t work, consider reducing exposure, because your level of exposure to the markets is a direct bridge to emotional exposure.

Personally, I’ve gotten to the point where I see a -15% day, and I think it’s funny. ‘Lol, stupid crypto markets. When will these overleveraged traders learn??".

That should be your goal. Complete zen with the markets. Let the emotions wash over you, but not control your life. Crypto is about freedom…but are you going to let prices dictate your emotions?

Cause that just sounds like a new form of tyranny ¯\_(ツ)_/¯

- David