DeFi is eating finance

Dear Bankless Nation,

Software is eating the world.

This 2011 article written by Marc Andreessen described how software native companies were eating incumbents and revolutionizing industries.

Amazon replacing consumer sales, Spotify taking on music, LinkedIn for recruiting—all poised to replace incumbents who didn’t build internet-native businesses.

Why? Software native companies were faster, cheaper, and a better for users. To Marc, it was only a matter of time before every industry was eaten by software.

But this hasn’t held true for finance.

Our financial system is still based on ancient infrastructure. Jim Bianco pointed this out on the podcast…Wire Transfers haven’t gotten any faster or cheaper since the days of the telegraph in 1871! 👀 (Watch Jim drop🔥 on our current banking infrastructure).

And FinTech? All FinTech did was give the existing analog system a UX facelift.

But DeFi changes everything…

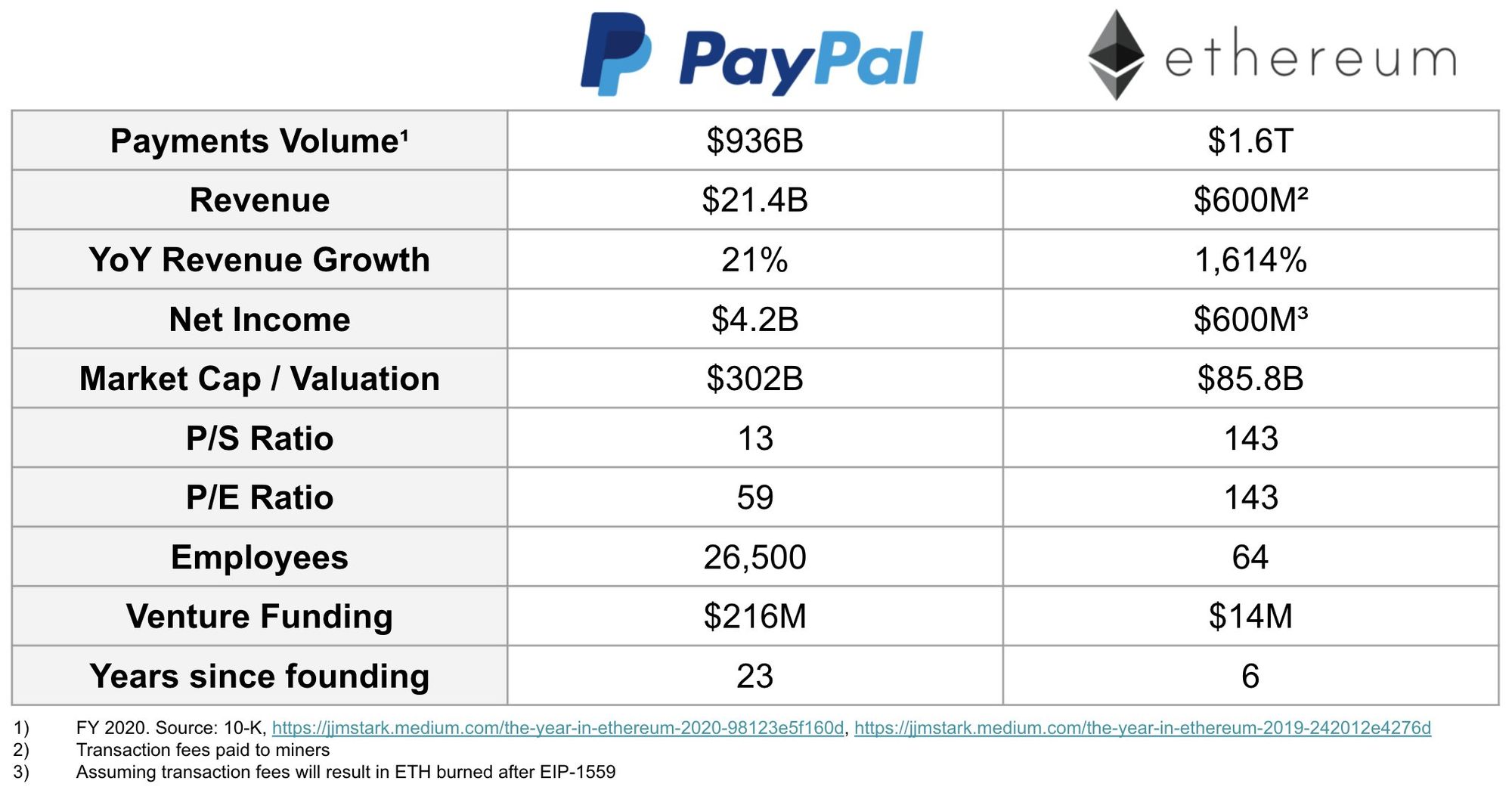

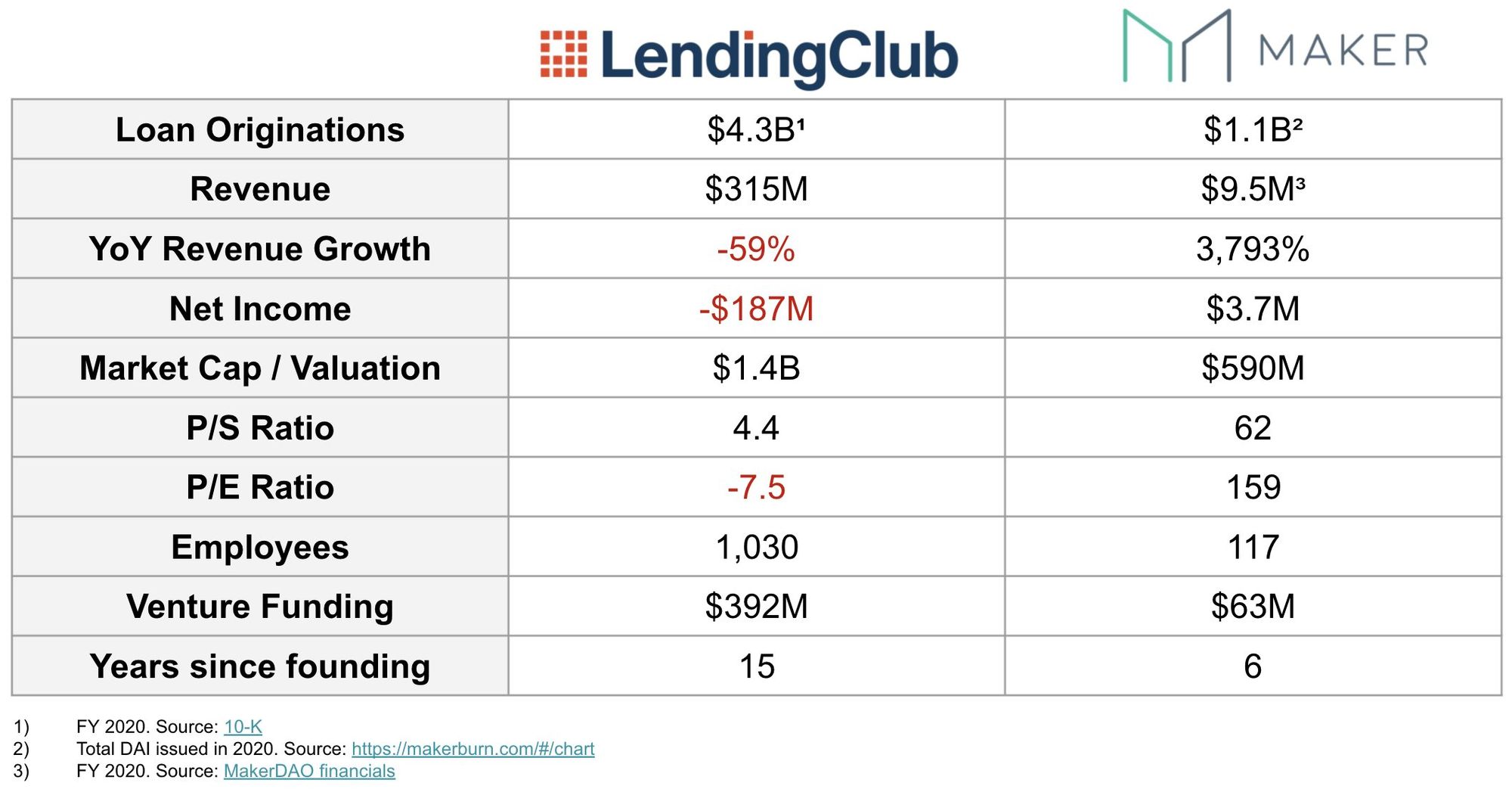

Compare PayPal and Ethereum as money transfer networks.

