Dear Bankless Nation,

Wealth gets a bad wrap. People equate wealth with greed. But wealth isn’t greed…wealth is just a tool to make you free.

We hope you get wealthy. And we hope you use your wealth to make others wealthy. But you’re not going to make it if you pursue the wrong type of wealth.

In crypto, there are two types of people.

- Those who pursue overnight wealth

- Those who pursue decade wealth

Overnight wealth is the typical path people take to crypto. Chasing 100x flips. Buying on leverage. Rotating in and out of narratives.

You’ll be tempted to do this at every turn.

Here’s the truth: overnight wealth doesn’t work.

Decade Wealth

Take a moment to appreciate that you’re living in the greatest wealth transfer event in human history.

We’ve had wealth transfer events before, but with the rise of the Internet and the accelerated pace of innovation of the digital age, the speed of this transfer event is unprecedented.

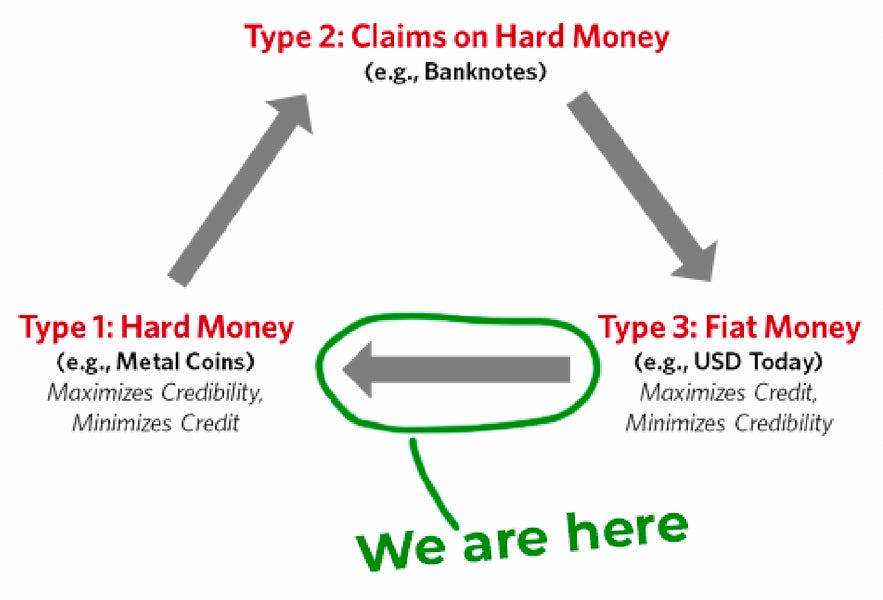

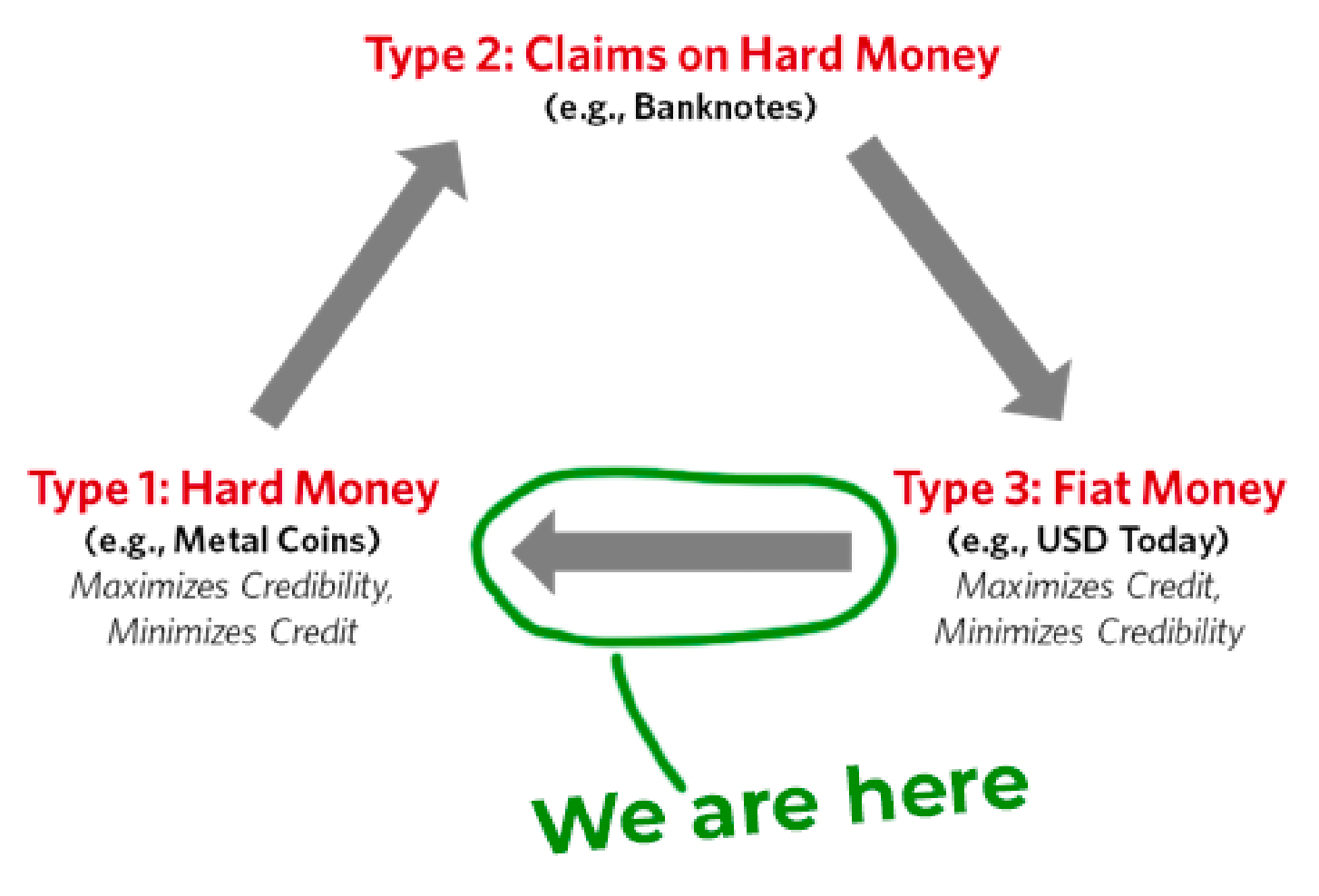

Ray Dalio frames the coming wealth transfers in this graphic:

The wealth transfer from type 3 to type 1 is where old institutions die, and brand new ones replace them. Investing in these institutions is the alpha.

If you believe we’ve entered a modern-age renaissance, then the last time an opportunity of this magnitude was available was the 1400s—and that was diluted over hundreds of years! This Renaissance will be compressed into the span of decades.

We’re investing in the next new institutions that will last for centuries.

You have a chance to get wealthy right now by buying and holding high conviction crypto assets. That’s literally all it takes.

But so many people will screw this up.

They'll choose overnight wealth over decade wealth. 👇

Three Ways to screw up the greatest wealth transfer event in history

In the age of 7-second TikTok videos and instant gratification, decade wealth just isn’t fast enough for most people.

Most people in crypto make one of these three mistakes:

1. Buying low conviction small caps

A recent highly upvoted post on the r/cryptocurrency subreddit was titled “How I accumulated my wealth by looking at pages 10 and beyond on Coingecko” and made the case for how the best returns are made shotgunning $$$ into micro-cap tokens.

Yes, things that have low market caps have the highest possible upside… hypothetically. If you “find the next Ethereum” at a $100m you’d have a 17,500x ahead of you.

But what about risk?

Go look at the exterior pages of CoinGecko and ask yourself: is this token going to be around in 10 years? Even if you’re planning to buy tokens on a narrative hunch to flip for a blue-chip later then you’re committing to some extra risks:

- Timing the sell

- The token not working out

- BTC or ETH going up while you’re in small-caps

It’s never as simple as “buy this illiquid small-cap, and sell it for a blue-chip later”.

Remember, the winners are loud and proud; the losers hide their losses. It’s a classic case of seen and the unseen. For every shitcoin millionaire out there, 1,000 people lost it all.

