While TradFi markets are “forward looking,” crypto-asset speculators can come across as overzealous golden retrievers, eager to chase down whatever flavor-of-the-week token comes across their timeline.

One week it’s the AI narrative, next it’s SocialFi, until we inevitably devolve, grasping at whatever memecoin most recently made us chuckle!

For a change of pace (and who knows, you actually might enjoy this exercise), let’s take a look at narratives that may actually have staying power over a decent timescale.

We’re talking sustainable business models, new primitives, and much-needed infrastructure upgrades. There’s a lot of noise in the crypto industry, and we’re here to help you filter through it all to isolate the signal.

💵 Yield-Bearing Dollars & LSTs

Token ponzinomics of a post-DeFi Summer saw inflationary rewards inflating APYs across crypto. Times were good until they weren’t.

It looks as though the market has (mostly) wised up to these unsustainable models and instead is beginning to build from stable ground. Namely, building off the back of “risk-free” rates – either from the Fed or Ethereum consensus.

Real Work Assets (RWAs), and more specifically, Yield-Bearing Dollars (YBDs), attempt to capture the current risk-free rate set by the Fed and deliver it conveniently to DeFi users. Users can deposit into these applications and tap into stable rates that are otherwise difficult to access for non-US citizens.

Liquid Staking Tokens (LSTs) are the other side of the coin. Since Ethereum’s transition to Proof of Stake, stakers securing the network have been rewarded with a steady stream of ETH for their troubles. The advent of LSTs means that DeFi users don’t have to run their own nodes to participate in the security of the network (and also earn some juicy rewards).

These sources of yield are similar in that they are backed by the very foundations of monetary policy in their respective venues.

- Want to play around in TradFi? You can always fall back to the safety of the Fed rate.

- Is DeFi more up your alley? The ETH staking rate is now your benchmark.

▪️ MakerDAO

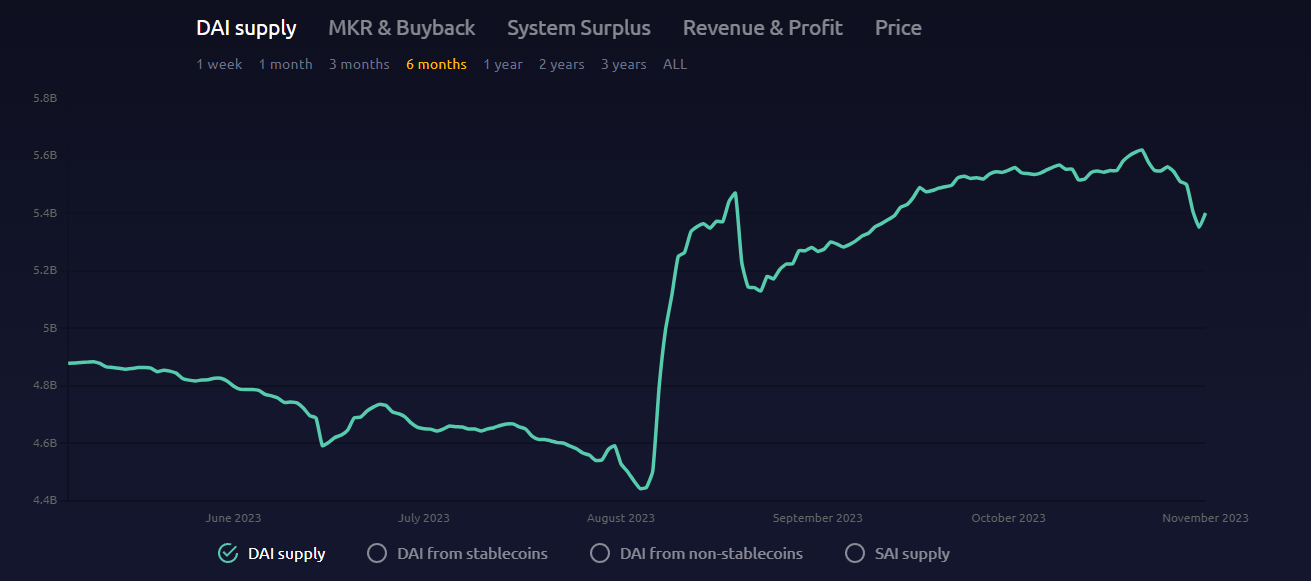

Maker ($MKR) is perhaps the most well-known advocate for the YBD strategy, with the popularity of their staked DAI ($sDAI) launching them to #2 in Total Value Locked (TVL).