Or take lending—MakerDAO has been profitable after 6 years of operation while LendingClub is still booking losses after 15 years.

DeFi enables software economics for financial services.

Faster. Cheaper. Better. Finance.

Here’s Dmitriy to explain why DeFi is eating finance and the thread that inspired it.

- RSA

P.S. Ledger x Paraswap integration is here—swap tokens at the best price from Ledger Live 👀 Learn more!

Learn about the Rise of The Creator Economy today at 5pm EST

Join a discussion with Jesse Walden, Li Jin, and Cooper Turley on the rise of the creator economy. Tune in today at 5:00pm EST (2pm PST).

WRITER WEDNESDAY

Guest Writer: Dmitriy Berenzon, Research Partner at 1kx

DeFi: Cloud-Native Financial Services

While software has been eating the world for the last several decades, it has done a relatively mediocre job disrupting financial services.

Due to entrenched incumbents, high switching costs, and regulatory capture, innovation in the industry has been mostly around channels (e.g. your favorite mobile banking app). This has given a nice UX facelift but the underlying value chain and cost structure are still largely based on systems developed in the 1970s.

DeFi applications are rearchitecting financial services from the ground up by replacing humans with machines, paperwork with code, and legal enforcement with cryptographic enforcement. As a result, they can operate orders of magnitude cheaper than their analog counterparts.

