Dear Bankless nation,

Here’s a recap of the biggest crypto news in the fourth week of November.

1. DCG Has (Another) Big Week

As the fallout from FTX’s collapse continues to develop, Digital Currency Group (DCG) is still in the crosshairs.

DCG is one of crypto’s largest conglomerates. The firm owns Grayscale, the issuer of products like the GTBC and ETHE trusts that allow investors to get exposure crypto through equity markets, and is also the parent company of Genesis, the largest prime broker in crypto.

Genesis, Grayscale, and DCG, have played a central role in the credit crisis that’s ravaged crypto since the collapse of Terra in May. There’s a lot to unpack there, and our analyst Jack wrote a piece on it for this week's Market Monday. I highly recommend you give it a read.

Since the piece was published, some new revelations have come to light regarding the relationship between DGC and its subsidiaries via a letter to DCG shareholders by CEO Barry Silbert. The note comes amid reports that DCG was seeking to raise $1B, and then $500M of capital to help keep Genesis afloat. It’s unclear whether they’ve sourced any interest.

Barry's message to shareholders via @fintechfrank pic.twitter.com/lz8ZZ8ClQK

— db (@tier10k) November 22, 2022

In the letter, Barry revealed that DCG has more than $2B in liabilities, including a $575M debt to Genesis. This figure also encompasses $1.1B in debt which the firm absorbed from Genesis following the bankruptcy of 3AC.

It’s unclear whether the firm will be able to meet these obligations. But with DCG’s debt to Genesis coming due in May 2023, it’s shaping up to be a big few months for Barry’s empire.

2. Avi vs Aave

With market makers reeling following the collapse of FTX, liquidity has dried up across crypto. Not only has this increased volatility in both directions, but it's opened the door for opportunistic actors to take advantage of this illiquidity to extract value from DeFi protocols.

A prime example of this in recent days is the saga surrounding CRV, the governance token of Curve Finance, and Aave, DeFi’s largest lending protocol. The drama began on November 14, when addresses with ties to Avi Eisenberg (the man behind the highly profitable trading strategy executed on Mango Markets) began to use Aave to open a massive short position on CRV.

The situation intensified on November 22, when the price of CRV jumped ~75% in 8 hours once traders became aware of and sought to squeeze the short-position. As a result, Avi’s position began to get liquidated, fueling the squeeze as liquidators needed to purchase CRV to repay the borrow and re-capitalize the protocol.

This is where the danger of illiquid markets began to rear its head, as there was not enough CRV available on-chain to fully repay the borrow, saddling Aave with ~$1.6M of bad debt.

2/6 A large CRV borrow that had been building up for the last week was mostly cleared by the protocol liquidation process. However, the position was not covered entirely & 2.64M CRV (≈ $1.6M at current value) remains. This represents < 0.1% of the borrows on the protocol.

— Aave (@AaveAave) November 22, 2022

It’s unclear what Avi’s angle was, or whether he was net-profitable. It’s possible that his real target was an AAVE short, as to cover bad debt, AAVE tokens may be sold from the protocols safety module.

All in all, given that the bad debt represents just ~0.05% of Aave’s TVL on its Ethereum deployment, it’s safe to say that the impact of the “attack” on the protocol was minimal. Aave’s risk parameters proved effective - Though in this low-liquidity, adversarial environment, it won’t be the last time we see the protocol, and others across DeFi, stress-tested.

3. Flashbots and Ethereum Censorship

Ethereum’s validators are being forced to choose between higher profits and sacrificing some of the Ethereum network’s neutrality.

