The EIGEN airdrop has triggered discussion about the rift between private and public markets. The points-based, large private rounds-fueled, high-FDV airdrop meta is creating structural problems with the vibes of the crypto industry.

Points programs that turn into multi-billion dollar, low-float tokens is not a stable equilibrium, yet we nonetheless find ourselves cornered in this meta by a confluence of factors: an overabundance of VC capital, a lack of new entrants, and an overbearing regulator.

The meta around token issuances is always in flux, here are the major eras we've seen:

- 2013: PoW fork-and-fair launch meta

- 2017: ICO meta

- 2020: liquidity mining era (DeFi Summer)

- 2021: NFT mints

- 2024: the points & airdrop meta

Each new token distribution mechanism brought its merits, and each one had its drawbacks. Sadly, this particular meta begins from a place of structural retail disadvantage, a natural consequence of the unforgiving regulatory spotlight that’s hovering over the industry.

Who did this? pic.twitter.com/pvpn8vVCkO

— Takuiten⚡ (@Takuiten) April 30, 2024

Abundant VC Dollars vs. Retail

Right now, there is simply an oversupply of venture capital in the crypto industry. Despite the terrible year 2023 was for VC fundraising, there is still plenty of capital from 2021 raises, and in general raising from VCs in crypto is a persistent, ongoing activity.

Currently, an abundance of well-capitalized VC firms are still willing to continue leading rounds at valuations in the billions of dollars, meaning crypto startups have room to stay private longer and longer. This is rational of course, because if tokens are currently launching at multiples of their last raise, then even the late VCs can still find a good deal.

The problem is, by the time a startup releases a public token at $1-10 billion, much of the upside has already been discovered by earlier parties – i.e., No one is going to get rich by buying a $10B token.

By structurally disadvantaging public market capital, the vibes of the crypto industry are souring.

People want to get rich with their internet friends and form strong online communities and friendships around this activity. This is the promise of crypto, and this promise is currently not being fulfilled.

26/ Man *this week alone* we have seen three token launches alone with $5B+ in aggregate supply overhang

— Regan Bozman (@reganbozman) April 19, 2024

Zero fucking chance there are enough institutional bids to eat the supply hitting the market@Arthur_0x can only buy so many of your bagshttps://t.co/fePbu1O7xo

Billions of unlocks, no new entrants

Here are a few datapoints that together should give you some pause:

- Vance’s napkin math says $200-300 Billion in sell pressure from VC unlocks in 2024+2025

This is the first cycle where retail is actually paying attention to unlocks. This is a good thing, and I hope they take this into account when making investment decisions. GCR literally had to gather a gang of neets to find this information last cycle.

— Vance Spencer (@pythianism) April 29, 2024

A few points of… https://t.co/QXLXDyr8PH

- Coinbase’s Q2 report illustrates further evidence that new market entrants are not present, at least not in size

On Coinbase Retail Trading volumes:

— Wazz (@WazzCrypto) May 2, 2024

Still multiples off 21' Highs, now this can have multiple interpretations, if you're ultra bullish u can scream to the skies "WAGMI, it's so early, we are going so fuckin high"

But if you look at Institutional trading volumes, you notice they… pic.twitter.com/9z6ZQIql9Z

- Since there aren’t a meaningful number of new entrants this cycle, VC capital significantly outweighs the demand for the fruits of that capital

25/ TLDR I think a TON of sell pressure hits every token with large unlocks that is more than 10-20x up from ANY private round

— Regan Bozman (@reganbozman) March 5, 2024

This is amplified by the fact that these tokens are not THAT liquid - a $1.5M sell moves the Binance $ARB market 2%+

Since retail predominantly owns the long-tail of crypto assets, the institutional liquidity coming in through the Bitcoin ETFs is not going to bid these markets. Capital recycling from crypto-natives dumping their $14k BTC buys on Larry Fink can prop up these assets for a while, but it's all internal capital from PVP-capable players who know how unlocks work, and how to avoid them.

The Effect of the SEC

By restricting the ability for startups to more freely raise capital and distribute tokens, the SEC is encouraging capital to flow into private markets, which has fewer regulatory constraints.

The SEC’s corrupt and overbearing nature towards the nature of tokens is nerfing the value of capital in the public markets, as startups cannot trade their tokens for public market capital without triggering mass aneurysms among their legal teams.

Crypto’s March Towards Compliance

Crypto has slowly become more compliant as it has progressed.

When I got into crypto, during the 2017 ICO mania, ICOs were touted as a way to democratize investment and access to capital. ICOs of course devolved into an exploited grift, but nonetheless it was a story that compelled me and many others toward the potential that crypto can bring to the world. But the ICO meta ended when it became apparent that regulators were viewing these transactions as clear unregistered securities sales.

The industry then pivoted into liquidity mining, which went through a similar process.

Every cycle, crypto manages to obfuscate its method of distributing tokens to the public, and every cycle, it becomes a little harder to hide this process – a process that is crucial to the decentralization of the projects, and the nature of our industry.

This cycle has the most unrelenting regulatory spotlight that we’ve ever seen, and thus the lawyers of VC-funded startups have been given the biggest compliance challenges the industry has ever experienced: distribute tokens to the public, without getting sued by regulators.