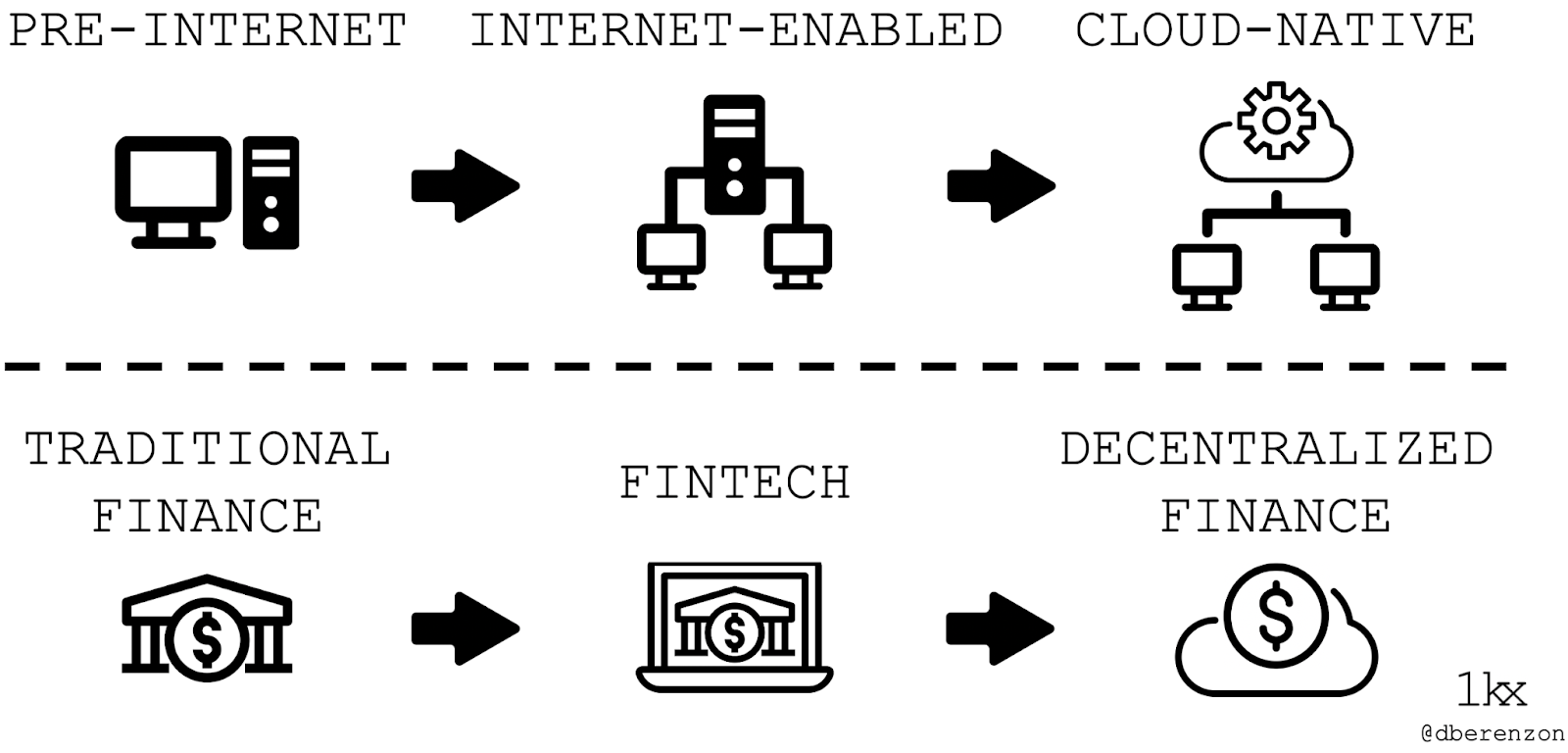

Interestingly, this evolution of financial services resembles that of the software industry; as software evolved from monolithic infrastructure & applications to cloud-native microservices, cost efficiencies were realized and new business models were invented.

In this piece, I will outline the software industry’s evolution, draw parallels to financial services, and discuss how these changes lead to fundamental improvements in the economics and profitability of the latter.

Traditional financial services is like pre-internet software

Before the emergence of the internet, there were high fixed costs and barriers to entry for software vendors. In the 1960s, back when computers were too expensive to purchase, vertically-integrated vendors would invest significant amounts of capital to develop & distribute software via their private networks.

For example, Computer Sciences Corporation spent $100 million (worth ~$900 million today) to develop “Infonet”, which was a network of mainframes offering access (via telephone communications lines!) to computer power and software like brokerage services and hotel reservations.

