Crypto's Quantum Threat

View in Browser

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

- 💸 Zcash Rally Melts Faces, Reaching Levels Unseen Since 2018. ZEC token price has ascended over 1,000% in the past six weeks.

- 🦙 DeFiLlama Launches LlamaAI, Conversational Interface for Crypto Data Analysis. The service is now available to DefiLlama Pro subscribers.

- 📈 Mantle Unveils Stock Tokens Powered by Backed, Bybit. The Ethereum L2 will soon unlock 24/7 trading for NVDA, AAPL, and MSTR.

| Prices as of 6pm ET | 24hr | 7d |

|

Crypto $3.46T | ↗ 1.7% | ↘ 5.7% |

|

BTC $103,512 | ↗ 2.3% | ↘ 5.5% |

|

ETH $3,443 | ↗ 4.0% | ↘ 10.7% |

Two weeks ago, I attended Trezor's unveiling of the new Safe 7 hardware wallet — a device that, beyond its UX and hardware refinements, arrives with what the company calls quantum readiness, a layer of hardware protection against the phantom “quantum threat.”

In fact, my experience at the event centered almost entirely on the threat of quantum computing to digital assets.

Earlier this year, we did a whole podcast devoted to the subject with Scott Aaronson, a quantum computing expert from UT Austin, and Justin Drake of the Ethereum Foundation, examining what quantum computing actually is, the scale of its threat, and its implications for Bitcoin and Ethereum.

Over the past few months though, both in and out of crypto, quantum has played an increasingly frequent role in conversations about the future, with the Federal Reserve even calling out the threat it poses to Bitcoin.

All of this chatter has prompted me to take a deeper look at the real threat quantum computing poses and a reassessment of my own understanding. Below, I'll break down what quantum computing is, what it can actually do, and how it threatens Bitcoin, Ethereum, and the broader cryptocurrency ecosystem. 👇

What is Quantum Computing?

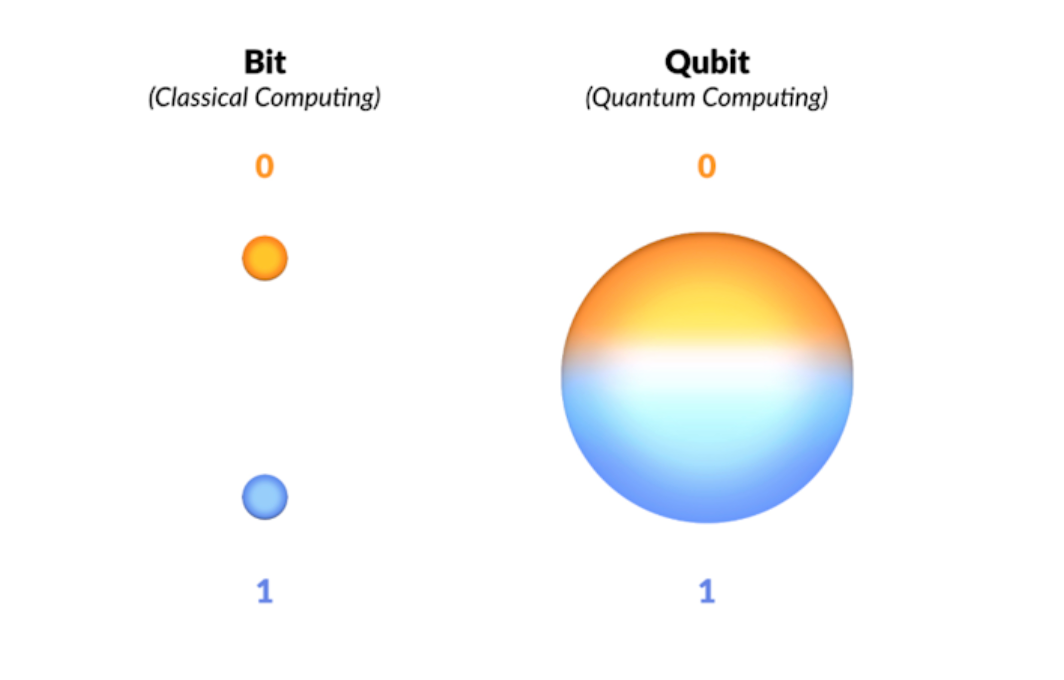

Quantum computing uses the principles of quantum mechanics to solve problems beyond the reach of classical computers.