$sDAI holders earn the DAI Savings Rate (or DSR) of 5% annually - which may seem small in comparison to the heights of Wonderland forks but has the benefit of a stable backing mechanism. MakerDAO uses the excess revenues to buy back and burn $MKR, leading to steady & organic buy pressure on their governance token.

▪️ Frax

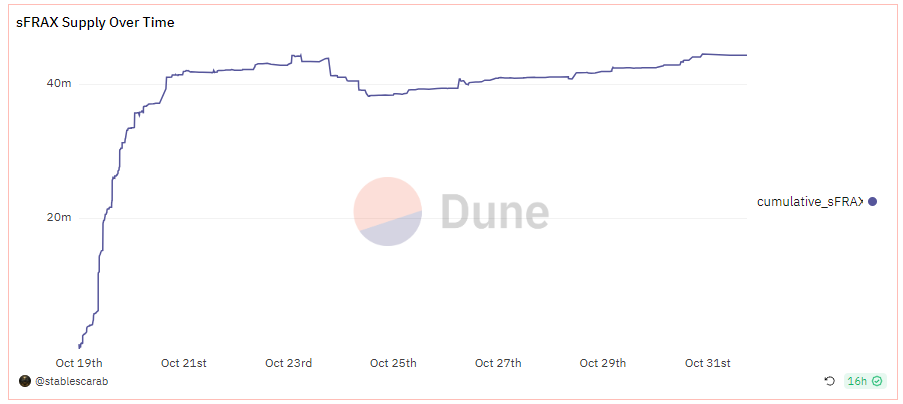

Maker’s peer, Frax, has launched a similar initiative with their $sFRAX recently coming to market. Unlike Maker’s model, which relies on external third parties to custody real-world assets, Frax has established a Public Benefit Corporation (PBC) that serves on behalf of the Frax DAO to hold short-duration yield-bearing assets. This PBC architecture is similar to how foundations such as Optimism maintain transparency and value alignment between onchain and offchain entities.

sFRAX has been met with similar excitement, achieving over $40M in deposits in under two weeks of being live.

Frax has also been teasing the idea of Frax Bonds (“FXBs”), which are set to bring another TradFi favorite onchain. These tokens would be backed by US bonds and would have savings rates commensurate to their dates of maturity. With how popular YBDs have been with DeFi users, it will be interesting to watch how quickly the Yield Curve transposes onchain.