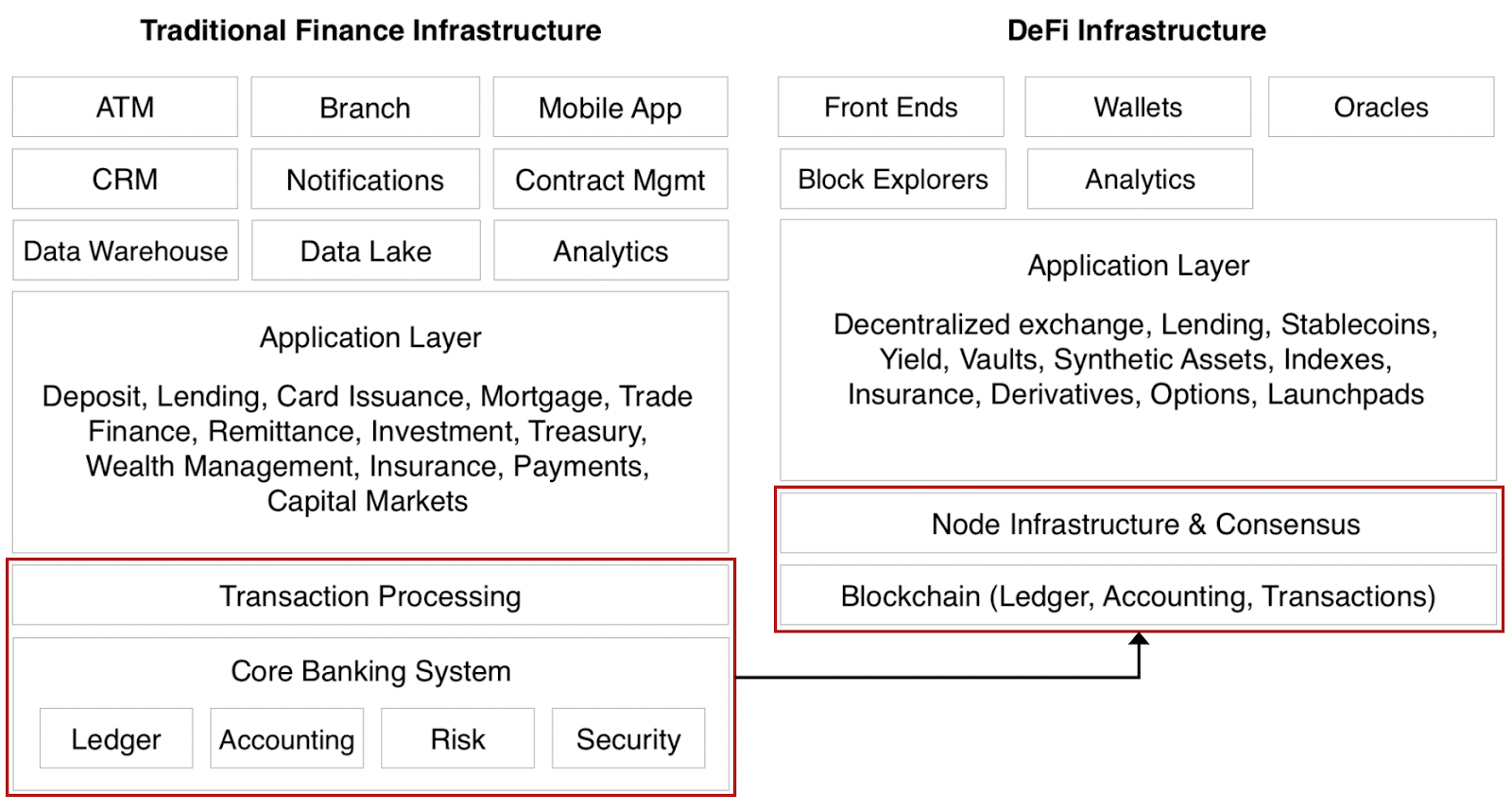

Traditional finance has similar dynamics. Due to high barriers to entry and economies of scale, vertically-integrated banks end up providing most core banking services, such as accepting deposits, lending money, transferring funds, issuing debt, forming clearinghouses, and, in the case of central banks, managing the money supply. These services are costly, involving physical presence, manual & paper-based processes, and complex & siloed infrastructure.

FinTech is like internet-enabled software

Since the 1990s, the internet enabled a new model for software delivery; instead of software living in separate instances on peoples’ computers, it lived in the cloud and was delivered remotely.

This, in turn, led to the rise of software as a service (SaaS), which was a business model innovation where software was licensed on a subscription basis. SaaS offers many advantages for users over the on-premises approach, such as browser-based accessibility, automatic updates, and a lower total cost of ownership.

FinTech and internet-enabled software are similar in that both leveraged emerging technologies to innovate on product and business model. Chime leveraged online channels to expand reach and reduce physical overhead for retail banking. Robinhood adopted an alternative business model to commissions, “payment for order flow”, to provide “free” retail trading. Transferwise circumvented the correspondent banking system by creating a two-sided marketplace to net payments for people transferring money in opposite directions around the world.

All of these companies are valuable, but Chime still relies on Visa (started in 1958), Robinhood still relies on the DTCC (started in 1973), and Transferwise has not displaced ACH (started in 1972) or SWIFT (started in 1973).

DeFi is like cloud-native software

The “modern cloud” started in 2006 with the launch of Amazon Web Services (AWS) and many applications migrated over the following decade.

That said, most of them remained as “cloud-enabled” rather than “cloud-native” applications, meaning that they likely still had monolithic & dependent modules that could not be individually upgraded without changing the entire application.

