DeFi Goes on Trial

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

1️⃣ Roman Storm on Trial

Prosecutors laid out their arguments against Tornado Cash developer Roman Storm this week in a New York courtroom. Storm faces charges of money laundering, conspiracy to operate an unlicensed money transmitter, and conspiracy to violate US sanctions. Early witnesses for the prosecution seemed to lack some basic understanding of how money is generally moved by crypto criminals and how funds are tracked.

The defense is expected to rest their case early next week. In February, Storm's co-founder Alexey Pertsev was sentenced to 64 months in prison by a Dutch court.

I am very concerned that the courts, these AUSA's prosecuting crypto crime, and the IRS do not seem to understand the difference between using LIFO to:

— Tay 💖 (@tayvano_) July 24, 2025

(1) establish the amount of assets that flowed through a very limited set of KNOWN parties and a very limited set of their… pic.twitter.com/y8eQHmbjAU

2️⃣ DOJ's Next Target?

While Storm's trial is still ongoing, some have criticized the silence of early Tornado Cash backer Dragonfly Capital throughout the process. It appears that the influential crypto VC firm is under the eye of the DOJ themselves with prosecutors detailing that they had not ruled out charges against the firm's founder Tom Schmidt and a number of other partners at the firm who had been involved in the deal.

"We believe deeply in Americans’ right to privacy, and the lack of it remains one of crypto’s largest unsolved problems. We therefore stand by our investment," Dragonfly managing partner Haseeb Qureshi said on Twitter.

Dragonfly invested into PepperSec, Inc., the developers of Tornado Cash, in August of 2020. We made this investment because we believe in the importance of open-source privacy-preserving technology. Prior to our investment, we obtained an outside legal opinion that confirmed that…

— Haseeb >|< (@hosseeb) July 25, 2025

3️⃣ ETH Treasury Level-Up

While ETH treasury operators are still early in their life cycles, the firms continued to make big moves this week, with BitMine effectively doubling its funds with its latest buy to over $2.1B worth of ETH. SharpLink continues to look like the premier venue with the firm gaining a new CEO from BlackRock's Digital Asset team this week, though the hire didn’t stop the firm’s stock from sliding. SBET fell 31% this week as ETH's breakout appeared to stall. This week's major new entrant was The Ether Machine, which comes online with $1.5B in committed capital to buy more ETH.

We are The Ether Machine.

— The Ether Machine (@TheEtherMachine) July 21, 2025

Today we launch the largest public vehicle ever built to own and manage ETH with over $1.5B in committed capital.

This is Ethereum’s institutional chapter.

Not passive. Not synthetic. Not outsourced.