Disrupting the Balance

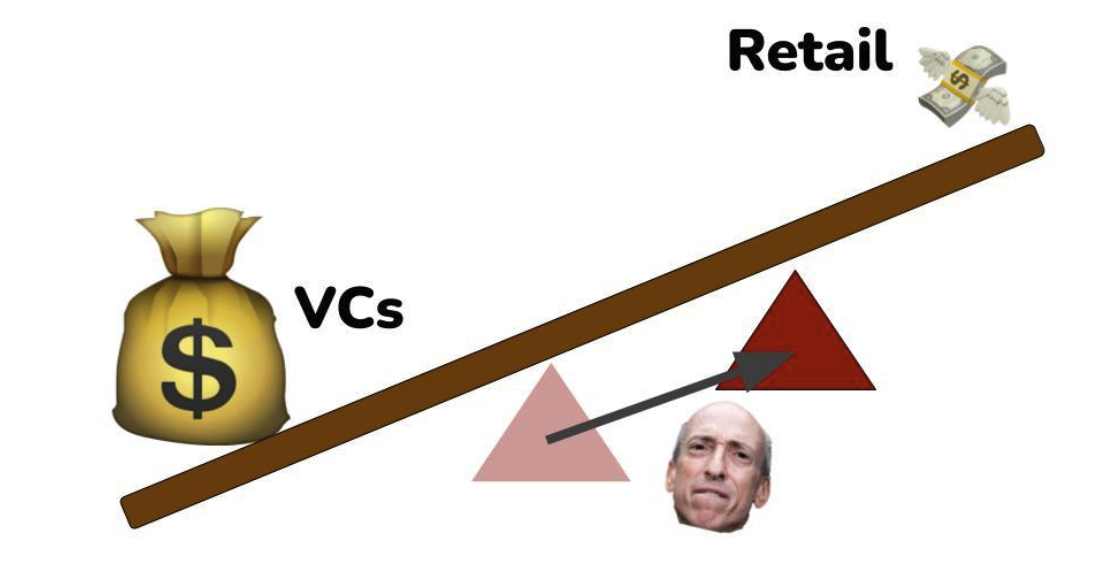

Regulatory compliance shifts the fulcrum of the public-private market to be heavily weighted towards the private side – since startups can choose to simply accept VC capital instead of potentially violating securities laws.

The position of the fulcrum that balances private vs public capital is determined by the strength of the chokehold that regulators have over the crypto markets.

- If there were no investor accreditation laws, then this fulcrum would be more balanced.

- If there was a clear regulatory path for compliantly issuing tokens, then the differences between public and private markets would be smaller.

- If the SEC wasn’t engaged in a war on crypto, then we would have far more fair and orderly markets.

Since the SEC won’t provide clear rules of the road, we end up with a complicated and convoluted ‘points’ meta which satisfies no one.

Points are unfair, disorderly markets

‘Points’ give retail users zero clarity on what they are actually receiving, because if there was ever an explicit articulation of what points actually are (a claim on tokens), the team would expose themselves as potentially violating securities laws (from the perspective of an overbearing and corrupt SEC regulator).

Points offer no investor protections, because in order to offer investor protections, the process needs to be given regulatory legitimacy in the first place. As a result of this extremely shitty conclusion that we’ve found ourselves in, we’ve discovered the Sybil vs Community debate, in which LayerZero is stuck between a rock-and-a-hard place.

We believe it is in the protocol's best interest to distribute tokens to durable users — not sybil farmers.

— LayerZero Labs (@LayerZero_Labs) May 3, 2024

If you are a sybil, you have two options:

– Self-report sybil addresses for 15% of your intended allocation. No questions asked. The deadline to do so is May 17th.

– Do… pic.twitter.com/Kme9ZKckC7

LayerZero recently announced a program for airdrop Sybils to self-report their Sybil attack on the incoming LayerZero airdrop, which triggered Kain Warwick to write this thread defending the Sybils as a group of people who have significantly supported LayerZero’s metrics, and have raised LayerZero’s perceived status in the market.

In reality, there is no line between a community member and a Sybil. Since your average crypto participant has no way of engaging in the private markets, the only way they have to gain exposure is pushing through committed and meaningful activity on the platform they want the token for.

In the absence of simply letting small-time investors write small-time checks into early rounds of crypto projects, the current token issuance meta has forced users to Sybil the projects they are bullish on. As a result, no ‘communities’ are banding together getting rich this cycle, like they did with LINK in 2020, or SOL in 2023. The current meta of token issuances don’t give affordances to communities gaining early exposure at low valuations.

As a reaction, Twitter mob attacks on airdropping startups are increasingly common – a logical consequence of communities of not being able to express their desires as valid stakeholders in a project. Big "No taxation without representation!" vibes.

This is to say nothing about the other snake in the grass: mercenary capital exploitatively farming tokens to dump. Without the ability for small-time investor to invest in earlier stages of a startup, these highly-aligned investors have to compete with toxic mercenary farmers for an airdrop, without any distinguishable difference between these two parties.

An Inadequate Equilibrium

The ‘points’ meta has become too explicit to be sustainable. Both the SEC and grifters are coming for it, and both will try to exploit it to their benefit.

We will have to move on to a different strategy, hopefully one more thoughtful about making many early community stakeholders wealthy while also not triggering the ire of the SEC. Sadly, without a regulatory carveout for token issuances, this is a pipe dream.

The meta is dead – long live the meta.