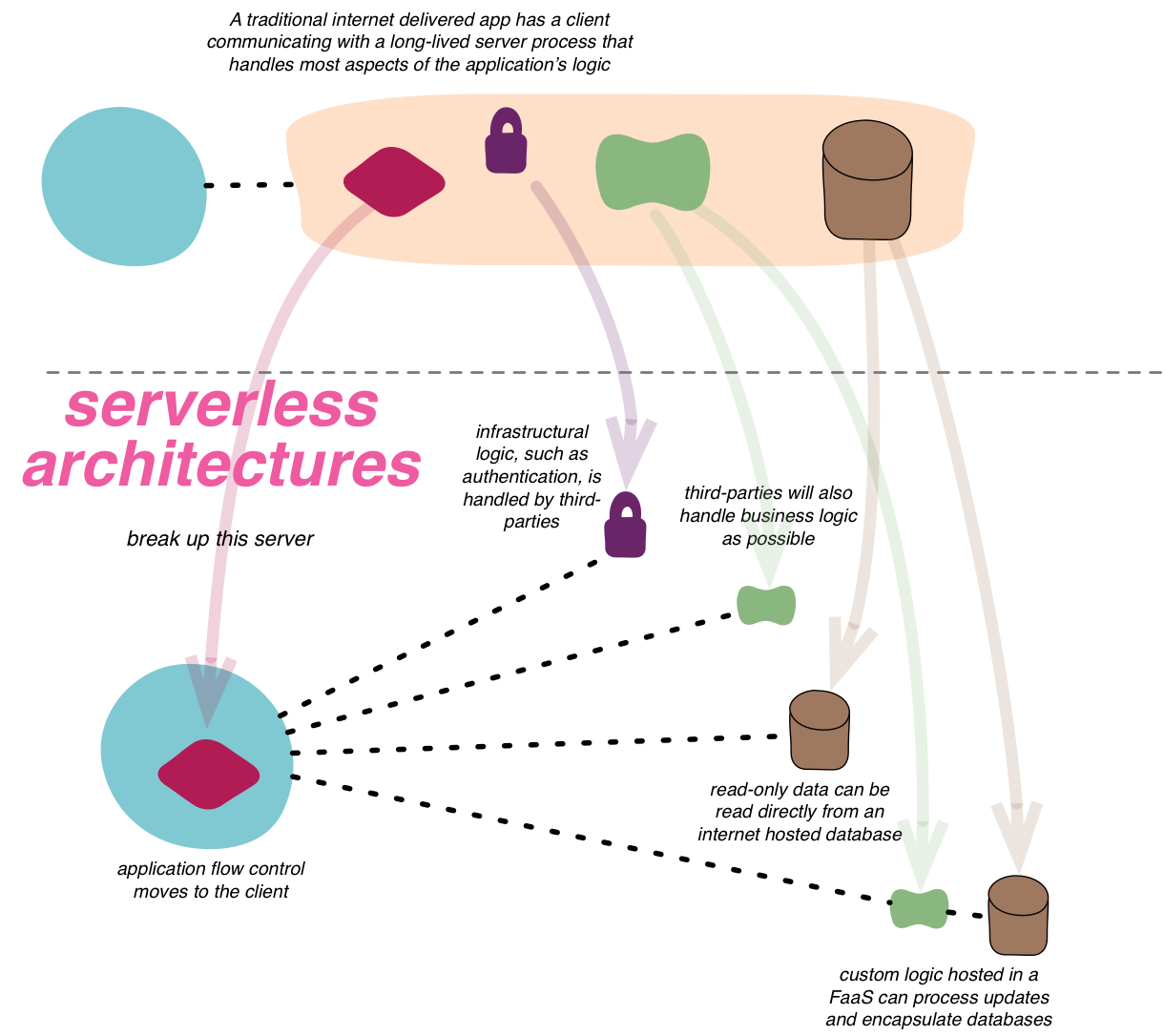

Cloud-native applications, on the other hand, are architected from the ground up to run in a public cloud like AWS. They leverage resource pooling, rapid elasticity, and on-demand services. They are also built on a microservices architecture that is designed as independent modules which serve a particular purpose. Today, many applications also run on a serverless architecture, which allows developers to purchase backend services on a ‘pay-as-you-go’ basis. These design patterns could also be used in tandem, leading to what is known as serverless microservices.

Cryptonetworks enable serverless financial microservices. This is possible because cryptonetworks are, in itself, a business model innovation; instead of vendors contractually providing infrastructure and services for dollar-based compensation; a distributed network of “nodes” (i.e. computers) provide those functions to earn protocol tokens and, in effect, become partial owners of that network.