⬇️

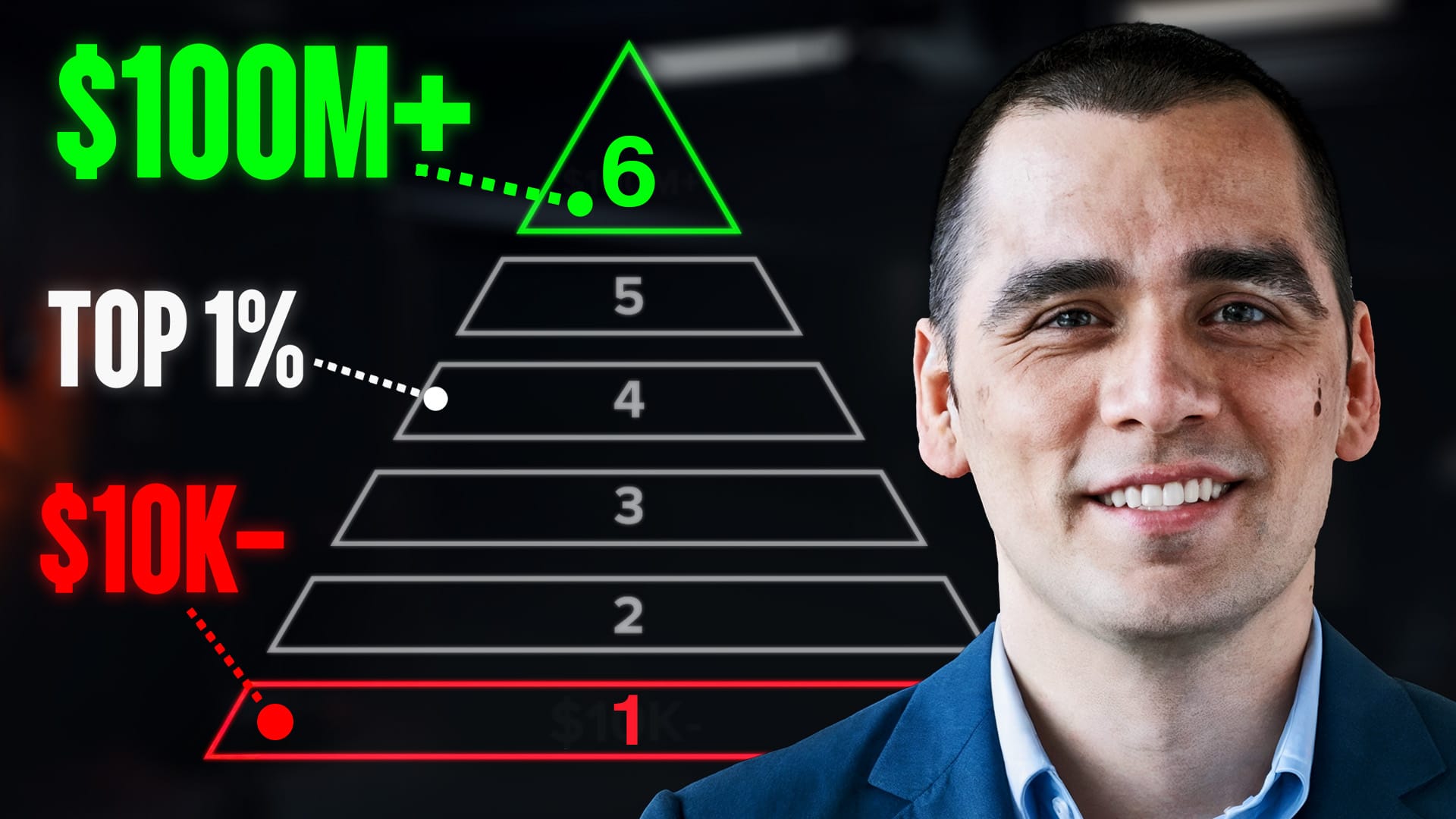

4️⃣ Trump Media's Bitcoin Strategy

Earlier this week, we laid out the Trump family's investments in the crypto space over the past couple years, as the President has completely reshaped his fortune via crypto investments. This week, Trump Media announced that it now holds the majority of its liquid holdings in BTC, some $2 billion in assets.

JUST IN: Trump Media is now the fifth largest corporate Bitcoin treasury with 18,430 Bitcoin pic.twitter.com/cxWuOHpcu0

— Bitcoin Archive (@BTC_Archive) July 21, 2025

5️⃣ Ethereum Pumps the Gas

Ethereum took a big gulp of gas this week as it boosted its block gas limit from 36 million to 45 million units (a 25% jump) at block 22,968,004. This means more transactions per block, less congestion, and potentially lower fees. It didn’t need a hard fork – validators phased it in themselves. Next up: a short‑term target of 60 million and long‑term dreams of 150 million gas per block via the “Fusaka” upgrade.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

This week, David and Ryan celebrate the crypto market reaching a $4 trillion market cap, explore the impact of the GENIUS Bill on stablecoins and digital assets.

They also discuss Ethereum's ETF inflows and the courtroom drama surrounding the Roman Storm trial.

Tune into this week's rollup! 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor