Decentralized VC will eat venture investing

Dear Bankless Nation,

One of the very first use cases of Ethereum was a community-owned venture fund. Many of us know it as The DAO.

This was one of the first instances where Ethereum showcased its potential as a digital coordination layer. Anyone in the world was able to contribute to this fund and have a future claim on the capital pool as well as voting rights on how the money was invested.

But as we know, it didn’t end well.

Regardless, this introduced a new paradigm in investing. It democratized access to venture investing, allowed thousands of individuals to coordinate capital on a global, digital scale, and gave anyone the opportunity to request funding for the project they were building.

The problem was that it was too early—the infrastructure wasn’t quite there yet.

Fast forward to today, and the tools are becoming a lot better. We’re seeing this sector take form again.

So we brought in Callum, one of the guys working on the ground floor for a decentralized VC fund known as MetaCartel Ventures, to give us a rundown on where it’s at today.

Like everything built on these decentralized networks, it has a solid chance of eating traditional venture investing.

Let’s explore why.

- Lucas

THOUGHT THURSDAY

Guest Writer: Callum Gladstone, Mage and Operations at MetaCartel Ventures

How MetaCartel Ventures is Decentralizing Venture Capital

Back in 2016, the idea of a collectively owned vehicle for the Ethereum community to invest together was ‘born’ as The DAO.

As many of us know, this early experiment ultimately ended in drained funds, a hard fork and a good few years of ‘PTSDAO’. The implementation of this experiment is famous for having failed on a technical level, but perhaps more importantly, the community, tooling, and breadth of investable projects weren’t really ready five years ago.

Fast forward to early 2020, and the soil for a decentralized venture fund was much more fertile. Driven by Ameen Soleimani, Gabriel Shapiro, and Peter Pan (among others), MetaCartel Ventures DAO (‘MCV’ for short) was summoned at ETHDenver 2020, creating a new paradigm for a bankless investment vehicle for the Ethereum community.

Investing in a Decentralized Future

The mission of any decentralized VC fund is simple: to allow a group of individuals to collectively and trustlessly pool capital and invest it into projects that further the mission towards a decentralized future.

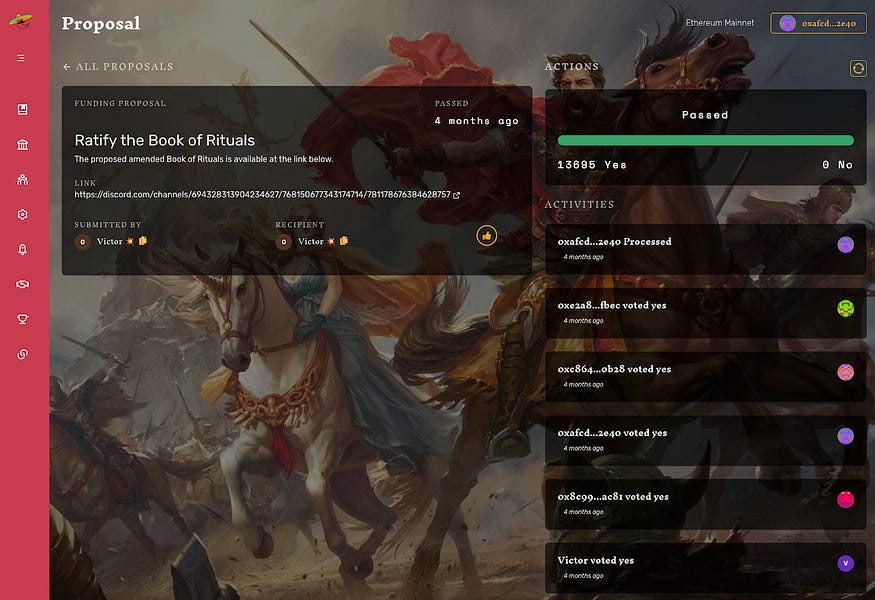

For MCV, members are known as ‘Mages’— they are liquidity providers, directors, deal sourcers, technical DD auditors, analysts, and everything in between. Mages bring investment deals to the DAO, carry out due diligence on projects, negotiate with teams, and eventually make an on-chain proposal for other members to vote on.

Investments are determined through simple majority: if a deal receives 51% approval, the DAO invests into the project according to the terms outlined in the proposal.

Today, admission to the DAO is permissioned and member-curated, while the ability to exit is completely permissionless, allowing exiting members to receive their pro-rata share of the DAO’s assets and investments at any time. Each member’s shares (and voting weight) are determined by their contribution to the DAO’s treasury—though shares can also be awarded to members for non-monetary contributions.

Thanks to Moloch V2, if a member of the DAO disagrees with the overall consensus on a decision, they always retain the ability to ‘ragequit’ the DAO before the decision is executed. During a seven day grace period following each proposal’s passage, any member may ragequit before the funds allocated to proposal are withdrawn.

Members can also protect the DAO’s interests by expelling free riders and malicious actors using ‘guildkick’ proposals, which are subject to a vote and result in the same pro-rata asset withdrawal as ragequits.

MCV members have found that this new design space comes with additional flexibility and reduced bureaucracy compared with a traditional venture fund. Leveraging a combination of smart contracts and legal structures, MCV is able to remain compliant while making investments and allocating capital in an efficient, transparent and fair manner.

Community Advantage

MetaCartel Venture members include founders, builders, community managers, economists, lawyers, designers and investment professionals who have been working in the web3 and crypto space for years.

Investing with a group of people who are deeply entrenched in the Ethereum ecosystem gives MCV the unique advantage of having an intimate, ground-level understanding of potential investments.

There is no need for technical advisors. MCV’s mages understand the viability of a potential investment, as many have been tackling the same challenges in their own projects. All members have hands-on experience in the space, which is key to the DAO’s ability to select the right projects to invest in and forms the basis for its ability to effectively support projects as they grow and mature into the household names of tomorrow.

As a portfolio project of MetaCartel Ventures, the opportunity to tap into this network, experience, and expertise can be invaluable. Whether it be help with a tricky smart contract bug, tokenomics design, a warm introduction to another project or team, or simply the amplification of a launch tweet, MCV is always looking to support our community and portfolio projects, as well as the Ethereum ecosystem as a whole.

MCV members are core contributors or founders in major projects like Nexus Mutual, Aave, Reflexer Labs, CoinGecko, and more. This cross-pollination of communities, both inside and out of the MetaCartel family, allows deep collaboration to happen effectively at a scale unsurpassed within the Ethereum community.

Slaying Moloch & Coordination Failure

So you might be thinking that Venture DAOs have solved all of the problems with venture investing. Unfortunately, this is really not the case!

As with any new technology or community (in this case both), there are always difficulties and challenges to overcome, and definitely times when it would have been a lot simpler to be a traditional fund!

For one, inactivity and free-riding can be an issue. There often ends up a situation where some people do a lot of work, some do a little, and some do close to nothing. This is an incentive problem and it isn’t one that is easily solved. MCV is currently experimenting with a number of different mechanisms to enforce the culture of collaboration and shared responsibility that we enjoy.

From voting on a ‘Mage of the Month’ who receives additional shares for going above and beyond in their work for the DAO, to designing incentive mechanisms that dynamically adjust DAO ownership based on absolute and relative participation, MCV is pushing the boundaries of decentralized coordination in situations where real money, projects and people are involved.

The willingness and ability to experiment and iterate on these kinds of mechanics, and to accept, learn and try again when they fail is key to success in the long term.

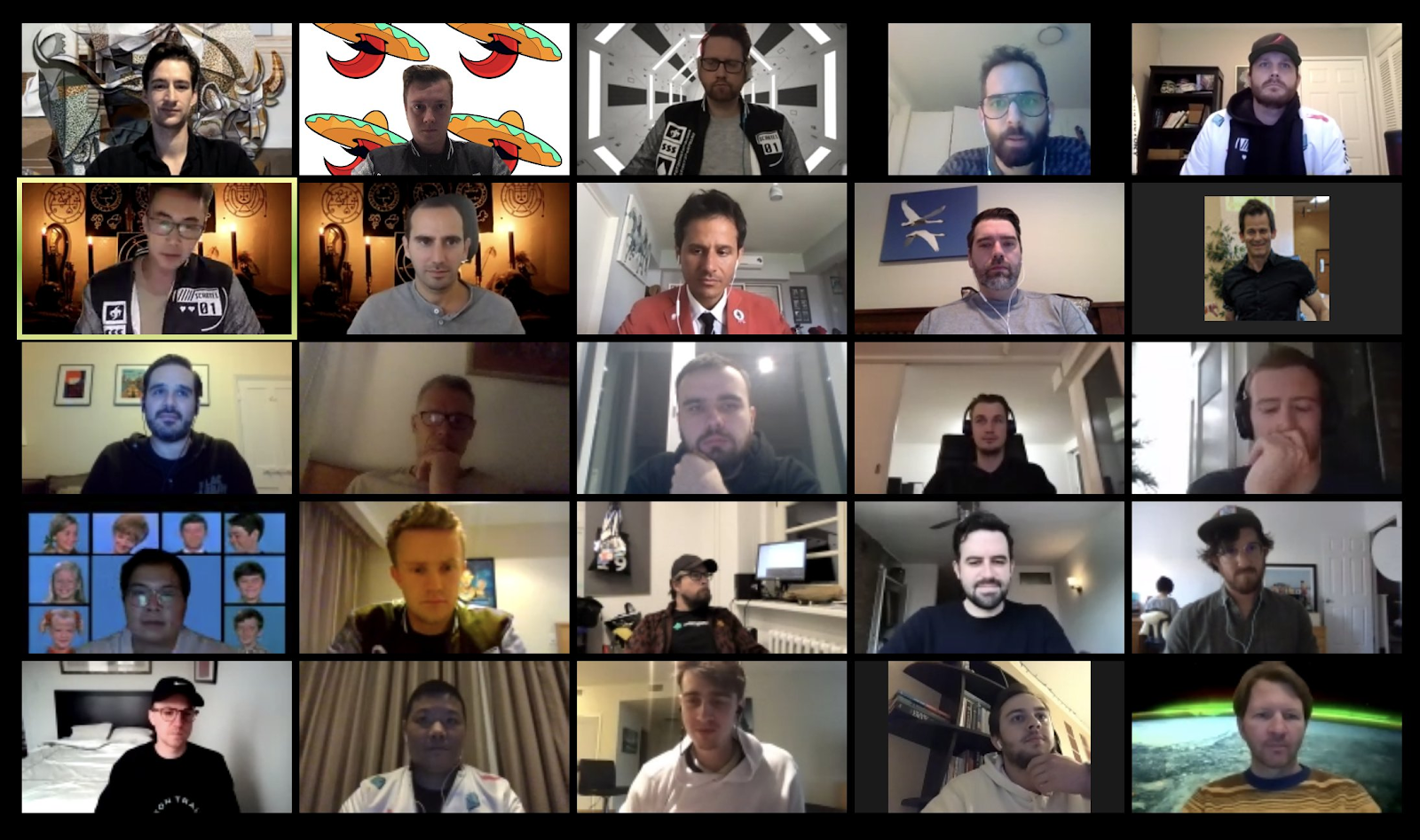

As mentioned above, coordinating 70+ members across the globe can be tough—especially when all of these people have their own projects, funds, day jobs and a million other things to do.

It is also tough to make decisions and assign tasks when there are this many people and no hierarchical structure. MetaCartel Ventures has no CEO, no intern, and no chain of command so to speak.

Instead, all DAO members are given an equal voice in discussions. This can obviously lead to some headaches sometimes, but this has also fostered a sense of collaboration and respect. Everyone’s opinion and efforts are given a chance, and this often leads to solutions and outcomes that would never have come out of a traditional fund where a small handful of Limited Partners (LPs) are making the decisions.

So what next?

MetaCartel Ventures has come a long way since its inception in the depths of a bear market. We have grown our AUM by multiples to over $25M, 70+ members, and 25+ portfolio projects. We’re beyond excited to continue to experiment around new ways to invest, collaborate, and work together to grow the Ethereum ecosystem for the better.

The funny part is that being founded at the very beginning of the pandemic, most of our Mages haven’t actually met each other in person. Everything has been coordinated over Zoom calls, Discord, Telegram chats and, of course, on-chain proposals (courtesy of DAOhaus!).

While this is a testament to the power of digital coordination, our first in-person ‘conclave of the mages’ could not happen soon enough! We are excited to supercharge our coordination and collaboration activities once non-pixelated faces can be matched with warm handshakes and the shake of solid laughter.

A New Way for Community’s to Invest

MCV sees a future where decentralized technology will serve as the backbone of venture funds, investment clubs, startups and more. A world where most people work for a DAO rather than a traditional company, where remuneration and value exchange is discussed in an open and transparent manner, and where no person has an unfair advantage over another.

We’re finding new ways to coordinate, incentivize, collaborate, and new tooling to empower all of this. The functionality and usability of the DAOhaus front end governance tool back when it was an ETHBerlin hackathon project was a shadow of what it has become today.

There are a plethora of projects across the Ethereum ecosystem working to expand the functionality and optionality available to decentralized communities.

To close this out, if you’re starting a project that’s aligned with the Ethereum ecosystem and are looking for funding, please reach out!

If your project isn’t quite at the stage of taking on capital, the MetaCartel Grants is always looking to empower impactful builders and projects looking to push the world towards a decentralized future.

Big thanks to Rolf Hoefer and Victor Rordvedt for the feedback on this post!

“If you want to go fast, go alone. If you want to go far, go together” - MetaCartel

Action steps

Consider the future of decentralized VC

Have a project that needs funding, reach out to the MetaCartel ecosystem

MetaCartel Ventures (investments)

MetaCartel (grants)

Author Bio

Callum Gladstone is an active contributor in the DAO ecosystem, including managing operations for MetaCartel Ventures. He’s also a member of 🔥_🔥 (Fire Eyes DAO) where he spends much of his time designing token economic systems and writing governance proposals for projects such as Balancer, Aave, DAOhaus, and others.