▪️ Lido

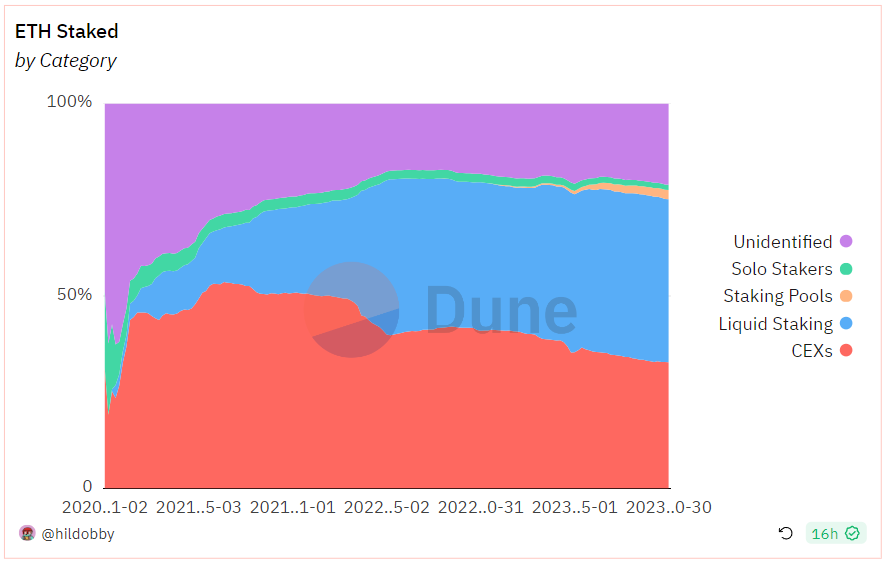

On the other side of the real-yield coin is that of staked ether. By simply running a validator, stakers can enjoy 2-5% steady yields on their ETH! The only problem - the complexities of running one’s own validator have driven market participants to offload this hassle, mainly to centralized exchanges (CEXs) and liquid staking providers.

The market seems to have picked an early winner – Liquid Staking Tokens (LSTs), for their ease of use and composability throughout DeFi. Just look at how LSTs are beginning to pull away with their lead.

And amongst LST providers, it is Lido vs Everyone Else. Market dominance generally begets more dominance unless a contender arises with a sufficient unique selling position. And with Lido’s $stETH becoming entrenched as the go-to LST throughout DeFi, they will be difficult to topple.

▪️ LST Contenders and Infrastructure

Despite Lido’s market dominance, the LST space has room to grow - especially in a potential future of lower Federal Funds Rates.

New contenders and LST-adjacent technologies to keep an eye on are:

- New LST Contenders. Stader and Liquid Collective have both seen impressive surges in interest over the past month, with 87% and 43% increases, respectively. Stader’s $xETH stands out for its use of DVT, while Liquid Collective markets itself as an API-first solution to LSTs for institutional clients. Keep an eye on the competition here.

- LST-backed stablecoins. Using the tried-and-true model of LUSD, many new stablecoin providers, namely Lybra and Prisma, allow users to mint stablecoins against LSTs. These stablecoins inherit the staking rewards from their underlying LSTs, in essence, turning themselves into YBDs (time is a flat circle, it appears).

- Rate Trading Platforms. Pendle and IPOR (with their upcoming v2), allow users to speculate long/short on the change of LST staking APRs. The more intrigue and diversity entering into these derivatives, the more potential opportunities for these LST-adjacent platforms.

♻️ Restaking

The robustness of Ethereum’s security layer comes from the sheer dollar value of ETH staked in validators. EigenLayer allows these validators to “re-stake,” securing additional networks besides Ethereum’s. By securing additional networks, validators can potentially earn more rewards outside of the standard ETH from the Beacon Chain.

Today, EigenLayer appears to stand alone as the restaking provider. And while the $EGN token isn’t live yet, we could see it making some waves at launch.

▪️ Liquid Restaking Tokens

In the same vein as LSTs, Liquid Restaking Tokens (or LRTs) are receipt tokens representing ETH deposits into EigenLayer. Similar to standard staking, ETH in EigenLayer is locked away from its holder. Like with LSTs, holders of LRTs will be able to use their tokens throughout DeFi, adding a layer of composability once unavailable.

Foreseeing this opportunity, a plethora of protocols have announced their plans to offer LRTs. Stader, Inception, Astrid, RestakeFi, Rio, Genesis, and Renzo (and I’m sure I’ve missed others) have all come out as LRT providers.

And while LRTs could compound risk on top of risk, it is an emerging dynamic that should be watched.

▪️ Ion

Well, now we have all of these LRTs – what can we do with them? Ion Protocol will create lending markets for every kind of Ethereum derivative under the sun. Whether you want to borrow or lend:

- Liquid Staking Tokens (LSTs)

- LST liquidity positions

- Restaking positions on EigenLayer

- Liquid Restaking Tokens (LRTs)

- Staked LST liquidity positions

- LST Indices

Ion will give you a market. By judging risk based on validator hardware specs and data, Ion promises higher loan-to-value (LTV) ratios compared to other lending markets.

Disclosure: BVC is an investor in Ion. They were not part of the pitching, writing or editing of this piece.

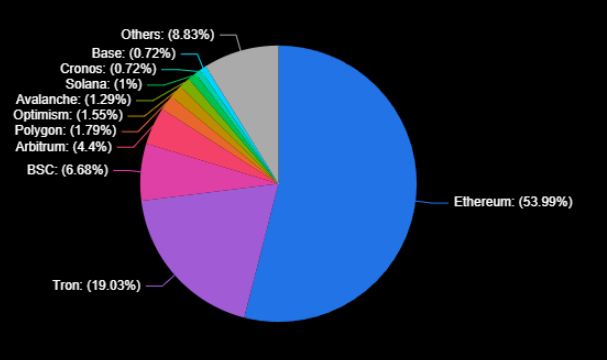

⛓️ Cross-Chain Communication Protocols

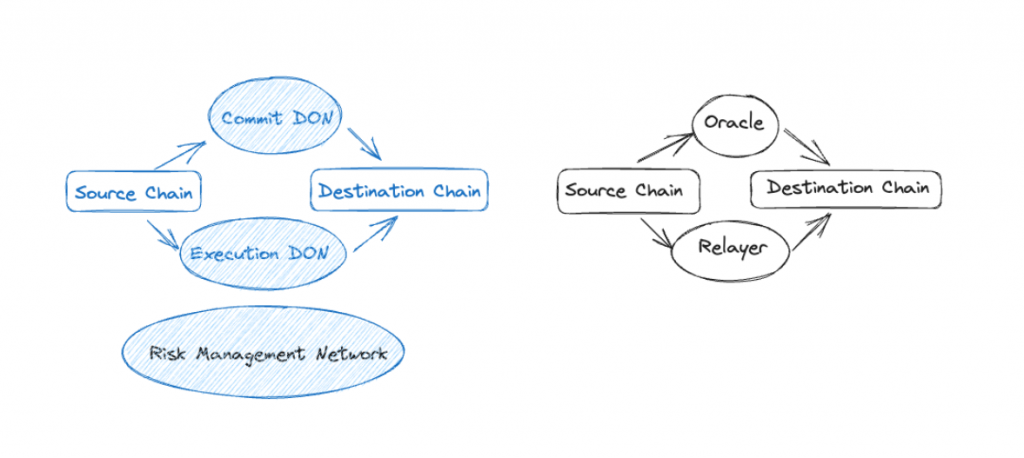

Opening up the aperture on our (admittedly) Ethereum-centric worldview, cross-chain communication protocols such as Chainlink’s CCIP and LayerZero are showing us just how connected the future of DeFi could be.

Today, value held on DeFi protocols is isolated to tiny fragmented islands. And while bridges seem to offer a potential life vest, they tend to get hacked… a lot.

Instead of a singular honeypot for hackers to target, the modular & independent designs of CCIP and LayerZero secure funds even in the case of a hack – a much-needed upgrade.

Chainlink is leveraging its sector-leading expertise in oracle networks to build out its ecosystem of interconnected financial institutions, with the eventual goal of bringing all of TradFi onchain. CCIP has been a much-anticipated upgrade to Chainlink, and with the cooperation of such likes as SWIFT, there is good reason to be optimistic.

LayerZero is taking a slightly different approach, instead opting to cater to DeFi-native applications. By allowing some flexibility in application of their design, protocols can dial up (or down) the security depending on their needs. After all, while a crypto gaming platform probably wants to optimize for user experience, a major DeFi app would prefer to maximize security. With LayerZero, they are free to choose their own path and still enjoy the benefits that omnichain tech lends.

If you want to dive deeper, go check out David and Ryan’s conversation with Sergey Nazarov as well as Revelo Intel’s CCIP vs LayerZero report.

Did we miss any big narratives that you're passionate about?

Let us know in the comments 👉