View in Browser

gm Bankless Nation,

There are levels to burning in Ethereum.

Today's Issue ⬇️

- ☀️ Need to Know: Polymarket USA Return

The top prediction market is coming home. - 🗣️ Tactic: Tokenizing ETH Burns

What is BETH worth and how will it get used? - 🎧 Latest Pod: ETH Ready for RWAs?

Can Ethereum handle the stress tests it needs to?

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

- 🇺🇸 Polymarket Cleared for U.S. Return by CFTC. The leading predictions market is ready for its stateside return.

- 💰 Etherealize Raises $40M from Paradigm, Electric Capital. The Ethereum advocacy group is building Wall Street ties and privacy tools.

- 👔 Trump Family's 'American Bitcoin' Debuts on Nasdaq. The venture backed by Donald Trump Jr. and Eric Trump also filed to raise up to $2.1B to finance buying more BTC.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.87T | ↗ 2.5% | ↘ 0.8% |

|

BTC $112,240 | ↗ 0.9% | ↘ 0.1% |

|

ETH $4,470 | ↗ 3.8% | ↘ 2.4% |

There are levels to burning in Ethereum.

At the network level, Ethereum's EIP-1559 mechanism continuously burns ETH. In the ecosystem, L2s like Linea are gearing up to burn some of their ETH fees. As for apps and end users, they can send tokens to burn addresses like 0x00...dEaD to cut supply.

Normally, the value that goes into these burns just disappears. Yet there's a new wrinkle of possibilities here now thanks to BETH (Burned ETH), i.e. tokenized proof of burns.

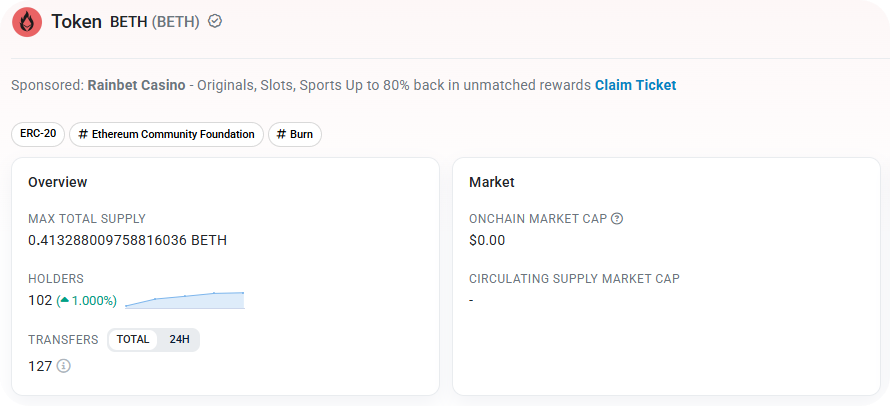

Created by Zak Cole of the Ethereum Community Foundation, BETH is an immutable ERC-20 token that represents ETH permanently destroyed at Ethereum's main 0x00...0000 burn address.

The smart contract is straightforward:

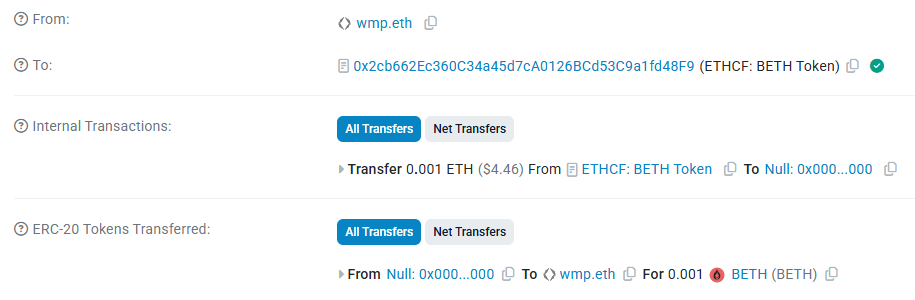

- You send ETH in.

- It forwards the ETH to the burn address.

- It then mints you back an equal amount of BETH.

As such, 1 ETH burned equals 1 BETH received, and so on.

But here it's also important to note that BETH isn’t redeemable. It's not a wrapper token, so you can’t ever turn it directly back into the ETH that you put in.

What's the value of this sort of onchain burn receipt? That's an open question.

At a minimum, it provides transparent accounting for burned ETH, turning something that's been abstract into something that's transferable, tradable, etc. Though the real potential lies in the experiments BETH may unlock.

Imagine governance systems where voting power comes from provable burns, or signaling schemes where people pay with BETH. L2s can also use BETH to prove and build upon burns in their own economies, as Linea is planning to do.

It remains to be seen how the market will come to value BETH, but it does offer Ethereum devs and communities a new primitive to play with. And that's something worth keeping an eye on.

As of now, there are just over 100 BETH holders with 0.41 BETH minted to date, so it's still very early days for the experiment. If you want to try it out, start by sending only a small amount of ETH that you’re comfortable with destroying.

But trying is simple if you decide to. Just tee up an ETH send to the BETH contract address at 0x2cb662Ec360C34a45d7cA0126BCd53C9a1fd48F9 and confirm it with your wallet. You'll instantly receive back an equivalent amount of BETH, like so:

The big picture? Until now, burning ETH has been a passive background mechanic or a symbolic gesture. With BETH, that act becomes composable and potentially strategic. And its arrival can open up new cultural spaces, too.

The question now isn’t just what BETH is worth, but what kinds of coordination it could unlock. That’s the frontier this experiment is pushing toward – so keep it on your radar!

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.

Austin Campbell (NYU) and Omid Malekan (Columbia) debate a simple question: is Ethereum ready to host Real-World Assets?

They walk through stress tests – what if an exchange is hacked, a stablecoin breaks, or a court order targets the chain – and whether the network should ever step in.

You’ll hear where they agree and disagree, what protections are realistic today, and what still needs to be built before RWAs can scale.

Listen to the full episode 👇