Do not get this confused with “blockchain not bitcoin” logic—the protocol token is necessary to incentivize “third party vendors”.

Because of this, DeFi realizes many of the benefits from software and SaaS economics that financial services do not have. Specifically, there are significant cost savings from siloed transaction processing and banking systems being replaced by a global blockchain and its associated smart contracts and node infrastructure. In addition, applications benefit from instant interoperability upon deployment and a single log-in (a user’s public/private key pair).

This reduces the need for multiple market infrastructure providers building effectively the same systems (e.g. there are about 100 ACH systems around the world) and for applications to build & maintain their own back-end infrastructure.

The proposition is even more attractive for application developers because it is not them who is paying for using the “financial cloud” but rather the users on a per-interaction basis in the form of “gas” paid to miners/validators. In other words, the transaction, service, and infrastructure costs are all bundled into a singular gas expense.

Moreover, external service providers often perform the core functions of the application, such as liquidators on Compound and liquidity providers on Uniswap. In addition, once a smart contract is deployed, there are no additional maintenance costs for that service and thus the marginal cost for the application acquiring an additional user is ~$0.

This cost structure enables DeFi protocols to be cash flow positive even with high churn rates and low recurring revenue.

Comparing companies and protocols

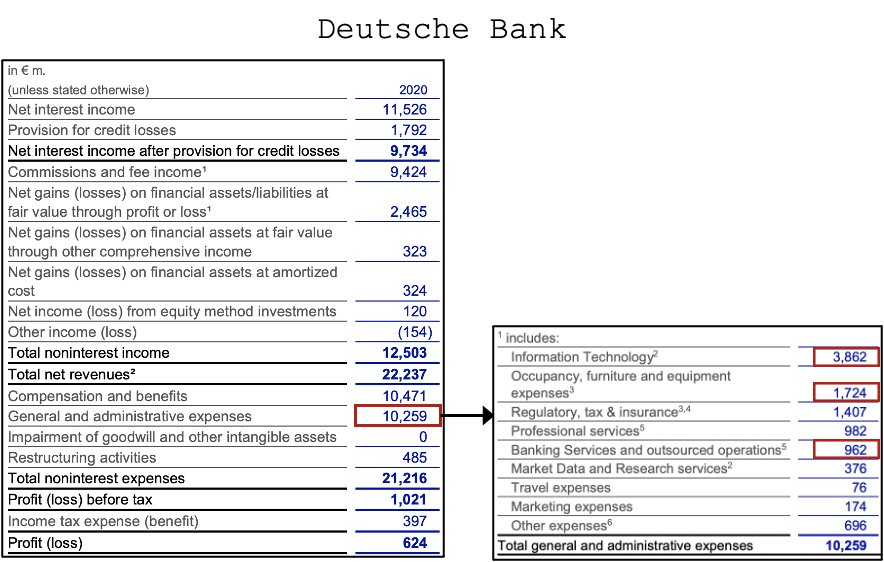

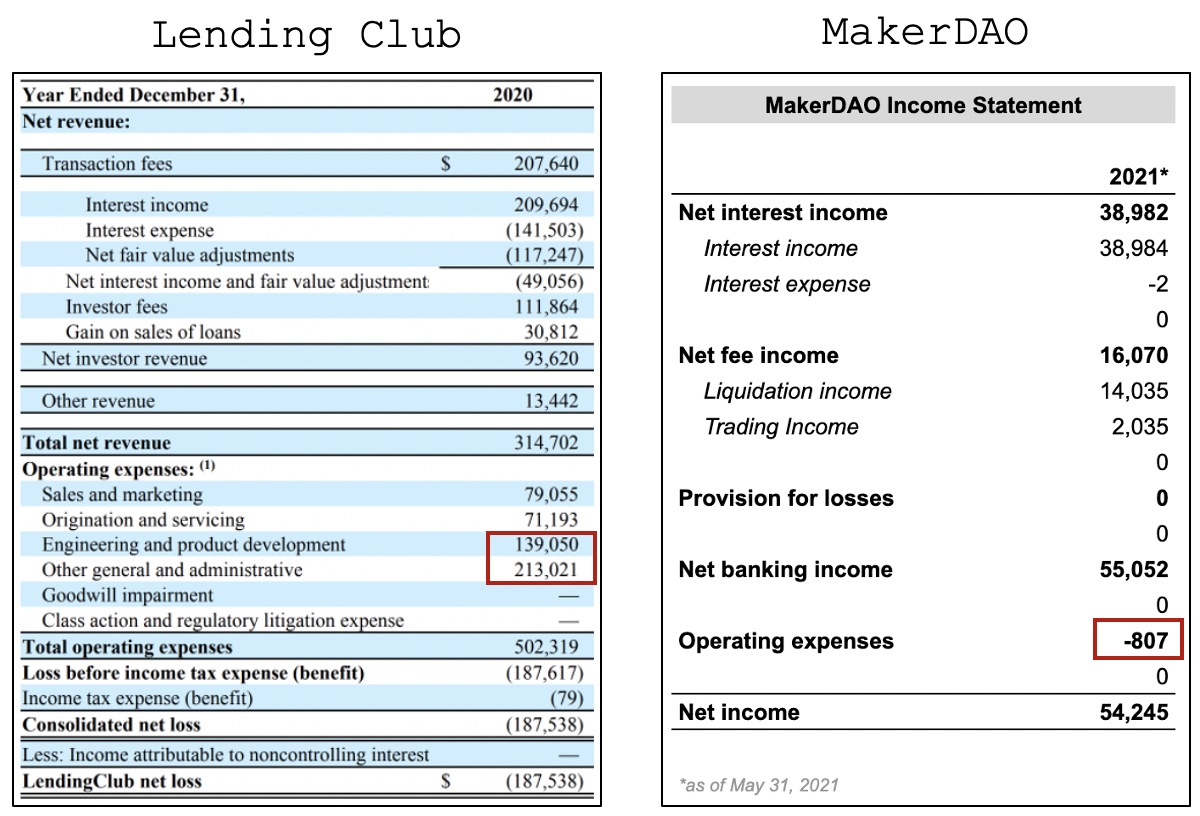

Nothing is completely apples-to-apples, but let’s do the best we can with a set of three example income statements that are most closely related: Deutsche Bank, Lending Club, and MakerDAO.

In 2020, Deutsche Bank had $8 billion worth of infrastructure, real estate, and operations related costs, which was 64% of its overall operating expenses. This cost structure is expected for such a large and structurally important organization with decades of technical debt, but we can do better.