Instead of being built on bits, the units of 0s or 1s that everything related to computers are built on today, quantum computers come built on qubits, units which can exist as 0 and 1 simultaneously through a phenomenon called superposition. This lets them explore many possible solutions in parallel, offering exponential speedups for certain problems by running quantum-specific algorithms.

In their rawest state, physical qubits are inherently error-prone. To make them useful, they must be assembled into logical qubits: grids of physical qubits governed by error-correction software from classical computers. Think of them like a choir: alone, one person (one physical qubit) may be out of tune, but with careful orchestration (logical qubits managed by classical computers), together they produce harmony (properly run quantum algorithms).

To be clear, quantum computers are not just faster classical computers. They only prove useful for specific problems like simulating quantum mechanics (chemistry, materials science, drug discovery) and breaking certain cryptography (factoring large numbers, solving discrete logarithm problems).

The Two Algorithms That Matter

While there are, as of now, about 130 documented quantum algorithms, two in particular pose the (potentially) existential threats to crypto: Shor's algorithm and Grover's algorithm.

Shor's algorithm is the serious one. An algorithm for factoring, which as Aaronson made clear in the podcast is the basis of much cryptography, Shor’s would allow an attacker to derive private keys from public keys and forge digital signatures, draining your wallet if they see fit.

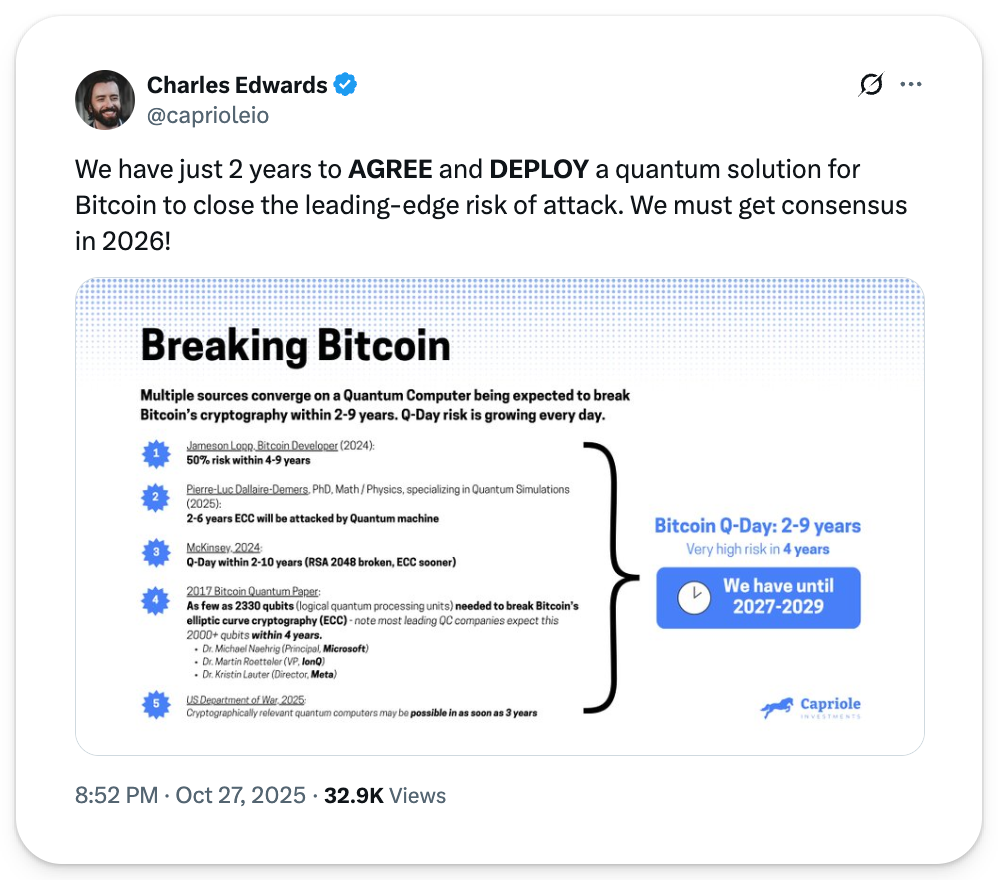

Moreover, the danger here is that a large number of public keys are already exposed onchain, especially from older, untouched wallets like Satoshi's. An estimated 25-30% of all Bitcoin (over 4 million BTC) sits vulnerable to what's known as "Harvest Now, Decrypt Later" (HNDL) attacks — where adversaries collect exposed public key data today, then decrypt and steal funds once quantum computers reach roughly 2,332 logical qubits.