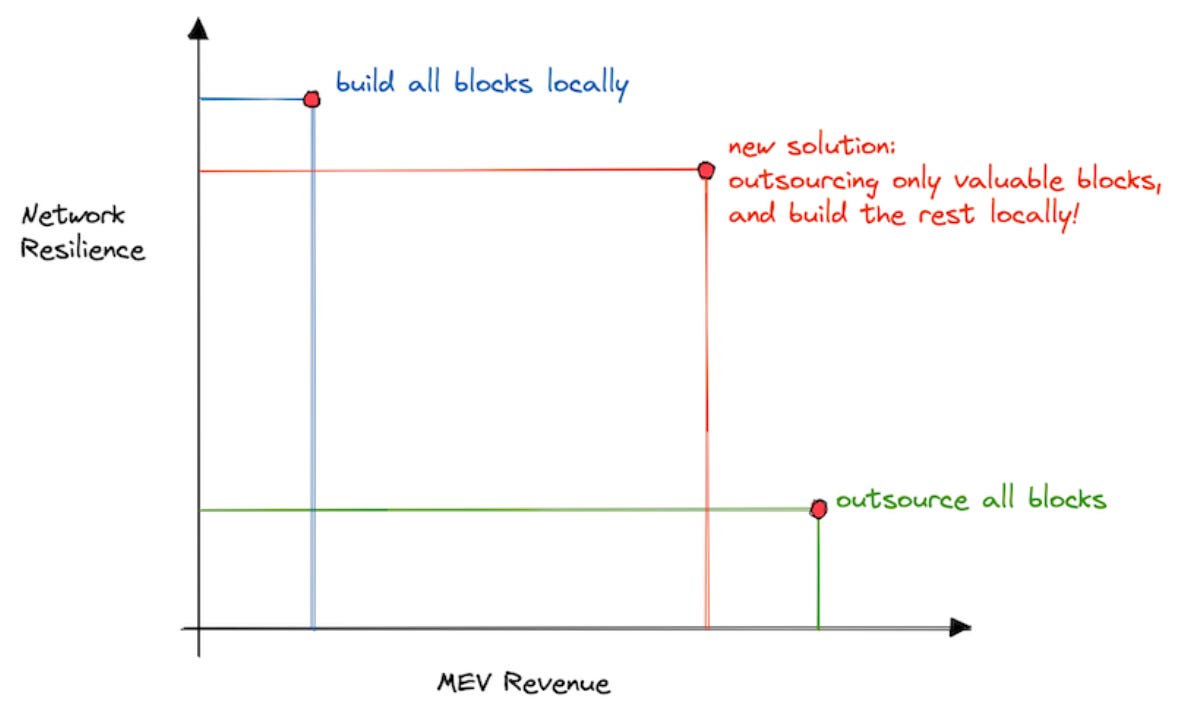

The latter is being done by validators outsourcing block-building through Flashbot’s MEV-Boost software that is compliant to OFAC’s Tornado Cash sanctions. The other choice is to build blocks locally that are Ethereum-neutral but might leave MEV profits on the table for other validators (See Bankless’ A Beginner’s Guide to Ethereum Censorship for more on this dynamic).

The latest solution at Flashbots offers a middle ground solution for this dilemma by letting validators set a minimum bid for outsourcing block building. This works because most blocks have low MEV profits. Validators committed to this strategy would leave a small amount of block-building MEV profits on the table, still acquire the mammoth share of MEV profits and vastly improve Ethereum’s censorship-resistance.

New short-term censorship resistance strategy dropped, courtesy of Flashbots: setting a min bid for outsourcinghttps://t.co/xEsxHvCqXY

— vitalik.eth (@VitalikButerin) November 22, 2022

Recommend stakers using mevboost take advantage of this option!

4. Curve launches new stablecoin design LLAMMA

On Wednesday, Curve released a new algorithmic design – LLAMMA (Lending-Liquidating AMM Algorithm) – for its own upcoming crvUSD stablecoin. How is this different and why should you care?

Today, an Aave liquidity provider (LP) would deposit ETH into the protocol, then borrow USDC against his position. But crypto is volatile, which either requires LPs to constantly monitor one’s collateral values, or DAOs to perform active governance votes that modify loan-to-value ratios for risky tokens.

LLAMMA wants to solve this by turning supplied collateral into an algorithmic token that would automatically sell LP collateral and buy the borrowed token when collateral’s price goes down, or sell the borrowed token and buy collateral when collateral prices goes up.

5. EIP-4844 Moves Forward

It’s not all doom and gloom in this bear market. Ethereum scaling continues to progress, with EIP-4844 inching closer to implementation.

With the merge behind us, 4844 has become one of the most anticipated near-term EIPs. The proposal will see Ethereum implement “proto-danksharding,” an upgrade that introduces blob transactions which will substantially reduce the cost of storing call-data on-chain.

The main beneficiary of this upgrade are rollups, as call-data storage on L1 is their largest cost driver. When rolled out, EIP-4844 is expected to lower transaction costs on L2s by up to 100x, greatly increasing their competitiveness with other networks while inheriting Ethereum’s best-in-class security.

The EIP was added to the Considered For Inclusion (CFI) List during an Ethereum core-devs meeting on November 24. So while it isn’t clear which network upgrade we’ll see 4844 implemented during, we do know that it’s now a higher-priority for core-developers.

First, we discussed which of the EIPs we've been discussing should be moved to "Considered for Inclusion" status. A few years ago, we added the CFI status to highlight EIPs that client teams liked and wanted to potentially implement, without committing them to a specific fork

— timbeiko.eth (@TimBeiko) November 24, 2022