In 2020, likely over 50% of Lending Club’s operating expenses were due to headcount and hardware, software, and maintenance costs. The company would have likely been profitable if it had a leaner cost structure.

While most of MakerDAO’s operating expenses were due to headcount, it is a tiny portion of overall net income, resulting in a profit margin of 99% vs. -60% for Lending Club. The caveat is that these are not “fully-loaded” costs for MakerDAO and will increase as additional costs from the Foundation (e.g. oracle operations, token-based compensation) are transferred to the DAO.

Looking forward

Over the next decade, DeFi protocols will be used as “financial microservices” for both legacy financial institutions and traditional fintech companies. These organizations will use DeFi as their backend infrastructure and will effectively become distribution channels for various customer personas, demographics, and geographies.

While DeFi protocols will likely layer on additional costs to enable them to further integrate with the fiat economy, it will still be orders of magnitude more efficient than the current market structure and business models in place today.

I am excited to see a thriving set of DeFi applications that will serve as the new infrastructure for a variety of financial applications for people around the world. If you are building a DeFi protocol, please reach out on Twitter.

Many thanks to Jason Choi, Christopher Heymann, Chris McCann, and Peter Pan for their feedback on this piece.

You could follow me on Twitter here.

Action steps

- Ask yourself: Will DeFi eat the financial system?

- Read Marc Andreseen’s Why software is eating the world

Author Bio

Dmitriy Berenzon is a Research Partner at 1kx, where he focuses on crypto research & investments. He was previously a Research Partner at Bollinger Investment Group, where he led crypto research & investments, and worked with CoinFund, a crypto-focused investment firm. Prior to this, Dmitriy was an Assistant Vice President with Deutsche Bank Labs, where he engaged with startups, investors, and academia to discover, evaluate, and adopt innovative technologies into the Bank.