Crypto’s Trump DeFi Anxiety ($)

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

1️⃣ World Liberty Financial Raises Eyebrows

Details about World Liberty Financial, the “high-yield” Trump-backed crypto project, have been unearthed, and it's making everyone a little nervous – supporters and critics alike.

As of now, the project intends to allocate 70% of its non-transferable tokens to insiders, raising serious doubts about the project's long-term viability. It plans to sell the rest, according to CoinDesk's reporting on an early white paper – a move that will certainly attract the ire of regulators, particularly if Trump is not successful in his White House bid.

Trump's official role with the project is "Chief Crypto Advocate," but his three sons are also formally involved. The project is linked to Dough Finance, a recently hacked lending platform, and its founder, Zak Folkman – a former pick-up artist turned entrepreneur, is officially registered as the owner of World Liberty Financial LLC.

2️⃣ Uniswap Settles as Investors Receive Subpoenas

Uniswap Labs announced a settlement with the CFTC this week, paying $175K for enabling leveraged token derivatives to be traded on the exchange, violating commodity laws. Meanwhile, a16z and Union Square Ventures, key investors in Uniswap, received subpoenas from the NY Attorney General, adding to the legal pressure Uniswap faces after the SEC’s Wells Notice from April. We can expect more developments following the DeFi hearing on September 10.

3️⃣ Aave and Sky Join Forces

Aave and Sky (formerly MakerDAO) have teamed up to launch Sky Aave Force, aiming to integrate Sky's rebranded stablecoins USDS and sUSDS into Aave V3. If the proposal is passed, the initiative will feature a 3.33M SPK monthly airdrop for sUSDS suppliers and a 100M debt ceiling for USDS in Aave’s Lido market. This partnership also promises a 50/50 revenue split and aims to boost both the expansion of Sky’s new tokens and Aave’s native stablecoin GHO.

4️⃣ Ethervista Gains Traction

Ethervista, the newly launched DEX and token launcher for Ethereum and Layer 2s, has made waves this week, with its VISTA token up over 20x. The no-code token launchpad and creator fee system aims to prevent quick rug pulls, a common risk in meme coin markets, and has seen ~$355K in volume traded since its launch on Aug. 31st. The DEX’s design has sparked excitement, with VISTA being fair launched to LPs on the platform, tokens needing to lock liquidity for 5 days — as rugs typically happen in 2-4 days, Ethervista’s research claims — and fees for swapped tokens being priced in ETH and distributed to both liquidity providers and token creators.

5️⃣ Bitcoin’s Rollercoaster After Jobs Report

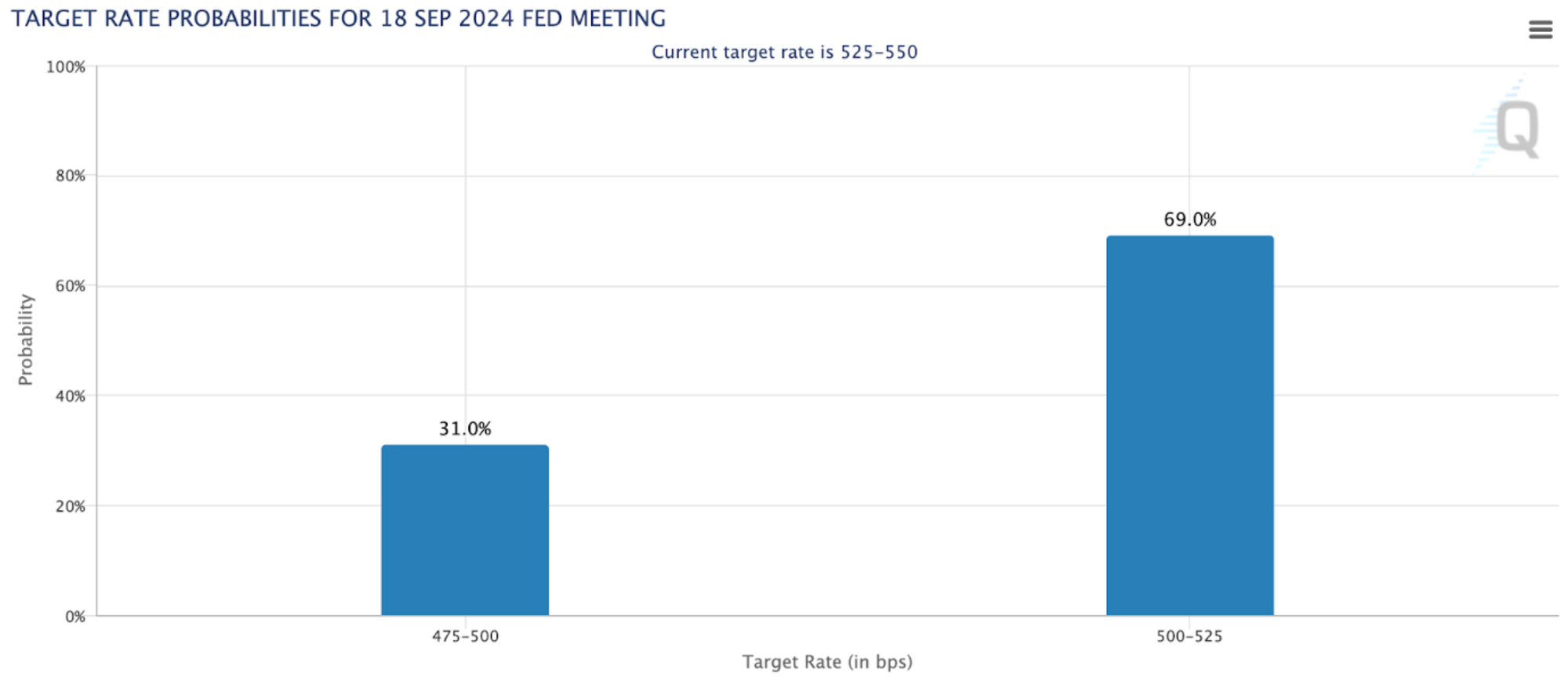

Following the release of U.S. labor data on Friday, Bitcoin spiked to $57K before plunging past $54K after the New York open. The report showed that 142K jobs were added in August, below expectations of 160K, and revised payroll gains for June and July lower by 61K and 25K, respectively. A 527K increase in part-time jobs contrasted with a 438K decline in full-time positions, signaling labor market softness. As a result, a 25 basis point Fed rate cut at the September meeting now has a ~69% probability, with a ~31% probability for a 50 basis point one, which many think would be bearish for risk assets.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

This week in crypto, Trump’s new DeFi project sparked debate—is it legit or a grift? After the SEC, the CFTC targeted Uniswap—what’s going on with regulators?

Markets are also asking if the 4-year cycle is dead, and Ryan has three takes on the lackluster crypto prices and what it could mean moving forward. On the brighter side, Polymarket is now on the Bloomberg terminal, and Coinbase is looking to bank the robots—an exciting step for AI and crypto.

Dig into all the analysis 👇

Get ready for the Bankless Summit! 🌋

We're going to Devcon in Bangkok and bringing some of the brightest minds in the Ethereum ecosystem. Our one-day event is sure to trigger plenty of conversations around what's next for Ethereum 🗣️

Bankless Citizens get 70% off tickets for the event 👀

📰 Articles:

📺 Shows:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.