2. Leveraging up cause “I’m late”

Is this your first crypto cycle? I bet you’ve thought something like this:

“Wow, this crypto thing is so fascinating! But I’m so far behind. I’m so late. I don’t have any ETH or BTC compared to everyone else. My portfolio is tiny! How can I get more crypto?”

No one feels FOMO over dollars, but there’s something about the provable scarcity of assets like BTC and ETH that triggers FOMO centers in the human brain.

“If only I bought ETH at $100 two years ago when I had the chance”

So how do people catch up? They take leverage. The only answer to “how do I get my hands on more crypto” after you have allocated all of your cash is leverage.

But most people forget that leverage is a commitment to sell. You are borrowing to buy more crypto, but if price drops below a certain level you’ll have to sell your crypto to pay back your loan.

You never want to be a forced seller.

If you want to stay around for the multi-decade time horizons, don’t take leverage.

3. Outsourcing their conviction

“You can copy someone’s trade, but you can’t copy someone’s conviction”

Newcomers often look to the veterans in order to inform their decisions in this space. At face value, it seems like a good move! If you have incomplete information, just follow someone more informed than you!

This can fall apart for a number of reasons.

Some ‘experts’ take advantage of this fact, and milk newcomers out of their cash using tricks, scams, or pump-n-dumps.

Even honest experts make mistakes. No one is that smart.

Which experts do you follow? Picking the right one isn’t simple. Instead of researching “which expert to follow” why not research the fundamentals of crypto and become an expert yourself instead?

And if you copy the expert traders… are you really copying them? Do you know when and why they make their trades? Are they really being transparent about their buys and sells?

If you want to make it in crypto for decades, you’re going to need to make your own choices. Might as well start now.

Conviction can’t be given, it must be earned.

The Cheat Code

The key to avoiding the mistakes above is self-control. Investing isn’t as much a skill as it is a temperament. Don’t let the dopamine hits control you.

And there’s one last tip that’s helped me more than anything else…

Just do a tiny bit of degen trading. Eating healthy for 3 meals a day, 7 days a week is a prison sentence… but when you introduce a cheat meal it’s suddenly manageable.

One cheat meal a week.

TikTok only after work.

Alcohol only on the weekends.

Giving yourself permission to be a small degen will help you control the part of your portfolio that is focused on the long-term. Satisfy your inner degen by compartmentalizing your portfolio!

Take <10% of your portfolio, and be a degen with that.

Then take your winnings, and rotate them into your long-term piggy bank.

You’re here. You already won. Just don’t eff it up.

Pursue decade wealth.

- David