Grover's algorithm is different. Used to speed up “searching,” this algorithm wouldn’t target private keys directly like Shor’s, instead it would exponentially speed up the process of solving for Bitcoin mining rewards. As a result, it could allow certain miners to find blocks dramatically faster than others, leading to centralization and destabilizing Bitcoin's consensus. This approach would require around 1,000 logical qubits.

While these numbers of logical qubits needed are far off from the levels we’ve been able to achieve today (a dozen or two logical qubits), quantum is gaining momentum on all fronts as governments, research institutions, and private companies are pouring billions of dollars into quantum research and development.

The question of "when" remains largely speculative, with estimates ranging from two to ten plus years. But regardless of where reality lands within that window, Tomas Susanka, Trezor's CTO, captured the shift plainly: "Years back, I believed quantum computers belonged to science fiction and now the pace of innovation is changing that. It's no longer just a theoretical risk."

What This Means for Bitcoin and Ethereum

Yet, the crypto community has been preparing.

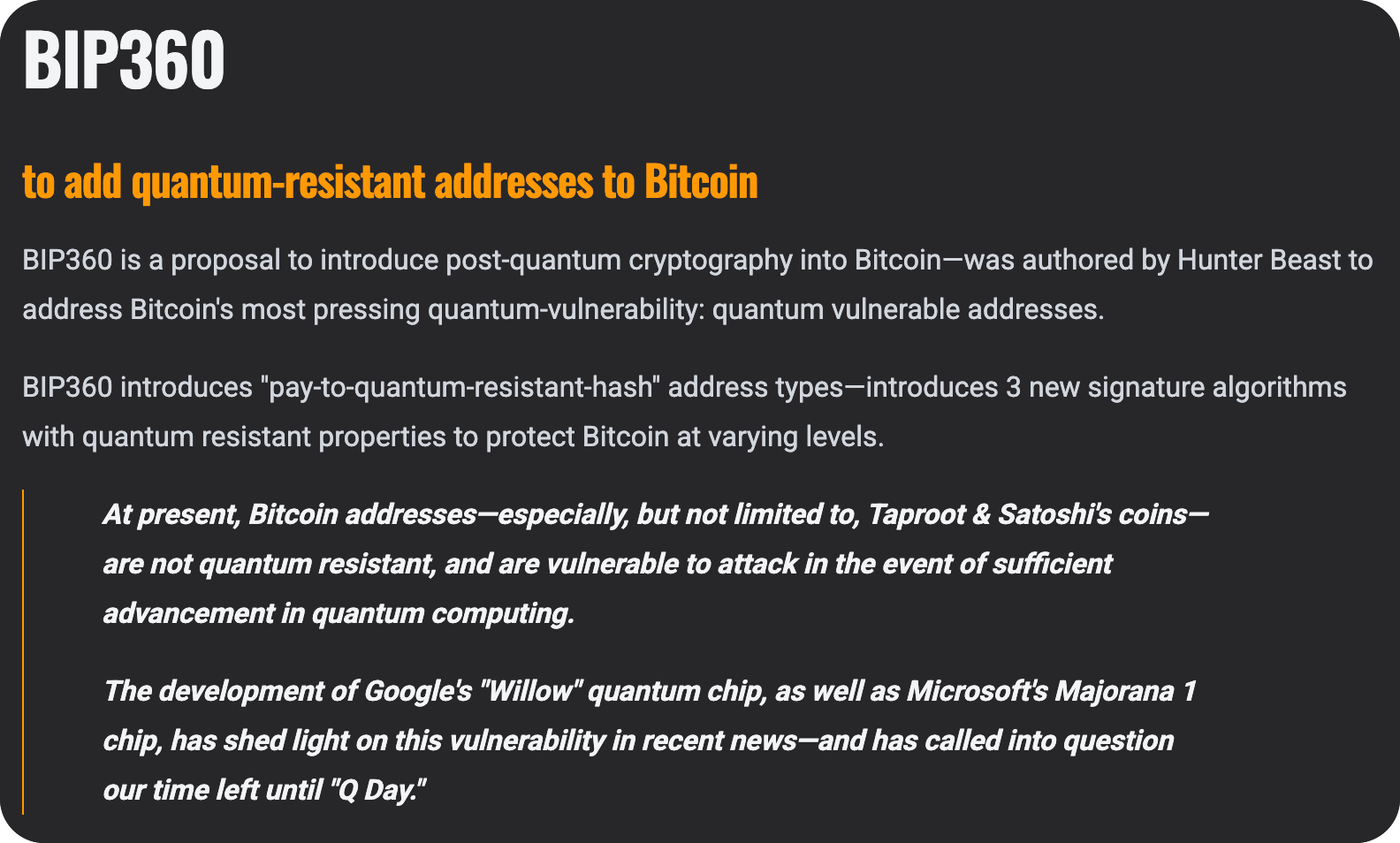

The Bitcoin community has been developing standards through Bitcoin Improvement Proposals (BIPs). Last year, a notable proposal called BIP 360, authored by pseudonymous Bitcoin developer, Hunter Beast, outlined a phased strategy to retire vulnerable legacy signature schemes by 2030, introducing quantum-resistant addresses under the proposed "Pay-to-Quantum-Resistant-Hash" (P2QRH) format, in a manner that would allow “developers, wallets, and users to opt into post-quantum security without forcing the entire network to switch at once," explained Tomas.

But Bitcoin faces its deepest challenge in the realm of philosophy and social coordination, not pure technology.

Beast’s BIP controversially suggests freezing funds in legacy addresses that remain unmigrated, effectively invalidating these transactions to prevent future quantum-enabled theft.

The dilemma is existential. Bitcoin must choose between two contradictory values: immutability or survival. Freezing vulnerable coins would protect the network from quantum theft — but it would also represent an unprecedented intervention in Bitcoin's core ethos of neutrality and unchangeability. Not freezing them means accepting that up to 4 million BTC could become bounties for the first entity to achieve quantum supremacy, potentially destabilizing the entire network and enriching a single adversary with hundreds of billions in stolen value.

With the gravity of this proposal’s implications, taken with Bitcoin's famously slow development culture, determining the path to take will be a fraught process, to say the least.

Ethereum, by contrast, faces a similar technical challenge but with far less social friction. As Justin Drake details, its account abstraction allows users to migrate to quantum-resistant signature schemes without a hard fork. Further, Ethereum's vulnerable supply is estimated at less than 1%, largely because it hid public keys from day one. And most importantly, Ethereum's culture embraces upgrades with the Merge, among all others, proving the network can sustain and grow after radical change.

The irony is stark: Bitcoin's immutability doctrine — its greatest ideological strength — could prevent it from adapting to survive. Ethereum's willingness to change may be the better path to long-term security.

No one has a clear idea whether the quantum threat will lean closer to two years or more toward ten, but the underlying conclusion remains the same: sooner or later, we'll need to make our coins — our entire digital monetary layer — quantum-proof.

For Bitcoin, the challenge extends beyond engineering. The community must confront an uncomfortable truth: preserving Bitcoin's future may require violating its past promises to some degree. The longer this reckoning is delayed, the narrower the window becomes for an orderly transition.

Quantum computing will arrive. What remains uncertain is whether Bitcoin's governance can move faster than physics — and whether its community will be able to reconcile survival with doctrine.

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.

BlackRock’s Head of Crypto Robbie Mitchnick joins Ryan to unpack how institutions are actually allocating (and why correlation to “digital gold” matters), what the ETF data says about demand for BTC and ETH, and why the October leverage flush didn’t dent long-term adoption.

We dig into BlackRock’s tokenization roadmap, from the BUIDL-style tokenized money market funds and the Genius Act angle to the stablecoin flywheel, plus what’s still missing: secondary liquidity and pragmatic regulatory clarity.

Robbie lays out a realistic 24–36 month path, a 2026 “show-me” phase for real utility, and candid advice for allocators on sizing and asset selection.

Listen to the full episode 👇